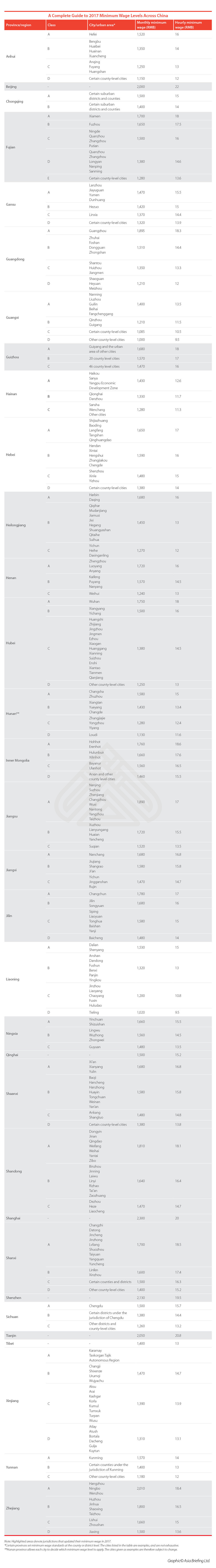

A Complete Guide to 2017 Minimum Wage Levels Across China

By Alexander Chipman Koty and Zhou Qian

Labor costs in China continue to rise – 20 regions have increased their minimum wages so far in 2017.

Regional authorities in Beijing, Fujian, Gansu, Guizhou, Heilongjiang, Henan, Hubei, Hunan, Inner Mongolia, Jiangsu, Jilin, Ningxia, Qinghai, Shaanxi, Shandong, Shanghai, Shanxi, Shenzhen, Tianjin, and Zhejiang have all raised their minimum wages in 2017. In total, these 20 regions are more than the nine that increased wages in 2016 and the 19 in 2015, but less than the 24 in 2014.

While the growth rate of minimum wages is lower than that of much of the last decade, wages are growing from a higher base than before, and wage increases continue to outstrip increases in productivity.

Minimum wages in parts of China – such as Beijing, Shanghai, and Shenzhen – are now higher than certain areas in the EU, namely Bulgaria. However, at their lowest levels – like in parts of Anhui, Guangxi, and Hainan – wages are more comparable to countries such as India and Vietnam.

![]() HR & Payroll Solutions from Dezan Shira & Associates

HR & Payroll Solutions from Dezan Shira & Associates

Since 2016, regional governments have had more authority and discretion to make minimum wage adjustments according to local conditions. Most provinces set different classes of minimum wage levels for different areas, depending on its stage of development and cost of living. For example, a higher class for the provincial capital and the most developed cities, and a lower class for smaller cities and rural areas.

Qinghai, however, has eliminated class brackets this year and has instituted a common minimum wage across the province instead. Hunan allows individual districts to choose their class rather than imposing one, while Guizhou assigns each urban area in the province the highest class rather than specific cities, with more rural areas falling under the lower classes. Meanwhile, Fujian, Heilongjiang, and Jilin, among others, have rearranged their class brackets in 2017 to add more nuance to wage differences between regions.

The complete guide to China’s minimum wages is as follows:

Overall, more regions increased their minimum wages in 2017 than appeared to be on track to do so earlier in the year. Minimum wages are typically updated in the first half of the year (if at all), but by early June only five regions had done so. Further, major provinces such as Guangdong and Sichuan announced wage freezes in an effort to maintain economic competitiveness.

Since then, however, 15 more regions updated their minimum wages to bring the total to 20. This may be partially explained by the politically important 19th Party Congress, which started October 18, when the Chinese Communist Party’s top leadership convenes to announce changes in policy and leadership positions.

Chinese President Xi Jinping has pledged to eradicate rural poverty by 2020, making the campaign a key pillar of his tenure as president. The late increases to minimum wages, in conjunction with other policies, such as tax cuts aimed at small and micro sized businesses, can earn the support of a key constituency at a politically sensitive juncture.

![]() RELATED: China’s Social Security System

RELATED: China’s Social Security System

Regardless of the impetus, China’s wages have risen in 2017, and should continue to do so going forward. For many foreign businesses, however, the impacts of wage growth will be a result of market demands, rather than statutory wage increases.

According to a survey released by the German Chamber of Commerce, 86.4 percent of German companies in China cited rising labor costs as a major challenge to their business in China. However, only 11.8 percent considered minimum wage increases as being very important factors influencing wage levels in China.

This is largely a result of the Chinese economy’s transition away from low-value and labor-intensive manufacturing towards higher-value manufacturing and services, in combination with its rapidly aging work force. Businesses reliant on low wages are increasingly looking to alternatives in India and Southeast Asia for their operations, while others invest in China for higher value businesses processes and access to the domestic consumption market.

Those factors make market considerations more important for determining wage increases for many foreign businesses. In China’s flourishing tech sector, for example, average wages are about five times higher than the local minimum wage, and far higher for positions that require greater skills and education.

As a result of rising wages, many investors are looking west towards inland China to benefit from lower labor costs, special incentives, and the growing markets there. Other businesses, however, are continuing to invest in China’s affluent coastal regions where infrastructure is the most developed and talent is more readily available. When investing in China, foreign investors are advised to not necessarily chase the lowest wages, but consider where their business plans best match the local conditions.

This article was originally published on October 10, 2017 and has been updated with the latest regulatory changes.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

In this issue of China Briefing magazine, we provide foreign investors with best practices for implementing internal controls in China. We explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes.

- Previous Article EU Data Processing Law May Affect Hong Kong from May 2018: Are You Ready?

- Next Article Calculating Value-Added Tax in China