Prospects for European Companies in China in 2023

As China sets its sights on growth in 2023, officials are highlighting the importance of foreign capital. This may signal the introduction of incentive policies and further market opening for foreign companies. Despite headwinds from strict COVID-19 policies and bilateral tensions, European investments in China skyrocketed in 2022. As China moves on from COVID-19, we look at European investment in China over the past few years and explore opportunities for European companies in 2023.

European investment in China grew for the first time in four years in 2022. This reversal in investment trends was particularly marked as it followed multiple years of decline, and significantly outpaced the average level of FDI coming into the country.

As China moves into a new era of “living with COVID” in 2023, it will be significantly easier for foreign companies to enter its market, potentially paving the way for higher levels of European investment. However, as we discuss below, there is a range of other headwinds beyond COVID-19 that could impede European companies’ participation in China’s industries.

In this article, we look at trends in European investment in China over the past few years and note some of the industries where European companies may hold a strategic advantage.

European investment in China prior to 2022

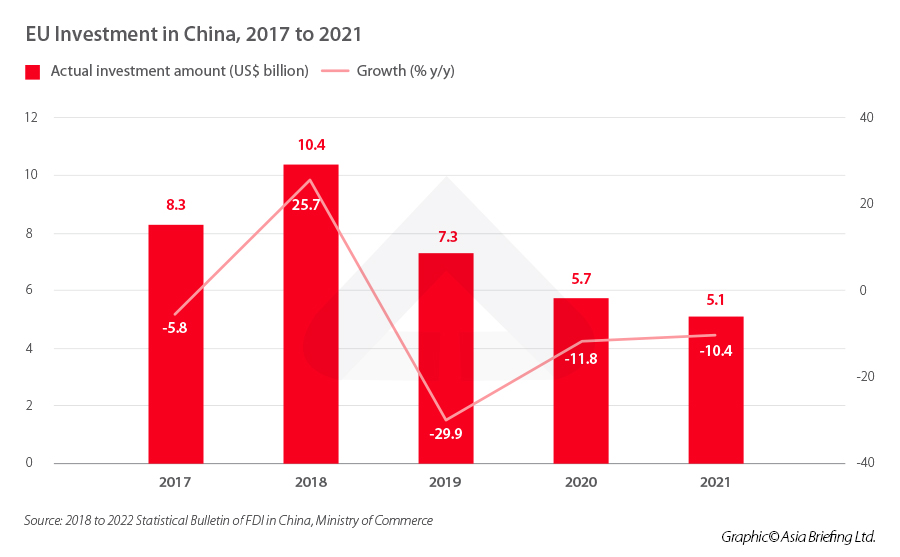

Investment from EU countries into China slumped in the first two years of the pandemic, even as overall FDI inflows grew at historic rates. According to data from China’s Ministry of Commerce, the actual investment amount dropped by 11.8 percent year-on-year in 2020 and 10.4 percent year-on-year in 2021. It is tempting to blame the pandemic for this drop, but EU investments in China were declining even before 2020. Four of the five years from 2017 to 2021 experienced a decline in investment inflows from the EU. The year 2018 was the only exception when investments grew 25.7 percent year-on-year.

Consequently, EU investments as a proportion of China’s overall FDI also dropped from 7.5 percent in 2018 to 2.8 percent in 2021.

This slowdown in growth has been blamed in part on long-standing hurdles faced by European companies in gaining access to the Chinese market.

The pandemic served to exacerbate this situation. A position paper from the European Union Chamber of Commerce in China (EU Chamber) released in September 2022 outlined some of the difficulties faced by EU companies under China’s zero-COVID policy. It also stated that many European companies, although not yet leaving China, were considering diversifying from China as a result of the restrictions.

At the same time, China’s slowing economic growth over this period could also have pushed companies to invest in other higher-growth markets.

According to research from Rhodium Group, the decrease in investment from EU countries has resulted in the concentration of European source countries, investing companies, and target sectors. Over the four years up until 2021, the top 10 European investors accounted for an average of 80 percent of total investments from Europe, compared to just 49 percent on average in the period from 2008 to 2017.

Further, just five sectors (automotive, food processing, pharmaceuticals and biotechnology, chemicals, and consumer products manufacturing) attracted around 70 percent of all FDI from European countries, compared to an average of 57 percent in the years from 2008 to 2012 and 65 percent from 2013 to 2017. Finally, in the four years until 2021, an average of 87 percent of the total value of investments from Europe came from just four countries – Germany, the Netherlands, the UK, and France. This was up from 69 percent on average in the preceding 10 years.

European investment in China jumps in 2022

Despite the decline in EU investment in China over the last few years, 2022 saw a sudden reversal of this trend. According to the latest data from MOFCOM, EU investments in China grew by a staggering 92.2 percent year-on-year in 2022. Investments from Germany grew 52.9 percent year-on-year. This uptick occurred despite overall FDI into China in 2022 slowing to a rate of just 6.3 percent year-on-year, as well as the continued impact of the pandemic on China’s economy.

The ministry did not provide a concrete value or breakdown of the investments. However, according to research from the German Economic Institute, German investment in China in the first half of 2022 reached EUR 10 billion, a half-year record and an increase from EUR 6.2 billion during the same period in 2021.

This uptick is likely partly due to the impact of a few major investment deals made by European companies in 2022. For instance, in February 2022, German carmaker BMW acquired a controlling stake in its China joint venture, BMW Brilliance, raising it from 50 percent to 75 percent in a deal worth EUR 3.7 billion. This is the direct result of a policy to gradually ease restrictions on foreign ownership stakes in the automotive industry, enabling foreign carmakers to hold a majority stake in their China ventures from 2022 onward.

This suggests that FDI from Europe in 2022 is still coming in from a small group of countries and companies and that the increase in overall FDI from Europe does not necessarily translate to more opportunities for European companies. As mentioned in the Rhodium Group report, smaller European companies are more risk-averse and therefore less likely to enter the China market. In fact, since the outbreak of the COVID-19 pandemic, almost no new European investors have entered the China market, according to the report.

Although these signs indicate that smaller companies didn’t enter China in 2022, more detailed data is required to make an accurate assessment of the investment trends of European companies in 2022.

Since November 2022, China has taken a series of steps to remove almost all of its COVID-19 restrictions, including the removal of its quarantine requirements for inbound travelers. This will significantly reduce barriers to entry for companies looking to invest in China, in particular smaller companies that don’t already have a significant presence in the country.

In addition, since China’s reversal of its zero-COVID policy and switch to a growth-focused economic agenda, Chinese officials have repeatedly stressed the importance of foreign capital for China in 2023 and beyond. This may mean that the Chinese government will introduce more preferential policies for foreign investors and facilitate access to China’s markets. These new developments may serve to encourage more European companies to invest in China in 2023.

Shifting EU-China relations

China-EU relations have cooled significantly in recent years as European governments seek to decrease their economic reliance on China. Disputes over alleged human rights abuses, unfair competition, as well as growing Chinese influence in Europe have placed pressure on European governments to take a harder stance toward China and have continued to plague bilateral relations.

In 2022, relations deteriorated further in the wake of the Russia-Ukraine war, as China and European countries found themselves on opposite sides of the conflict. In addition, European countries have also been under pressure from the US to distance themselves from China as the US seeks to decouple its economy from China. Most recently, this has taken the form of pressurizing European governments to uphold its ban on chip exports to China. This has put EU chip companies, such as ASML, Europe’s largest technology company by market capitalization, caught directly in the crossfire of the US-China tech war.

Despite the frosty relations, European countries have continued to maintain bilateral trade and investment relations with China. As stated in the EU-China relations factsheet, the EU “has remained committed to engagement and cooperation given China’s crucial role in addressing global and regional challenges”.

Moreover, 2022 also saw significant developments in the relations between China and some EU countries. The new German Chancellor Olaf Scholz visited China in early November, the first G7 leader to do so since the start of the pandemic. Although the trip proved somewhat controversial at home, it nonetheless proved fruitful in restoring communication between the two powers.

Bilateral dialogue is also set to continue in 2023, as China’s top diplomat and former foreign minister Wang Yi prepares to go on a trip to Germany and Belgium next month, in which he will meet with EU officials.

According to Head of European Business Development at Dezan Shira & Associates Riccardo Benussi, European countries are increasingly trying to tread their own path when it comes to their relationships with China, rather than follow the US’ lead. For many, this will require striking a precarious balance between maintaining trade and investment relations with China while avoiding getting caught in the crosshairs of US sanctions.

Prospects for European companies in China in 2023

In a concrete effort to expand market access to foreign investors, China has continued to expand its Catalogue of Encouraged Industries for Foreign Investment (2022 Version) (the “2022 FI Encouraged Catalogue”). The 2022 version of the catalogue includes a total of 1,474 items across two catalogues (a nationwide catalogue and a regional catalogue), an increase of 19 percent from the 2020 version.

Below we look at some of the industries that show high growth potential in 2023 and beyond and are open to foreign investors.

Aviation

With the lifting of COVID-19 restrictions, both domestic and international air travel are set to rebound in China in 2023. The increase in demand for air travel will in turn put more pressure on the industry to develop and expand. Beyond the short-term increase in demand, China has had long-standing plans to expand and upgrade its aviation sector, which will include both the building of new airports and upgrading existing airport and fleet technology.

In October 2022, the Civil Aviation Administration of China (CAAC) issued the Action Plan for Comprehensively Deepening Civil Aviation Reform, which outlines key tasks and goals for developing the industry over the next three to five years. Among other tasks, it calls for the digitalization of civil aviation services, innovation in safety supervision models, resource allocation optimization, and the establishment of a market mechanism for aviation carbon emissions reduction.

The 2022 FI Encouraged Catalogue explicitly outlines several areas in the aviation industry in which foreign investment is encouraged, including the design and manufacturing of civil aircraft, civil helicopters and helicopter parts, ground-effect vehicles, and unmanned aerial vehicles, among many others.

There are thus ample opportunities for European companies within China’s growing aviation sector.

In January 2022, the European aerospace company Airbus announced that it had signed a Memorandum of Understanding with the city of Chengdu to establish the first sustainable aircraft “life cycle” service center in China, which will “cover a range of activities from aircraft parking and storage, to maintenance, upgrades, conversions, dismantling and recycling services for various aircraft types”.

Healthcare

China’s rapidly aging population and rising standards of living are placing an ever higher demand on the country’s healthcare system. As such, revenue in China’s healthcare market is expected to grow at a compound annual growth rate of 5.8 percent from 2023 to 2027 to reach a market volume of US$22.9 billion, according to Statista.

However, China’s healthcare market remains relatively undeveloped, with total expenditure accounting for only 7.12 percent of the total GDP in 2020. By comparison, the US’ expenditure reached 18 percent in the same year. This means that there is significant potential for market growth as China seeks to improve its health outcomes over the next decade.

Sectors with significant growth potential include medical devices, online healthcare services, and biopharmaceuticals.

Renewable energy

China’s renewable energy industry continues to show huge growth potential as China seeks to rapidly decarbonize its economy and reach its climate targets. In many ways, China and Europe have mutually beneficial energy goals, as both regions seek to reduce reliance on fossil fuels, in particular following the wake of the Russia-Ukraine war in Europe’s case.

Certain sectors of China’s renewable energy industry, such as solar and hydropower, are already extremely saturated and would be difficult for foreign companies to penetrate. However, there are still several areas in which European companies can compete and supplement the Chinese clean energy market. These include the energy storage market, smart grids, energy-efficient technologies, and hydrogen energy.

Both Europe and China are investing heavily in hydrogen energy, with the EU approving EUR 5.4 billion in subsidies for the hydrogen market in July 2022, and China identifying it as one of the “six industries of the future”. The 2022 FI Encouraged Catalogue encourages foreign investment in the “development, storage, transportation, and liquefaction of hydrogen fuel green preparation technologies”, among other areas.

Meanwhile, in the energy storage sector, China has set goals to boost its non-pumped hydro energy storage capacity to around 30GW by 2025 and 100GW by 2030 – a more than 3000 percent increase from 3.3GW in 2020. The 2022 FI Encouraged Catalogue also especially encourages foreign investment in R&D and the application of large energy-storage technologies.

High-end manufacturing

High-end manufacturing remains a lucrative industry in China. Having held the position as the “world’s factory” for decades, China is now investing heavily in moving the manufacturing sector up the industrial value chain. This is not simply a means of increasing the value of production, but also a necessary step to future-proof the sector, as rising labor costs and an ageing labor pool will make it increasingly difficult for China to compete with cheaper high-growth markets.

Automation and “digital transformation” will play huge roles in this process, providing many opportunities for European companies in China’s robotics, automation, manufacturing solutions, and high-end machinery industries.

Europe is home to a large number of companies with advanced manufacturing capabilities, particularly in the automotive sector (another industry with high growth potential in China). It is also home to a range of industry automation, machinery, and robotics companies with technological capabilities that are in demand in China’s manufacturing industry.

Will European investment in China continue to grow in 2023?

The growth of European investments in China in 2023 will depend in large part on the steps that Beijing will take to expand market access and ease of operations for European companies. Although Chinese officials have repeatedly stated their intention to attract more foreign investment in 2023, no concrete measures to do so have been issued yet, but it is still early days in the year. For this reason, it is difficult to predict in absolute terms whether European investment will continue its upward growth trajectory from 2022 or return to the decline seen in previous years.

There are however indicators that China’s business environment will improve for European companies. This is not least thanks to the lifting of COVID-19 restrictions, which will go a long way to appease grievances of companies confronting disrupted supply chains, restrictions on public movement affecting travel and staffing, and market shutdowns.

In addition, given China’s strength and high growth potential across a multitude of industries, it is inevitable that it will continue to attract investors from Europe, at the very least from the continent’s larger and more well-established companies.

Dezan Shira & Associates’ Presence in Europe

Europe has significant trade and investment dealings with Asia – China, ASEAN, and India are all among the bloc’s top trade partners. With Asia emerging as a growth engine of the world economy and an area of certainty amid global volatility, there is a wealth of opportunities for European investors in the region. Incorporated in Munich in January of 2021, Dezan Shira & Associates’ European office under Riccardo Benussi serves as the first point of contact for European companies wishing to do business in Asia. Meanwhile, our Europe-based team in both the Munich and Milan offices works with a variety of partners to connect European businesses with developing Asian economies. To set up a call with our Europe-based team, please contact riccardo.benussi@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China to Extend Preferential Individual Income Tax Policies

- Next Article China’s Winter Sports Market: Outlook and Opportunities for Foreign Players