How Will the US-China Trade War End? We Explore 3 Scenarios

The US-China trade war began in July 2018 taking everyone by surprise. We discuss how global trade dynamics may have permanently shifted.

The US and China have been locked in a trade war since July 2018. As things stand, the US has slapped tariffs on US$250 billion worth of Chinese products and has threatened tariffs on US$325 billion more.

Multiple rounds of talks have taken place between trade representatives from the two countries in Washington DC and Beijing but hopes for an imminent settlement are no longer assured after the most recent tariff escalation.

In the meantime, American business leaders are actively assessing whether they need a rethink on their China strategy, beyond the trade war.

While the ongoing tariff brinkmanship has put tremendous pressure on firms doing business in China, they were already feeling the pain of growing labor costs and mounting compliance standards, besides the competition from state-controlled entities (SOEs) and restrictive market access.

Tackling the latter – competition from SOEs and restrictive market access – are two key demands by American trade negotiators who want China to implement real structural reforms by reducing the role of the state in its economy and opening up market access to private sector players.

How will the US-China trade war end?

Last year, as the trade war rapidly escalated, we presented three distinct scenarios on China Briefing – as a thought experiment – for business planners in the region.

This still holds relevance as any final outcome will likely have elements of each of these scenarios.

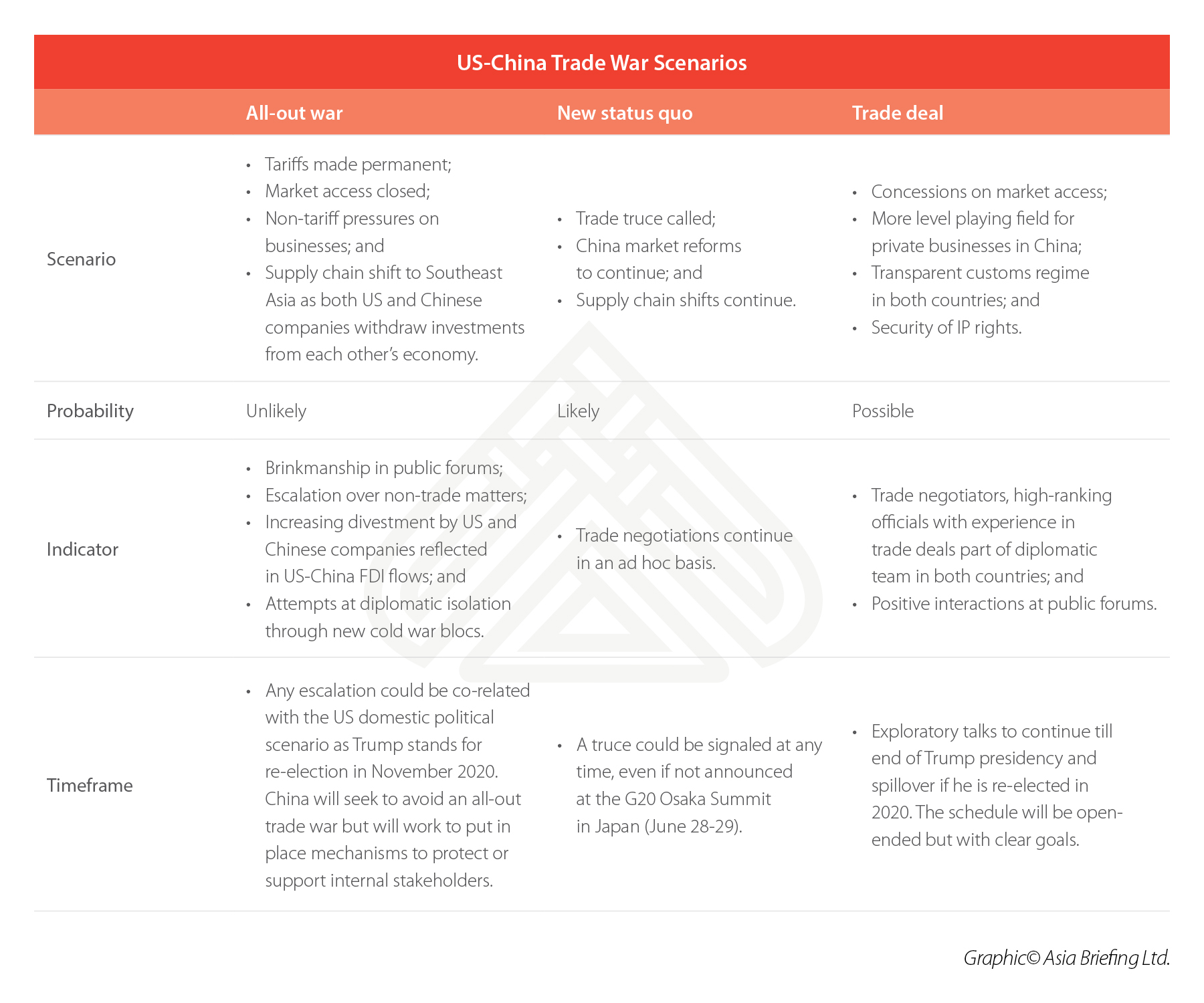

Rapid escalation leads to all-out trade war: Scenario 1

How will this scenario play out?

Trump and Xi decide that negotiation is not an option; neither side wants to look weak and both sides look to establish their own cold war-type camps. Escalating tariff and non-tariff barriers make it impossible for Chinese firms to do business in the US and vice versa.

High tariffs raise costs for suppliers, manufacturers, retailers, and consumers – albeit disproportionately in the US market. As prices increase, production volumes decrease, profit margins diminish, companies go out of business, and jobs are lost.

China begins to invest aggressively in its market ties with Europe, Africa, Asia, and Latin America. The US does the same. American firms seek to shift their supply chain ecosystem out of China into Southeast Asia – in part or wholescale. Similarly, Chinese firms divest their operations in the US.

How likely is it?

The scenario is improbable as both sides will incur huge costs.

Businesses will exert greater pressure on both governments to draw-back, which propaganda machinery won’t be able to cushion.

US and China are the world’s largest economies, biggest markets, and are at the heart of the global industrial supply chain. The two countries won’t be able to sustain a trade war unscathed, and an all-out trade war could trigger a new global recession.

However, Trump has been known to react unpredictably, and China should be preparing itself for the worst case scenario – no ceasefire followed by tariff escalation.

How will we know?

American and Chinese brinkmanship at international forums will signal that both sides are unable to trust each other to continue talks or reach a compromise.

Businesses should pay attention to who the respective governments are talking to, where new investments are headed, if Chinese or American investments in either market are getting blocked, and how regional trade arrangements are shaping up. Here, the role of proxy actors could prove sensitive as witnessed in the American case against Huawei.

New status quo reached: Scenario 2

How will this scenario play out?

Trump and Xi agree to end trade hostilities and agree to bilateral talks – all the while backing it up with rhetoric in their respective countries. Both sides retreat to their initial positions and withdraw the tariff hikes.

A new status quo is reached where trade flows resume as per usual, but business leaders in both countries seriously assess their future risk exposure.

The biggest winner from the US-China trade war is Southeast Asia as multinational companies acknowledge the need to reduce their over-reliance on China’s supply chain ecosystem.

China, on its part, continues to invest in moving up the supply chain and reducing its own reliance on foreign research and development.

How likely is it?

The scenario is relatively more likely, at least in the near term, as global stock markets have not reacted kindly to the growing economic uncertainties due to the trade war. US retailers and consumers will also feel the pain more acutely if the tariffs against Chinese imports stay high.

In the case of China, decline in employment, financial sector reform, and a slowdown in the manufacturing sector and domestic consumption will push the government to engage in talks with the US.

Nevertheless, even if a ceasefire is agreed to, the trade conflict will permanently affect how US and Chinese firms do business with each other. It could also impact how the rest of the world does business with US and China.

How will we know?

Official statements that talks are ongoing between high-level officials on both sides. A public acknowledgment or announcement of future talks at public forums or state-level visits.

Regardless of how it may transpire, businesses should pay attention to who are leading trade negotiations and exploratory talks.

On the Chinese side, Vice Premier Liu He is serving as the chief negotiator in the trade talks with the US, leading a team of about 100 experienced officials.

On the American side, the situation is relatively unpredictable with high ranking officials falling in and out of favor with Trump in quick succession. Here, it is most likely the influence of key business leaders, industrial and agricultural lobbies, and Congress that will affect a positive outcome.

Another aspect to watch out for are speeches made by key members in Trump’s administration, such as those by Vice President Mike Pence. Changes in tone and the topics stressed in these speeches might signal a potential détente or escalation in tensions with Beijing.

Key US officials in the trade negotiations are US Trade Representative Robert E. Lighthizer and Treasury Secretary Steven Mnuchin.

Negotiating a new trade deal: Scenario 3

How will this scenario play out?

China and the US strike a new trade deal, with concessions negotiated on both sides.

After coming to a truce, the two governments get to the drawing board over bilateral market access, securing intellectual property rights, a more level playing field for the private sector in China, and greater regulatory and customs transparency.

Both countries ask for safeguards against future trade confrontation.

How likely is it?

A new trade deal between the two countries is possible, but not in the near term.

It will certainly take longer than the current Trump administration, and China will be wary of setting a bad precedent – where it does not hold the upper hand.

Establishing a fair and transparent trade relationship with China is a bipartisan issue in the US, and both Republicans and Democrats remain diligent on securing concessions as foreign businesses in China get impatient with the ‘market opening’ rhetoric in Xi’s speeches.

How will we know?

Frequent rounds of meetings between trade negotiators, trade and business lobby groups, consultations with high-ranking officials in both governments will be the clearest indicator that the two countries are serious about reaching a new trade deal.

In other words, it is important to assess whether the two countries are talking to each other or at each other.

The tariff escalation begun by Trump in 2018 may not have achieved its initial objectives – reducing trade deficits and getting back US manufacturing jobs – but it has ensured that the status quo will never be the same, new deal or not.

Finally, securing some form of trade deal or a compromise deal may be prioritized by Trump as he is running for a second term as president.

Businesses should prepare for any trade war fallout

The US-China tariff war has established a new reality in international trade relations and introduced systemic risks to businesses.

Companies who are overly dependent on China for sourcing, manufacturing, or both find themselves confronting rising costs, fluctuating tariffs, market restrictions, tighter regulatory oversight, and dwindling profits.

Firms that ignore these risks or fail to draw up actionable contingency plans will be compromising on their long-term stability and financial security.

Through its rapid escalation over the last seven months, the trade war has threatened to upend entire business processes – demonstrating the need for firms to be more agile and geographically diverse.

Businesses need to closely monitor geopolitical developments and economic stressors and establish internal systems that respond to them proactively.

Initial steps include ensuring clear lines of communication between senior management and local offices, being sensitive to the regulatory actions of state authorities, and training staff on how to manage practical risks.

More complex decisions will involve assessing the viability of business relocation, diversifying sourcing and distribution networks, and mitigating exposure to economic uncertainties.

Finally, businesses should watch out for deadlines announced by either side as key dates but begin putting together strategic plans in place.

Editor’s Note: This article was first published on November 20, 2018 and has been updated to reflect new developments.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China’s Tax Concessions for Elderly Care, Childcare, and Domestic Services Industries

- Next Article Shanghai Businesses to Comply with New Waste Management Norms from July 1