Tapping into New Growth Opportunities in China’s F&B Market

China’s F&B market remains a compelling proposition for foreign investors as new preferences for healthy and imported foods are complemented by supply chain integration and emergence of new retail segments.

COVID-19 and its subsequent control measures significantly disrupted China’s catering sector earlier this year. It also had a negative knock-on effect on the sales of beer, liquor, and condiments to restaurants. But these effects are expected to be short lived.

As the outbreak subsides, food and beverage (F&B) demand, particularly for consumer necessities, is returning to normal. For foreign investors, it is worth noting that changes in Chinese consumer behavior since the outbreak has established a ‘new normal’ and is driving transformation in the industry, most visibly in the marketing and distribution channels of F&B products.

Investors should note the changing trends in China’s e-commerce, new retail, and food supply chain integration to seize the developing opportunities in one of the world’s most dynamic markets.

An overview of China’s F&B import market

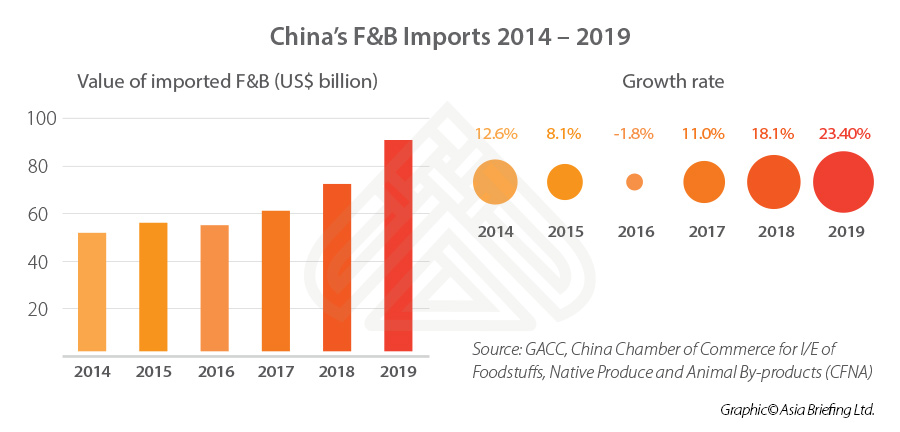

As the world’s largest food importer and consumer, China’s net demand for imported F&B products shows no sign of waning. In 2019, China’s food imports reached US$90.8 billion, showing a year-on-year growth of 23.4 percent. From 2014 to 2018, the value of China’s imported food grew at a CAGR of 7.4 percent. At this rate, the country is expected to import more than US$100 billion worth of foods in 2021.

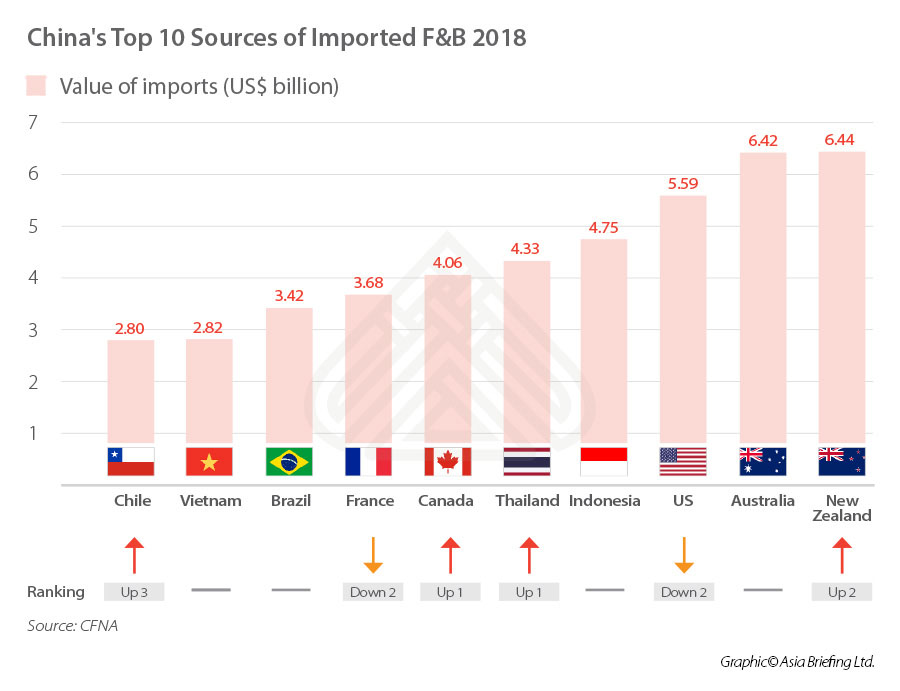

In 2018, out of 17 categories of China’s imported food – aquatic products, meat, and dairy products were the three most popular food segments among Chinese consumers. Imports of aquatic products, meat, and dairy products reached US$12.2 billion, US$11.1 billion, and US$10.6 billion, respectively, and together accounted for about 46 percent of the total imported food. 185 countries and areas exported F&B products to China in 2018, up from 170 in 2017. New Zealand leapfrogged the US and Australia to become China’s top import partner. Dairy products are New Zealand’s main food export to China.

Chile made it to China’s top ten overseas food suppliers, with a year-on-year growth rate of 50.2 percent in 2018. What’s more, thanks to favorable factors, such as free trade agreements and the Belt and Road Initiative (BRI), New Zealand, France, and Vietnam have significantly increased their export footprint in China.

New opportunities and leading trends in China’s F&B market

Emergence of fresh food e-commerce

Virus-led city lockdowns and traffic restrictions damaged traditional offline food retail businesses in the affected areas but catalyzed the emergence of e-commerce and new retail for food supplies. During the extended Chinese Lunar New Year holiday in late January, fresh food e-commerce platforms with last-mile delivery services, such as Freshippo, experienced short-term spikes in orders, as home stayers were inclined to order food and groceries online. Daily new users of major fresh food e-commerce platforms increased by 50 to 200 percent, and year-on-year growth in transaction volume on these platforms rose by three to four times. Changed habits during this intense crisis period is certain to cultivate long-term preferences for online shopping. As supply chains improve, the future seems bright for fresh food e-commerce businesses.

Live streaming e-commerce, and KOLs

The popularity of live streaming and its relationship with e-commerce is evident in the influence it wields over Chinese consumers. In 2019, China’s live streaming e-commerce market size reached RMB 434 billion (US$61.24 billion) with a year-on-year growth of 226 percent. E-commerce giants Taobao and JD.com and live streaming companies Kuaishou and Douyin have invested heavily in live streaming. To illustrate this – the live streaming company Kuaishou now allows its users to buy products from JD.com through the Kuaishou App. A new segment has also emerged, derived from the popular South Korean mukbang, which is “eating while live streaming,” where the host eats food and entertains viewers.

According to the 2019 Taobao Food Live Streaming Trend Report, fresh fruits, dietary supplements, pastries, dried meat, aquatic products, instant food, biscuit puffs, dried candies, nuts, and bird’s nest supplements are the most popular foods in live shows in China. More than 70 percent of the audience watching eating live shows are in their 20s and 40s, and 65 percent of them are women. F&B enterprises should review their marketing channels to assess whether they are successfully targeting the preferred age group. A shift to omni-channel strategies is essential if firms are to stay relevant given the intense market competition.

Food supply chain integration

Consumers are now more conscious of food hygiene and safety than before and growing more accustomed to online services. This means that the current state of China’s complex and fragmented food supply chains, which can produce inferior products, are expected to be the target of major reforms. Stricter food safety regulations and innovative technologies will accelerate the integration, industrialization, and standardization of China’s food supply chains, thereby also enabling food safety traceability.

China’s relatively less-developed cold-chain logistics system might also witness a shift toward how Europe has developed its cold chain model. In the upstream segment of the food supply chain, leading companies engaged in breeding, slaughtering, and processing livestock are being encouraged by the government to extend the industry chain at provincial markets. F&B enterprises should fully understand, plan, and prepare for these changes in China’s food supply chain.

And, as the industry reforms, innovates, and upgrades, investors may find it more convenient to stabilize their market presence or navigate entry through merger and acquisitions (M&A).

Meatless meat and health food market

The intermittent break out of zoonotic diseases like bird flu, swine flu, SARS, and now COVID-19, have pushed consumers to rethink their diet structures. Consequently, plant-based meat producers and retailers are seeing bigger opportunities emerge over a relatively short period of time.

In April this year, Starbucks and KFC began testing the market preference for plant-based meat with new menu offerings; in May, Nestlé announced it was investing US$100 million to build a new plant-based food facility in China. Spurred by the COVID-19, the demand for dietary supplements, immune-boosting foods, and energy drinks are also expected to climb.

Health concerns, an aging population, and the expanding Chinese middle class cohort will continue to drive the future growth of the health food market.

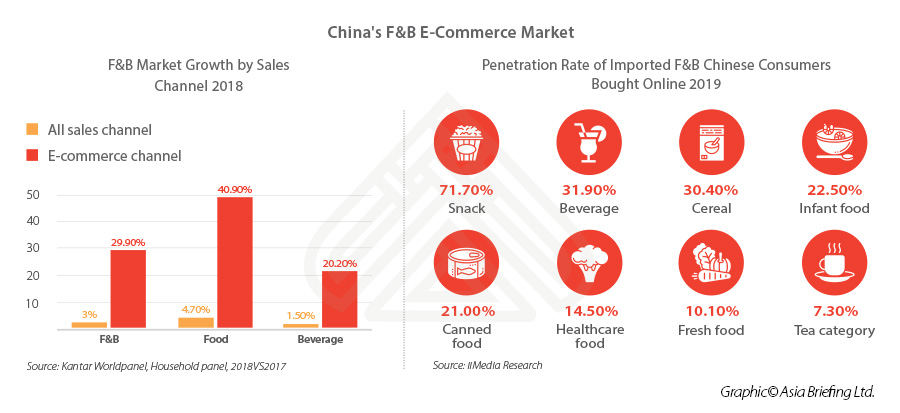

China’s F&B cross-border e-commerce

The development of cross-border e-commerce (CBEC) – activities of purchasing or selling products via online shopping across national borders – is gaining momentum despite COVID-19 and is opening China’s F&B market wider for foreign exporters.

According to iiMedia Research, in the first quarter of 2020, Chinese CBEC users were more likely to purchase F&B, toiletries, and healthcare products through CBEC platforms, partly because of the Chinese New Year holiday and the COVID-19 epidemic.

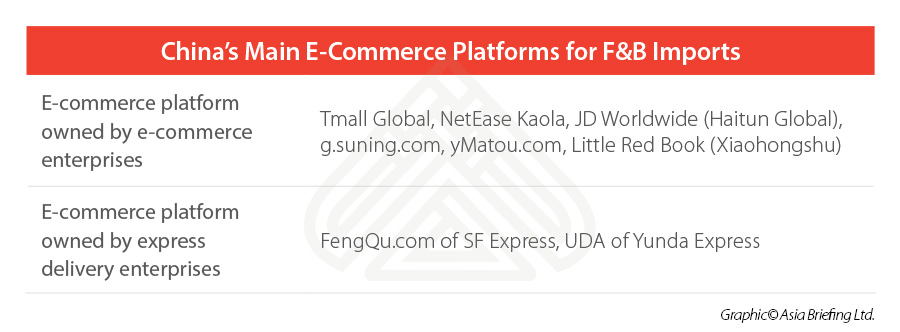

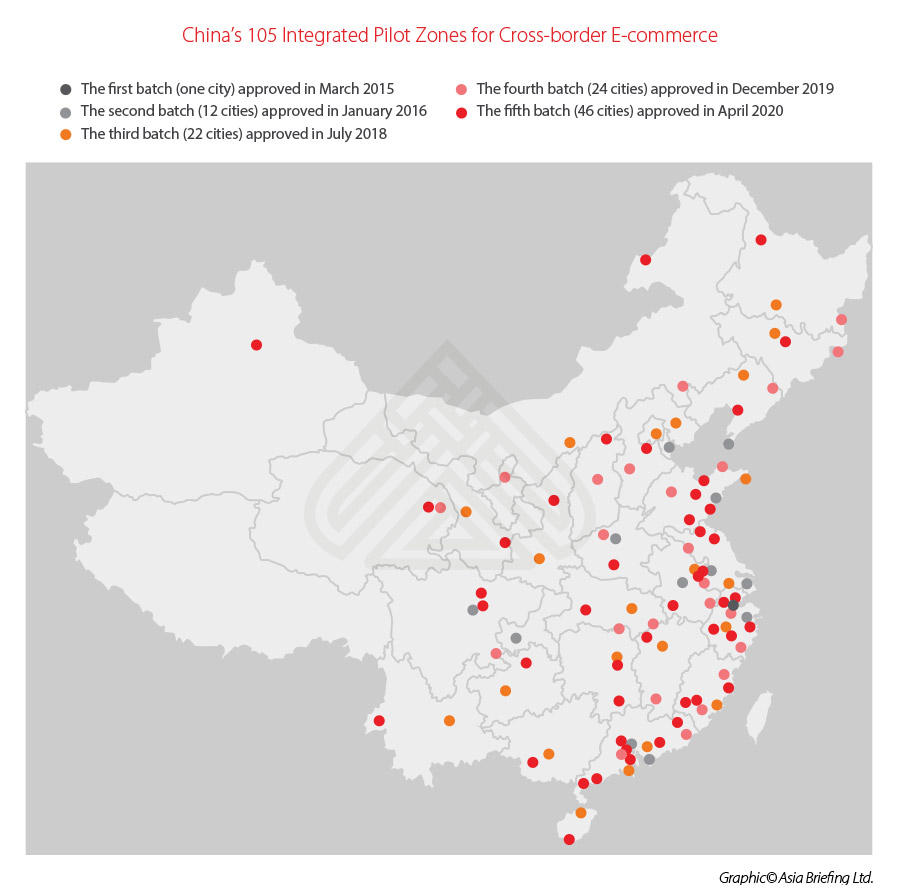

At present, China has 105 CBEC pilot zones. Further, under a new pilot scheme of CBEC retail import, in 86 cities and Hainan island, Chinese consumers can purchase goods on China’s retail import list (also known as the “positive list”) from overseas through a CBEC third-party platform through the bonded warehouse import mode (customs supervision code 1210).

Listed retail goods can be regarded as goods imported for personal use and will not be subject to the license approval, registration, or filing requirements for first-time importation. Last year, China expanded the CBEC retail import list to allow more foreign F&B products to be retailed through CBEC. From January 1, 2020, China’s List of CBEC Retail Imports (2019 Edition) officially took effect. Compared with the 2018 Edition, the new list added 92 items, including frozen seafood like frozen oysters, scallops, and octopus, and alcoholic drinks like gin and vodka.

These programs have lowered the entry threshold for international food brands in China. CBEC’s overseas warehousing model is also helping small foreign brands – that cannot establish a physical presence – finally enter the Chinese market. Foreign F&B exporters and enterprises can make use of the CBEC channel to tap into China’s market, establish a mechanism to obtain consumer and sales data from CBEC platforms, and develop market expansion strategies as well as explore offline channels.

This article has been adapted from the China Briefing magazine, “Opportunities for Foreign Investors in China’s Service Industries After COVID-19, which is available as a free download from the Asia Briefing Publication Store.

This article has been adapted from the China Briefing magazine, “Opportunities for Foreign Investors in China’s Service Industries After COVID-19, which is available as a free download from the Asia Briefing Publication Store.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Shenzhen Announces Comprehensive Pilot Reforms Plan amid 40th SEZ Anniversary

- Next Article China Individual Income Tax and Social Insurance Calculator