How to Stay Compliant under China’s New Foreign Investment Law

For foreign investors who maintain operations in China, or plan to enter the market, figuring out the impact of the new Foreign Investment Law (FIL) on their plans is a business-critical task.

Among the incentive, management, and protection measures introduced, Article 31 and Article 42 of the new FIL clarify issues related to the organizational form, governing structure, and operating rules for foreign investments.

Accordingly, these are the most relevant articles to all foreign-invested enterprises (FIEs).

According to Article 31 of the new FIL, the organizational form, governing structure, and operating rules of FIEs will be subject to the provisions of the Company Law, the Partnership Enterprise Law, and other applicable laws, in the same way as enterprises established by domestic investors are treated.

According to Article 42 of the new FIL, the Law on Wholly Foreign-owned Enterprises (WFOE Law), the Law on Sino-foreign Cooperative Joint Ventures (CJV Law), the Law on Sino-foreign Equity Joint Ventures (EJV Law) will be repealed simultaneously when the new FIL comes into force on January 1, 2020.

However, FIEs established in accordance with the three laws on WFOE, CJV and EJV before the FIL takes effect may retain their original organizational structures for five years after January 1, 2020.

This five-year transitional period gives foreign investors more time to arrange relevant transitions to achieve compliance with the new FIL requirements. But at the same time, it also sets a deadline for FIEs to make timely changes to the current organizational forms, governing structure, and other operating rules.

In this article, we analyze the new FIL’s impact on foreign investments, with specific focus on two challenges for foreign investors: how to plan new investments and how to amend current operations to become compliant.

How to plan new foreign investments

For foreign investors who are looking to establish new operations in China, the impact of the new FIL is limited.

Firstly, and most importantly, foreign investors planning to enter the market need to learn more about the investment structures that are available. As mentioned, some of the current investment forms, such as CJV, will no longer exist after the FIL comes into effect.

Foreign investors will need to set up their businesses in accordance with the provisions of the Company Law, the Partnership Enterprise Law, and other applicable laws, similar to domestic investors.

On the one hand, the unified treatment of foreign domestic investments will make the investment path less complicated in the long run. However, on the other hand, it also means that anything foreign investors have learned about investment structures in China will become partly outdated.

Foreign investors should pay close attention to relevant legislative updates and seek professional advice before making an investment ahead of and following the implementation of the FIL.

Investors should note that Article 18 of the new FIL states that a local government – at or above the county level – can only develop foreign investment promotion and facilitation policies within its statutory authority, and according to laws, as well as administrative and local regulations.

That is to say, any unreasonable incentives promised beyond the local government’s authority or against the law may be nullified by the national government later.

Foreign investors should seek to check whether incentives offered locally are compliant with the law and consult professional advisors who may be able to help identify incentive schemes offered by local governments that appear noncompliant.

Foreign investors planning to set up operations in China in the second half of 2019 face the dilemma of whether to apply under the old or new law.

While the new FIL hasn’t come into force, investors that set up under the old law will need to make systematic changes to their newly established businesses soon if they set up the operations based on the current WFOE, CJV and EJV laws.

In this case, foreign investors should consult advisers to understand the impact of the FIL on their investment plan, contact the local business registration authority in charge for further clarification, or simply sit on their investment plan until the new FIL takes effect in January.

How to amend existing investments to become compliant

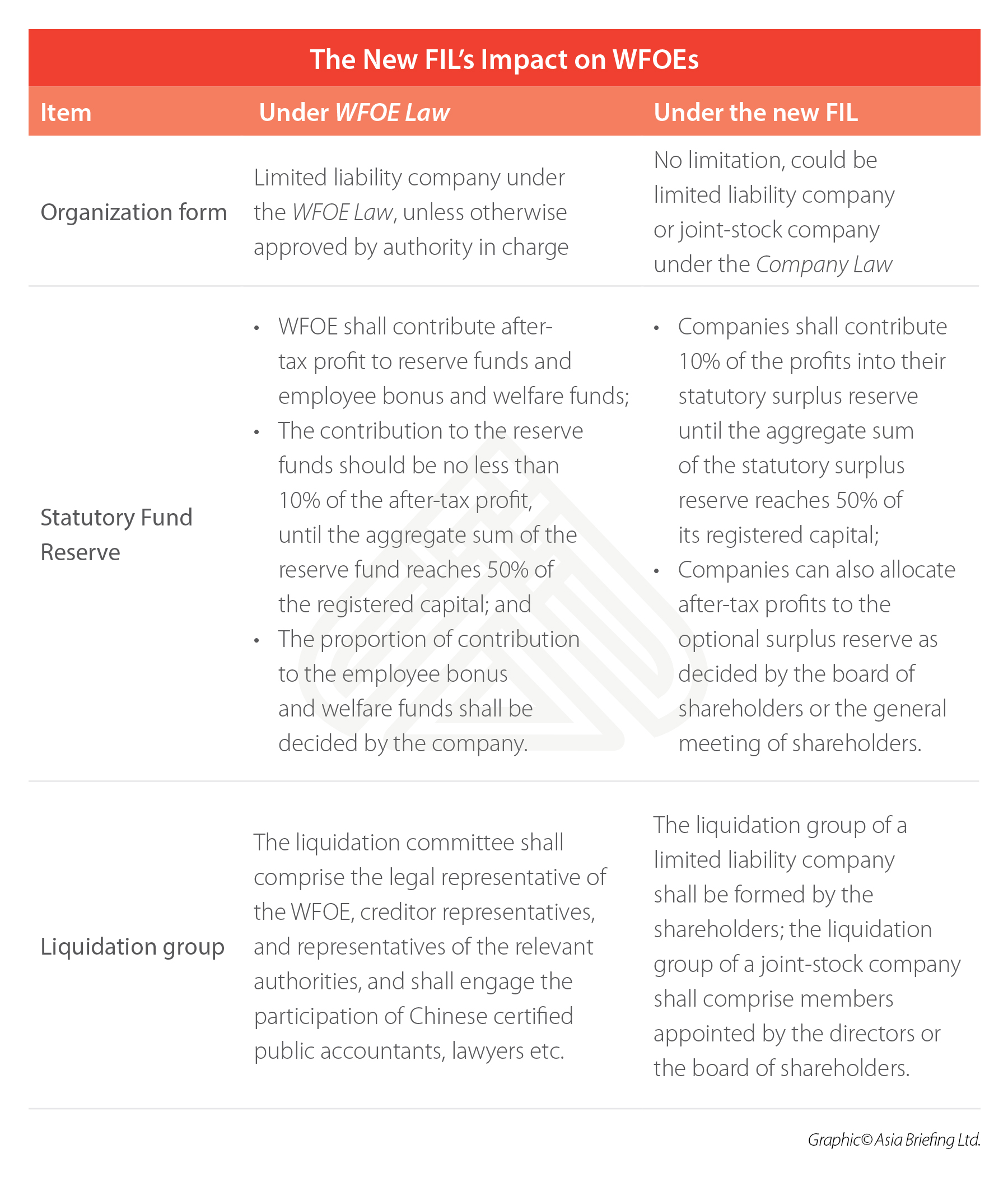

The new FIL’s impact on WFOEs

Considering that WFOEs are generally limited liability companies, which are basically in line with the Company Law, the new FIL has a limited impact.

If we must find some, the limitation of the organization form on WFOE will be removed after the new FIL comes into force. Besides the limited liability company form, a WFOE can also take the form of joint-stock company or a sole proprietorship, after the Sole Proprietorship Enterprise Law is amended.

Notably, certain operating rules are different under the WFOE Law and the Company Law.

For example, under the WFOE Law, WFOEs need to contribute after-tax profit to reserve funds as well as the employee bonus and welfare funds before distributing profit to investors. The contribution to the reserve funds should be no less than 10 percent of the after-tax profit, until the aggregate sum of the reserve fund reaches 50 percent of the registered capital.

The proportion of contribution to the employee bonus and welfare funds is decided by the company.

Under the Company Law, companies are required to contribute 10 percent of the profits into their statutory surplus reserve until the aggregate sum of the statutory surplus reserve reaches 50 percent of its registered capital.

Companies can also allocate after-tax profits to the optional surplus reserve, as decided by the board of shareholders, or the general meeting of shareholders. But there is no requirement of making contributions to the employee bonus and welfare funds.

For ease of reference, we put together the below table.

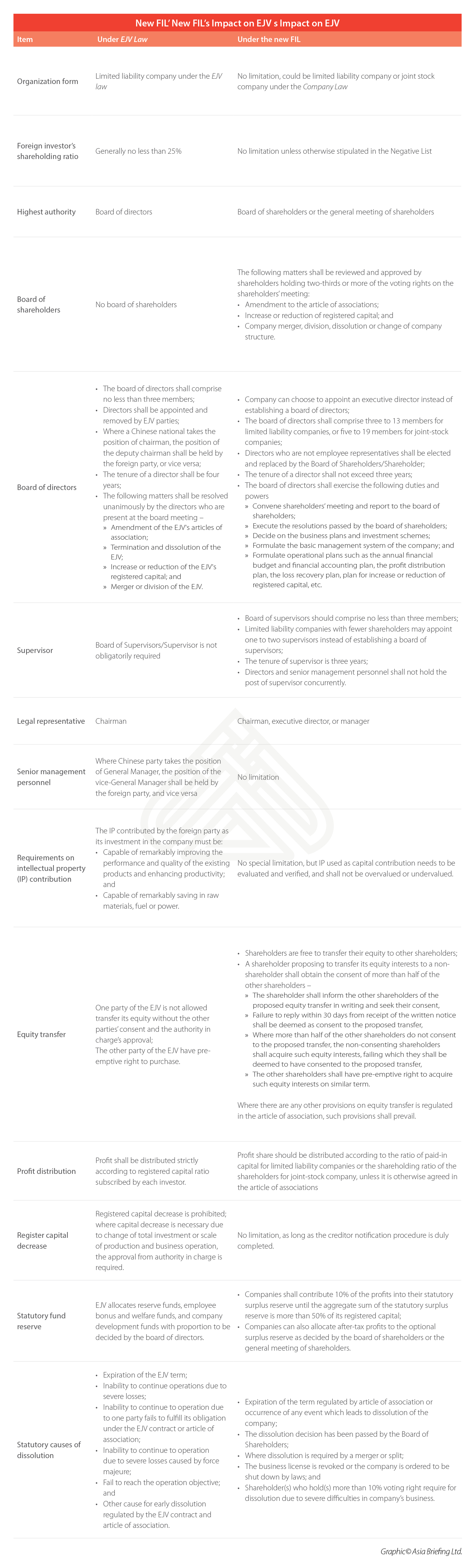

The new FIL’s impact on CJVs and EJVs

For existing FIEs in the form of a CJV or EJV, they need to change their governing structure within the five-year transitional period to the three-tier structure (the board of shareholders, the board of directors, and the manager), in accordance with the Company Law.

This change will make the governing structure of the company clearer, avoiding situations in which the board of directors make decisions with absolute power in CJVs and EJVs.

Under the Company Law, board resolutions on significant matters must be reviewed and approved by shareholders holding two-thirds or more of the voting rights at the shareholders’ meeting, rather than resolved unanimously by the directors who are present at the board meeting under the CJV Law and EJV Law.

This will avoid the company being trapped by deadlock.

For existing CJVs, the impact of the new FIL depends on whether they have legal person status. If they are CJVs with legal person status currently, they will need to restructure during the five-year transitional period into a limited liability company or joint-stock company, in accordance with the Company Law.

If they are CJVs without legal person status, then they can transfer within the five- year transitional period to a partnership enterprise, in accordance with the Partnership Enterprise Law, or a limited liability company or joint-stock company, in accordance with the Company Law.

After the FIL is fully implemented, there will no longer be FIEs in the form of CJVs. Existing EJVs will need to amend their article of associations and change their governing structure and operating rules within the five-year transitional period, in accordance with the Company Law.

For ease of reference, we put together the below table.

Plan ahead

Lorena Miera Ruiz, International Business Advisory Senior Associate at Dezan Shira & Associates, said businesses “pay close attention to the supporting laws, regulations, and implementation measures to assess the real impact the FIL will have on the structure of their company.”

She further noted, “the FIL could be a good occasion for foreign investors to gain more control over their operations in the country, if the sectors they engaged in is further opened.”

The new FIL is expected to bring some uncertainties in the early months of implementation, as with the implementation of any overhauling regulation in the country. Both investors and local authorities should prepare for an “adaptation period” and determine how to manage this transition.

Dezan Shira & Associates advises clients to evaluate the effects of the FIL and get prepared as soon as possible, even with the five-year transitional period.

This is especially prudent for EJVs and CJVs: investors should allow ample time for unexpected events, such as long negotiations with business partners.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China Rolls-Out New Measures for Tax Credit Restoration, Effective January 1, 2020

- Next Article China’s New Foreign Exchange Rules to Ease Cross-Border Transactions