China’s Q3 2022 Economic and Trade Roundup: Recovery Better Than Expected

China Q3 2022 data shows economic recovery was faster-than-anticipated but zero-COVID policies and global recessionary trends are constraining efforts at a broader growth rebound.

China’s economy recovered at a faster-than-anticipated pace in the third quarter. Beijing’s efforts, however, have been hampered by continued COVID-19 restrictions, a worsening real estate crisis, and the risk of a global recession.

Nevertheless, some areas of the Chinese economy are particularly promising. Industrial production data – a measure of activity in the manufacturing, mining, and utility sectors – showed a steep increase in September from a year earlier. Other sectors have not been as high performing. China’s property market downturn has worsened, export growth slowed some more, and consumer spending declined again after a brief summer bounce.

Below we look at China’s key economic and trade data for the July-September quarter and discuss what measures the government is implementing to get the country out of its current economic slump.

Key economic indicators

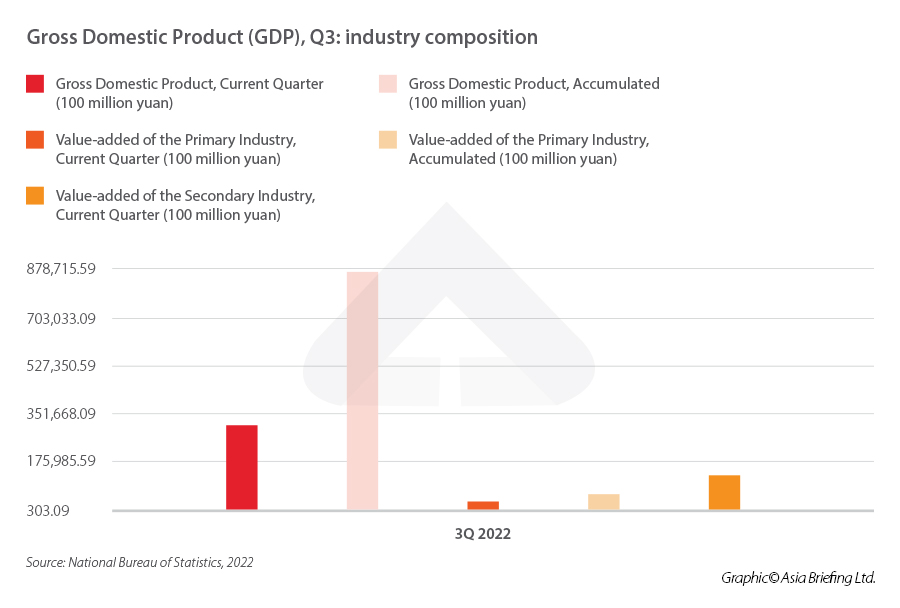

According to official data released on October 24, 2022, by the National Bureau of Statistics (NBS), the world’s second-largest economy’s gross domestic product (GDP) increased by 3.9 percent in the July-September quarter compared to the same period last year, exceeding the 3.4 percent pace predicted by some previous analyses and picking up speed from the 0.4 percent growth recorded in the second quarter.

Compared to the previous year, in the third quarter of 2022 – all three sectors of the economy experienced growth: – The value added of the tertiary industry was RMB 46,530.0 billion, up by 2.3 percent.

- GDP increased by 3.9 percent year-on-year.

- Industrial production rose 6.3 percent between January and September.

At a quick glance, by the third quarter of 2022:

- Retail sales growth slipped to 2.5 percent (3 percent below predictions).

- In the first nine months of the year, fixed asset investment increased by 5.9 percent.

- Unemployment rose to 5.5 percent in September, from 5.3 percent in the previous month.

- Export growth reduced from 7.1 percent in August to 5.7 percent in September, showing an overall decline in Q3.

- The value added of the secondary industry was RMB 35,018.9 billion up by 3.9 percent.

- The value added of the primary industry was RMB 5,477.9 billion, up by 4.2 percent.

Industrial production recovery led by high-tech manufacturing

Industrial production in the third quarter rebounded significantly from the second quarter, with the best recovery registered in September.

Value-added output of industrial enterprises over a designated size (those with an annual main business income of RMB 20 million (US$2.9 million) and above grew by 3.9 percent year-on-year, 0.5 percentage points faster compared to the first half of the year. The value added to high-tech manufacturing and equipment manufacturing increased by 8.5 percent and 6.3 percent, respectively, compared to 2021.

All three main industries experienced an annual growth increase:

- Mining grew 8.5 percent.

- Manufacturing grew by 3.2 percent.

- Electricity, heat, gas, and water production and supply grew 5.6 percent.

Certain industries saw significant quarterly growth, such as green energy and smart products:

- New energy vehicles were up 112.5 percent.

- Solar energy batteries grew 33.7 percent.

The manufacturing purchasing manager’s index (PMI) grew to 50.1 in September, from 49.4 in August. A PMI reading over 50 indicates growth or expansion of the manufacturing sector. This is also the first time it recovered since July 2022.

Slow consumption

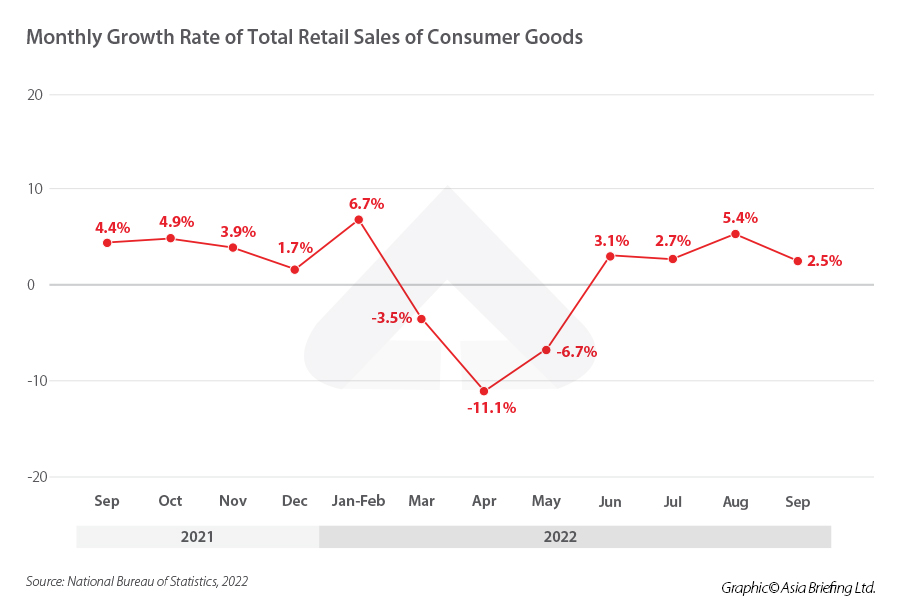

Year-on-year growth in retail sales made a shaky comeback in the third quarter, declining slightly to 2.7 percent in July before increasing to 5.4 percent in August and declining once more to 2.5 percent in September. However, analyses suggest that the trend was partially a reflection of the fluctuation in numbers between June and September, influenced by the macroeconomic conditions and the resurgence of COVID-19 cases. Overall, throughout the first three quarters of 2022, retail sales grew by just 0.7 percent year-on-year.

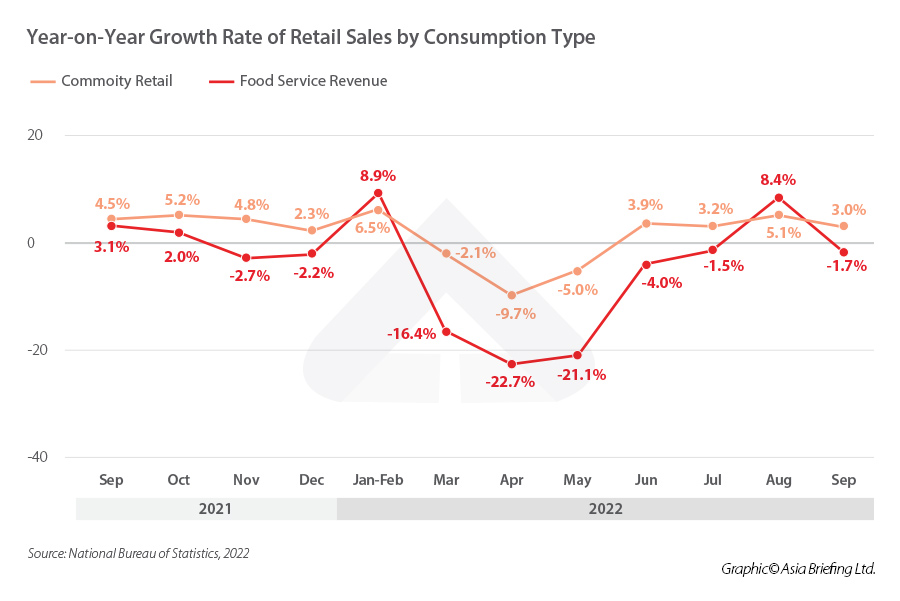

Looking at consumption patterns, sales of products reached RMB 28,905.5 billion (US$4,008.9 billion), an increase of 1.3 percent from 2021. Meanwhile, catering revenues came in at RMB 3,124.9 billion (US$433.9 billion), a significant decrease of 4.6 percent. This drastic drop in catering sales is mainly due to the measures adopted by the ‘Zero-COVID’ and dynamic clearing policy, which has particularly impacted this sector.

For the same reason, online retail sales increased by 4.0 percent from January to September to reach RMB 9,588.4 billion (US$1,329 billion). Among them:

- Online retail sales of physical goods increased by 6.1 percent, accounting for 25.7 percent of all retail sales of social consumer goods.

- Online retail sales of physical goods increased by 15.6 percent, 4.7 percent, and 5.2 percent, respectively, for food, clothing, and consumer goods.

Production indicators of the main services sectors still saw moderate growth in the first three quarters of 2022:

- Information transmission, software, and IT services grew 10.3 percent year-on-year.

- The financial industry grew 5.5 percent year-on-year.

Fixed asset investment stable with a focus on manufacturing and infrastructure

In the first three quarters of 2022, fixed asset investment (FAI) reached RMB 42,141.2 billion (US$5,844.6 billion), an increase of 5.7 percent compared to 2021 (excluding rural households), and up 0.1 percentage points from the January-through-August period. Specifically, investment in manufacturing increased by 10.1 percent, and that in infrastructure increased by 8.6 percent.

Investment also increased in each sector of the economy individually, with the primary, secondary, and tertiary sectors seeing a 1.6 percent, 11.0 percent, and 3.9 percent increase year-on-year, respectively.

In terms of high-tech manufacturing, investments increased by 28.8 percent in the production of electronic and communication equipment and 26.50 percent in the production of medical equipment, measuring instruments, and meters. In the high-tech services sector, investments grew by 22.1 percent in services for transforming scientific and technological advancements and 18.7 percent in research, development, and design services.

FAI growth is a major contributor to domestic demand and includes infrastructure spending. Spending on infrastructure projects has increased year-on-year at a quicker rate since May, with an 8.6 percent increase noted in the first nine months. This significant increase in infrastructure spending coincided with a massive central government stimulus: the State Council granted the nation’s policy banks an additional RMB 800 billion (US$120 billion) quota for lending to infrastructure projects in early June, in an effort to support the economy.

On the other hand, real estate development, investment, and sales saw the largest contraction, with commercial housing sales dropping 26.3 percent from the previous year to RMB 9,938.0 billion (US$1,378.3 billion). Since several developers began defaulting loans in the second half of 2021, leading to a widespread mortgage boycott, China’s housing market has been in experiencing a profound crisis. In October 2022, however, indicators have been pointing to a more positive turn of events. According to data gathered by brokerage Cinda Securities Co. Ltd., China’s pre-owned housing market has shown signs of stabilizing amid a loosening of property regulations, with transactions in 15 surveyed cities increasing 40 percent year-over-year to 1.9 million square meters.

Foreign trade on a slow rise

With decreases in export volumes to China’s major markets like the US, Germany, and France, export growth slowed in September to 5.7 percent. Trade was a reliable source of economic development for China during the pandemic, but in recent months, global demand has decreased and worries about a global recession have grown.

Nevertheless, cumulative trade data for the past three quarters show signs of continuous growth. Total imports and exports of goods in September reached RMB 3.81 trillion (US$560.77 billion), a year-on-year increase of 8.3 percent. Exports continued to see strong growth, reaching RMB 2.19 trillion (US$322.76 billion), up 10.7 percent from the previous year.

The growth of imports remained slow, reflecting weak domestic demand, increasing 7.4 percent year-on-year to reach RMB 1.62 trillion (US$238.01 billion), just a slight increase from August.

China’s largest trade partner in the third quarter of 2022 remained the ASEAN region, which accounted for 15.1 percent of all imports and exports between January and September. China’s trade surplus with this region has also expanded by 93.4 percent during this time, reaching RMB 753.6 billion (US$104.5 billion). The country also imported the largest amount from ASEAN, reaching RMB 1.97 trillion (US$218 billion).

The EU was China’s second-largest trading partner with a total of RMB 4.23 trillion (US$586.6 billion), accounting for 13.6 percent of all imports and exports so far in 2022.

The US is China’s largest export market and third-largest trade partner. Exports grew 10.1 percent to reach RMB 2.93 trillion (US$331.5 billion), while imports grew just 1.3 percent. The trade surplus expanded by 14.2 percent to reach RMB 2.07 trillion (US$287 billion).

South Korea is China’s fourth largest trade partner, accounting for 5.8 percent of total imports and exports. Exports to South Korea grew 16.5 percent, while imports merely grew 0.6 percent. China’s trade surplus with South Korea shrank by 34.2 percent, standing at RMB 206.66 billion (US$28.66 billion) as of September 2022. According to recent analysis, the bilateral deficit was partly caused by China’s COVID-19 regulations, but also Seoul’s need for a long-term plan to gradually transform the way in which commerce between the two nations is structured. The South Korean government has highlighted the slowing trade with China among the top risks for the national economy to be addressed promptly.

Mechanical and electrical products accounted for 56.8 percent of all exports in the period from January to September 2022, increasing 10.04 percent from the same period in 2021. Among them, exports of automatic data processing equipment and components increased by 1.9 percent to reach RMB 1.18 trillion (US$163.65 billion), while exports of mobile phones increased 7.8 percent to RMB 672.25 billion (US$93.23 billion) and exports of automobiles grew 67.1 percent to RMB 259.84 billion (US$36.03 billion).

How to read this data?

Comparing the third quarter of 2022 to the second, the real economy has made some progress. The supply shock has subsided, and the demand stimulus is still in effect, which are the two main factors contributing to this marginal growth.

Economic activity in the industrial and service sectors has significantly increased compared to the second quarter, and supply shocks like production and logistics brought on by the pandemic in the previous quarter have been mitigated. From the demand side, infrastructure investment has started to exert pressure, and commodity retail and service consumption have both increased.

However, this year saw a continuation of the declining trend in real estate investment. Also, in August, the export growth rate dramatically decreased. China’s economy is still under pressure as a result of the rise in global interest rates, the deepening conflict between Russia and Ukraine, and the European energy crisis.

Although the third quarter’s GDP growth rate increased by 3.4 percentage points over the second quarter’s, the initial growth objective of 5.5 percent by the end of the year still seems too far from the actual situation.

Government plans to revive the economy

The data was originally scheduled for release on October 18, 2022, but was delayed amid the 20th National Congress of the Communist Party (CPC). On this occasion, President Xi Jinping outlined the importance of boosting economic growth, praising the Chinese economy for having “great resilience, potential, and scope of action,” and promising that “ its strong fundamental will remain unchanged.”

To achieve so, the government has implemented several policy packages throughout the year. In May 2022, Beijing released 33 stimulus measures in an effort to revive the economy in the wake of the COVID-19 lockdowns. The stimulus measures build on the assistance programs for businesses affected by the epidemic and work to stimulate investment and guarantee the availability of essential resources.

These were followed by another set of 19 measures unveiled in August in the wake of a worsening real estate crisis and prolonged electricity shortages brought on by a severe drought. The package included fresh financing totaling more than RMB 1 trillion (US$146 billion) to promote investment and consumption as well as greater freedom for local governments to support the real estate sector. They also comprised regulations designed to remove administrative obstacles and facilitate business people’s cross-border movement.

Moreover, following the conclusion of the 20th National Congress of the CPC, China’s top economic planner, the National Development and Reform Commission (NDRC), along with five other ministries, issued 15 new measures to ease the implementation of foreign-invested projects. These policies include measures such as facilitating international travel for key personnel and allowing foreign companies to raise money on China’s stock markets, a move that analysts said demonstrates China’s determination to further open up its market and strengthen its economy.

Restoring business confidence and attracting investors are top priorities

Most major central banks around the world have initiated a cycle of interest rate increases lately, and China’s consumer price index grew by 2.8 percent year-on-year in September, indicating stronger inflation pressure. Yet in August 2022 China’s central bank announced a rate cut, surprising most experts. The market anticipated that the People’s Bank of China (PBOC) would prioritize structural monetary instruments, such as increased liquidity or rate reductions for specific industries, over a more widespread interest rate decrease.

According to official reports, China is anticipated to increase its attractiveness to investors by stepping up its efforts to manage its expectations. The 33 measures released in May were also meant to hasten the completion of important foreign investment projects and more actively entice foreign investment.

To direct foreign capital into industries like high-end manufacturing and scientific innovation in locations like the middle, western, and northeastern Chinese regions, the modification of the industrial catalog for sectors that favor foreign investment will also be expedited.

Along with expanding cross-border financing options for businesses, improving communication between Chinese authorities and foreign chambers and businesses, and actively facilitating foreign trade, the country will also assist foreign investors in setting up research and development centers in high-end and emerging technologies.

Other moves include accelerating market opening, such as via the expansion of pilot areas for comprehensive opening-up in the services sector. Further, government policies also focus on guiding foreign investment into important sectors like advanced manufacturing, high-end technology, energy conservation, and modern services. They aim to improve working mechanisms at both the central and local government levels for large-scale foreign investment projects.

These resolutions show that the Chinese government is aware of the key role played by foreign capital and businesses in supporting overall economic growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Vape Industry: Consumption Tax Imposed from Nov. 1, 2022

- Next Article More Than a Hobby: Understanding the Esports Market in China