Guangzhou is a top investment destination in China, located in its southern region and part of the Greater Bay Area. The city has a strong production and service sector base, mature industrial ecosystem, and policies to incentivize high-tech innovation, R&D, and growth of future competitive industries. We profile Guangzhou's economy, key industries, and incentives for foreign investors in this article.

Guangzhou, the capital city of Guangdong province, is an important political, economic, industrial, and cultural center in the South China region.

North of Hong Kong, Macao, and the South China Sea, Guangzhou’s location in the Pearl River Delta has long secured the city’s position as the southern gate of Mainland China. As the origin of the ancient Chinese Maritime Silk Road, it was the oldest foreign trading port in Mainland China and the only one that has never been closed.

Now, as one of the prominent cities included in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) plan and a key location on the Belt and Road Initiative (BRI), Guangzhou is an established a global transport and trade hub and an emerging science and technology innovation center.

Guangzhou boasts of advanced infrastructure, including the third-busiest airport (Guangzhou Baiyun International Airport) in terms of passenger throughput, the fourth-largest port (Guangzhou Port) in terms of cargo throughput, and the most well-connected railway network in the Chinese mainland.

The China Import and Export Fair, or Canton Fair, is held in Guangzhou every spring and autumn. A mass of merchants and foreign enterprises from over 200 countries and regions attend the annual fair.

Guangzhou also has the third largest number of national high-tech enterprises (over 11,000) and is home to most the province’s university personnel and scientific and technological workers.

The 2021 White Paper on the Business Environment in China released by the American Chamber of Commerce in South China, confirmed that Guangzhou was the most popular investment destination in the country – the city having held this title for four consecutive years.

In 2021, Guangzhou attracted investment from 330 Fortune Global 500 companies, with an average annual growth of 10 percent, and an actual use of FDI amounting to RMB 224 billion (US$33.32 billion).

2021 economic overview

Judging from the annual trend, Guangzhou's economy rebounded rapidly in the aftermath of the COVID-19 pandemic.In 2021, Guangzhou’s GDP reached RMB 2.82 trillion (approx. US$0.44 trillion), showing an 8.1 percent growth year-on-year. The city's industrial added value, exports, and investment in fixed assets also showed strong growth, increasing by 5.1 percent, 9.6 percent, and 10.8 percent on a two-year average, respectively.

Moreover, for the first time, Guangzhou's total retail sales of consumer goods reached RMB 1 trillion (US$148.654 billion).

Investment and trade

2021 was a good year for investment and trade in Guangzhou, recording a total increase on investment in fixed assets at 11.7 percent over the previous year (when the market had been noticeably affected by the COVID-19 pandemic). In particular, the combined FDI (including inflow from Hong Kong, Macao, and Taiwan) increased by 1.5 percent.The investment in Guangzhou’s primary sector grew 40.7 percent in 2021, followed by a 6.5 percent increase for the manufacturing industry, and 12.5 percent increase in the service sector.

Investment in real estate development saw a sharp increase of 10.1 percent. While investment in commercial housing grew 17.8 percent, that in office spaces decreased by 15.5 percent – mainly due to multiple local COVID-19 outbreaks and implementation of disease control measures.

The total value of imports and exports in 2021 reached RMB 1,082.588 billion (US$160.931 billion) – an increase of 13.5 percent from the previous year. In particular, the value of commodity exports was RMB 631.217 billion (US$98.83 billion), while that of imports was RMB 451.371 billion (US$67.09 billion).

4,048 new FDI projects were approved in 2021, increasing 50.2 percent when compared to 2020. Guangzhou’s actual use of foreign capital reached RMB 54.326 billion (US$8.07 billion), a 10 percent growth year-on-year.

Sector profile

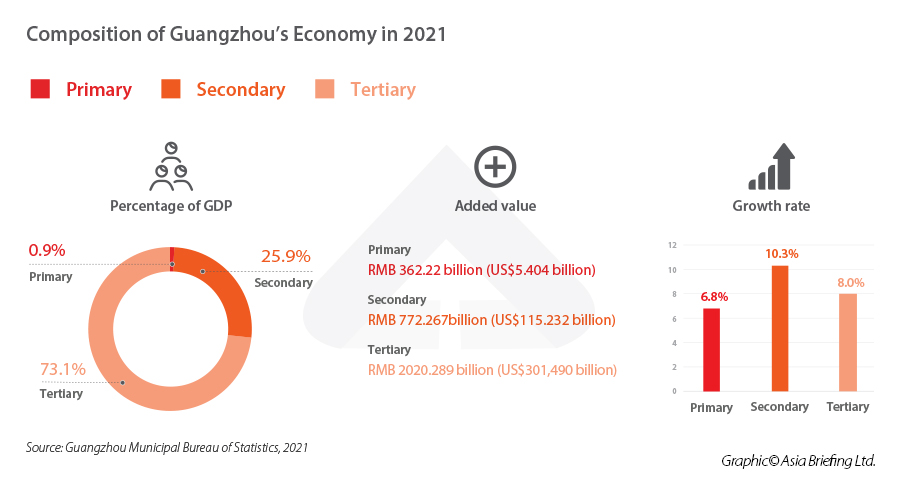

The tertiary industry (service sector) is the main contributor to Guangzhou’s GDP, representing 73.1 percent of the GDP in 2021.

Automobiles, electronics, and petrochemicals are among the pillar industries of Guangzhou. The combined output value of these three industries account for 50.3 percent of the city’s total GDP. Other industries, like wholesale and retail trade, finance, real estate, leasing business services, and transportation services also contribute significantly to the city’s GDP.

Moreover, designated as a “Made in China 2025” pilot demonstration city, Guangzhou’s high-tech industry is flourishing. In 2021, the output value of its advanced products represented 59.3 percent of the total output value of all industrial enterprises above a designated scale, while the added value of the high-tech manufacturing industries above designated size increased by 25.7 percent. (By designated scale, we mean enterprises with an annual business income of RMB 20 million (approx.US$2.9 million) and above.)

Key industries

Automotive industry

The output value of automobiles in Guangzhou increased by 3.3 percent year-on-year to RMB 538.3 billion (US$84.57 billion) in 2021. In particular, the city has strengthened its position as a leader in China's automotive industry by stepping up efforts to develop intelligent connected and new energy vehicles (NEVs).Guangzhou has created 13 centers for automotive technology and innovation at the national and provincial levels and has already made routes available for testing self-driving cars. Innovation in this sector is driven by electrification, Internet connection, and car-sharing, following national trends.

Nansha district's vehicle production capacity has exceeded 800,000 units annually, with an output value of more than RMB 100 billion (US$14.86 billion).

In terms of output value, Guangzhou's automotive industry aims to reach RMB 1 trillion by 2025. The Guangzhou Automobile Group Co., Ltd. (GAC Group), the leading Chinese state-owned automobile manufacturer, is headquartered in the city. Companies under the GAC Group are involved in automobile R&D, passenger car and commercial vehicle manufacturing, automotive finance, and trade and logistics, among others. The GAC Group includes GAC Honda, GAC Toyota, GAC Passenger Cars, GAC New Energy, GAC Research Institute, GAC Fiat Chrysler, GAC Mitsubishi, and other dozens of well-known companies and R&D institutions in the sector.

As such, Japanese, European, and American joint ventures have been successful in Guangzhou. The impact of foreign companies and technology sharing is visible in the diversification of auto brands. For instance, the independent NEV brands – GAC Trumpchi, Dongfeng Nissan Chenfeng, GAC BYD, and BAIC, as well as Evergrande Hengda.

Electronics and new information technology industry

Guangzhou boasts of a strong industrial foundation in intelligent terminals, information communication, 5G networks, communication equipment, computer equipment, and other products. The overall output value of the industry ranks at the forefront of the country, and several well-known globally competitive enterprises have their origin here. As a pillar industry of the regional economy, Guangzhou’s electronic information industry had an operating income of RMB 4.3 trillion in 2021, ranking first across China for 29 consecutive years, and accounting for 29.4 percent of the province's industrial operating income.Recent data released by the Guangzhou Daily Data and Digital Research Institute (GDI Think Tank) confirms that the electronic information industry is the leading force supporting the city's development. The most successful companies belong to the computer, communication and other electronic equipment manufacturing industry, software and information technology service industry, and electrical machinery and equipment manufacturing industry. ZTE, one of the world's largest telecommunications manufacturers, is also based in Guangzhou. Other international firms thriving in the area in this sector include HARMAN, Siemens, and Samsung.

Infrastructure investment

The Guangzhou 2022 Plan was formally unveiled on February 8, 2022, by the Guangzhou Development and Reform Commission. According to the plan, the city will host 650 major formal construction projects with a total annual expenditure of RMB 345.2 billion (US$51.32 billion) and 130 preparatory projects with a comprehensive investment of RMB 18.8 billion (US$2.79 billion). In addition, the local government has already planned to launch 780 projects at a total investment of RMB 4.55 trillion (US$676.9 billion).The projects focus on specific areas, which will serve as drivers of development for Guangzhou in 2022.

In particular, the city aims at improving its comprehensive urban functions by strengthening its role as an international transportation hub. This area is also the focus of the most significant projects, with a total investment of over RMB 10 billion (US$1,48 billion).

273 infrastructure projects are slated for construction, representing more than half of the total yearly budgeted investment.

Seaports

The Port of Nansha (part of the Guangzhou Port Group) is the fastest growing port in South China, and its capacity has been increasing every year ever since its opening in 2004. The fourth phase of its development will be completed in 2022, paving the way for the fifth phase of the expansion project, in which four 200,000-ton container berths will be constructed. Currently, the structural design bottom elevation of the dock is -18.7 meters, and the coastline perimeter is 1,880 meters long.Airports

The third-phase development project of the Baiyun Airport will be completed in 2022, as it remains a top priority for the government. Indeed, the Guangzhou Baiyun International Airport Phase III Expansion Project is one of China's major transportation hub plans that executes the requirements of the Guangdong-Hong Kong-Macao Greater Bay Area Development Plan – specifically regarding “building a world-class airport cluster”.Railways

In 2022, Guangzhou will expedite the preparatory work on the Guangzhou-Zhuhai (Macao) high-speed rail (Guangzhou part), Nansha-Zhuhai (Zhongshan) intercity, and Guangzhou East Station refurbishment projects. Rail transportation has garnered a lot of interest. The route is straightforward: it begins at the hub in Guangzhou, links to the Guanghe high-speed train, travels via Nansha and Zhongshan, and concludes at the Hengqin port in Zhuhai. With a total expenditure of RMB 643 billion (US$95.65 billion), the new line is approximately 202 kilometers long, with 113 kilometers in Guangzhou.Huangpu-Nansha Eastern Expressway

The Shiziyang Corridor Project (Guangzhou Section), an expressway project, is of particular relevance since it has been included in the 14th Five-Year Plan for the Development of a Modern Comprehensive Transportation System, under the central government. The project's overall investment exceeds RMB 24 billion (US$3.57 billion), with a route 34.915 kilometer long, built using a two-way eight-lane technical standards, on a roadbed 41.5 meters wide.Additionally, preparatory construction on the Huangpu-Nansha East Expressway will be also carried out in 2022. The project will create a double-Y road grid between the Shayuzhou Channel and the Hualong River Crossing Channel. The path will cover 37.2 kilometers.

Preferential policies for foreign investment

Land use

The Catalogue of Encouraged Industries for Foreign Investment (Catalogue of Encouraged Industries) establishes regulatory policies for land use in designated industries. Fast-track channels are also available for the land use evaluation and approval of FDI projects, reducing the time required for such formalities. The minimum land transfer fee can be set at 70 percent of that of the same land category and grade as indicated in the National Standards for Minimum Land Transfer Fee for Industrial Use for industrial FDI projects.Science and technology

Those industries included in the Catalogue of Encouraged Industries are eligible to apply for special grants under the Top 500 Modern Industry Projects. Moreover, multinational corporations and foreign R&D organizations are supported in establishing their R&D headquarters or subsidiaries in Guangdong. At the same time, local universities, scientific and technological research institutes, multinational corporations, and foreign-invested R&D organizations are invited to establish joint R&D centers in Guangzhou, with the objective of creating an overall environment that facilitates innovation and growth.Financial policies and taxation

As mentioned above, provincial-level industrial parks foster the presence of foreign-invested businesses. Such businesses are given preference over their Chinese counterparts who meet the same qualifications when it comes to fund allocation – especially in the field of high-tech and innovation. International corporations receive more assistance in setting up their regional headquarters in Guangdong province, and the administration of such headquarters as well as the approval processes is significantly enhanced. As per a nationwide policy, an income tax cut of up to 15 percent is offered to high-tech businesses (both foreign and domestic).HR incentives to attract talent pool

High-level foreign specialists are encouraged to join foreign-invested businesses. People who satisfy specific requirements are given preferential treatment when it comes to housing, healthcare, the education of their children, etc. The treatment outlined in the Interim Provisions on Special Material Benefits for Attracting Foreign Investment is available to overseas high-level executive officers working for foreign-invested companies.Priority in applying for a visa letter, a work permit in China, and a Foreign Expert Certificate goes to overseas high-level management staff and professionals of foreign-invested businesses that adhere to the Directory for Encouraged Projects of Foreign Investment, as well as overseas technical experts and high-level professionals employed by joint R&D centers or key laboratories. Additionally, assistance is provided to them for the application for an extension of their stay in China.

Why firms should look to set up in Guangzhou: Other policies and trends

Urban infrastructure

Guangzhou’s Comprehensive Urban Plan: 2017-2035 (Draft) aims to build Guangzhou into a “livable flower and dynamic global city” by 2035. China has set a mandate for its cities to focus on smart resource consumption and environmental protection, which will be a part of Guangzhou’s urban growth strategy as well.Greater Bay Area

In addition, Guangzhou is coordinating with the Greater Bay Area’s development objectives, such as strengthening its connections with Hong Kong and Macao. Guangzhou’s Nansha New Area sub-zone of the China (Guangdong) Pilot Free Trade Zone, for example, was launched in 2015 and is designed to promote free trade between Guangdong, Hong Kong, and Macao.Economic zones and encouraged industries

Important economic zones include the Guangzhou Development District, Guangzhou Nansha Development Zone, the Airport Economic Zone, Zengcheng Economic and Technology Development Zone, and Sino-Singapore Guangzhou Knowledge City.These zones and other smaller industrial parks produce about 70 percent of the city’s total industrial output and accommodate more than 9,000 enterprises and more than one million employees, according to the Chamber of Commerce of Guangzhou.

Moreover, the regional government has labeled high-tech industries – new generation information technology, artificial intelligence, and the biopharmaceutical industry (“IAB” industries) and new energy and new materials industries (“NEM” industries) – as future competitive industries. Guangzhou hopes to attract foreign investment in these industries and to set up in its development zones, offering streamlined business processes and financial subsidies.

The 14th Five Year Plan

The Outline of the 14th Five-Year Plan for National Economic and Social Development of Guangzhou and the Long-Range Objectives Through the Year 2035 formally went into effect in May 2021. The Plan focuses on three emerging industries – intelligent and new energy vehicles, next-generation information technology, and biomedical and health – and intends for them to be reflected in Guangzhou’s cornerstone businesses.In addition, the Plan clarifies individual development strategies of Guangzhou's eleven districts. Among them, Tianhe district will serve as the city's central functional hub, while Haizhu district is projected to host a digital economic zone, and Huangpu district will function as the "Eastern Integrated Development Core" of the city's central business district.

Future projections indicate that by 2025, the added value of Guangzhou's strategic developing sectors will account for 35 percent of regional production, serving as the city's primary engine of economic growth.

The emphasis on developing such sector capabilities is expected to substantially boost Guangzhou's need for office space.

High-tech and innovation-led growth

The government attaches great importance to high-tech and innovation as drivers of economic growth, and Guangzhou has been the incubator for several high-tech projects. In line with this, in 2021, the city inaugurated the Guangdong-Hong Kong-Macao Greater Bay Area National Technology Innovation Center. The government also incorporated the Nansha Science City in the Greater Bay Area Comprehensive National Science Center and increased the number of national key laboratories to 21. In the same year, R&D investment accounted for 3.15 percent of the total regional GDP, and the number of patents approved grew by 21.6 percent. Industrial enterprises and businesses in the service sector above the designated size also increased their investment in R&D by over 20 percent and 10 percent, respectively.In 2022, a group of five high-tech businesses in Guangzhou jointly established a new industry organization, the Guangzhou Metaverse Innovation Association, located in the Nansha District. GrowthEase, a business technology services provider under global video gaming giant NetEase, and 37Games, a browser game publisher, are among the organization’s founding companies. The industry body aims to support China’s first attempt at creating a metaverse ecosystem in Guangzhou besides strengthening the regional digital economy. The Guangzhou Metaverse Innovation Association also sets an example for how public-private partnerships can develop to support new technologies. Since its founding, the group has come to include 23 Guangzhou-based technology businesses and research centers, as well as the world's largest provider of Chinese AI voice recognition technology, iFlyTek, which has its headquarters in Hefei in eastern Anhui province.

Vision for a digital economy

In 2022, the Guangzhou Academy of Social Sciences released the Guangzhou Digital Economy Development Report (2022), aiming to provide a digital economy for all sectors of society.Guangzhou is among the most pro-growth and investment-friendly destinations in China, yet, setting up a foreign-invested enterprise or a factory here may still be challenging for foreign investors with limited or no experience of doing business in China. Determining the right corporate structure, making use of Guangzhou’s preferential policies and subsidies, and building relationships with key authorities will require local expertise on the ground.

For queries and business support, feel free to email our experts on the ground at china@dezshira.com.