IIT Subsidy Application in the Greater Bay Area: FAQs in 2020

- From the start of 2019 to the end of 2023, eligible overseas talents working in nine cities of Guangdong province are able to apply for individual income tax (IIT) subsidies, because of a talent policy for the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

- During the period from July 1 to August 31, 2020, all nine cities have successively started and closed their first round of IIT subsidy applications.

- Successful applicants will get the subsidies, equaling to the portion of the IIT paid in the GBA city that exceeds 15 percent of the taxpayer’s taxable income of 2019.

- This article lists some commonly asked questions about the IIT subsidy application process and provides answers based on our on-the-ground experience.

By Daisy Huang, Dezan Shira & Associates’ Guangzhou Office

Editor: Zoey Zhang

By the end of August 2020, nine cities of Guangdong province – Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing – have successively completed procedures for overseas ‘high-end’ and ‘urgently-needed’ talents to apply for the individual income tax (IIT) subsidies.

Dezan Shira & Associates’ GBA offices have been busy providing advisory services regarding this policy and assisting talents and their employers in material preparation, application, and coordination with local government departments.

As this incentive will remain in effect for the next four years (until the end of 2023), we would like to share some frequently asked questions and our comments, in a bid to help future applicants succeed in obtaining the IIT subsidies.

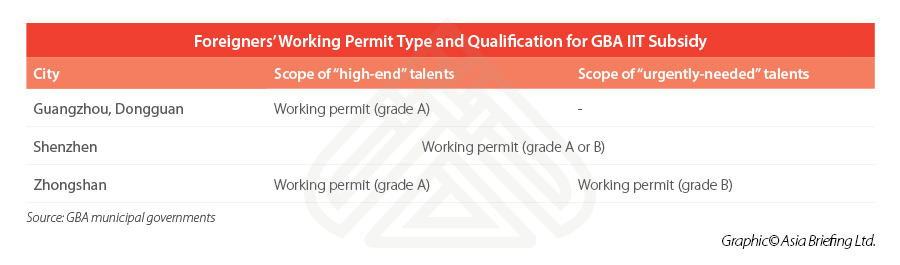

Q 1: I am a foreign national and have been working in Guangzhou since the end of 2018. I got my working permit grade A in 2019. Can I apply for GBA IIT subsidy?

A: According to the implementation rule announced by the Guangzhou government with regards to the GBA IIT subsidy application, taxpayers holding the working permit grade A are entitled to apply for the subsidy. However, the working permit must be issued by the Guangzhou State Administration of Foreign Experts Affairs and it must be valid within 2019.

Q 2: In 2019, I received income from two companies in two cities of China. Details of my gross salary income are shown in the following table:

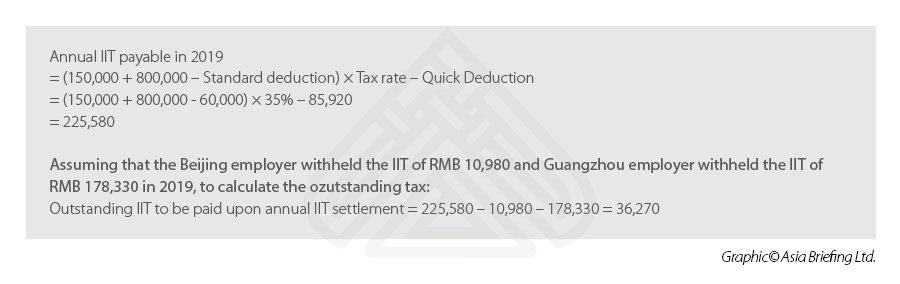

Both of my Chinese employers have withheld the IIT for me, according to the labor contract. How much GBA IIT subsidy I can apply for from the Guangzhou government?

A: Since you have two sources of income from China in 2019, the first step is to complete the annual tax settlement by consolidating all China-sourced incomes and recalculate the tax amount on an annual basis. If the annual tax amount payable exceeds the accumulated monthly prepaid tax, you may need to make up the outstanding tax by June 30, 2020.

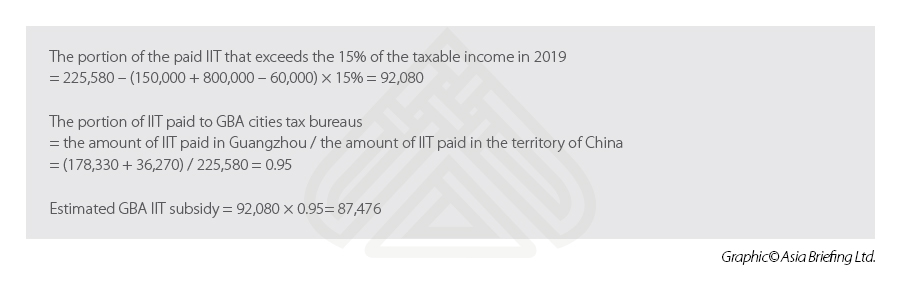

The second step is to calculate the estimated GBA IIT subsidy amount, which will be basically calculated based on two criteria – first, the portion of the paid IIT that exceeds the 15 percent of the taxable income in 2019; and second, the portion of the IIT paid to GBA cities’ tax bureaus (IIT paid to the Beijing tax bureau will be excluded).

The second step is to calculate the estimated GBA IIT subsidy amount, which will be basically calculated based on two criteria – first, the portion of the paid IIT that exceeds the 15 percent of the taxable income in 2019; and second, the portion of the IIT paid to GBA cities’ tax bureaus (IIT paid to the Beijing tax bureau will be excluded).

Q 3: Can I use my overseas bank account to receive the GBA IIT subsidy from the government? Or do I need to open a Chinese bank account?

Q 3: Can I use my overseas bank account to receive the GBA IIT subsidy from the government? Or do I need to open a Chinese bank account?

A: Only a Chinese bank account is able to receive the subsidy from the Chinese government. Please also make sure that the beneficiary name of the bank account is the same as the taxpayer name registered with the tax bureau.

Q 4: If I missed the deadline in 2020, can I make the application in 2021 for GBA refund of 2019?

A: Yes. Considering the impact of the COVID-19 pandemic and restrictions on traveling to China, the taxpayer is allowed to make the application in 2021 for GBA IIT subsidy of 2019.

You are welcome to contact our GBA-based professionals for more information. We can help in the foreigners’ IIT calculation and subsidy application, as well as derive practical solutions to your human resource arrangement needs in the GBA. Please email us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Managing Your China Business During the Coronavirus Outbreak

- Next Article HS Codes in China – What Should Foreign Investors, Trading Entities Pay Attention To?