Global investors often find themselves in an unfavorable position of having to face being double taxed – taxed by two different countries on the same income – unless there is a double tax avoidance agreement in place. For example, a company might be subject to taxes in its country of residence and also in the countries where it raises income through foreign investments for the provision of goods and services.

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable.

It is therefore extremely worthwhile for foreign investors to be aware of which double taxation avoidance agreements (DTAs) between China and other countries might be applicable to their situation, as well as understand how these agreements are applied.

DTAs not only provide certainty to investors regarding their potential tax liabilities but also act as a tool to create tax-efficient international investments.

List of Double Tax Avoidance agreements

As of 2022, China has signed DTAs with 110 countries or regions. Investors may check the table below and determine whether they are a tax resident of a country that has an effective DTA with China.

|

Countries (Regions) with Signed DTAs with China (as of September 2022) |

|||||

|

A-C |

D-J |

H-K |

L-N |

O-S |

T-Z |

|

Argentina* |

Cambodia |

Hong Kong |

Laos |

Oman |

Tajikistan |

|

Angola* |

Canada |

Hungary |

Latvia |

Pakistan |

Taiwan* |

|

Albania |

Chile |

Iceland |

Lithuania |

Papua New Guinea |

Thailand |

|

Algeria |

Congo* |

India |

Luxembourg |

Philippines |

Trinidad & Tobago |

|

Armenia |

Croatia |

Indonesia |

Macao |

Poland |

Tunisia |

|

Australia |

Cuba |

Iran |

Macedonia |

Portugal |

Turkey |

|

Austria |

Cyprus |

Ireland |

Malaysia |

Romania |

Turkmenistan |

|

Azerbaijan |

Czech Republic |

Israel |

Malta |

Russia |

Ukraine |

|

Bahrain |

Denmark |

Italy |

Mauritius |

Saudi Arabia |

United Arab Emirates |

|

Bangladesh |

Ecuador |

Jamaica |

Mexico |

Serbia & Montenegro |

United Kingdom |

|

Barbados |

Egypt |

Japan |

Moldova |

Seychelles |

United States |

|

Belarus |

Estonia |

Katar |

Mongolia |

Singapore |

Uzbekistan |

|

Belgium |

Ethiopia |

Kazakhstan |

Morocco |

Slovakia |

Uganda* |

|

Bosnia-Herzegovina |

Finland |

Kenya* |

Nepal |

Slovenia |

Venezuela |

|

Botswana |

France |

Korea (ROK.) |

Netherlands |

South Africa |

Vietnam |

|

Brazil |

Gabon* |

Kuwait |

New Zealand |

Spain |

Zambia |

|

Brunei |

Georgia |

Kyrgyzstan |

Nigeria |

Sri Lanka |

Zimbabwe |

|

Bulgaria |

Germany |

|

Norway |

Sudan |

|

|

Greece |

|

Sweden |

|

||

|

|

Switzerland |

|

|||

|

|

Syria |

|

|||

| * Signed, but not in effect at time of writing. | |||||

Who do DTAs apply to?

DTAs apply to residents (individuals or companies) of the countries or regions who are parties to the agreement.

The DTA applicant must be a tax resident of a country that has an effective DTA with China, and the applied benefits must qualify for tax exemption or reduction as stipulated by the DTA.

Applying for DTA benefits

Non-resident taxpayers are no longer required to submit the relevant documents to the tax bureau when applying for the DTA benefits. Rather, they can determine whether they are qualified for the tax benefits by themselves, enjoy the preferential tax rates when filing for relevant taxes (or when withholding taxes by a withholding agent), and retain the required documents by themselves for future inspection from the tax bureau in charge.

Materials to be retained for future inspection include:

- Tax resident identity proof issued by the tax authorities of the treaty contracting party to prove the taxpayer’s obtaining tax resident status in the current year or the preceding year; for those claiming benefits under the international transport clause of a treaty or benefits under an international transport agreement, the tax resident identity proof may be replaced by a certificate proving that the taxpayer satisfies the identity stipulated in the treaty or agreement;

- Ownership proof materials such as contract, agreement, board resolution or shareholders’ meeting resolution, proof of payment, etc., which are related to the income derived;

- For those claiming benefits under dividend, interest, or royalty clauses under a treaty, the relevant materials proving “beneficiary owner” identity shall be retained; and

- Any other materials for which the non-resident taxpayer deems to be able to prove its satisfaction of criteria for claiming treaty benefits.

Non-resident taxpayers shall bear legal liability for the veracity, accuracy, and legitimacy of the information completed in the Information Report on Non-resident Taxpayers Claiming Treaty Benefits and the documents retained for future inspection.

A Chinese translation will be required where the submitted documents are in foreign languages. The applicant shall be responsible for the accuracy and integrity of the Chinese translation.

The non-resident taxpayer or the withholding agent should posses both original copy and photocopies of the relevant materials for submission or inspection by the tax authorities in charge.

Permanent Establishment and Beneficial Owner status

Among other details, permanent establishment (PE) and beneficial owner status are of critical importance for understanding the workings of DTAs.

Permanent establishment (PE)

A foreign company can be deemed to have a PE in China, if:

- It has an establishment or a place of business in China (Fixed place PE);

- It has a building site, a construction, assembly or installation project or related supervisory activities that last for a certain period of time (Construction PE);

- It appoints an agent in China to conclude contracts or accept orders in China (Agent PE); or

- It has employees working in China for a certain period of time (Service PE).

If a PE is constituted under the DTA, the foreign entity will be liable for tax over the income earned in China, or income that is attributable to its presence in China.

A PE can be defined as a fixed place where the business of an enterprise is carried out in a given country. It is a key concept for the applicability of DTAs.

A non-resident enterprise can only claim exemption from its taxes payable if its establishment or premises in China do not constitute a PE pursuant to the PE article under the relevant DTA.

Tax implications of a PE

If an establishment or venue of a non-resident enterprise constitutes a PE in China, it will be subject to 25 percent tax on all of its China-sourced income, as well as non-China sourced (worldwide) income that is deemed to have an actual connection to the PE.

The general principles on PE taxation as laid out in Article 7 of most DTAs, clarifies the following:

- Only the profits of a non-resident enterprise attributable to its PE in China are taxable in China;

- When determining the profits of a PE, transactions between the non-resident enterprise and the PE are treated as transactions between independent parties;

- Expenses incurred in the business of a PE, including general and administrative expenses allocated from the non-resident enterprise, are deductible; and

- Royalty service fees that have substantial connections with a PE will be taxed as the profit of the PE, incurring the 25 percent tax payable rather than the reduced or exempted rates under the DTA’s royalty provision.

Below are the range of deemed profit rates that the tax authorities will apply depending on the nature of the non-resident enterprise’s business:

|

Deemed Profit Rates of Different Non-resident Enterprises |

|

|

Types of business |

Deemed profit rate |

|

Construction projects, design and consulting services |

15% - 30% |

|

Management services |

30% - 50% |

|

Other services or operating activities other than service |

No less than 15% |

Beneficial owner

It is important to understand who can be regarded as a beneficial owner when applying for DTA treatments on dividend, interest, and royalties clauses. Beneficial owner refers to an individual, company, or any other group having the ownership and right of control over the income or the right or property derived from the income. A beneficial owner should be engaged in actual operating activities; therefore, an agent or a designated payee does not constitute a beneficial owner.

Unfavorable factors for beneficial owner assessment

To determine the “beneficial owner” status of an applicant who needs to enjoy the tax treaty benefits, a comprehensive analysis should be carried out, taking into account actual conditions of the specific case.

Among others, there are some factors regarded as “unfavorable” during the assessment:

- The applicant is obligated to pay 50 percent or more of the income to a resident of a third country (region) within 12 months from receipt of the income. “Obligated” shall include agreed obligations and de facto payment even though there is no agreed obligation;

- The business activities undertaken by the applicant do not constitute substantive business activities like manufacturing, sales and marketing, and management (including Investment holding management);

- The counterparty country (region) of the tax agreement does not levy tax or exempts tax on the relevant income, or the actual levy rate is very low;

- Aside from loan contracts upon which interest is derived and paid, there exist other loan or deposit contracts between the creditor and a third party which are similar in their terms of amount, interest rate, and date of execution, etc.; and

- Aside from contracts for the transfer of copyrights, patents, proprietary technologies, and other usage rights based upon which royalties are derived and paid, there exist contracts between the applicant and a third party pertaining to the transfer of copyrights, patents, proprietary technologies, and other usage rights or ownership.

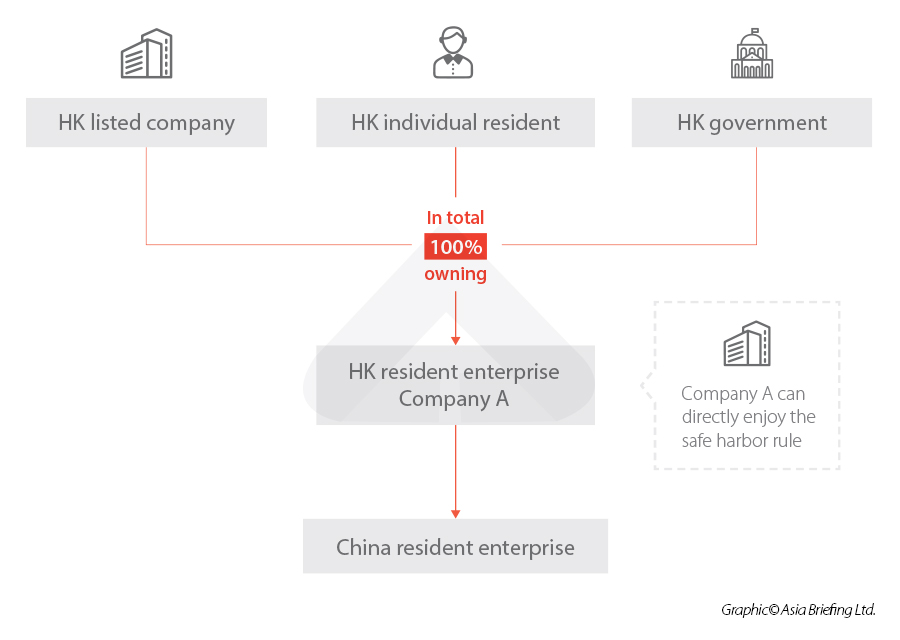

“Safe harbor rule” in beneficial owner determination

To reduce the burden of the applicants who want to enjoy DTA benefits, China tax bureaus created the “safe harbor rule”, where the applicant can be determined as a beneficial owner without going through the comprehensive analysis based on the unfavorable factors, upon satisfying certain conditions.

Under the current laws and regulations, the below applicants are subject to the safe harbor rule for their dividends, regardless of the assessment outcome based on the unfavorable factors:

- The applicant is a company that is a tax resident of a state that has a valid DTA with China (hereinafter, the DTA counterparty) and is listed in that jurisdiction;

- The applicant is the government of DTA counterparty;

- The applicant is an individual who is a resident of the DTA counterparty; and

- The applicant is a subsidiary that is 100 percent directly or indirectly owned by one or more persons covered by the safe harbor rule (In the case the subsidiary is indirectly owned by the persons covered by the safe harbor rule, the multi-tier holders should be either Chinese residents or residents of the DTA counterparty).

Can an applicant still apply for a DTA if they neither pass the beneficial owner assessment nor are they eligible for the safe harbour rule?

For applicants deriving dividends from China who neither pass the beneficial owner unfavorable factor assessment, nor are qualified to enjoy the safe harbor rule, there are other opportunities to qualify as beneficial owner.

Applicants deriving dividend income from China will still be deemed as a beneficial owner if the shareholder who directly or indirectly holds 100 percent share of the applicant is a qualified beneficial owner who can enjoy the DTA benefits. Furthermore, the abovementioned shareholder should fall into either of the below circumstances:

- Circumstance I: Where the above-mentioned shareholder is a resident of the same country (region) for which the applicant is a resident, there is no special requirement for the intermediate shareholders (if any); and

- Circumstance II: Where the above-mentioned shareholder is not a resident of the country (region) for which the applicant is a resident, then the above-mentioned shareholder and any intermediate shareholders should be qualified to enjoy the same or better DTA treatment compared to that is entitled to the resident of the country (region) for which the applicant is a resident.