How Can Foreign Technology Investors Benefit from China’s New Infrastructure Plan?

- Since the COVID-19 outbreak, China’s new infrastructure plan has developed into a strategy to meet the twin goals of stimulating job creation and preparing for new changes in the global economy, particularly in the realm of technology and sustainable development.

- Compared to the 2008 construction of traditional infrastructure in the wake of the global financial crisis, the 2020 stimulus package is much more reliant on market forces and private investment.

- Opportunities therefore exist for business stakeholders to participate in this next phase of China’s development with investment opportunities getting liberalized in key segments like industrial internet, NEVs, and artificial intelligence.

- However, as the global tech industry becomes increasingly politicized, strategic investors should craft an appropriate market-entry strategy that accounts for the new challenges in China’s the tech landscape.

Building ‘new infrastructure’ (新型基础 or新基建 for short) has recently become a top development priority for China – and refers to infrastructure that is ‘digital, smart, and innovative’.

As part of its post-COVID-19 relief package, China is ramping up plans to construct new digital infrastructure across the country – including building 5G networks, artificial intelligence (AI), Internet of Things (IoT), intercity high-speed rail, and setting up research and development institutions.

In doing so, a new wave of government support for private sector participation can be seen – through the issuance of special bonds, encouraging public-private partnerships, or extension of credit support.

These plans work in concert with China’s other industrial policies like Made in China 2025 and China Standards 2035 Plan – which together signal China’s ambitious long-term strategy of becoming the global leader in high-tech and innovative industries of the future.

New opportunities now exist for early investors looking to participate in these fast-growing technology industries and subsectors. In addition, large industry players have the chance to invest in projects that will propel the commercialization of emerging technology.

Foreign investors should continue to follow-up on the latest policy developments in their target area of investment, as more government policies will likely be released shortly to guide the development of each of these new technologies.

In this article, we explain what we know about China’s new infrastructure plan so far, along with the opportunities for investors to get involved.

What is China’s new infrastructure plan?

At the 2020 National People’s Congress, the CCP announced that in addition to doubling down on its Made in China 2025 and China Standards 2035 initiatives, it would spend approximately US$1.4 trillion on a digital infrastructure public spending program.

The new infrastructure includes seven key areas: 5G networks, industrial internet, inter-city transportation and rail system, data centers, AI, ultra-high voltage power transmission, and new-energy vehicle charging stations.

Originally touted as a way for China to achieve domain independence and accelerate its industrial upgradation, the new infrastructure plan has transformed into a long-term national economic strategy.

However, in April 2020, the National Development and Reform Commission released a revised categorization of new infrastructure to include three broad aspects of ‘next-generation technology’:

Innovative infrastructure

Infrastructure with public benefits, which support science and technology infrastructure, science and education infrastructure, and industrial technology innovation infrastructure.

This includes R& D institutions, research infrastructure, and innovation-focused industrial parks.

Information infrastructure

The foundation of this technological development and refers to technology that increases productivity, speed, accuracy, and breadth of information collected, stored, disseminated, and analyzed.

This includes 5G, IoT, industrial internet, AI, cloud computing, blockchain, data centers, and internet communication network infrastructure.

Integrated infrastructure

Fusion infrastructure formed through the application of internet, big data, AI, and other technologies to support the transformation and upgradation of traditional infrastructure.

This includes constructing inter-city high-speed rail and inner-city rail systems, charging stations for electric vehicles (EVs), and ultra-high voltage (UHV) power transmission.

Broadly speaking, these three categories have three main functions –

- innovative infrastructure forms the basis of research and development that is needed for building next-generation products;

- information infrastructure are the tools which we can use to upgrade our traditional industries; and

- integrated infrastructure is the large-scale and integrated application of these technologies to build the framework for the development of smart cities across China.

New infrastructure construction from 2020-2025

According to estimates from analysts at the CCID Think Tank Electronic Information Institute, a government-affiliated think tank as well as Haitong Securities, a major Chinese securities firm, the investment associated with new infrastructure projects is expected to total around RMB 10 trillion (US$ 1.43 trillion) to RMB 17.5 trillion (US$2.51 trillion) for the next five-year period until 2025.

Since the NDRC clarified the scope of what is new infrastructure, 25 provinces have launched their own local plans.

Among them is the Shanghai plan, which set the total investment target for the next three years at RMB 270 billion (US$38.7 billion), while Guangzhou signed 16 digital new infrastructure projects with a total investment of RMB 56.6 billion (US$8.09 billion). Zhejiang province, home to tech giant Alibaba, also committed to a new batch of projects – 61 percent of which are in the high-tech field, a 20 percent increase from the previous year.

Xu Xianping, former deputy director of the NDRC estimates that: “the scale of upstream and downstream businesses in the industrial chain will see RMB 2.8 trillion (US$400 billion) in investment, with an average annual growth rate of 22.6 percent.”

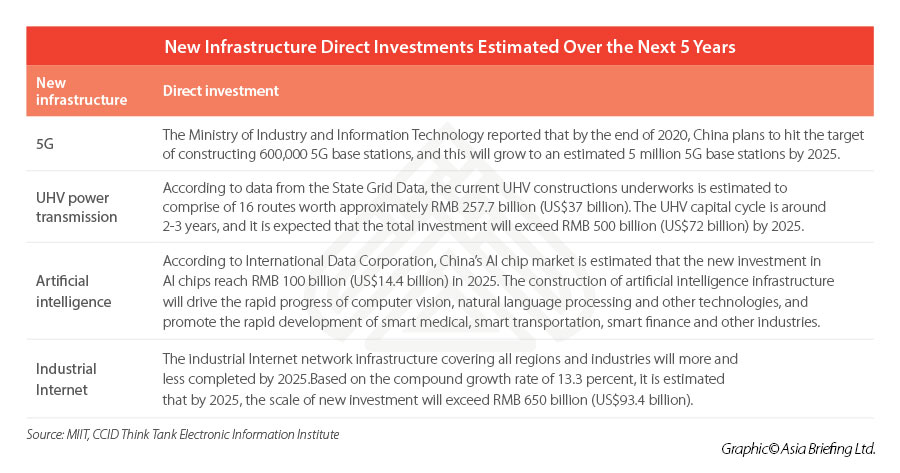

The same momentum can be seen across different types of technology, where for example, China has announced that by 2025, it will invest RMB 500 billion (US$72 billion) in UHV, RMB 100 billion in AI chips, and RMB 650 billion (US$93.4 billion) in the industrial internet. In terms of 5G networks, China has committed to constructing five million 5G base stations by the end of 2025 – a 25-fold increase in less than five years.

Which sectors are open to foreign investment?

Compared to the state-led investment push in traditional infrastructure in the wake of the 2008 global financial crisis, the biggest distinction in the 2020 stimulus package is that this time round the government is much more reliant on market forces and private investment.

Thus, there are many more opportunities for business stakeholders to participate in this next phase of China’s development.

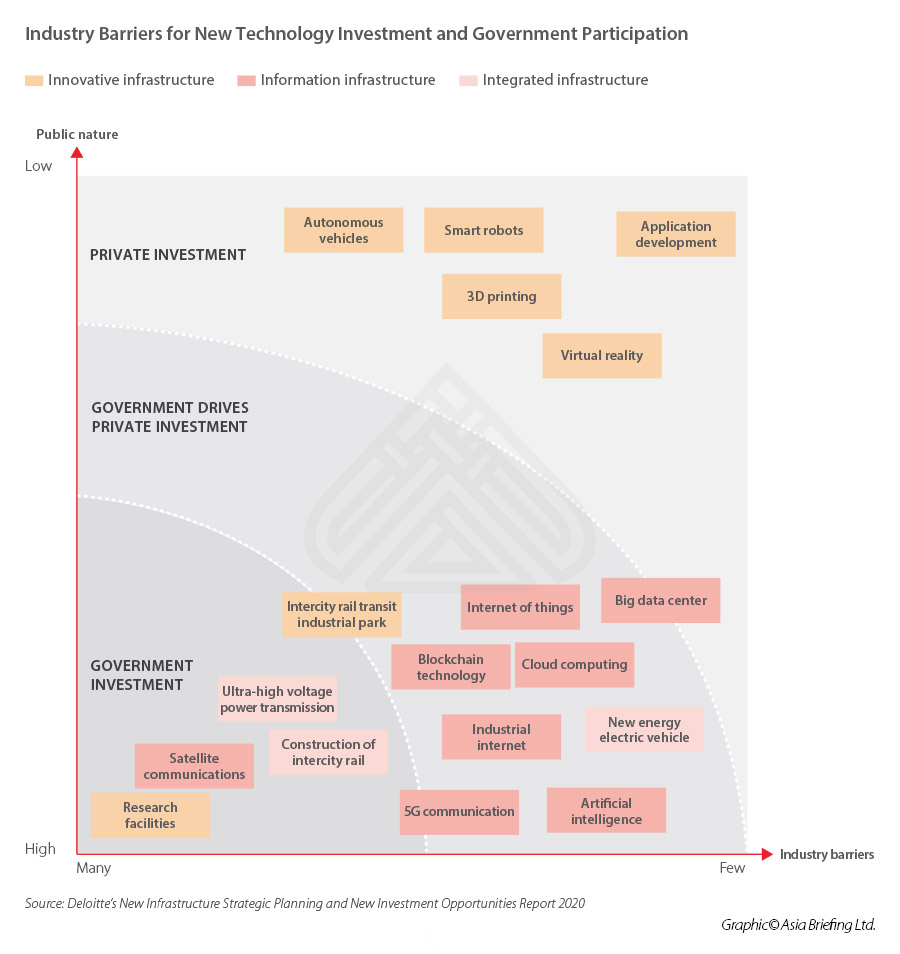

Still, each sector will see varying degrees of government investment. Consequently, private technology firms will need to assess whether they willing to align their participation with government directives to form partnerships with state-owned-enterprises.

For example, research and satellite communications will have a high government investment ratio, whereas application developments, virtual reality, 3D printing, and smart robot production will typically be comprised of private investments and have relatively low industry barriers for foreign investment.

Foreign direct investment in infrastructure development

Ultimately, openness to foreign investment will depend on whether the sector is mentioned in the Special Administrative Measures for Access to Foreign Investment “Negative List” (2020 Edition) or the Catalogue of Encouraged Industries for Foreign Investment “Encouraged List” (2019 Edition).

Based on these lists, foreign investment in internet data centers and 5G networks face the most stringent restrictions, while investment in industrial internet, NEVs, and AI are generally perceived to be the most foreign-investment friendly – with many upstream and downstream subsectors featured on the encouraged list.

Recently, China also released the exposure draft of its Catalogue of Encouraged Industries for Foreign Investment (2020 Edition), which further encourages foreign-invested enterprises to participate in the high-tech development of its manufacturing industry.

The 2020 draft catalogue proposes to expand the list to include a further 56 items, adding manufacturing of LiDAR (light detection and ranging) and millimeter-wave (MMW) radars related to autonomous driving technology as well as manufacturing of charging piles. In the fields of computer, communication, and electronics manufacturing, the proposed list added manufacturing of smart wearable devices, intelligent unmanned aerial vehicles (UAVs), customer service robots, and smart home systems and equipment.

Though this draft catalogue is still currently undergoing its final round of public consultation, if implemented, it will further open up a range of high-tech sectors to foreign investors.

Foreign-invested enterprises who invest in encouraged industries will be subject to tariff exemptions, preferential land prices, looser regulation of land uses, and lowered corporate income tax. However, those industries that appear on the negative list will either be restricted or prohibited from foreign investment entry.

We will examine seven key sectors of China’s new infrastructure, and their openness to foreign investment below.

Small and medium enterprises drive innovation in supply chain upstream and downstream

Similar to the trend in other countries, China’s small and medium-sized enterprises (SMEs) have been a critical driver of innovation, and currently account for approximately 66 percent of the patents issued.

Though direct investment in infrastructure may not be a viable option for SMEs, there are many opportunities either upstream or downstream of the supply chain where they can participate.

There are two sides to the potential opportunities available for SMEs – supply and demand. Businesses can either choose to participate in the construction and manufacturing of these new technologies or participate in the commercial application of these technologies across various sectors.

On the supply side, there are other opportunities that exist on the periphery of this large-scale infrastructure build.

For small-to-medium enterprises, many opportunities exist in the upstream (manufacturing of equipment) and downstream (program development) of the industry chain and are encouraged by the government.

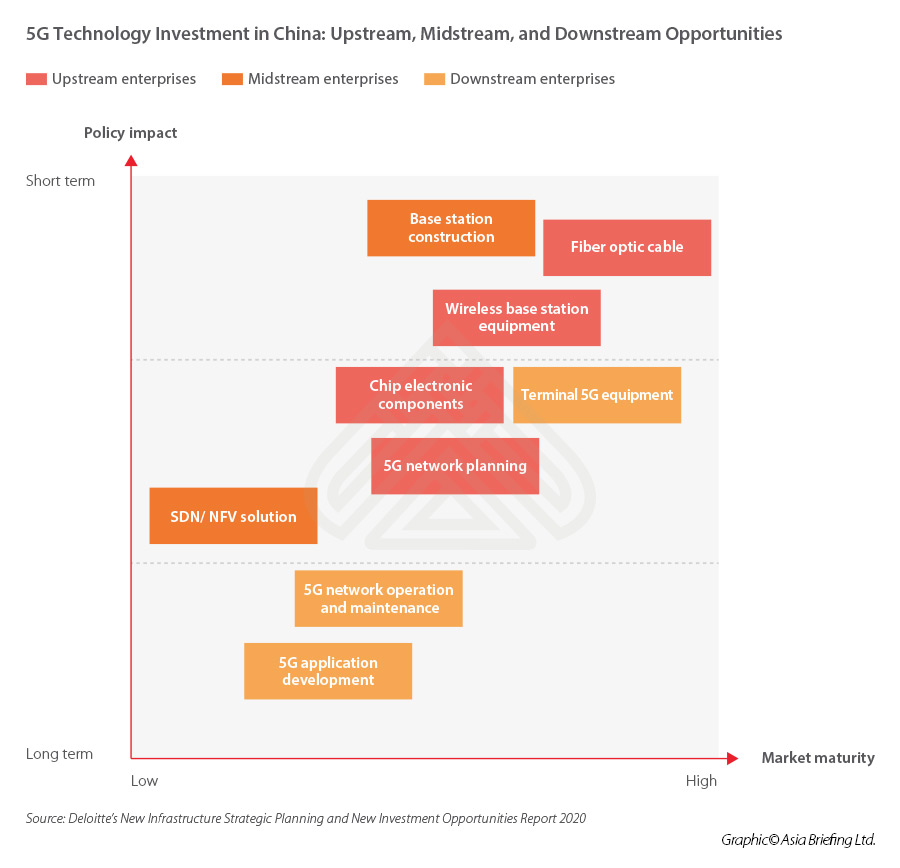

Take 5G for example – though investment in the network itself is, in practice, an area that is restricted to a few large Chinese players, there are opportunities that exist within the supply chain.

This is particularly true of the automobile industry; for example, 5G network giant Huawei recently announced that it will partner with 18 carmakers, including FAW group, BYD, and T3 Mobility, to build a 5G-enabled automobile ecosystem in the automobile industry – moving to accelerate the uptake of 5G technology in smart cars and achieving a significant transformation of its industrial capacity.

Investments into the upstream segment of supply chain attached to 5G networks continue to be in “encouraged” category for foreign investors, including:

- Development and manufacturing of visual sensors (digital cameras, 3D sensors, Lidars, millimeter wave radars, etc.) and their core components (optics lens, laser, photosensitive chip, radar, photoelectric module, etc.); and

- 5G mobile terminals (phones, cars, unmanned aerial vehicle, virtual reality, and augmented displays).

On the demand side, there are a whole array of ‘new use’ scenarios that will come with the advent of each new type of next-generation technology.

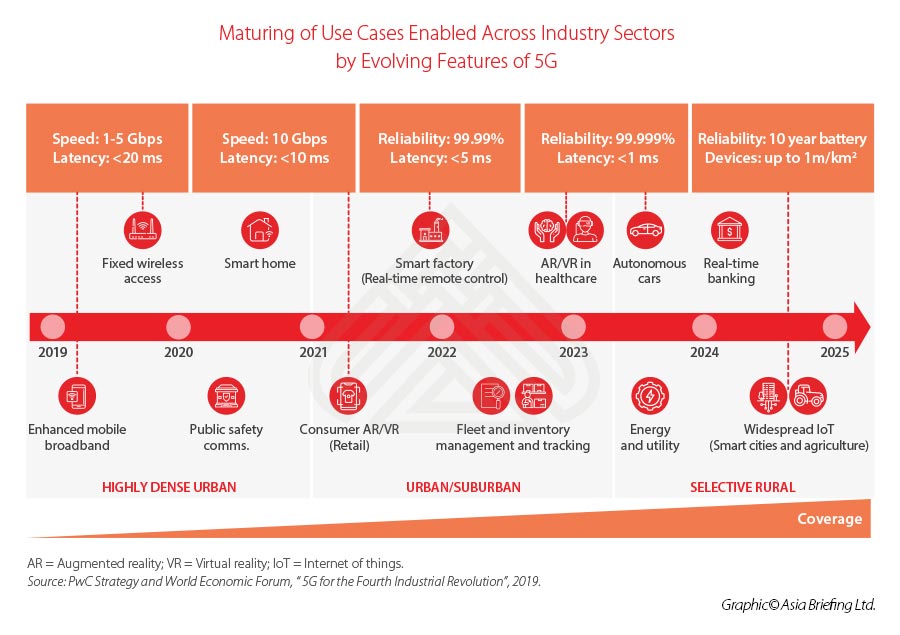

Using the same 5G example, which offers a combination of faster speed, higher capacity, and lower latency – this will enable the digitalization of traditional business models. As 5G technology matures, there will be greater opportunities for it to be applied across industries.

Traditional industries, such as medical care, education, retail, manufacturing, services, and logistics will all inevitably have to shift towards digital business models that will adapt to the radical digital transformation or application of new technologies.

For example, CloudMinds Technology, a SoftBank-backed startup in Beijing, donated robots with 5G-enabled cloud-based systems to Wuhan’s hospitals. The robots worked 24/7 hours and undertook jobs like remote nursing, body temperature taking, heart rates and blood oxygen levels measurement, medication delivery, disinfection, and cleaning.

Investing in China’s tech industry: Understanding the hurdles alongside the opportunities

Though there are many opportunities in China’s tech industry for investors, as the global technology industry becomes increasingly politicized, the challenges may amplify.

As discussed in the Hinrich Foundation’s report titled Strategic US-China Decoupling in the Tech Sector, the global tech industry continues to see an a heightened sense of techno-nationalism, displayed through “a set of mercantilist-like behaviors that link tech innovation and enterprise directly to the national security, economic prosperity and social stability of a nation.”

This is especially so as China-US geopolitical competition reaches a tipping point, and mutual tariff hikes, US restriction on exports of high-tech goods and services to China, and targeted restrictions of large tech companies with strong national ties (Huawei and Tiktok) result in an inevitable reshuffling of technological supply chains between the two countries.

Going forward, a much clearer distinction will now be made between foreign and domestic players, a point strongly emphasized by the recent Hinrich Foundation report.

“Subsidies, government-backed credit programs for customers, and the Digital Belt and Road Initiative [all] contributed to the meteoric rise of Huawei, and Chinese tech companies in general,” the report explains. “The US, EU and other state-actors will focus increasingly on countering Beijing’s economic nationalism with techno-nationalism initiatives of their own.”

Countries around the world will continue to be locked in a race to become the first to successfully develop, commercialize, and thus set the standards for the many types of new generation technology that are set to emerge.

Indeed, this is already starting to precipitate with the emergence of the China Standards 2035 Plan, which is an initial blueprint of the standardized processes and specifications to ensure products in the tech industries worldwide are built to work together seamlessly.

Though a growing sense of techno-nationalism will inevitably follow, a complete technology decoupling is unlikely to prevail as technology supply chains still require the participation of many foreign players.

In China, one clear example of this is the semi-conductor industry where China still overwhelmingly relies on foreign companies for its supplies – only 16 percent of its semiconductors are produced in the country as of 2019.

Although China has spent billions of dollars in earlier decades to create a domestic semiconductor industry – a critical component of the technology supply chain – this has so far come with little success. The chief difficulty for Chinese firms is not access to equipment but their lack of experience and ‘know-how’ currently falls behind foreign firms.

Therefore, foreign companies still have a large role to play where current domestic capabilities in China’s tech industry fall short, particularly, where industries like the semiconductor industry have recently become beneficiaries of a slew of new government preferential policies.

Managers and strategic investors should seek out experts on the ground to craft an appropriate market-entry strategy that accounts for the newly arisen challenges in an increasingly competitive but opportunity-filled landscape.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong.

Please contact the firm for assistance in China at china@dezshira.com. We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s Incentives for Integrated Circuit, Software Enterprises

- Next Article China Reopens Borders, Visa Channels to 36 European Countries