Labor Markets in China’s Tech Cities: Shenzhen, Beijing, and Hangzhou

By Alexander Chipman Koty

The competition to become “the Silicon Valley of Asia” is stiff. Hong Kong, Singapore, and Bangalore all have solid claims, while the mainland Chinese cities Shenzhen, Beijing, and Hangzhou are also strong competitors.

A recent report published by Renmin University’s National Survey Research Center replaces this hotly debated topic by dividing China’s innovative cities into three distinct tech business models: Shenzhen’s high-tech model, Beijing’s innovation-driven model, and Hangzhou’s dotcom model.

Driven by generous incentives under policies, such as the 13th Five Year Plan and Made in China 2025, China is fast becoming a leader in tech innovation. But foreign entrants looking to establish a presence in China’s burgeoning IT and innovative field should seek to better understand the respective labor markets of the cities underpinning this growth. Given the importance of talent in technology-driven business, an understanding of the local labor market can make the difference between boom and bust.

Wages in comparison

IT employers should carefully examine minimum and average wages in investment destinations before taking a closer look at wages within their industry.

Minimum and average wages

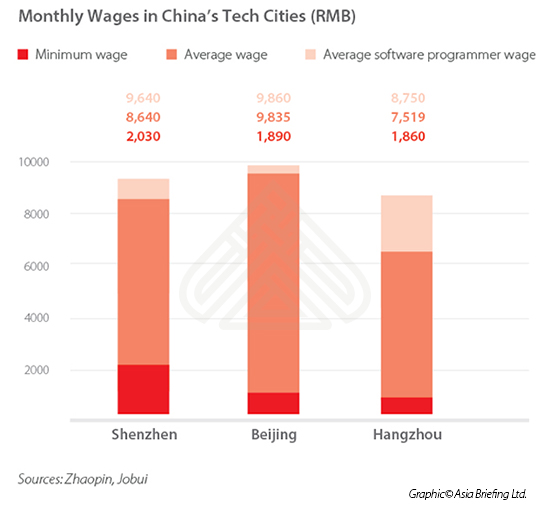

Before analyzing IT wages in China’s three main tech cities, it is worth noting their minimum and average wages as means of comparison. Shenzhen has the highest monthly minimum wage of the three cities at RMB 2,030, followed by Beijing at RMB 1,890, and Hangzhou close behind at RMB 1,860.

According to Chinese career website Zhaopin’s Q4 2016 labor market review, Beijing has China’s highest average monthly salary at RMB 9,835. Shenzhen has the country’s third highest (RMB 8,640), while Hangzhou has the sixth highest (RMB 7,519).

Among all workers in 34 of China’s leading cities, the average monthly salary is RMB 7,606.

Wages in the IT industry

Wages in the IT industry are considerably higher thanthe average wages in each city. According to recruitment company Michael Page, the salary of an analyst programmer in Beijing ranges from RMB 120,000-600,000 per year, with a median salary of RMB 360,000, or RMB 30,000 per month.

In Shenzhen, the same position ranges from RMB 200,000-300,000 per year, with a median of RMB 250,000, or about RMB 20,833 per month. The same trends are true for other positions, including senior ones: Beijing has a broader range of salaries than Shenzhen, and a consistently higher median.

Data was not available for the same position in Hangzhou. However, industry representatives and open source information suggest that a typical salary for a young analyst programmer at a top internet company in Hangzhou would be around RMB 200,000 per year, or about RMB 16,667 per month.

Across China, the recruitment company Hays puts the salary range of an analyst programmer at RMB 180,000-400,000, depending on the specialization.

![]() RELATED: Payroll and Human Resource Services

RELATED: Payroll and Human Resource Services

However, according to Chinese career websites, wages in the IT industry can be lower than the figures provided by Michael Page and Hays.

Per Chinese recruitment website Jobui, the average wage for a software programmer (generally a less senior position than analyst programmer) in Shenzhen is RMB 9,640 per month, with 29 percent earning RMB 10,000-15,000. In Beijing, wages for the same position are slightly higher at RMB 9,860 per month, including 26 percent earning RMB 10,000-15,000. Salaries are lowest in Hangzhou, at RMB 8,750 per month, with just 22 percent earning between RMB 10,000-15,000. Jobui, pins the average monthly salary for a software programmer in China at RMB 8,760 per month.

While these figures are lower than those reported by Michael Page and Hays, they are still at the higher end of Chinese salaries. Zhaopin reports that across the 34 cities surveyed, IT management/project coordination was the second highest paid position after senior management, with an average monthly salary of RMB 14,554, while software/internet development/system integration had an average wage of RMB 9,759.

The lower average salaries reported by Chinese career platforms may be due to a broader definition of IT-related positions, including IT-related positions in companies not involved in the industry itself, as well as encompassing smaller Chinese tech companies and startups that are not captured by foreign HR companies.

Talent availability

Of the three cities of Shenzhen, Beijing, and Hangzhou, Beijing easily stands out for the strength of its education institutions, and the young talent and innovation they supply. Beijing has 12 universities within the top 100 on the QS University Rankings: BRICS 2016 list – including the top two spots – compared to just one for Hangzhou and none for Shenzhen.

The volume of universities in Beijing contributes to high levels of competition among graduates. Zhaopin’s competitive index, based on the number of applications per job vacancy, indicates that Beijing has by far China’s highest labor competition. Beijing topped the list with a 93.5 rating, while Shenzhen was fourth at 48.8 and Hangzhou 16th at 26.9.

It is highly likely that there are fewer applications per vacancy when solely looking at the IT industry, however. In the fourth quarter of 2016, China’s internet/e-commerce sector had the most job vacancies among all sectors. Given the rapid rate of expansion of China’s tech industry, Hays identifies recruitment activity in IT as its top talent trend for China in 2017.

Tech companies will be competing to attract talent, which means that turnover will be high, as will annual raises. Average salaries in China are projected to grow by seven percent in 2017, including 5.2 percent in Shenzhen and 3.2 percent in Beijing. In the IT industry, annual raises for top talent are more likely to be in the range of 15-20 percent.

Identifying the right fit

Shenzhen, Beijing, and Hangzhou are at the forefront of China’s transformation into a global high-tech power. Each city offers unique benefits tailored to different IT subsectors.

For companies focusing on hardware, with its clustering of manufacturing, young talent, and tech startups, Shenzhen is undoubtedly the go-to spot. For tech companies concentrating on innovation and research and development, Beijing offers the deepest and most skilled talent pool, helping offset higher costs across the board. For those developing internet-based products and applications, particularly in e-commerce, Hangzhou is an attractive location due to spillover effects from Alibaba and lower operating costs.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

An Introduction to Doing Business in China 2017

Doing Business in China 2017 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates in January 2017, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies who already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

New Considerations when Establishing a China WFOE in 2017

New Considerations when Establishing a China WFOE in 2017

In this edition of China Briefing, we guide readers through a range of topics, from the reasons behind foreign investors’ preference for the WFOE as an investment model, to managing China’s new regulations. We discuss how economic transformations have favored the WFOE, as well as the investment model’s utility, and detail key requirements that businesspeople need to examine before initiating the WFOE setup process. We then walk investors through the WFOE establishment process, and, finally, explain the new and idiosyncratic “Actual Controlling Person” regulation.

- Previous Article Mise en Place à Shanghai d’une Nouvelle Procédure de Demande en Ligne de Visa de Travail

- Next Article Dezan Shira’s 25 Year History of Handling British Business in Asia – An Interview with Chris Devonshire-Ellis