China’s 2022 Government Work Report: Highlights from the Two Sessions

We look at key points of China’s 2022 Government Work Report, including the 5.5% GDP target, preferential tax policies, government stabilization policies, policies to boost investment and consumption, government spending plans, employment creation measures, COVID-19 prevention measures, climate and environment policy, and measures for elderly care and childcare.

On Saturday, March 5, 2022, the National People’s Congress (NPC) convened for the opening meeting of the annual Two Sessions. The main task of the meeting: to confirm and release the 2022 Government Work Report (GWR). Delivered by Premier Li Keqiang on behalf of the State Council, the GWR is the most important policy document to be released this year as it sets out a vast range of economic and development tasks for the country to pursue over the coming year, including the main 2022 GDP target.

Background

Since last week, more than 5,000 of China’s political, business, and social elite have gathered in Beijing for the country’s most important annual meeting – the Two Sessions. On Friday, March 4, the Two Sessions officially kicked off.

The Two Sessions, or Lianghui, is the popular name for the back-to-back meetings of two of China’s major political bodies – the Chinese People’s Political Consultative Conference (CPPCC) and the NPC.

The CPPCC is a consultative body that includes over 2,000 members from various aspects of Chinese society, ranging from business entrepreneurs to movie stars. The NPC is China’s top legislative body.

The Two Sessions are always of interest to foreign investors, as they offer more direct insights into China’s politics, revealing Beijing’s priorities for the coming year, and therefore the overall policy direction that the country will take.

This year, with global headwinds and COVID-linked uncertainties dampening China’s economic growth outlook, the Two Sessions take on added importance as stakeholders eagerly await China’s policies to stabilize its economy.

In this article, we summarize the highlights of the 2022 GWR.

China’s GDP target of “around 5.5 percent”

The annual announcement of the GDP growth target is among the most anticipated features of the Two Sessions. Because the government plays a significant role in steering the Chinese economy and faces political pressure to meet publicly stated goals, the GDP growth target in China is not just a predictor of growth output but also an input signal of forthcoming government credit and spending.

In the readout of the 2022 GWR, an economic growth target of “around 5.5 percent” for 2022 was announced, which although the lowest in years – is still higher than anticipated. Economists had widely expected the GDP target to be set at about five percent or slightly higher.

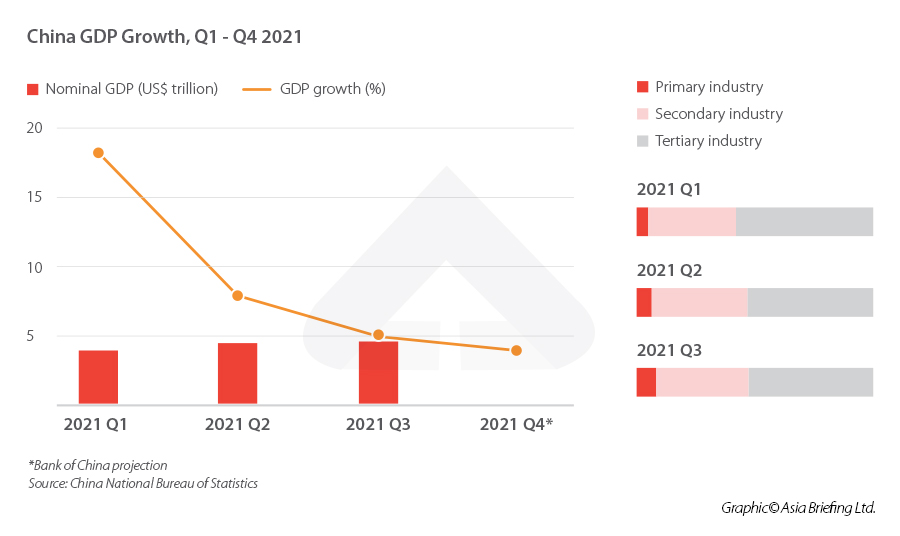

During his readout, Li said that China needs to take “arduous efforts” to realize this “medium-high growth from a high base”. In Q4 2021, China’s economic growth was slowed to four percent year-on-year despite a full year growth of 8.1 percent.

To achieve the 5.5 percent economic target, China will give further tax support to help businesses survive the difficulties. Businesses can also expect measures to boost domestic consumption, expand investment, and further promote foreign investment. Moreover, Li said that China needs to pursue “prudent and effective macro policies,” with its micro policies continuing to stimulate the vitality of market entities. Nevertheless, analysts are waiting for more details about any stimulus plans to resuscitate the sluggish economy.

Other key economic and development targets that China has set for 2022 include the following:

- At least 11 million new jobs in cities and towns.

- Consumer price rise of around three percent.

- Maintaining a more or less equal income growth and economic growth.

- Stable and improved imports and exports and balanced international payments.

- Grain output over 650 million metric tons.

Preferential tax incentives

Fiscal and tax policies are another area closely followed by China watchers as it is directly related to benefits that companies can enjoy in the following year.

The COVID-19 pandemic is still taking a toll on businesses, especially smaller enterprises. The ongoing tax and fee reduction policies have reduced their spending burden somewhat and made it easier to survive.

In the readout of the GWR, Li stated that China will implement a new policy combination of tax cut and tax rebate in 2022; around RMB 2.5 trillion (approx. US$396 billion) in taxes will be reduced or rebated this year. Among others, around RMB 1 trillion (Approx. US$158 billion) will benefit six sectors, including manufacturing and small businesses.

To be specific, the following incentives were unveiled:

- China will extend the tax and fee reduction policies to support manufacturing, small and low-profit enterprises, and self-employed businesses and will increase the scope of tax and fee cuts and expand their application.

- Among others, small-scale taxpayers will be exempted from value-added tax (VAT) for a period of time.

- The corporate income tax (CIT) liability of small and low-profit enterprises for the portion of taxable income exceeding RMB 1 million (approx. US$152,800) but less than RMB 3 million (approx. US$ 458,500) will be halved based on existing preferential policies.

Here, small-scale taxpayers normally refer to taxpayers whose annual VAT taxable sales do not exceed RMB 5 million (approx. US$0.77 million) and those that choose to be treated as small-scale taxpayers instead of being registered as general taxpayers. Small and low-profit enterprises refer to enterprises engaged in industries that are not prohibited or restricted by the government with an annual taxable income not exceeding RMB 3 million (approx. US$461,100), number of total employees not exceeding 300 persons, and total assets not exceeding RMB 50 million (approx. US$7.7 million).

Currently, only small-scale taxpayers whose sales ceiling are RMB 150,000 (approx. US$23,000) per month or RMB 450,000 (approx. US$69,000) per quarter are eligible for VAT exemption. And for small and low-profit enterprises, a 20 percent CIT rate on 50 percent of their taxable income amount is applied for the proportion of taxable income exceeding RMB 1 million (approx. US$152,800) but less than RMB 3 million (approx. US$458,500) (effective from January 1, 2019 to December 31, 2021).

On the other hand, to provide cash flow support to enterprises and promote consumption and investment, China will greatly improve the VAT exemption, credit, and refund system, and implement a large-scale tax rebate on VAT credit in 2022.

Priority will be given to small and low-profit enterprises: All the remaining tax credits for small and low-profit enterprises will be refunded in one lump sum before the end of June 2022, and the incremental tax credits will be refunded in full. China will also comprehensively address the issue of tax rebates in manufacturing, scientific research and technical services, ecological protection, electric power and gas, and transportation. It is estimated that about RMB 1.5 trillion (approx. US$ 238 billion) will be reserved for tax rebates, all of which will go directly to enterprises.

In addition to the support to small businesses and targeted sectors, China is also using tax incentives to encourage innovations among enterprises and optimize supply chains:

- The addition pre-tax deduction of R&D expenses of technology-based small- and medium-sized enterprises (TSMEs) will be raised from 75 percent to 100 percent.

- Tax breaks will be given to enterprises that invest in basic research.

- The accelerated depreciation of equipment and equipment policy and the tax incentives to high-tech enterprises will be improved.

Individual income tax – special additional deductions

As for the individual income tax (IIT), to encourage child birth and support the implementation of the three-child policy, the nursing expenses for infants under three years old will be included in special additional deductions for IIT.

Policies to boost investment and government spending

The 2022 GWR announced that RMB 640 billion (US$101 billion) of the central budget would go toward investment.

As for where the government spending will be directed, the GWR stressed the importance of investment in infrastructure, in line with the investment goals of the 14th FYP. Proposed infrastructure spending include:

- Key water conservancy projects

- Comprehensive transportation networks

- Important energy bases and facilities

- Renovation of urban gas pipelines and other pipeline networks

- Improving flood control and drainage facilities

- Construction of underground integrated pipeline corridors

Infrastructure spending is a key means of boosting local economies, and the 2022 Government Work Report reiterates the need for local governments to increase spending. To help them do this, the GWR announced that transfer payments from the central government to local governments will increase by about RMB 1.5 trillion (US$237 billion), reaching a total of nearly RMB 9.8 trillion (US$1.5 trillion), an increase of 18 percent year-over-year.

In addition, the GWR proposes “reasonably expanding the scope of use” for local government special-purpose bonds (SPBs). Issuing SPBs is one of the main ways through which local governments raise funds to spend on infrastructure projects, but there are strict requirements for the types of projects that can be financed using these funds. For example, projects must be commercially viable and be able to pay off the debt through the revenue it garners.

The GWR also says that the government will support follow-up financing of projects under construction and launch new construction projects, including large-scale projects that meet certain criteria, new infrastructure projects (usually advanced and high-tech projects, such as 5G networks, high-speed rail, data centers, and EV charging stations), and renovation of old public facilities.

The approximate 2022 quota for SPBs is set at RMB 3.65 trillion.

Stimulating consumption

Increasing consumption will be a major challenge for the government in 2022. Consumption recovered significantly in the first half of 2021, and the total retail sales for consumer goods – including spending by households, governments, and businesses – rose 12.5 percent year-over-year, 16.4 percentage points higher than in 2020.

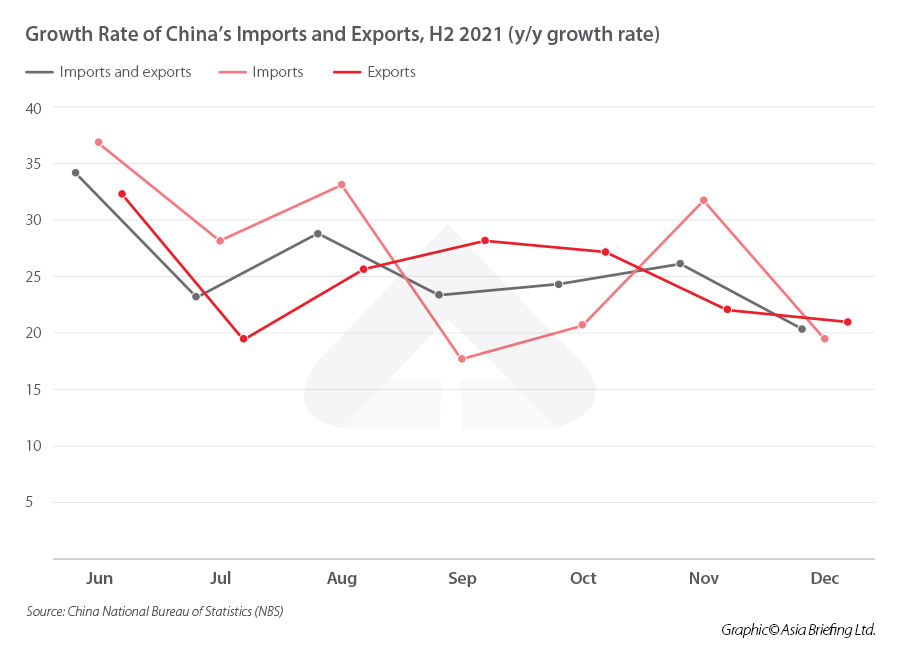

However, recovery in 2021 was uneven, with consumption slowing significantly in the latter half of the year due in part to sporadic COVID-19 outbreaks, natural disasters such as flooding over the summer months, and power crunches in the fall. In December 2021, total retail sales grew just 1.7 percent from the same period a year earlier, which was weaker than November’s growth rate of 3.9 percent and marked the slowest expansion since August 2020, suggesting weakening consumption.

Increasing consumption is not only a post-COVID recovery goal, but also a long-term strategy for economic growth. As the economy continues to mature, the government is hopeful that consumption on domestic goods and services can prop up the economy as other areas, such as low-cost manufacturing, decline. This will ultimately mean more money has to go in the hands of consumers.

However, increasing consumption and changing consumption habits will likely take a long time and is largely predicated on the stability of other areas of the economy. The GWR therefore does not provide many concrete measures for stimulating consumption as, short of handing out stimulus checks, there is not much the government can do in the short term. Many of the proposals that it does outline will take some implementation to bear fruit.

For example, the GWR calls for increasing income and improving income distribution, as well as providing better social infrastructure at a community level, such as community pensions and childcare. They also include rather vague objectives, such as improving the quality of products and services.

To promote services consumption, the GWR calls for the expansion the domestic service industry, the construction of county-level commercial systems, and development of rural e-commerce and express logistics and distribution.

Foreign trade and investment

As a major contributor to the economy, the GWR also emphasizes the importance of stabilizing imports and exports in 2022. 2021 was a record year for Chinese exports, but officials have warned exporters of a tough year ahead as overseas manufacturers restart operations and overseas consumers revert to spending on domestic services following the lifting of COVID-19 restrictions.

Many exporters are also SMEs and are therefore particularly vulnerable to falling demand, as well as other pressures from the rising costs of shipping and commodities.

Proposed supportive measures for foreign trade companies include:

- Expanding the coverage of export credit insurance for foreign trade SMEs.

- Strengthening export credit support.

- Optimizing foreign exchange services and speeding up the progress of export tax rebates.

- Fully leveraging cross-border e-commerce and supporting the construction of overseas warehouses.

- Expand imports of high-quality products and services.

- Developing service trade and digital trade and promoting the implementation of a negative list for cross-border service trade.

For foreign investment, the readout proposed measures to further develop foreign investment and increase the utilization of foreign capital. Foreign investment saw healthy growth in 2021, with actual use of foreign capital reaching RMB 1.15 trillion (US$182 billion), breaking double-digit growth for the first time in many years at 14.8 percent year-over-year.

Among other measures, the readout calls for expanding the scope of encouraged fields for foreign investment and support the increase of foreign investment in sectors, including high-end manufacturing, R&D, and modern services, especially in less-developed areas of China, such as the central, western, and northeastern regions.

COVID-19 prevention measures in 2022

Many may have been hoping for an announcement of a roadmap toward re-opening China’s borders and relaxing COVID-19 restrictions, but preliminary information laid out in the GWR appears to double down on the current zero-tolerance strategy. The GWR calls for:

- Persisting with the strategy of defending against imported cases and stopping the rebound of cases domestically.

- Continuously improving and perfecting prevention measures.

- Strengthening pandemic prevention in port cities.

In addition, the GWR calls for:

- Intensifying research of and capabilities to guard against new variants of COVID-19.

- Accelerating R&D of COVID-19 vaccines and drugs.

- Continuing vaccine roll-out.

- Continuing to scientifically and precisely handle local outbreaks to maintain normal production, operations, and pace of life.

Guaranteeing employment

Ensuring employment is a core concern for the Chinese government in 2022, following uneven recovery of employment rates since the outbreak of COVID-19. The surveyed urban unemployment rate has remained stubbornly at above five percent since 2019, reaching 5.1 percent at the end of 2021, down from 5.6 percent in 2020.

With over 10 million graduate students expected to join the job market this summer, the government is looking to strengthen employment and entrepreneurship opportunities for young people in particular (the unemployment rate among those aged 16 to 24 is higher than the rest of the population, reaching 14.3 percent in December 2021).

Fiscal and financial policies will facilitate implementation of the “employment-first policy”, and greater support will be provided for enterprises to stabilize and expand employment.

Proposals to lower the unemployment rate include:

- Reducing unemployment and work-related injury insurance premiums: For enterprises that do not lay off employees, the policy of returning unemployment insurance premiums will continue to be implemented; and for MSMEs, the return ratio of the unemployment and work-related injury insurance premiums will significantly increase.

- Improving social security policies for flexible employment.

- Launching occupational injury protection pilot programs for new employment formats.

- Preventing and correcting gender, age, and other employment discrimination, and focusing on solving outstanding problems that infringe upon the legitimate rights and interests of workers.

- Using the RMB 100 billion (US$15.8 billion) unemployment insurance fund to support job stabilization and training and foster urgently needed talent in the manufacturing industry.

Climate and environment

China has set two major carbon emissions goals: reaching peak carbon emission by 2030 and carbon neutrality by 2060. Reaching these goals will be achieved through the implementation of the “1+N” policy framework. This framework is the foundation for China’s long-term carbon emissions strategy and consists of one main policy document acting the country’s overarching guiding principles (the “1”) and a series of auxiliary policy documents targeting specific industries, fields, and goals (the “+N”).

In the lead up to COP26 in 2021, the government released the “1” document (the Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy) and the first of the “N” documents (the Action Plan for Reaching Carbon Dioxide Peak Before 2030). These two documents form the basis of China’s policy framework for reaching its two key carbon reduction targets.

Now, the core tasks for 2022 set out in the GWR will be the implementation of these policy documents. In addition, it once again emphasized the “orderly” reduction of carbon emissions. This is a reference to the overzealousness of some local authorities, whose eagerness to reduce carbon through measures, such as shutting down coal plants, was in part to blame for a power crunch in the latter half of 2021.

Specific measures include:

- Strengthening the clean and efficient utilization of coal and reducing and replacing it in an orderly manner and promote the transformation of coal-fired power generation for energy saving and carbon reduction, flexibility transformation, and heating transformation.

- Promoting the planning and construction of large-scale wind and photovoltaic bases.

- Improving the power grid’s ability to absorb renewable energy power generation.

- Promoting the R&D, promotion, and application of green and low-carbon technologies.

- Promoting energy conservation and carbon reduction in industries, such as steel, nonferrous metals, petrochemicals, chemicals, and building materials.

- Resolutely curbing the development of “two highs” projects – high energy consumption and high emissions.

- Improving incentives and restraint policies for pollution and carbon reduction.

Elderly care and childcare

In response to the accelerated aging population, the readout of the GWR promises to optimize the supply of elderly care services in both urban and rural areas, support nongovernmental sectors in providing day care, assisted meals and cleaning, and rehabilitation and nursing services to the elderly, encourage the development of mutually assisted elderly care services in rural areas, and promote the high-quality development of programs and industries for the elderly.

According to another document, the 14th Five-Year Plan for Healthy Aging, more than 60 percent of secondary and higher general hospitals will have geriatrics departments by 2025. The plan calls for improving the standard system for the combination of medical and nursing services.

Based on the latest census, 190.64 million people, or 13.5 percent of China’s population, are 65 years or older, a sizeable increase from 8.9 percent in 2010. The government’s support for private capitals to engage in the elderly care services will give a welcome flip to the housing market.

To reduce the burden of childrearing and encourage child birthing, as mentioned earlier, the GWR proposes to make the nursing expenses for children under the age of three a special additional deduction item for IIT. Also, the GWR promises to develop preferential childcare services and strengthen the protection of minors.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Top 3 Reasons to Invest in China in 2022

- Next Article Le principali tendenze di consumo sostenibili in Cina nel 2022