China’s Industrial Standards for the Internet of Things: What the Draft Guidelines Say

The Ministry of Industry and Information Technology (“MIIT”) released the Guidelines for Building Basic Security Standard System for the Internet of Things (“Draft”) on January 15, 2021 to gather public opinions until February 14, 2021.

The Internet of Things (“IoT”) can be defined as a network of physical objects embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the Internet.

The Draft aims at building and developing an IoT basic standard system, that will be implemented in two phases.

By 2022, the said system will be established, and at least 10 industry standards will be drafted along with the stipulated security requirements clarified.

Following that, by 2025, more than 30 industry standards are expected to be drafted targeting the improvement of the security level of IoT cross-industry application.

Five major standards

Considering the influence of IoT in daily life, and the rapid increase in the number of connected devices, the urgency for setting standards is palpable. The data exchanged via devices must be managed, processed, transferred, and stored securely.

In this regard, it is important that uniform standards are established so that technologies get built in a way that they can be used by different products designed by different companies. In other words, this makes the technology product scalable – as it is designable, producible, and usable worldwide. Industry standardization is essential to guarantee the interoperability of devices globally.

With regards to IoT basic security standards, the Draft highlights that these mainly refer to the security standards of key basic links – IoT terminals, gateways, and platforms.

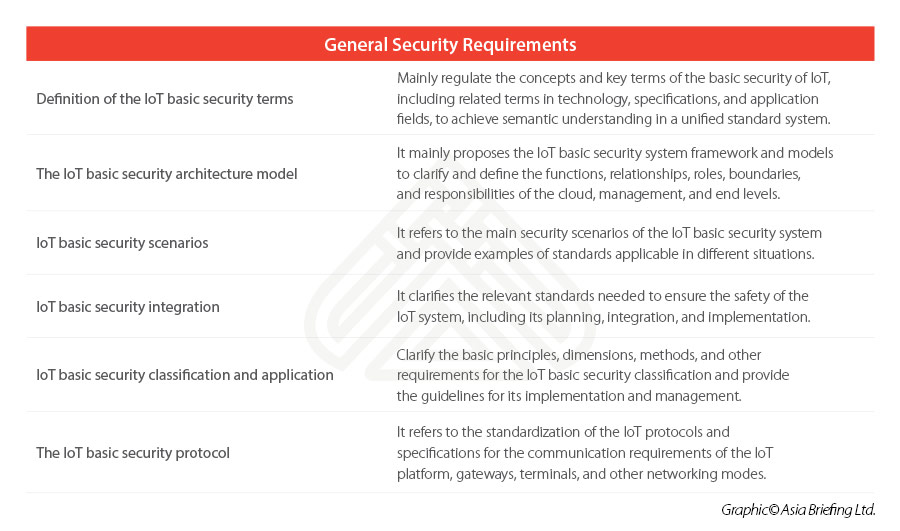

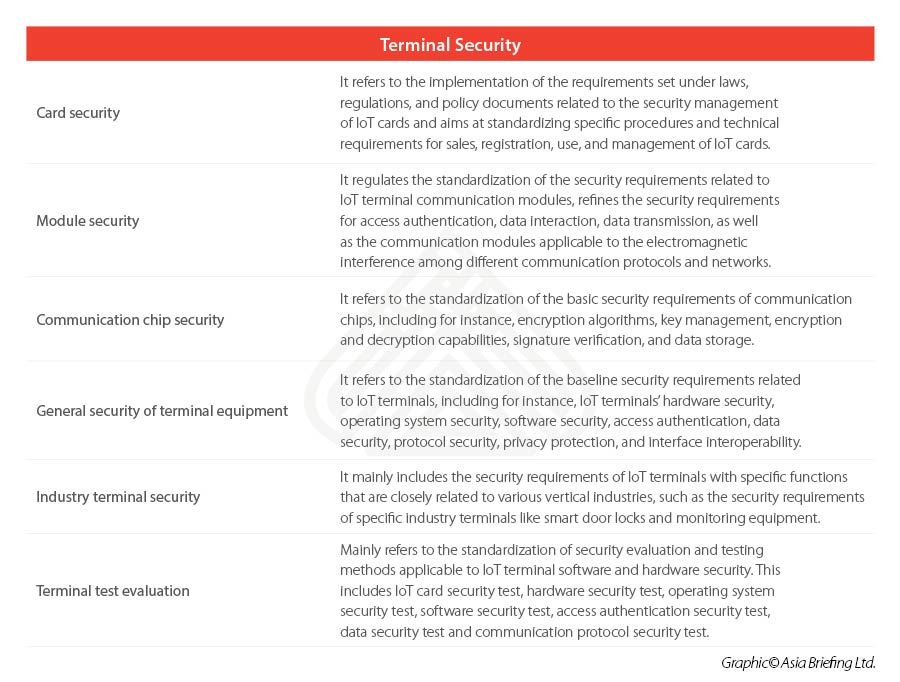

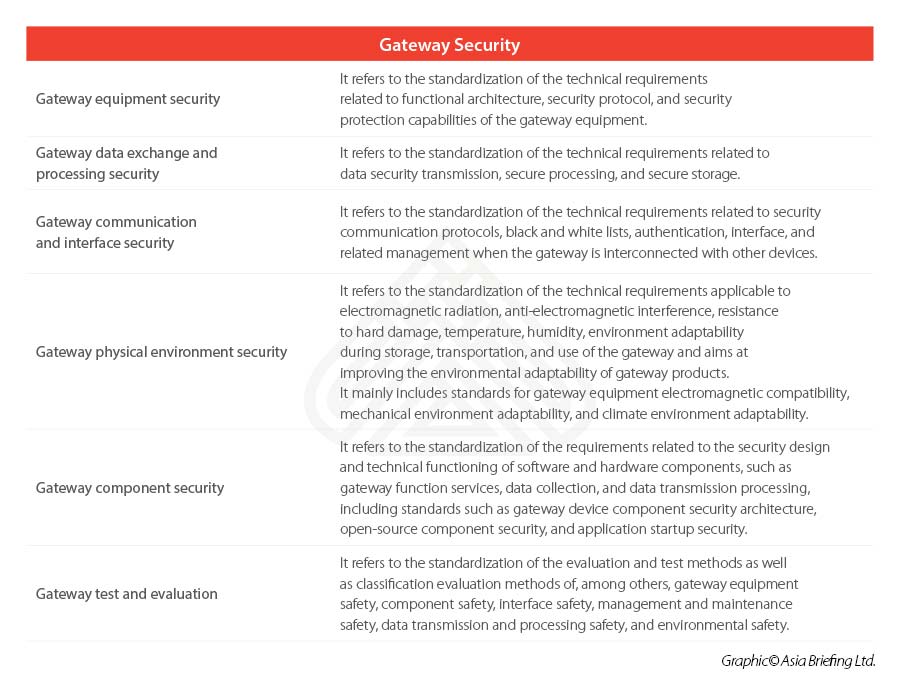

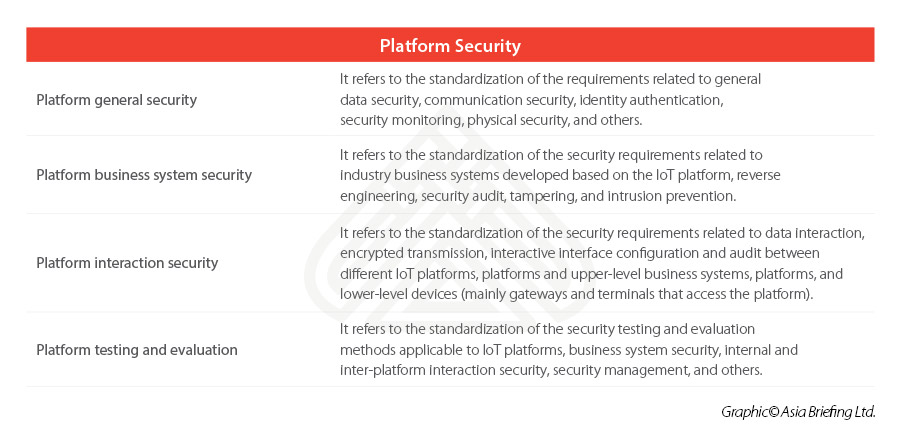

The Draft identifies five major standards for the IoT basic security standard system, which are general security requirements, terminal security, gateway security, platform security, and security management.

For each of these standards, the Draft provides for key standardization areas and directions, that can be summarized as follows.

-

General security

Under general security, the Draft’s requirements consist of guiding standards for the IoT basic security system and include basic security terms, architecture models, security scenarios, security integration, security classification, and application standards as well as security protocols.

-

Terminal security

Terminal security standards refer to those standards applicable to the IoT basic security system. This includes card security, module security, communication chip security, terminal equipment general security, industry terminal security, terminal testing, and evaluation standards.

-

Gateway security

Gateway security standards include IoT gateway device security, data exchange and processing security, communication and interface security, physical environment security, component security, and testing and evaluation.

-

Platform security

IoT platform security standards include platform general security, platform business system security, platform interaction security, as well as platform testing and evaluation.

-

Security management

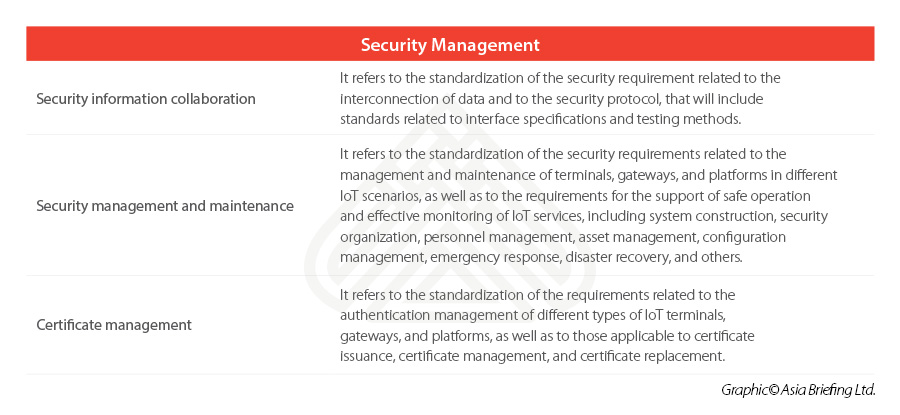

Security management standards are mainly used to guide the industry to implement general safety management requirements and include safety information coordination, safety management and maintenance, and certificate management standards.

The Chinese Government intends to rapidly develop the above-mentioned standards while also ensuring that the IoT basic standard system is updated and able to satisfy the needs of such a fast-changing industry. Further, the implementation of IoT basic standards will find support and promotion mechanisms established at, both, the national and local levels. In addition, the Draft provides for international cooperation between China and other countries on setting basic security standards for IoT, as well as to facilitate China’s active participation in the formulation of international standards for IoT security.

Opportunities and challenges in China’s technology innovation sector

China Standard Plan 2035

The necessity to provide standards in the innovation technology sector, and more specifically in IoT, has been highlighted in the China Standards Plan 2035. This Plan will drive the Chinese government and leading technology companies to set global standards for emerging technologies, including IoT, 5G internet, and artificial intelligence, among others.

The China Standards Plan 2035 – to be read together with the Made in China 2025 strategy – demonstrates China’s intention to become a leader in tech innovation, with the aim of achieving technology self-sufficiency and fostering the ability of Chinese companies designing and producing high-tech products as well as setting the relevant standards.

Setting technical standards holds critical value – it enables interoperability between devices and their usability worldwide. Since international panels have long been dominated by Western countries – China is keen to change the status quo in future. Tech giants like Nokia Corp. and Qualcomm Inc. earn billions in revenue annually from the patents used by rivals making smartphone systems – and going forward, Beijing wants to ensure that standards are designed to align with the technologies developed by its own enterprises.

A recent piece published by The Wall Street Journal reported on China’s “channeling of state funding and political influence” to take the driving seat in organizations that set up technical standards for cutting-edge technologies, especially those reliant on 5G networks. From the paper: “Chinese officials direct at least four global standards organizations; official documents estimate Beijing and regional governments supply annual stipends of up to 1 million yuan (roughly US$155,000) for firms leading global standards development, while Western funding is dwindling.”

Recent information from the Ministry of Industry and Information Technology (MIIT) revealed that 90 domestic Chinese companies had filed a joint application to establish the National Integrated Circuit Standardization Technical Committee with its proposed secretariat at the China Electronics Standardization Institute. This is a relatively weak area for China as the industry is dependent on access to US technology and is populated by small-scale enterprises. The 90 Chinese firms include Huawei, HiSilicon, Xiaomi, Datang Semiconductor, Unichip Microelectronics, Zhanrui Communication, ZTE Microelectronics, SMIC, Datang Mobile, China Mobile, China Unicom, ZTE, Tencent. Through the committee, these firms intend to strengthen cooperation between weak industries.

Incentivizing foreign investments in tech innovation

Last year, China’s new infrastructure plan was developed into a strategy to meet the twin goals of stimulating job creation and preparing for new changes in the global economy, particularly in the realm of technology and sustainable development. Foreign investment opportunities were carved out in state policies and incentive schemes for business stakeholders to participate in this next phase of China’s development with key segments getting liberalized like industrial internet, new energy vehicles (“NEV”), and artificial intelligence.

In particular, China rolled out a wide range of favorable policies for the integrated circuit (IC) and software industries – tax breaks, favorable financing, IP protection, and support for R&D, import and export, and talent development etc. to attract foreign know-how. This has also been followed by amendments to its legal regime to strengthen intellectual property protection safeguards.

Among other industries where foreign companies are encouraged to invest in China, it is worth mentioning the opening of the automotive industry, including the manufacturing of NEVs. Joint venture (“JV”) restrictions for manufacturing passenger automotive vehicle – in terms of equity ratio and maximum number of JVs that can be established by a foreign investor in China – shall be nationally removed in year 2022.

Here it should be noted that foreign investment into information communication technology (ICT) – where IoT is applied – is allowed but foreign companies often face difficulties in securing licenses and meeting other establishment requirements; many find that regulations relating to data management and cyber infrastructure, for instance, favor domestic firms. That is why they often choose the JV route to enter the Chinese market; going forward, these hidden barriers to direct and free market access may need to be addressed.

Technology and innovation decoupling

In the technology sector, foreign companies now have to deal with innovation decoupling, which involves R&D and standards and digital/internet decoupling, which involves data governance, network equipment, and telecommunications services.

Digital decoupling is impacting foreign businesses engaged in activities related to ICT, telecommunication, and network equipment as they struggle to enter the Chinese market and/or compete with Chinese digital and tech giants like Huawei. Foreign companies may also be subject to further restrictions by means of the Export Control Law and related catalogues. (Here, we provide a detailed analysis of the Export Control Law that limit their trading activities.)

On the other hand, with reference to innovation decoupling, concerns are spreading across the EU with reference to standards and data. In fact, in areas such as machinery and chemicals, where foreign investors’ contributions in terms of know-how and technologies is important for Chinese companies to become self-reliant, the Chinese standards appear in line with the international ones, while in sectors that are considered the core of China’s development – like IoT – the EU Chamber of Commerce reports divergence in standards settings.

EU companies engaging in activities within the digital sector in China report that they would like the participation of foreign companies in standardization activities in China as these will be the standards to which they will have to abide, not only locally but potentially, also globally. This will also level the playing field between foreign and domestic players in the market, a consistent pain point for many foreign companies. China has previously promised such inclusion.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Annual Audit in China: Why it’s Important and How to Get Started

- Next Article China Enforces Antitrust Guidelines on its Online Economy