The Beijing-Tianjin-Hebei Integration Plan

By Mark Preen

As the capital city of China, it is widely known that Beijing has a significant and central role in many aspects of modern day China. However, less is known about Tianjin and the Hebei province, which make up the region surrounding Beijing and are somewhat overshadowed by the capital.

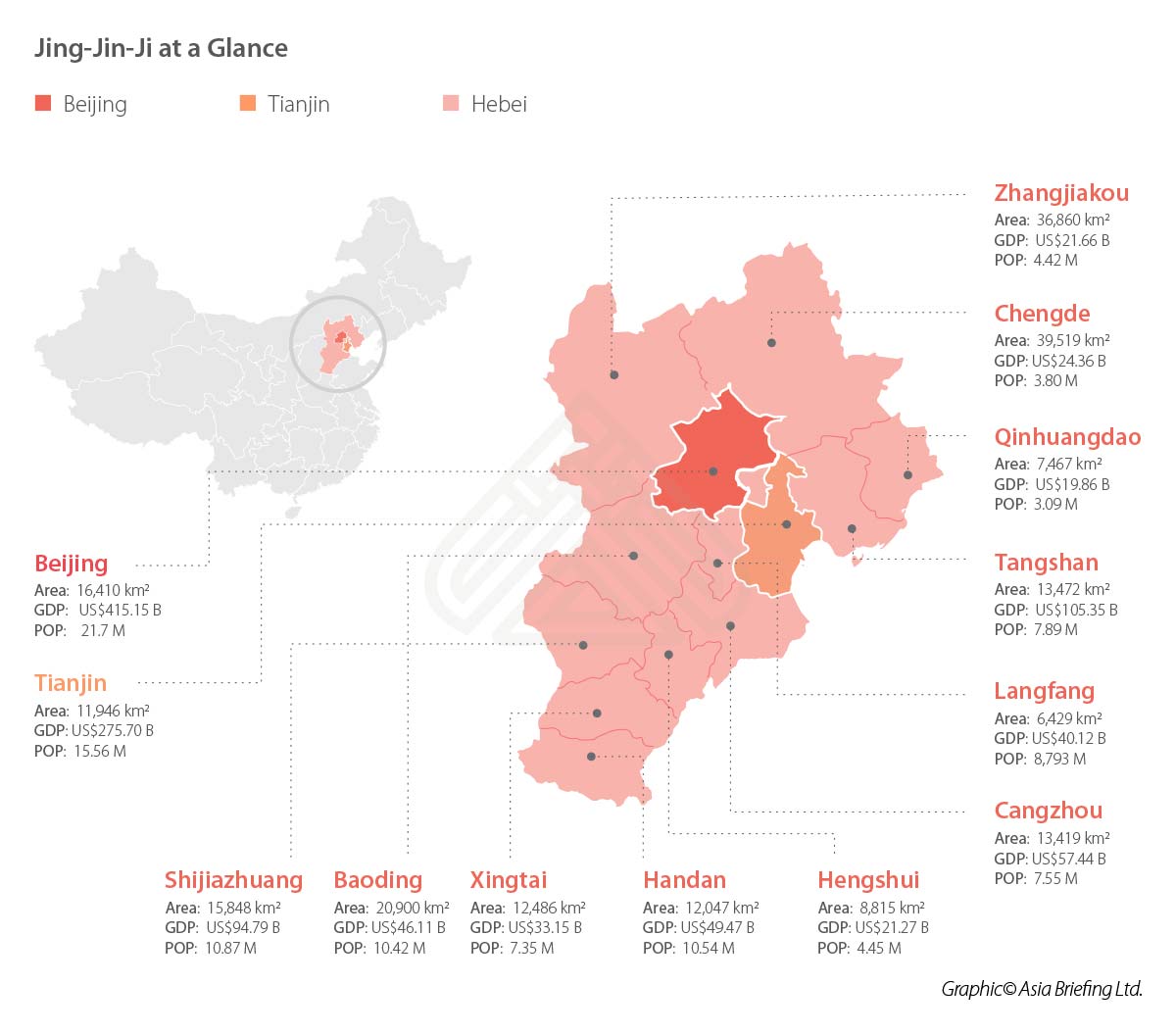

However, this is set to change, with the inclusion of Tianjin and Hebei province in a grand project that aims to create a world-class city cluster centered around Beijing. This project is known as the “Beijing-Tianjin-Hebei Integration Plan”, as well as “Jing-Jin-Ji” and the “capital economy circle”.

Beijing is one of China’s economic powerhouses, with a 2017 GDP of RMB 2.8 trillion (US$443.6 billion) and a population of over 21 million people. However, this pales in comparison to the wider Jing-Jin-Ji region.

Currently, Jing-Jin-Ji’s combined GDP accounts for approximately 10 percent of China’s total GDP and is made up over 100 million people – eight percent of China’s population and three times that of the Tokyo megalopolis. In addition to Beijing and Tianjin, there are 11 cities in Hebei province, with the whole region covering over 200,000 km2 – more than twice the size of South Korea.

This grand project has the full backing of the Chinese government and is one of several projects that will lead the way in China’s next stage of economic development.

Integration plans and opportunities

The National and Development Reform Commission (NDRC) first proposed the Jing-Jin-Ji project over 10 years ago, and it later appeared in the 12th Five Year Plan (2011-2015). In recent years, however, integration plans have been accelerating.

The Jing-Jin-Ji plan looks for different areas in the region to focus on their own comparative advantages so that duplication is avoided, areas complement each other, and synergies are maximized.

Areas within the Jing-Jin-Ji region already have their own strengths in specific areas. Beijing is known as a political, educational, cultural, and R&D center; Tianjin is known as northern China’s logistics center, with one of the busiest ports in the world; and Hebei province is known for its heavy industries, including steel production.

Economic rebalancing

However, the project will not be successful if the various cities are static and solely focus on their current strengths. The project will require resources within the region to be rebalanced more optimally, including from industries where there is overcapacity, and areas will need to become more dynamic by building upon and adapting their current strengths. This is also important more widely for China’s next stage of economic development – moving up the value chain.

Hebei province will be required to move away from heavy polluting industries by upgrading and modernizing its industrial base, while Tianjin attempts to become an R&D center for manufacturing and a pilot area for financial innovation and reform. The Tianjin Free Trade Zone (FTZ) will play an important role in assisting Tianjin with this, as an area that benefits from policy experimentation and looser restrictions.

Meanwhile, Beijing has already begun transferring some non-essential resources that do not enjoy a comparative advantage, including factories and wholesale markets, to Tianjin and Hebei.

The decision to transfer non-essential resources out of Beijing also looks to alleviate the “urban diseases” the city is facing, including congestion and air pollution. As part of this campaign, Beijing seeks to limit its permanent population to 23 million by 2020.

It is not just Beijing that is facing environmental problems – eight of China’s ten most polluted cities are in the region. Therefore, to make the whole region’s economic development more sustainable, Hebei province will become an important ecological protection area, with national and forest parks surrounding the capital.

![]() Business Intelligence from Dezan Shira & Associates

Business Intelligence from Dezan Shira & Associates

To this end, last year Chinese President Xi Jinping announced the creation of the Xiongan New Area. Xiongan is poised to become an innovative testing ground for pilot reforms and new technologies, like the Shenzhen Special Economic Zone and Shanghai’s Pudong New Area before it.

One of the roles of Xiongan, which is located about 100 km southwest of central Beijing, will be to act as an eco-friendly smart area. To work towards greater sustainability, the region has already coordinated its environmental management with the wider region, including with the Jing-Jin-Ji Plan for Prevention and Control of Air Pollution. China also recently announced that it aims for Xiongan to run on 100 percent renewable energy.

The project also strives to make economic development in the region more inclusive. Social and public services, including hospitals and education, will be developed outside of Beijing, in areas that are generally poorer than the capital city.

In the case of Hebei, these services will contribute to the province’s industrial upgrading and modernization. The Beijing municipal government will also transfer some government administrative buildings to Tongzhou, which will create more jobs outside of the capital. Both will help to ease Beijing of its “urban diseases” and further urbanize the areas around Beijing.

These new urban centers outside of Beijing will act as “urbanization demonstration areas”, offering opportunities for businesses that are able to offer innovative of improving social and public services, and ease urban transitions. Further to this, if the project is successful at rebalancing resources and integrating the region, then businesses should see the creation of bigger mass markets and an increase in demand due to higher incomes.

Infrastructure development

Physical infrastructure will play an important role in integrating the cluster, including for integrating supply chains and the labor market.

To reduce train travel times, nine additional intercity railway lines (spanning 1,100 km) will be built by 2020, which the National Development and Reform Commission (NDRC) estimates will require a total investment of RMB 247 billion (US$ 39.30 billion). By 2020, the region will consist of 9,500 km of railways and 9,000 km of expressways, which means that travel times between any of the major cities in the region will be under one hour by train and three hours by car. Furthermore, an additional 16 intercity railway lines will be added by 2050.

Travel within the region will also be made more efficient with the use of a single transport card that can be used on buses and metros across the Jing-Jin-Ji region.

In addition to rail and road infrastructure projects, the region will be further internationalized with the construction of the Daxing International Airport. The airport is currently being built next to Daxing district in Beijing and Langfang in Hebei province, and is expected to open in 2019. By 2050, it will be able to carry 120 million passengers per year.

![]() RELATED: China to Establish Hainan Free Trade Zone

RELATED: China to Establish Hainan Free Trade Zone

Integration challenges

A successful cluster requires not only a strong core city, such as Beijing, but also satellite cities to be economically strong and sufficiently integrated to support the whole cluster. However, this is currently not the case in Jing-Jin-Ji, and there are concerns that the region lacks the ability to achieve this in the future.

One of the concerns is that the disparity in resources and development between the areas is too great to overcome. This disparity is particularly prominent in Hebei province, which had a GDP per capita of only 36.4 percent of that of Beijing and 37.4 percent of Tianjin in 2016.

Hebei is also at a different stage of industrialization compared to Beijing and Tianjin. Hebei is known for its heavy and lower value adding industries, whilst Beijing and Tianjin are known for their light and higher value adding industries.

There are therefore questions about whether the cluster’s local supply chains can properly integrate with and complement each other. For example, car manufacturers in Beijing currently prefer to source parts from the Yangtze River Delta cluster rather than from Hebei province as Hebei relies too much on low-value production and lacks competitiveness with other more vibrant regions.

Moreover, some critics of the Jing-Jin-Ji project say that it is too centered on Beijing and that the city is merely dumping its problems onto its neighbors.

In response to this criticism, Beijing government representatives have stated that Hebei and Tianjin have benefited from technology transfers and industrial upgrading. In 2016, Beijing transferred technologies worth about RMB 15.4 billion (US$2.39 billion) to Hebei and Tianjin, an increase of 38.7 percent compared to the previous year.

Another concern with the Jing-Jin-Ji region is that it is not sufficiently internationalized and therefore not sufficiently integrated into global supply chains. This lack of internalization is apparent when the region is compared with other clusters in China, namely the Yangtze River Delta region around Shanghai and the Pearl River Delta area in South China.

In 2012, exports accounted for 15 per cent of the Jing-Jin-Ji area’s GDP, compared to 60 per cent in the Yangtze River Delta cluster and 63 per cent in the Pearl River Delta cluster.

![]() RELATED: How Beijing is Making Doing Business Easier

RELATED: How Beijing is Making Doing Business Easier

An ambitious project

The Jing-Jin-Ji integration project is clearly ambitious, and offers great potential with its promotion of sustainable and inclusive development and infrastructure investment.

However, the project also faces many challenges, which appear to be even greater than those faced by the more dynamic Yangtze River Delta and Pearl River Delta clusters.

If the ambitions and potential of this grand project are to be realized, then cooperation and skillful coordination by government actors will be required. This will be a challenge in itself, as there is a tradition of regional governments competing for projects and investment opportunities.

Although Jing-Jin-Ji must overcome its fair share of hurdles for successful integration, the plan presents interesting and novel opportunities for stimulating the North China region.

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article Hiring Staff in China: 8 Quick Tips for Managers

- Next Article China to Cut US$9.5 Billion in Taxes for Small and Micro Enterprises, High-tech Firms