Investing in Inland China: Chongqing, Gateway to China’s West

Situated in inland China, the sprawling city of Chongqing is a key port along the Yangtze River economic belt and a prominent logistics node for the Belt and Road Initiative (BRI).

Serving as a strategic base for the development of western China, Chongqing broke away from Sichuan province in 1997 and since then gained the same political status as Beijing, Shanghai, and Tianjin, as a city that reports directly to China’s central government.

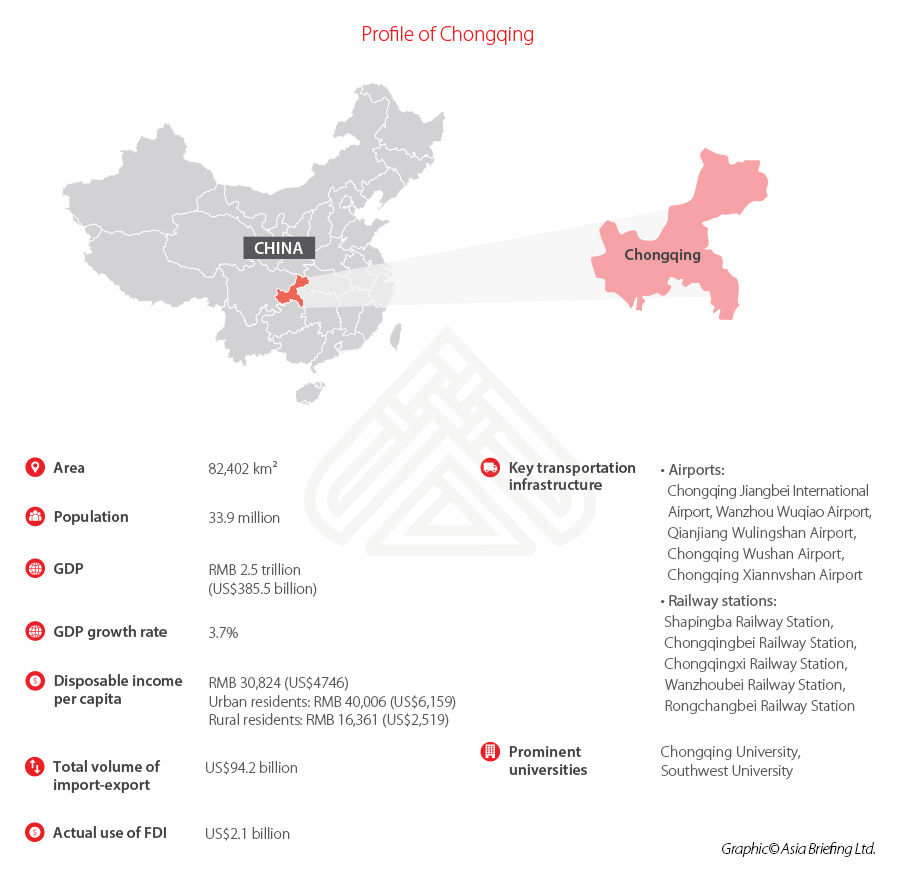

But different from the other three, Chongqing is much larger and populous. It has an area of 82,400 kilometers, 13 times that of Shanghai and as large as Austria. It is home to 33.92 million residents, 7 million more than that of Shanghai and close to that of Canada.

With relatively cheaper labor, well-developed infrastructure, integrated industrial clusters and supply chains, and sound business environment, as well as benefiting from national policies, Chongqing is standing out as a major destination for foreign investment in China’s central and western regions.

Chongqing’s strategical geographical position

The provincial-level city of Chongqing has an extensive system of highway and rail networks that connect major global markets.

The Chongqing-Xinjiang-Europe Railway, a direct rail route from Chongqing to Germany established in 2010, brought Chongqing to the forefront of China’s trade with Central Asia and Europe.

The Land-Sea New Corridor that is presently being constructed, links Chongqing to southwest China, which will further facilitate trade between the country’s western region and markets of nearby Southeast Asia, particularly the Indo-China peninsula.

The Chongqing-Manzhouli-Russia freight railway, opened in 2014, operated over a thousand trips between China and Russia in 2020.

Chongqing and Chengdu, the capital city of Sichuan province, together form the Chengdu-Chongqing Economic Circle, the fourth largest megacity cluster in China, following the Yangtze River Delta region, the Guangdong-Hong Kong-Macao Greater Bay Area, and the Beijing-Tianjin-Hebei region.

The ambitious city aims to construct a railway network with a total length of 5,800 kilometers by 2030, including 2,032 kilometers of high-speed railways. By then, Chongqing will become an important transport hub connecting Europe, Asia, and other parts of China.

Chongqing’s economic profile

As China’s largest municipality by size and population, Chongqing ranks as the fifth Chinese city with the strongest GDP, following Shanghai, Beijing, Shenzhen, and Guangzhou. The city recorded a GDP of RMB 2.5 trillion (US$385.5 billion) in 2020. For perspective, that’s about the size of Israel’s or Argentina’s economy.

Chongqing’s economy was formerly based on agriculture and heavy industry, but is now more balanced, with the secondary and tertiary industries contributing to 40.0 percent and 52.8 percent of its GDP.

Over the last two decades, its GDP per capita has increased 16-fold, from US$544 to US$8,908, and the urbanization rate has doubled from 29.5 percent to 62.2 percent, according to the World Bank. In the rapid urbanization process, however, Chongqing has avoided some major challenges faced by first-tier Chinese cities, such as high cost of living and scarcity of affordable housing.

In 2020, Chongqing logged total imports and exports of US$94.2 billion, up 12.5 percent, which is 10.9 percentage points higher than the national average growth rate. This province-like city ranked 12th in terms of total import-export volume among 31 Chinese provinces.

The US, Hong Kong, and Germany are the top three destinations of Chongqing’s goods exports, while Taiwan, Vietnam, and South Korea are top countries or regions from where Chongqing imports goods.

Chongqing’s major industrial products and key investment areas

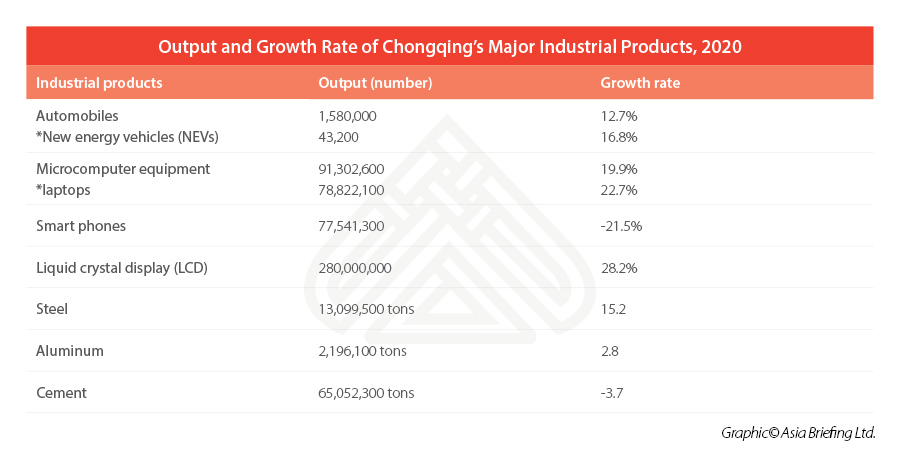

Chongqing was one of China’s main old industrial bases, dominated by heavy industries, such as automobile manufacturing, military, iron, steel, and aluminum industries. In 2019, heavy industry still accounted for 79.5 percent of Chongqing’s gross industrial output. The city is the largest automobile and motorcycle manufacturing base in China.

But with the much efforts into transforming its industry, Chongqing electronics industry recently grew strongly. The share of gross output of telecommunication equipment, computers, and other electronic equipment industries in total gross industrial output grew from 11.4 percent in 2012 to 23.8 percent in 2019.

Now, Chongqing produces one-third of the world’s laptops and 90 percent of the world’s IT network terminals, making it the world’s largest laptop production base and the second largest mobile phone production base in the world.

Chongqing is doubling down on developing its electronics industry, which maintained strong growth momentum, growing 13.9 percent last year. Chongqing’s Liangjiang New Area has formed an electronics industry pattern dominated by three industrial clusters: integrated circuit (IC), display panel, and intelligent terminal.

Dubbed “Chicago in Yangtze River”, Chongqing is also putting efforts into upgrading its conventional pillar industry – automobile manufacturing. Leveraging its existing automobile base, Chongqing endeavors to become a global leader in producing and using new energy vehicles, including electric cars.

Last year, BYD, China’s leading electric automaker backed by Warren Buffett, decided to build its FinDream Battery Factory in Chongqing that produces the BYD Blade Battery. The project is expected to invest no less than RMB 20.5 billion (US$3.2 billion).

Striving to become a hub for advanced manufacturing, Chongqing also encourages manufacturing of high-end equipment, such as CNC (computer numerical control) machine tools, 3D printing, laser manufacturing equipment, environmental protection equipment, rail transit equipment, etc. So far, the city is home to Foxconn Technology, Isuzu, and ABB.

In 2020, Chongqing welcomed 287 new foreign-invested projects, up 28.7 percent compared with the year before. The city utilized about US$10.3 billion of foreign capital, including US$2.1 billion of foreign direct investment. By the end of 2020, a total of 296 Fortune Globe 500 enterprises have settled down in Chongqing.

Operational costs – key factors of production

Chongqing has a population of about 33 million, of which 2.7 million are skilled industrial workers. The labor cost is about 60 percent that of the eastern coastal areas, according to the municipal government.

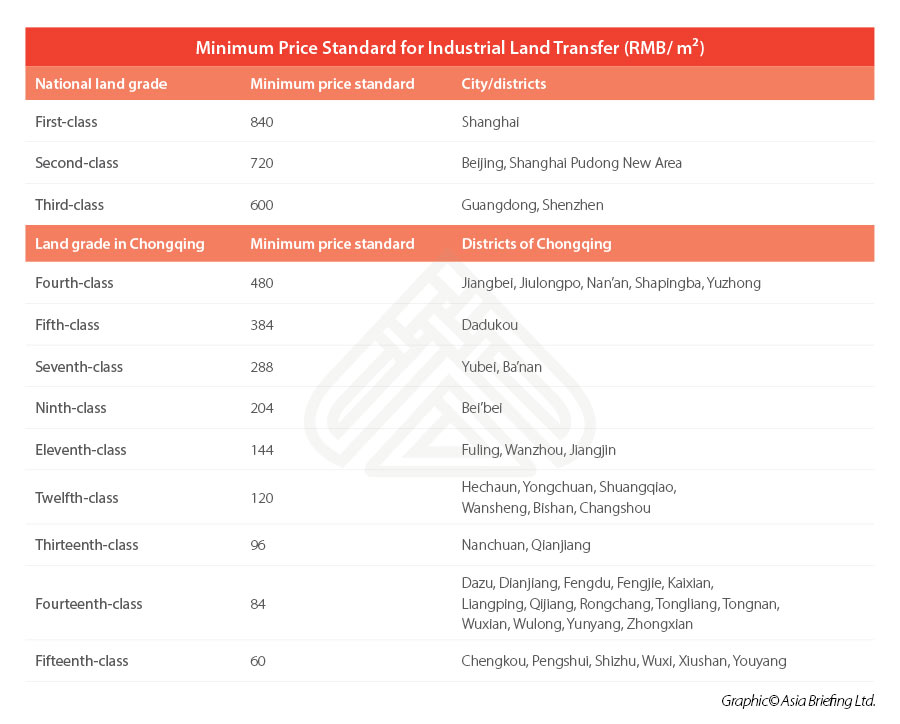

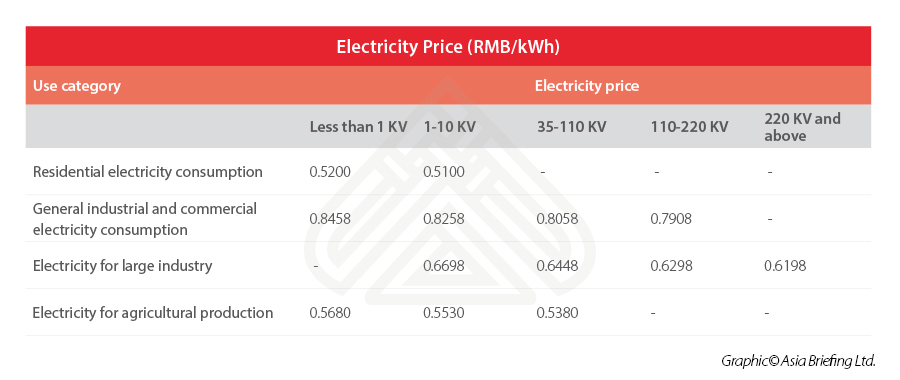

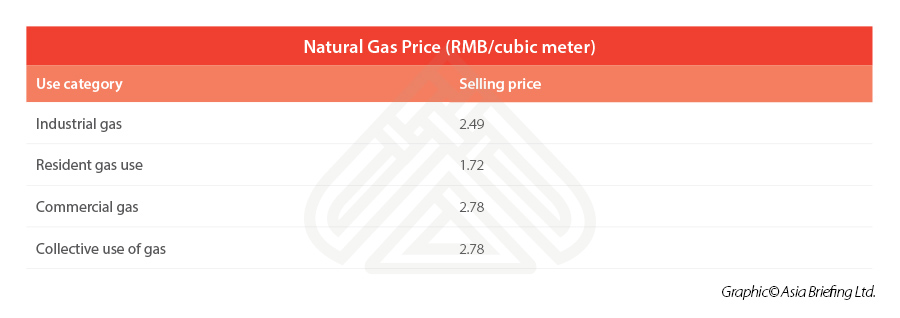

The city also has an abundant of factors of production, such as coal, natural gas, water, electricity, and land, with prominent cost advantages.

Business environment and preferential policies

According to the “2018 quality report on the business environment of Chinese cities” jointly released by PwC China, BBD, Caixin Insight, and Chengdu Institute of New Economic Development, Chongqing ranks the first in the central and western regions in terms of business environment.

As part of China’s western regions, Chongqing offers favorable tax treatment and various incentives, including a lowered corporate income tax (CIT) rate of 15 percent, tariffs exemptions on imported equipment, access to preferential land prices, and looser regulation of land uses for foreign investors engaged in doing business in the industries encouraged by Chongqing. (You can find the industries encouraged by Chongqing in the Catalogue of Industries Encouraged for Foreign Investment in the Central and Western Region of China).

Chongqing has promulgated a series of policies to build a talent pool catering to the needs of the city’s development. Last year, the city introduced the “Hongyan Plan” to attract domestic and overseas high-tech talents, offering eligible talents cash rewards and budget subsidies.

Chongqing, as a western city, has greater autonomy to offer local incentives and adopt local preferential policies. Its preferential policies also include other tax incentives, land and real estate benefits, foreign exchange management and credit, import and export assistance, and visa advantages. However, investors should note that preferential policies vary in different development zones even within the same province.

Special economic zones

Chongqing Pilot Free Trade Zone

Chongqing Pilot Free Trade Zone (FTZ) was officially established on March 15, 2017, with an area of 119.98 square kilometers, covering the Liangjiang area, Xiyong area, and Guyuan port area.

It focuses on the development of manufacturing of high-end, digital, or intelligent equipment, cloud computing, biomedicine, and services, such as international transit and integrated distribution.

In 2020, 14,393 enterprises were newly established in Chongqing Pilot FTZ, with registration capital totaling RMB 140.97 billion (US$21.71 billion). Among them, 129 are foreign-invested enterprises (FIEs), with a total of registration capital of US$843 million.

Chongqing Liangjiang New Area

Chongqing Liangjiang New Area is the first national-level development zone in inland China, and the third nationally after Shanghai Pudong New Area and Tianjian Binhai New Area.

It covers 1,200 square kilometers, and focuses on chip, liquid crystal panel, intelligent termina, core parts. Major industries based here are the electronics information industry, general aviation, rail-transportation equipment manufacturing, emerging financial, international logistics, big data and information service, cross-border settlement, and e-commerce, bonded trade and entrepot trade, and professional services, such as health care, tourism, and other services.

On April 9, the promotion meeting of Chongqing Liangjiang New Area-Shanghai Cooperation Organization (SCO) Countries Trade and Economic Multifunctional Platform was held in Beijing. Liangjiang New Area will play an important role to strengthen the cooperation with the SCO countries and BRI countries in terms of establishing communication channels, logistics, trade, industry, cultural and educational exchanges.

In recent years, the New Area has established an opening-up system extending in all directions and a modern industrial system. A total of 160 Fortune 500 enterprises have settled in Liangjiang, with several more international organizations, associations, and multinational enterprises joining the investment and settlement campaign in the New Area.

Chongqing High-Tech Industrial Development Zone

Chongqing High-tech Industrial Development Zone, approved in March 1991, has a total planned area of 1,093 square kilometers, focusing on the development of biological drugs, precision medical and other large health industries, power semiconductors, the internet and other new information technology industries, automobile electronics, intelligent robots, and other advanced manufacturing industries, testing certification, R&D services, and other high-end services.

Chongqing Economic and Technological Development Zone

Chongqing Economic and Technological Development Zone was established in 1993, with total area of 90 square kilometers. The economic development zone is a foundational base for electronics and information, high-end equipment manufacturing, modern service industry, etc.

Special customs supervision zones

Lianglu Chuntan Bonded Port Area

Approved in November 2008, Chongqing Lianglu Chuntan Bonded Port Area is the first bonded port area in inland China. With a planned area of 8.73 square kilometers, the port area has become an important bonded production and processing area, a hub of foreign trade logistics, and international exhibition and trading center of featured commodities, and a port of distribution for import and export of goods in the upper reaches of the Yangtze River.

Xiyong Comprehensive Bonded Zone

Xiyong Comprehensive Bonded Zone (CBZ) approved in February 2010, has a planned area of 10.3 square kilometers and focuses on the development of export-oriented electronic information industry. It has formed a laptop computer base and will help build Chongqing into the largest processing trade base in the central and western regions.

Jiangjin Comprehensive Bonded Zone

Approved in January 2017, with a planned area of 2.21 square kilometers, Chongqing Jiangji CBZ focuses on the development of bonded processing, bonded logistics, and bonded services. It has a supporting area covering 27.9 square kilometers, focusing on development of intelligent equipment, medical equipment, consumer electronics, modern logistics, and other industries.

Fuling Comprehensive Bonded Zone

Fuling CBZ was approved in October 2018, with a planned area of 2.7 square kilometers. It focuses on development modern manufacturing and modern services industries.

Dezan Shira & Associates has handled multiple foreign investments into western China over the years. We have offices in China, Vietnam, Singapore, and elsewhere in ASEAN and can therefore assist at both ends of the manufacturing supply chain. For more information and for support in investing in Chongqing and China’s Western Regions, you are welcome to email us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Hints at Launching Shanghai-Zurich Stock Connect Program

- Next Article Belt and Road Weekly Investor Intelligence, #27