Investing in Inland China: Assessing Chongqing’s Industrial Zones

By Waiyan Varsha Tse

Rising minimum wages have led commentators to declare the end of affordable Chinese labor. However, these assertions ignore the vast expanse of the Chinese mainland, and the varying economies that exist within it. The sprawling city of Chongqing especially stands out as a major emerging manufacturing destination for foreign investors.

Over the past years, manufacturing in China has steadily crept inland as companies seek not only to lower their costs, but also to take advantage of government incentive programs aimed at developing western provinces. In particular, the State Council enacted the “China Western Development Plan” in 2000, which prioritized increasing foreign direct investment (FDI) into Central and Western China.

The introduction of preferential development policies has seen Chongqing – long a strategic hub in the country’s west – become one of China’s most important cities. Chongqing has achieved the highest regional GDP growth in China for three years running, growing at 10.9 percent in 2014, 11 percent in 2015, and 10.7 percent in 2017. As FDI in Western China continues to evolve, Chongqing will become an even more important city.

Preferential policies are often offered through industrial parks that seek to develop certain industries. In order to assist foreign investors better assess their investment opportunities in Chongqing, this article explores three key industrial zones and their preferential policies for foreign businesses.

Chongqing: Western China’s manufacturing hub

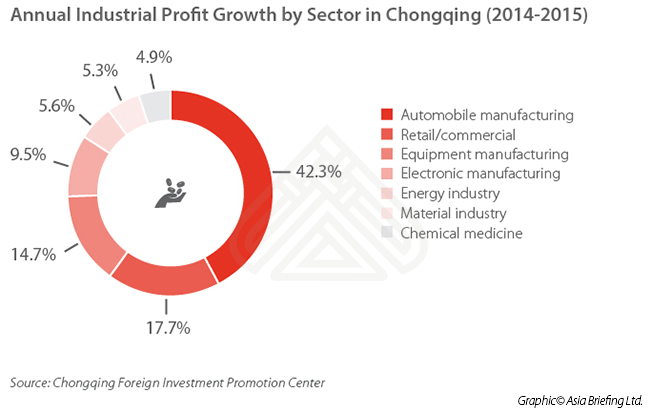

The Chongqing government actively promotes the electronic information and electronic manufacturing industry, as well as other emerging industries like high-end equipment manufacturing, chemical medicine, new materials manufacturing, and new energy industry. In 2015, electronic manufacturing was the third fastest growing industry by profit in Chongqing, after automobile manufacturing and retail/commercial.

With the rapid growth in electronic and high-tech manufacturing, many leading multinational enterprises, including Hewlett-Packard, Foxconn, Inventec, Acer, IBM, Honeywell, CISCO, and HP are setting up their businesses in Chongqing. In June 2017, Ford made headlines when it announced that it would base its new production center in Chongqing Liangjiang New Area instead of Mexico, the originally planned destination.

These companies are drawn by Chongqing’s comparatively low cost of doing business, well-established infrastructure, pools of skilled labor, and regional preferential policies.

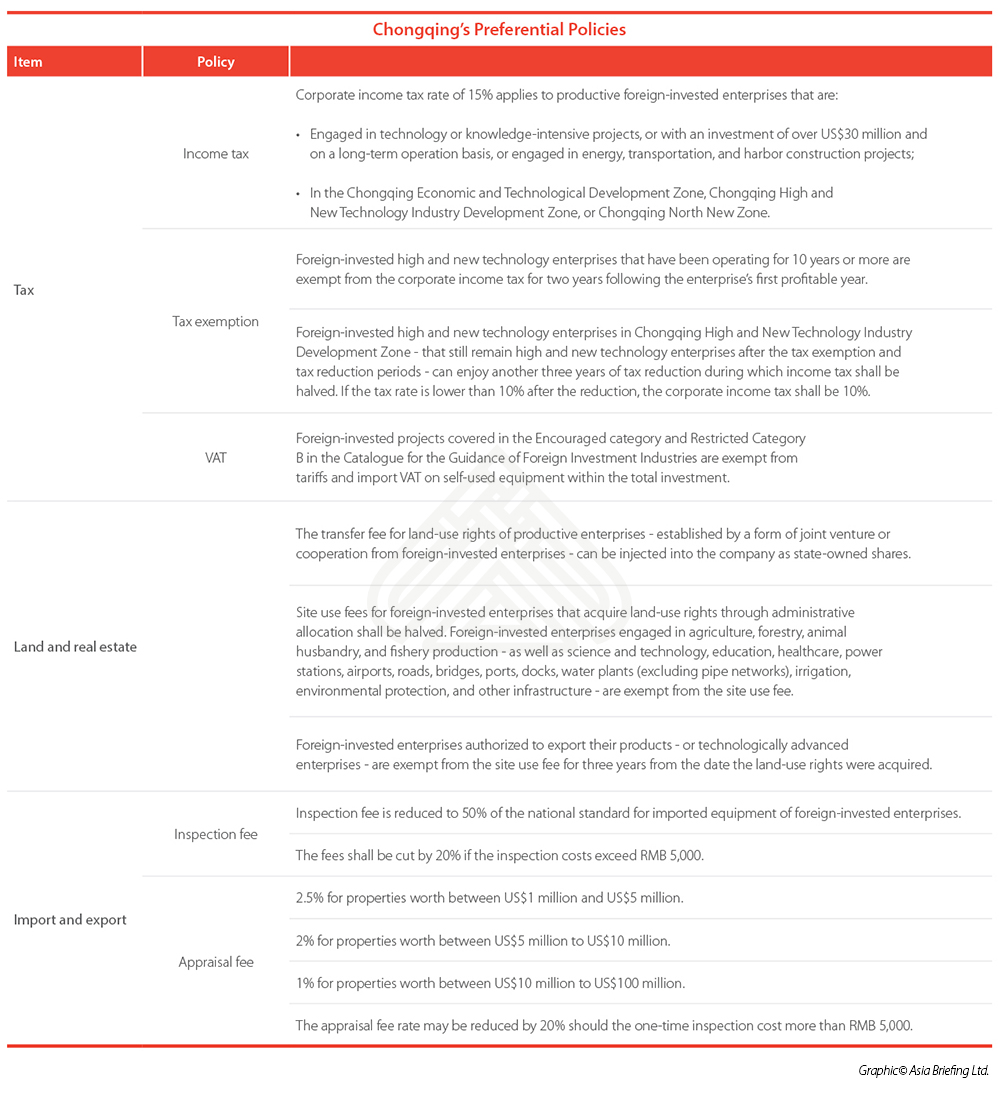

Chongqing’s preferential policies are one of the most appealing factors for foreign investors. In early 2017, the State Council released a guideline, Circular on Several Measures on Expanding the Opening to and Active Use of Foreign Investment (the Circular), outlining how the central government seeks to increase FDI into Central and Western provinces. The Circular grants local governments in these regions greater autonomy to offer local incentives and adopt local preferential policies.

Chongqing’s preferential policies are one of the most appealing factors for foreign investors. In early 2017, the State Council released a guideline, Circular on Several Measures on Expanding the Opening to and Active Use of Foreign Investment (the Circular), outlining how the central government seeks to increase FDI into Central and Western provinces. The Circular grants local governments in these regions greater autonomy to offer local incentives and adopt local preferential policies.

![]() RELATED: Made in China 2025: Implications for Foreign Businesses

RELATED: Made in China 2025: Implications for Foreign Businesses

Generally, Chongqing’s preferential policies include tax incentives, land and real estate benefits, foreign exchange management and credit, import and export assistance, and visa advantages. However, investors should note that preferential policies vary in different development zones even within the same province.

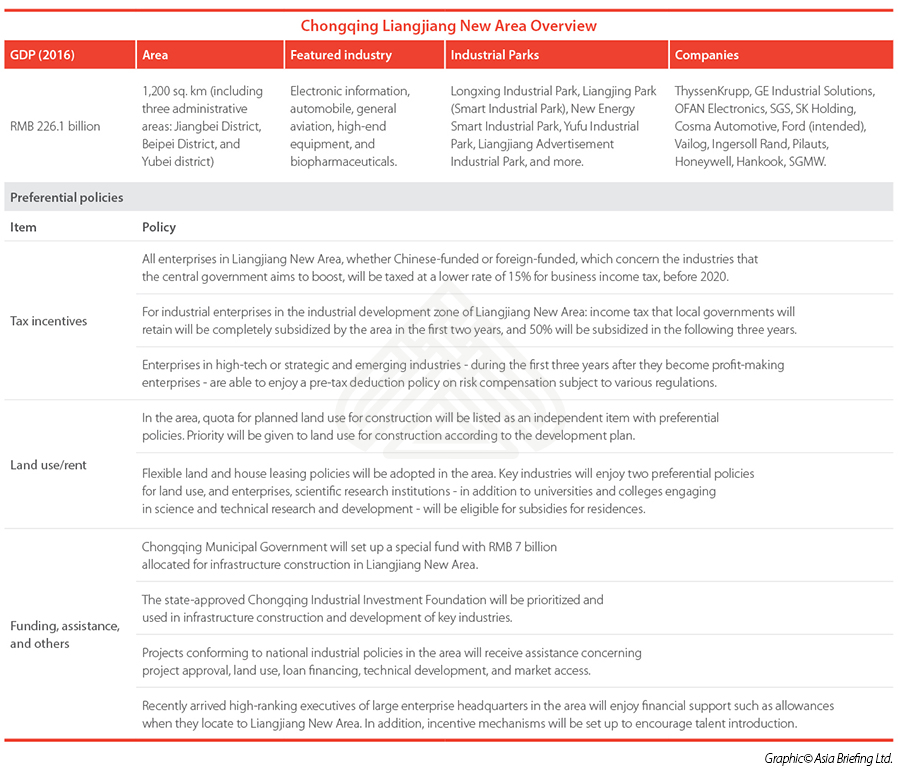

Chongqing Liangjiang New Area

Located in the north of the Yangtze River and east of the Jialing River, Liangjiang New Area is the first national-level development zone in inland China, and the third nationally after Shanghai Pudong New Area and Tianjian Binhai New Area.

As the first development area in inland China, Liangjiang New Area is expected to become a key component of Chongqing’s development. According to the Liangjiang New Area government, by 2020, 60 percent of Chongqing’s industrial land (171 square kilometers), 40 percent of its commercial land (125 sq. km,) and 60 percent of public land (108 sq. km) will be located in Liangjiang New Area.

To compete, Liangjiang New Area has a “Six Low Costs” concept, which includes low construction costs, low logistics costs, low production costs, low financing costs, low official business costs, and low tax cost. These “Six Low Costs” are formulated within Liangjiang’s ten preferential policies.

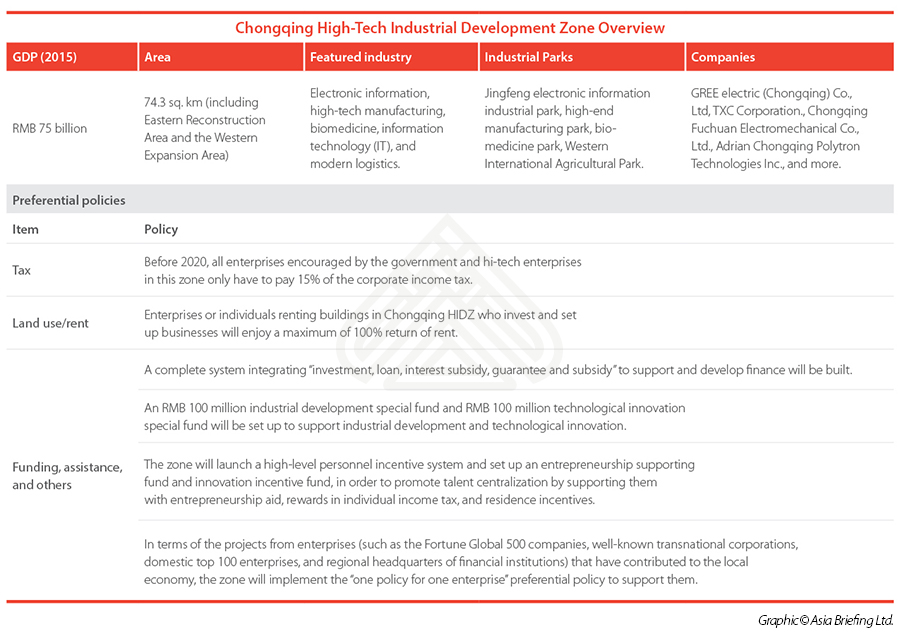

Chongqing High Tech Industrial Development Zone (HIDZ)

Located in Chongqing Economic Circle and the metropolitan area, the heart of the Two Rivers peninsula, Chongqing High-Tech Industrial Development Zone (HIDZ) is the base for Chongqing’s industrial overhaul from traditional industries to high-tech industries. It was approved and established by the State Council in March 1991 as a state-level development zone.

![]() Business Intelligence Services from Dezan Shira & Associates

Business Intelligence Services from Dezan Shira & Associates

Spatially, Chongqing HIDZ is divided into two parts: the Eastern Reconstruction Area and the Western Expansion Area. While the majority of the industrial parks are in the Western Expansion area, the Eastern Reconstruction Area caters to more service-oriented industries.

Chongqing HIDZ has released six preferential policies in order to build an encouraging environment for foreign investors.

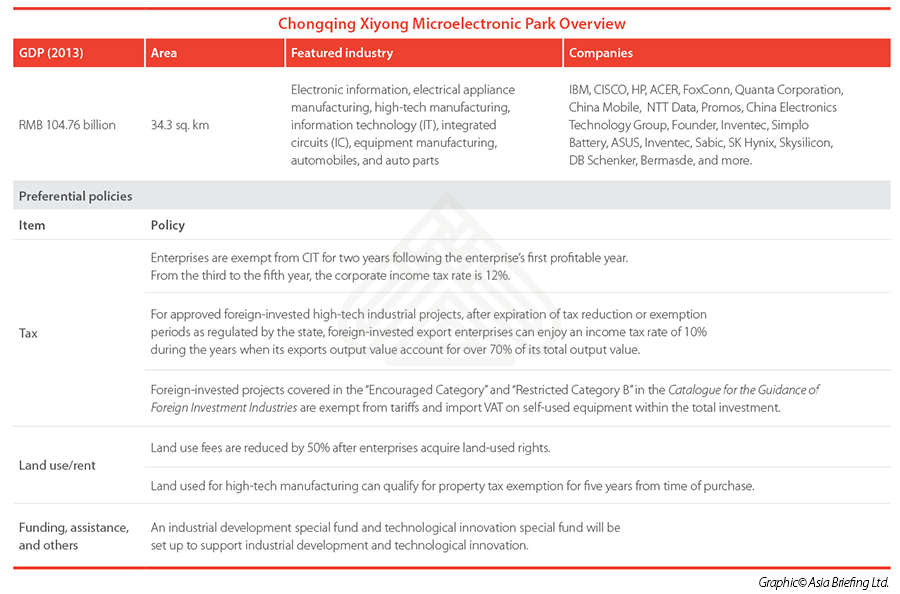

Chongqing Xiyong Microelectronic Industrial Park (MIP)

Located in western Chongqing, the Chongqing Xiyong Microelectronic Industrial Park (MIP) was established by the Chongqing municipal government in 2015.

The Chongqing Xiyong MIP is comprised of Xiyong Central Business Area, Xiyong Comprehensive Bonded Zone (CBZ), a chip manufacturing park, a packaging and testing park, a software park, an application industrial park, a scientific and technological innovation area, and a residential area. The Xiyong CBZ was approved by the State Council in February 2010 and is, so far, the largest duty-free zone in inland China. Along with the Xiyong MIP, the comprehensive bonded zone serves as a major gateway for inland China to international trade.

Xiyong MIP draws on skilled labor from the neighboring university district. Meanwhile, Xiyong area is the start of Yuxinou Railway to Europe. Xiyong MIP’s exclusive focus is on electronic manufacturing industry, including integrated circuit, software, and information services industries.

Identifying the right location

Chongqing’s industrial parks present huge opportunities for foreign investors, especially those in the high-tech and electronic manufacturing industries.

Chongqing Liangjiang New Area has the most offerings of preferential policies, and it emphasizes low costs of production for investors, and the area boasts diversified industry focuses. It is especially attractive for electronic-focused manufacturing, automobiles, new-energy vehicles and high-end equipment manufacturing industries.

Meanwhile, Chongqing HIDZ caters to foreign enterprises committed to developing high-tech and focusing on technological innovation. The preferential policy in Chongqing HIDZ would not only benefit Fortune 500 companies, but also high-tech oriented SMEs and entrepreneurs.

Chongqing Xiyong Microelectronic Park is an option for electronic manufacturing and investors with export-oriented business operations due to its exclusive focus on electronic compliance manufacturing. It also has well-established infrastructure and logistic centers, and proximity to the neighboring Xiyong Bonded Zone, the largest duty-free zone in inland China.

It is also critical to note that beyond these three zones discussed above, there are other industrial zones in Chongqing and Western China at large that investors should consider. When foreign investors are looking at industrial and development zones for their future operations, it is important to evaluate the preferential policies that they offer and conduct thorough pre-investment research to make the best investment decision.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Asia Investment Brief: Import-Export in Laos, Digital Payments in India, and Indian Investment in Vietnam

- Next Article Incentives in Shenzhen for Attracting Foreign Talent