An Introduction to China’s Cross-Border E-Commerce Pilot Zones and Pilot Cities

Cross-border e-commerce (CBEC) – activities of purchasing or selling products via online shopping across national borders – is gaining momentum in China.

To fuel this engine of China’s import and export growth, Premier Li Keqiang reiterated the government’s support for accelerating the growth of CBEC and enhancing the country’s international shipping capacity in the 2020 Government Work Report.

In fact, over the last several months, the government has been rolling out policies, including adding new CBEC pilot zones and pilot cities for CBEC retail importation, extending the CBEC retail import list, and lowering tax and tariffs, in a bid to boost CBEC:

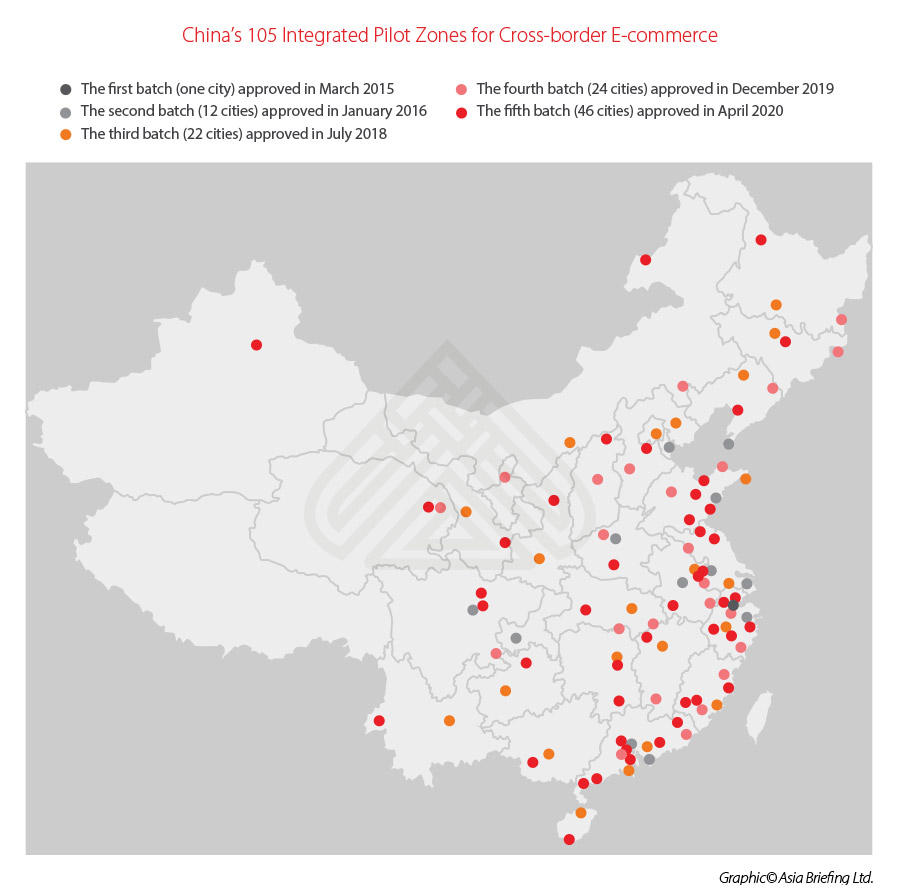

- In May 2020, the State Council unveiled 46 new comprehensive pilot zones for CBEC, bringing the total CBEC pilot zones in China to 105.

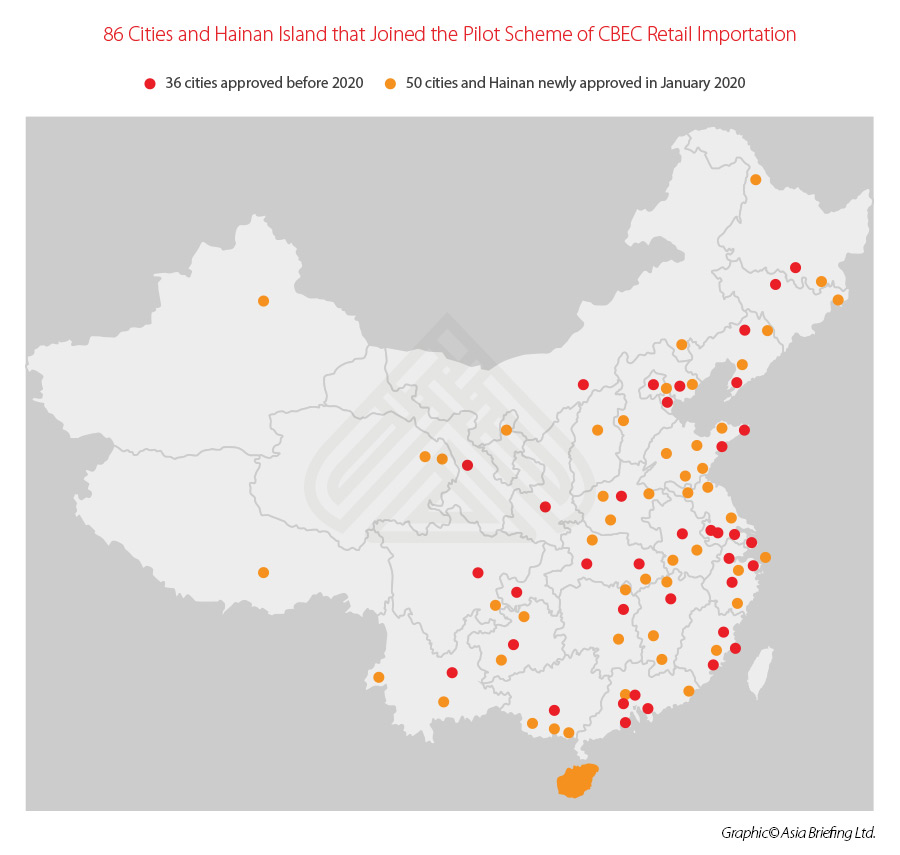

- In January 2020, five authorities, including the Ministry of Commerce (MOFCOM), jointly released a notice to expand the pilot cities for CBEC retail importation, adding 50 cities and the whole Hainan island (to the existing 36) into the pilot scheme of CBEC retail importation.

- In December 2019, 13 authorities extended the “List of Goods under Cross-border E-commerce Retail Importation” to allow more foreign goods to be delivered to Chinese consumers through CBEC retail importation program. The list, also dubbed ‘CBEC positive list’, has taken effect this year.

This article aims to provide you a holistic look at China’s CBEC world. What is China’s CBEC pilot zone program? What is the pilot program of CBEC retail importation? What is the difference between China’s CBEC pilot zones and pilot cities? How do enterprises benefit from these programs? What is the import duty and tax liability?

Understanding China’s comprehensive pilot zones for cross-border e-commerce

By far, the State Council has approved five batches of 105 comprehensive pilot zones for cross-border e-commerce (CBEC pilot zones), covering almost all the provinces except for Tibet. Most zones are located in coastal regions like Beijing (1), Shanghai (1), and the provinces of Guangdong (13), Zhejiang (10), Jiangsu (10), Shandong (7), and Fujian (6).

The CBEC pilot zones are designed to boost China’s import and export businesses (especially export). As China has been putting much effort into upgrading its manufacturing infrastructure, it is seeking opportunities to export products with higher value and margins.

Policy makers think that the CBEC trade will help China diversify its trade links in the context of the One Belt and One Road Initiative and reshape international trade patterns amid US-China trade tensions.

In addition, the CBEC can also help foster new industrial chains like cross-border logistics, cross-border financial payment, and supply-chain finance, adding impetus to China’s economic growth.

At the micro level, the CBEC pilot zones are also enabling entrepreneurship, connecting domestic small- and medium-sized companies (SMEs) and local industries with the world.

-

Innovative management system, integrating services

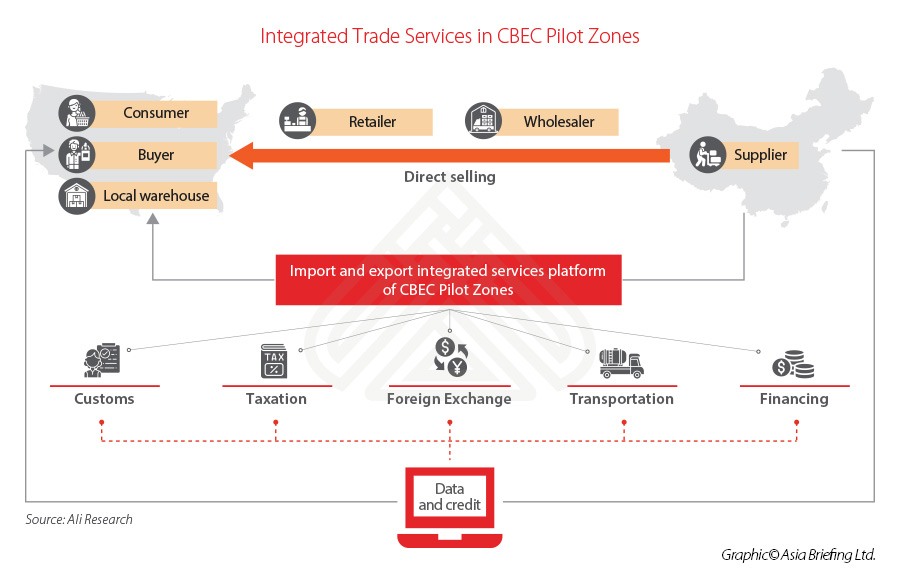

The CBEC pilot zones have been pivoted as the ideal home for manufacturing companies, e-commerce export enterprises, e-commerce platform companies, logistics enterprises, and financial service firms.

For example, Hangzhou CBEC Pilot Zone, the first CBEC pilot zone in China, hosts established import e-commerce platforms (like Tmall Global, NetEase Kaola, and JD Worldwide), export e-commerce platforms (Jollychic and club factory), third-party payment platforms (Alipay), logistics companies (EMS, SF Express), and other enterprises providing supporting services, such as credit insurance, for CBEC businesses.

In a move to facilitate CBEC import and export, local CBEC pilot zones are exploring innovative breakthroughs in the management of customs clearance, tax collection and management, foreign exchange supervision, cross-border financial services, and logistics.

For instance, the Hangzhou CBEC Pilot Zone has taken the lead in innovating the management mechanism. They call it “six systems and two platforms” – the “six systems” refer to the information sharing system, financial service system, intelligent logistics system, e-commerce credit system, statistics monitoring system, and risk prevention and control system; the “two platforms” refer to the online integrated service platform and offline industrial park platform.

The mechanism can achieve information sharing among customs, taxation, foreign exchange, and other government departments, which largely shortens the period of goods export declaration. Meanwhile, it builds up CBEC enterprises’ credit database and risk prevention and control systems, and provides enterprises with more innovative services in financing, guarantee, foreign exchange settlement and sale, and intelligent logistics.

Besides the innovative system and facilitating customs clearance procedures, the government has also rolled out favorable tax policies for in-zone e-commerce export enterprises.

The following policies are applicable nationwide:

-

CBEC retail export “duty-free” policy

According to the Notice on Tax Collection Policies for Retail of Exports in CBEC Pilot Zones (Cai Shui [2018] No.103) released by the Ministry of Finance (MOF) and the State Taxation Administration (STA) in 2018, in-zone e-commerce export enterprises that have not obtained a valid proof of purchase (like input value-added tax invoice) are still allowed to be exempted from value-added tax (VAT) and consumption tax (CT) when exporting goods if they meet certain criteria.

-

CIT verification and collection policy

According to the STA Announcement on Issues Concerning the Levy upon Assessment of Income Tax on Retail Export Enterprises in CBEC Pilot Zones (STA Announcement [2019] No.36) released in 2019 and taken effect January 1, 2020, for the in-zone e-commerce export enterprises that meet certain criteria – corporate income tax (CIT) can be levied upon verification. CIT will be assessed and levied with a taxable income rate of 4 percent, namely:

CIT payable = total revenue × 4% × 25%

Further, if the enterprise meets the conditions of preferential policies for a small low-profit enterprise, the enterprise can enjoy the applicable preferential CIT policies for small low-profit enterprises on top of the aforementioned treatments. If the income of an enterprise falls under the scope of tax-free income as stipulated in Article 26 of the Corporate Income Tax Law of China, the CIT on such income can be exempted.

China’s CBEC retail importation program and CBEC retail import pilot cities

Different from general trade, China’s CBEC retail importation program is designed to make it easier to import certain foreign goods for Chinese consumers’ personal use, in order to satisfy the growing domestic demand.

Pilot cities which joined the CBEC retail importation program can conduct more convenient import modes like “online shopping bonded import mode” (customs supervision mode 1210) – whereby imported retail goods can be temporarily stored at the bonded warehouse before being delivered to customers. As a prerequisite condition, these pilot cities usually own free trade zones (FTZs), comprehensive bonded zones (zones), and act as logistics hubs with trading partner countries.

In January 2020, China added 50 cities and the whole Hainan island into the pilot program of CBEC retail importation. Now the country has a total of 86 CBEC pilot cities as well as Hainan island.

Pilot cities which joined the program of China’s CBEC retail importation usually overlap with CBEC pilot zones geographically. But they are different.

For example, Hangzhou is the city where Hangzhou CBEC Pilot Zone was established. The Hangzhou CBEC Pilot Zone has over ten offline industrial parks for interested companies to settle in.

Meanwhile, Hangzhou is also a pilot city for CBEC retail importation. Imported retail goods can be stored at the bonded warehouse established in Hangzhou, for example, in a warehouse in Hangzhou Comprehensive Bonded Zones, and deliver to domestic customers after they place orders through a third-party CBEC platform.

To be noted, under the CBEC retail importation program, the imported retail goods have to fall under the “List of Goods under Cross-border E-commerce Retail Importation” (2019 version), which is also dubbed a ‘CBEC positive list’, limited to personal use, and must satisfy the criteria stipulated in the tax policies for CBEC retail importation.

In addition, goods need to be transacted through an e-commerce platform linked with the Chinese Customs network – where the “three documentation” comparison of transaction, payment, and logistics electronic information can be achieved.

In case the transaction does not happen through an e-commerce platform linked with the Chinese Customs network, the inbound and outbound courier operator or postal enterprises will undertake the corresponding legal liability – they will need to transmit the electronic information of transaction, payment, and logistics to Customs, according to the Notice on Work Relating to Improved Regulation of CBEC Retail Importation (Shang Cai Fa [2018] No.486).

How enterprises can benefit from the CBEC retail importation program

First-time import registration waiver

CBEC retail imports are regulated as items imported for personal use and can’t be re-sold. So, there are no requirements for license approval, registration, or record filing for first-time importation. This indefinitely extends the waiver of the pre-importation registration requirements on specified categories of products, including cosmetics, infant formula, health food, and medical devices, which was originally set to expire on December 31, 2018, as long as the goods are on the ‘CBEC positive list’.

Expanded positive list

As we mentioned above, retail imported goods have to be on the “List of Goods under Cross-border E-commerce Retail Importation”. The 2019 version of this list, which has taken effect since January 1, 2020, contains 92 new taxable items compared with the previous version, including frozen aquatic products, alcohol, and consumer goods. The positive list is expected to continue to expand as the government improves the CBEC regulatory system and domestic consumer demand grows.

Import modes

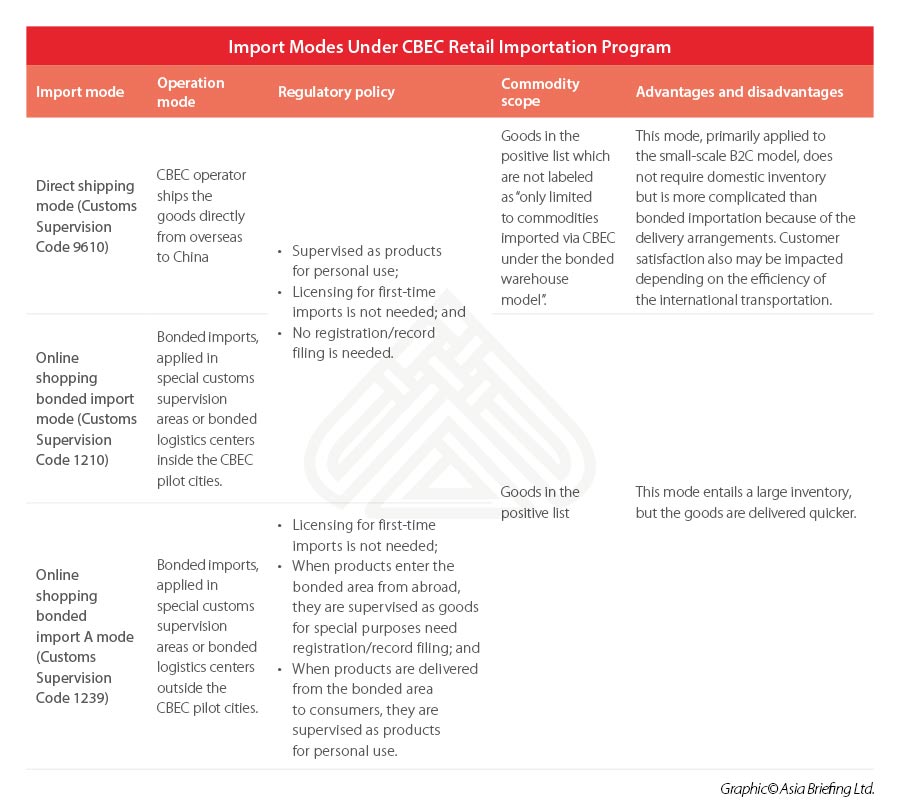

The CBEC retail imports can be divided into two modes of operation:

-

Bonded Warehouse Import (Customs Supervision Code 1210 and 1239)

Goods are purchased in advance and temporarily stored in a bonded warehouse in China. After a consumer places an order, customs clearance and delivery will be carried out immediately from the bonded warehouse. Then the products can be delivered to consumers by logistic companies.

Currently, the bonded warehouse mode involves two customs supervision codes – 1210 and 1239. 1210 refers to “online shopping bonded import mode” and is only applicable in CBEC retail importation pilot cities; 1239 refers to “online shopping bonded import A mode” and is applicable in other cities not in the CBEC retail importation program.

-

Direct Shipping Mode (Customs Supervision Code 9610)

In this scenario, consumers place an order through CBEC websites, then overseas suppliers or sellers directly deliver the products to China by post or express, mainly by air. The product will need to go through the customs clearance process to be released to the consumer.

Import duties and taxes

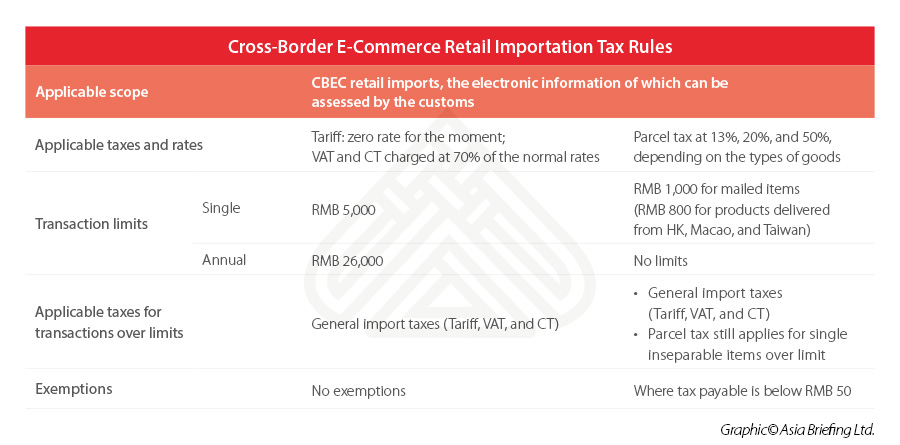

Under certain single and annual transaction limits, retail imported goods on the ‘CBEC positive list’ are deemed as duty-free, and the import VAT and consumption tax (CT) are temporarily levied based on 70 percent of the statutory tax payable.

Since January 1, 2019, the government has increased the duty-free quota on a single transaction from RMB 2,000 (US$291.6) to RMB 5,000 (US$729) and the annual quota per person from RMB 20,000 (US$2,916.2) to RMB 26,000 (US$3,791) for retail imports, according to the Notice on Improving Tax Policies for Cross-border E-commerce Retail Importation (Cai Guan Shui [2018] No.49). Over these limits, consumers will need to pay full general import taxes, including tariff, VAT, and CT.

If the customs value of a single product exceeds the single transaction limit of RMB 5,000 (US$729) but less than the annual transaction threshold of RMB 26,000 (US$3,791), the item can still be imported via the CBEC retail channel. However, tariff, import VAT, and CT will be levied in full and the transaction amount must be included in the total annual transaction amount.

Individual customers are the import taxpayers. But the e-commerce service providers, or the logistic companies as the case maybe, will act as the withholding agent and pay tax on behalf of individual customers.

For goods mailed into the country by individuals, the electronic information of which can’t be accessed by Customs – the parcel tax will be levied. Since April 2019, the parcel tax has been reduced to 13 percent, 20 percent, or 50 percent, depending on the type of goods and can be exempted if the tax is less than RMB 50 (US$7.07). For a single transaction exceeding a certain limit – RMB 1,000 (US$141.3) for mailed item from abroad or RMB 800 (US$113) for items from Hong Kong, Macao, or Taiwan, goods must be cleared and subject to general import taxes (Tariff, VAT, and CT), or they will be returned.

Conclusion

CBEC is becoming a more prominent channel for import and export in China. In the past six years, the proportion of China’s CBEC exports in the country’s total foreign trade jumped from 2.2 percent to 11.25 percent.

This year, from January to February, China’s import and export volume of CBEC retail was RMB 17.4 billion (US$2.45 billion), up 36.7 percent year-on-year, despite the COVID-19 pandemic. In 2019, the number reached RMB 186.2 billion (US$26.25 billion), five times that of 2015, showing an average annual growth rate of 49.5 percent, according to the official data.

The Chinese government is trying to promote CBEC business to stabilize and promote foreign trade. It is expected that China will scale-up favorable policies to support the growth of CBEC as well as roll-out further measures to regularize CBEC. Foreign investors who are looking to tap into China’s CBEC market should stay abreast of the latest developments.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Revises Rules of Origin for Some Goods Under CEPA, Effective July 1

- Next Article China’s 2020 New Negative Lists Signal Further Opening-Up