A Complete Guide to Minimum Wage Levels Across China 2014

Updated: Please refer to our 2015 update of China’s minimum wages

By Matthew J. Zito, Rainy Yao and Camille Chen

SHANGHAI — For some time now, rising labor costs in China have been setting off alarms among foreign investors, prompting many to move their manufacturing operations elsewhere, especially to ASEAN nations such as Vietnam. Based on 2014 figures, however, it looks like China’s wage increases have begun to slow down, as the Central Government exerts pressure on maintaining economic growth targets. In keeping with our annual tradition here at China Briefing, a comprehensive list of minimum wages across China for 2014 is provided below.

The task of evaluating wages in China is not as simple as it may seem, with complications stemming from regional variation, welfare costs and ongoing regulatory changes. To unravel this complexity, it must first be noted that wage standards are set for individual cities, provinces and other administrative units by their respective local governments, rather than on a nationwide basis. Next, each of these principalities is divided into a number of wage classes, whose minimum wages vary according to local socioeconomic conditions. Lastly, minimum wage is differentiated between minimum monthly salary and minimum hourly wage (for full-time and part-time workers, respectively). According to China’s Employment Promotion Plan, the minimum wage in each jurisdiction must be increased at least once every two years; meanwhile, the 2011-15 Five Year Plan stipulates an average increase of 13 percent per year.

As of June of this year, wages have been hiked in a total of eleven areas—Beijing, Chongqing, Gansu, Guangdong (Shenzhen), Qinghai, Shaanxi, Shandong, Shanxi, Shanghai, Tianjin and Yunnan—at an average of 11 percent for monthly minimum wage increases. An announced wage increase for Sichuan is due to take effect on July 1, 2014. Based on the date of their last respective updates, wages will also be increased in Hebei, Heilongjiang and Tibet before the year is up. If this trend continues through the remainder of 2014, some 26 regions may be on track for increases to their minimum wage. This is slightly better news for foreign investors when compared with last year’s total of increased wages in 27 province-level jurisdictions at an average of 17 percent.

In light of the more developed economies and higher living standards in Beijing, Shanghai and Tianjin, these cities received comparatively higher increases this year: their monthly minimum wages rose by 11.4, 12.3, and 12 percent, respectively, and hourly minimum wages by 11.2, 21.4, and 12 percent, respectively. Of these figures, Shanghai’s 21-percent increase to the hourly minimum wage is likely to carry the most significance for businesses, as it results in Shanghai overtaking Shenzhen’s claim to the highest hourly wage in China. Notably, Xinjiang wages are far beyond those of any other province in western China, comparable instead with wages in Beijing, Hebei and Jiangsu.

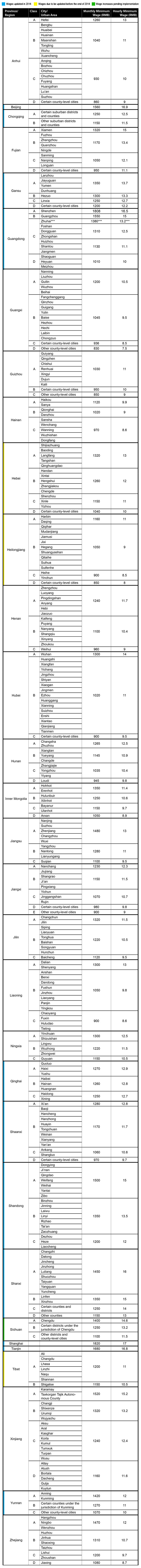

Monthly and hourly minimum wage levels across all provincial-level jurisdictions in China are provided below (the municipal government of Zhuhai, Guangdong, independently sets a slightly higher minimum wage). It should be noted that these figures describe net wages only and do not take into account deductions, such as pensions or social insurance. For the most part, regions below the city-level have been omitted from the table or otherwise grouped together. Questions pertaining to regions not included in the table should be submitted directly to Asia Briefing’s professional editorial staff.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Payroll Processing Across Asia

In this edition of Asia Briefing Magazine, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use to manage their payroll across various countries with external vendors, and explain the differences among three main models: country-by-country, managed, and integrated models while highlighting some benefits and drawbacks of each.

Social Insurance in China

In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings. We hope this will give you a better understanding of the system in China.

A Complete Guide to China’s Minimum Wage Levels by Province, City, and District

China’s 2014 Q1 Minimum Wage Hikes

Tips for Recruiting Retail Personnel in China

- Previous Article Strategies for Repatriating Profit from China: New Issue of China Briefing Magazine

- Next Article Logistics, Warehousing and Transportation in China (Part 1)