China’s 2020 New Negative Lists Signal Further Opening-Up

On June 23, 2020, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOF) jointly issued two “negative lists”, both of which will take effect on July 23, 2020. This is a timely follow-up of the promise made in the 2020 Two Sessions about further relaxing market access for foreign investment.

The two Negative Lists refer to the Special Administrative Measures for Foreign Investment Access (2020 edition) (“2020 National Negative List”) (full list in Chinese available here and full list in English available here) and the Special Administrative Measures for Foreign Investment Access in Pilot Free Trade Zones (2020 edition) (“2020 FTZ Negative list”) (full list in Chinese available here and full list in English available here), which will replace their respective 2019 versions.

These two negative lists enumerate the industries where foreign investment will either be prohibited or restricted.

What is the latest reduction in restrictive/prohibitive measures affecting foreign investment?

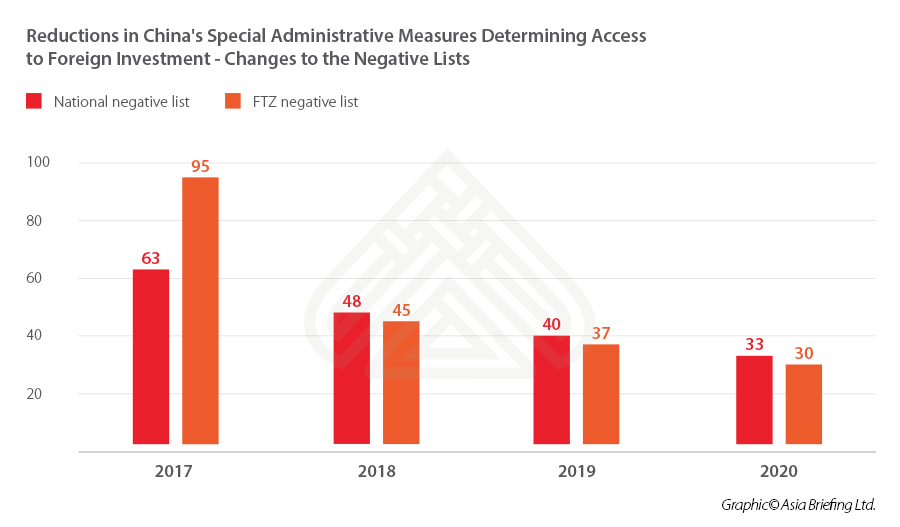

For four years in a row, the two new negative lists have continued to reduce the number of measures limiting access for foreign investment.

Compared to the 2019 negative lists, the new 2020 National Negative List has cut the number of restrictive measures by 17.5 percent from 40 to 33, and the new 2020 FTZ Negative List has cut the measures by 18.9 percent from 37 to 30.

Services sector

The new 2020 National Negative List aims to accelerate the process of further opening key areas in service industries.

In the financial sector, the caps on foreign ownership of securities companies, securities investment fund management companies, futures companies, and life insurance companies are now lifted.

By far, all restrictions on the share ratio of foreign capital in the financial sector have been eliminated in accordance with the established opening timetable, which makes 2020 known as the first year of the full opening of China’s financial sector. This is also in line with China’s promise in its phase one deal with the US.

In the infrastructure sector, it is no longer required that the construction and operation of urban water supply and drainage pipeline networks in a city with a population of 500,000 or more must be controlled by the Chinese party.

In the transportation sector, foreign investors are no longer prohibited from investing in air traffic control systems.

Manufacturing and agriculture

The new National Negative List has further relaxed foreign investment’s access to the manufacturing and agriculture sectors.

In the field of manufacturing, the restrictions on the share ratio of foreign investment in commercial vehicle manufacturing are liberalized; and the prohibitive measures on foreign investment in the smelting and processing of radioactive minerals as well as the production of nuclear fuel are eliminated.

In the agricultural field, the selection and breeding of new wheat varieties and the production of the seeds are no longer required to be controlled by the Chinese party. However, the Chinese party should hold a share ratio of not less than 34 percent.

Further opening-up in FTZs

Based on the national opening-up measures, the Pilot Free Trade Zones (FTZs) will continue to act as pioneers of China’s reform and opening-up.

In the pharmaceutical sector, the measures prohibiting foreign investment in traditional Chinese medicine decoction units have been removed.

In the education sector, wholly foreign-owned enterprises are now allowed to establish vocational training institutions.

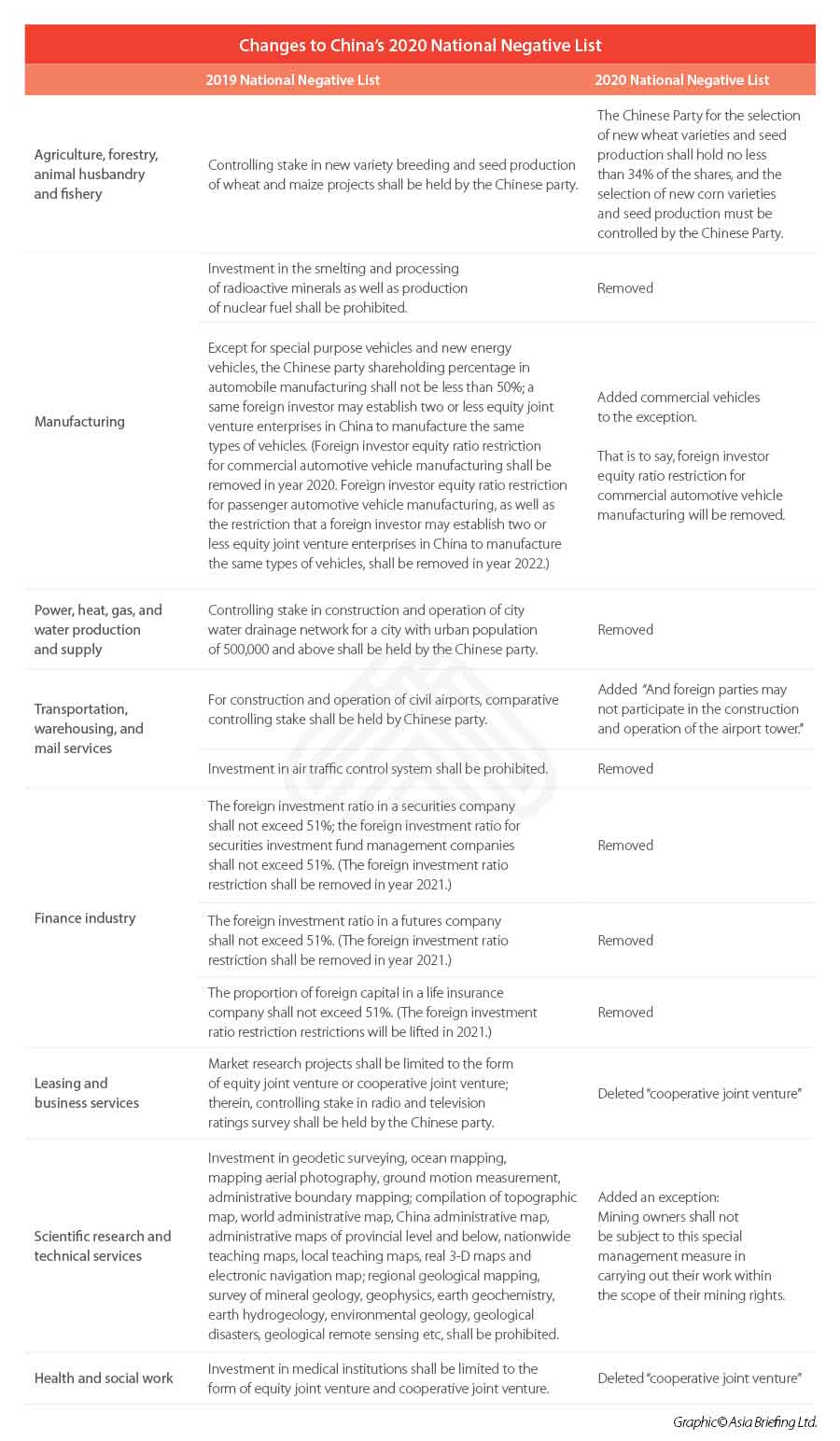

A thorough comparison of the 2019 National Negative List and the 2020 National Negative List can be found below.

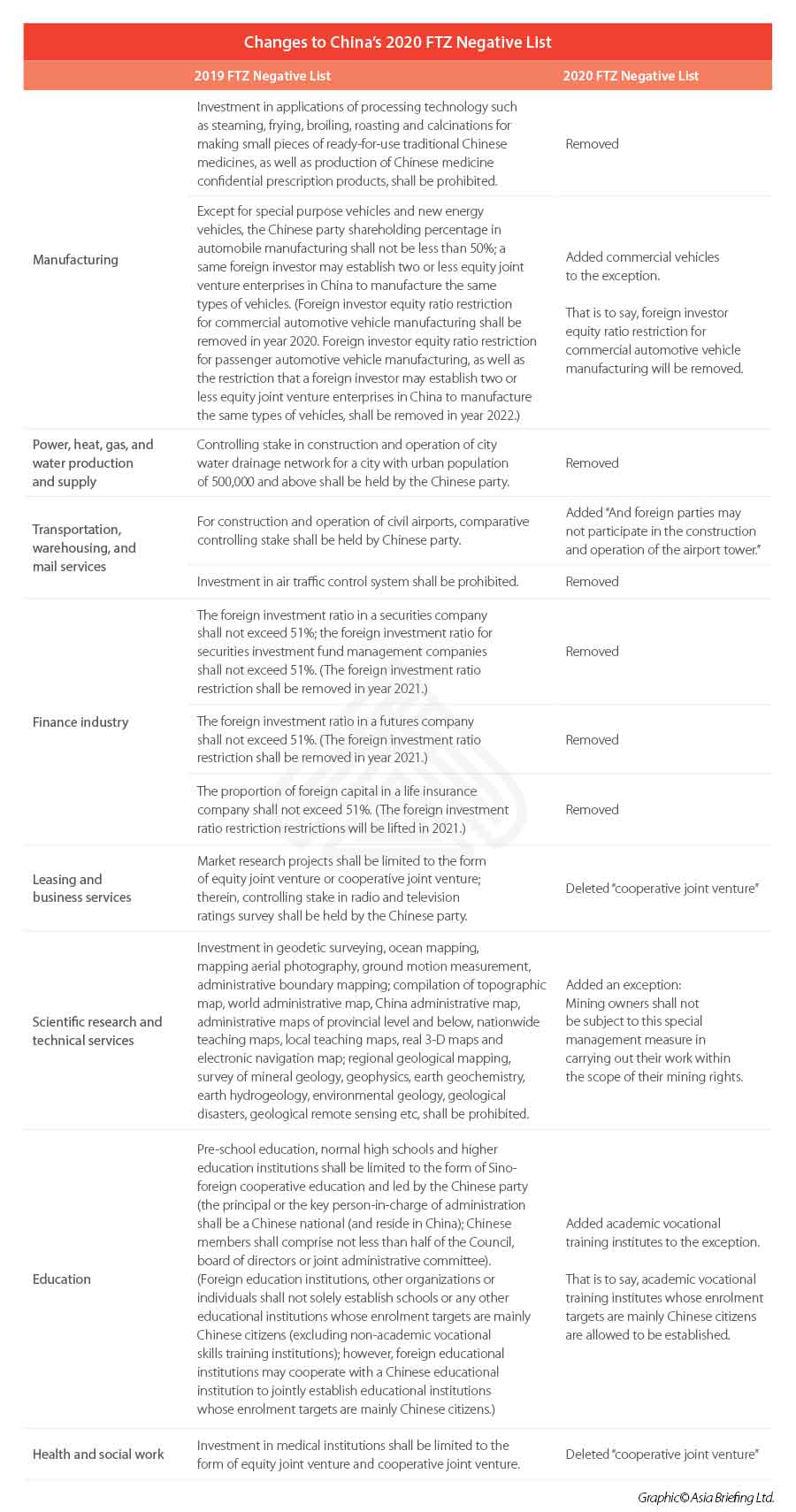

A thorough comparison of the 2019 FTZ Negative List and the 2020 FTZ Negative List can be found below.

Streamlined legislation

In addition to the further opening-up measures, the new negative lists also streamline the connections with other laws and regulations in the foreign investment field.

With the Foreign Investment Law in force since January 1, 2020, the Law on Sino-foreign Cooperative Joint Ventures has been repealed. The measures that restrict foreign investment into cooperative joint ventures are no longer suitable, and are thus revised in the new negative lists.

Meanwhile, they added an exceptional scenario to the negative lists. Upon review by the relevant competent departments of the State Council and approval by the State Council, the provisions of the two negative lists may not apply to specific foreign investments.

Looking forward

China’s foreign investment landscape is changing. With rising labor wages and other manufacturing costs, more investors are starting to cast their eyes on China’s huge market base and high-end manufacturing. The liberalization facilitated by the 2020 new negative lists will facilitate this trend.

The new lists also signal a new level of opening-up – they will boost foreign investor confidence in China as well as accelerate structural upgrades to the existing supply chains in the country.

Looking forward, the negative lists can be expected to be shortened further. Investors planning to engage in relevant areas are suggested to keep a close eye on future developments. For assistance in China, please contact us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article An Introduction to China’s Cross-Border E-Commerce Pilot Zones and Pilot Cities

- Next Article What is the China Standards 2035 Plan and How Will it Impact Emerging Industries?