Export Tax Rebates in China: Recent Changes and Risk Management

Export tax rebates refer to refunds of the value-added tax (VAT) and consumption tax (CT) actually paid by the exporting enterprises on exported goods during the production and circulation process. While it is an important trade policy widely adopted by various countries to promote exports, enterprises might be exposed to certain risks and disadvantages when applying the policy. In this article, we will walk you through the recent changes in China’s export tax rebates regime and provide our suggestions on how to prevent and manage the risks in a practical way.

China’s export tax rebates system: An overview

China began to implement the export tax rebates policy in April 1985 to enhance the country’s competitiveness in foreign markets by eliminating double taxation on exported goods. In the past 30 years, the export tax rebates policy has gone through a lot of major reforms and changes, some of the most significant ones are discussed below.

Adjustment on the rate and scope of export tax rebates

After joining WTO, China has made multiple changes on export tax rebates, including the overall adjustment on export tax rebates and the expansion on the scope of export tax refund.

According to Circular on VAT and Consumption Tax Policies for Export Goods and Services (Caishui[2012]No.39), VAT shall be exempted for manufacturing enterprises exporting self-produced goods or deemed self-produced goods and providing processing, repairing, and replacement labor services. VAT shall also be exempted for selected enterprises listed in the circular when exporting non-self-produced goods. The relevant input VAT shall be deducted from the VAT payable and the rest of unreduced portions shall be refunded. This significantly expand the scope of export tax rebates.

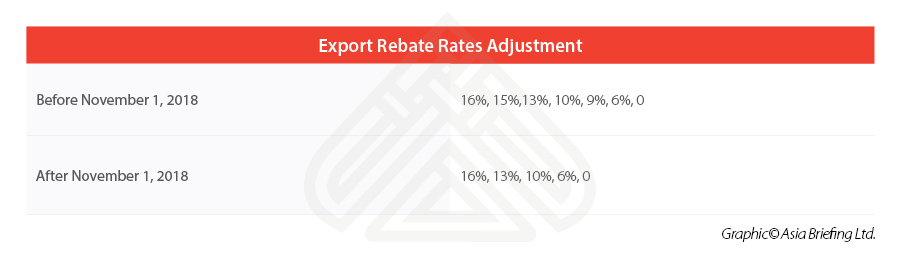

As to the export tax rebates rates, a graded export tax rebates system has been established. According to the Circular about Adjusting Export Tax Rebate Rates for Some Products (Caishui[2018]No.123), starting from November 1, 2018, the export tax rebates rate was raised by one percent to 16 percent, 10 percent, and six percent, respectively. Beyond that, the grade of export tax rebates rates has been decreased from seven levels to five levels, making it easier for tax collection and management.

In 2020, with many foreign trade enterprises exposed to severe challenges under the COVID-19 pandemic, China raised export tax rebates rates for certain products again.

According to the Announcement about Raising Export Tax Rebate Rates for Some Products (State Taxation Administration Announcement 2020 No.15), starting from March 20, 2020, the export tax rebate rate will be increased to 13 percent for 1,084 products, and to 9 percent for 380 products.

After the implementation of this policy, except for products with high energy consumption, high pollution, and high resource consumption – the export tax rebates rates for all export products is the same as the VAT rates applied, which means zero tax rate for all export products have been achieved with limited exceptions.

Simplified declaration procedures of export tax rebates

Along with the continuous adjustment of China’s tax policy, the declaration procedures of export tax rebates have been thoroughly simplified and optimized.

Previously, companies had to declare the export tax refund on time, or else they would neither be able to enjoy export tax rebates, or alternatively enjoy the VAT exemption. As a contrast according to the Announcement about Issues Concerning Export Tax Rebate (Exemption) (State Taxation Administration [2018] No.16), starting from May 1, 2018, although companies cannot enjoy export tax rebates for the overdue declared goods, they still can enjoy the VAT exemption.

Moreover, the pre-declarations on export tax rebate and VAT exemption has been scrapped, and the requirement that export companies must submit VAT tax returns, import declarations, export tax rebate declarations, as well as other relevant documents and records has been removed. It also canceled the Nil filing for manufacturing enterprises, which was to be submitted if there is no business.

The simplified declaration procedures of export tax rebates have improved the efficiency of the examination and approval process, making China’s export tax rebates simpler and more convenient.

Shortened time on receiving the fund of export tax rebates

According to the revised Announcement on Issuing the Revised Measures for Classified Administration of Export Tax Refund (Exemption) Enterprises (State Taxation Administration Announcement [2016] No.46), which became effective as of September 1, 2016, the maximum reviewing time for export rebates for Grade B and Grade C companies (categories recognized based on their size, credit, tax record, etc.) were shortened to 10 days and 15 days, respectively, from the original 20 days.

In addition, in a State Council executive meeting, Premier Li Keqiang stated that China will further shorten the average turnaround of export tax rebate from 13 days to 10 days.

Potential risks associated with export tax rebates

Risks caused by frequent policy changes

China’s export tax rebates have been subjected to frequent changes in recent years under the changing global environment. Many enterprises find it hard to adapt to the policy changes, and the actual production of enterprises have been negatively affected as a result.

For example, the deadline of export tax rebates declaration has been extended while the declaration frequency has been reduced. Since 2013, the declaration frequency has been reduced to one batch per month from the previous two batches per month. Given this development, if the enterprise misses the declaration in one month, the whole review will be delayed to the next month, which may affect the tax and finance management of the enterprise.

Risk caused by the incapability of the staff who is in-charge of export tax rebates

In practice, if the staff who is in charge of managing the export tax rebates lacks thorough understanding of China’s tax system, does not possess the basic tax management skills, and does not have the basic sense of risk control, they may not be able to retain and prepare sufficient documents that are required in processing export tax rebates, or they may submit flawed receipts to the bureaus in charge without any double checks, which may consequently lead to delayed export tax rebates or a total failure of the application. The company will suffer losses as a result.

Risk caused by loopholes in company’s own management

Company’s internal control system is not well rounded

Internal control is important in ensuring the smooth application of export tax rebates and avoid unnecessary risks. To be more specific, internal control regarding export tax rebates implies the below targets:

- Ensure the authenticity of export business and compliance of the operation;

- Accurate reporting of basic information to tax authorities;

- Correctly apply relevant export rebates policies;

- Ensure the documentation for export tax rebates is complete and standardized;

- Timely and accurate declare the export tax rebates;

- Ensure the financial accounting for export tax rebates is correct; and

- Take the initiative to cooperate with the export tax rebates verification.

In practice, a company’s internal control system might be deficient either because of cost efficiency considerations or because the significance of the internal control system is underestimated by its management. Loopholes in the company’s internal control system could cause unnecessary lapses or losses to the business in terms of whether they are successfully able to utilize the preferential export tax rebates policy.

For example, a company’s internal control system should investigate and verify the normal operation of the supplier and establish a standardized packing and loading vehicle monitoring and inspection system to ensure that the customs declaration and departure goods conform to the outbound goods and the goods listed in the packing list, and ensure the enterprise’s receipt and payment of foreign exchange match with transactions. If the company’s internal control system fails to do so, the authenticity of the export businesses cannot be ensured, which may impact the company’s credit in applying export tax rebates.

Company’s basic framework relating to export tax refund is not solid enough

In China, many enterprises tend to allocate most of their resources to production that can increase economic business and underestimate the importance of tax management. This may lead to a situation where the company fails to retain the actual supporting data that might be required in export tax rebates, such as the product code, source of origin, and the quantity of the product, etc. It will apparently affect the success rates of the export tax rebates application.

Suggestions to strengthen risk management of export tax rebates

Pay more attention to the regulatory updates

Enterprises are suggested to take more active measures to scan and monitor the regulatory updates on export tax rebates. It is advisable for enterprise to develop a list of websites where the regulatory updates on export tax rebates are posted, visit these websites regularly, and archive the updates properly in an established format for easier tracking. If the enterprise finds that managing this scanning internally is too onerous, they can opt for services from a professional third-party firm, which will save the company more time for core business activities.

After monitoring the updates, relevant staffs of the enterprises are suggested to study the changes carefully and form a thorough understanding of the regulation and its implications. Only in this way can the enterprise carry out any stipulated changes properly in practice.

Moreover, enterprises are suggested to make corresponding modification without procrastination on the basis of comprehensive consideration of the existing system and the new policy, so to reduce the potential risks in export tax caused by the policy changes.

Establish a wholesome tax rebate management system

Enterprises are suggested to pay extra attention to the rebates basic tax refund work. Although the basic tax work is relatively simple, it has strict requirements on details, which requires the practitioners to scrupulously manage the data filling, the information of goods, the amount of goods, etc. By carefully conducting control and review, delay or constant revision of the export tax rebates declaration can be avoided to a large extent.

Improve the specialty of relevant staffs in charge

Enterprises are suggested to improve the tax-in-charge staff professional ability and knowledge by organizing constant internal and in-time training sessions. Correspondingly, the staff who is in charge of the export tax rebates can understand and master the up-to-date requirements of the export tax rebates declaration process, and improve the efficiency of the enterprise’s export tax rebates.

In practice, the staff in charge of managing export tax rebates must have financial knowledge and an acute understanding of the enterprise’s financial business, as well as have possess cross-industry professional knowledge and sensitivity to the volatile regulations on export tax rebates. Therefore, the training provided to them should be comprehensive, rather that limited to tax only updates. They should also be able to develop a unified risk control standard in export tax rebates and successfully implement it in daily operations.

Summary

Managing export tax rebate is an important topic for, both, foreign trade enterprises and China’s national economic system. However, it brings with it potential risks and financial loss to enterprises if their export tax rebates are managed improperly, either due to the incapability of the staff in charge or due to the deficient company institutions.

Only by closely monitoring the regulatory updates in the regime, carefully studying the changes, continuously providing due training to its employees in charge, and vigorously improving the company’s internal control system, the enterprise can effectively reduce risk in export tax rebates to the largest extent, safeguard the due financial benefits of the enterprise, and avoid any unnecessary financial losses.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Services Sector Openings in Tianjin, Shanghai, Hainan, and Chongqing

- Next Article What’s Next for Australian Wine in China?