What Are the Encouraged Industries in China’s Western Regions?

China has rolled out the latest Encouraged Catalogue for Western China after launching another round of its ‘Go West’ campaign, in a bid to lure investment into its vast western region. Lower corporate income tax rate can be enjoyed by eligible companies. The western region is also acquiring strategic importance as China seeks to enhance the construction of the Belt and Road and cement its position in global supply chains.

On January 26, 2021, the National Development and Reform Commission (NDRC) published the Catalogue for Encouraged Industries in the Western Regions (2020 Edition) (“Western Region Encouraged Catalogue”), to be implemented from March 1, 2021 and to replace the 2014 Edition.

Unlike the Encouraged Catalogue for Foreign Investment (FI Encouraged Catalogue), which only applies to foreign-invested enterprises (FIEs), the Western Region Encouraged Catalogue, in principle, is applicable to both domestic and FIEs in the western regions of China.

Eligible foreign and domestic companies registered in the western regions can enjoy a reduced corporate income tax (CIT) rate of 15 percent (China’s standard CIT rate is 25 percent). To enjoy this preferential CIT rate, the company’s main business must fit into the encouraged categories and its main business revenue must account for at least 60 percent of its total business. This preferential policy will last at least until the end of 2030, according to the Announcement about Continuing to Implement Preferential Corporate Income Tax Policies for Western Development.

Where are the western regions of China?

The western regions include 12 provinces – Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang, which cover more than 70 percent of the country’s land area and have nearly a third of its population. Some cities or regions in other provinces, such as Xiangxi of Hunan, Enshi of Hubei, Yanbian of Jilin, and Ganzhou of Jiangxi are also within the scope of the application of the Western Region Encouraged Catalogue.

What’s in the Western Region Encouraged Catalogue?

The Western Region Encouraged Catalogue is like a mother catalogue, consisting of:

- the encouraged industries as detailed in the existing national industrial catalogues, such as the Catalogue for Guiding Industry Restructuring and the Catalogue for Encouraged Industries for Foreign Investment; and

- a list of the newly added encouraged industries in China’s western regions, which is, it must be noted, applicable only to domestic companies.

FIEs should always implement their production or operations in accordance with the Encouraged Catalogue for Foreign Investment. You can access the full FI Encouraged Catalogue for nationwide here (in English), and FI Encouraged Catalogue for the western regions here (in English).

Here, we summarized the industries in each western province, that encouraging both domestic and foreign investment.

The revision of the Western Region Encouraged Catalogue indicates four general directions for the development of western regions, namely supporting the self-reliance of high-tech industries, undertaking the industrial transfer from the eastern regions, developing local advanced industries, and consolidating achievements in ecological environment protection and poverty alleviation.

The Go West campaign and Belt and Road Initiative

China’s ‘Go West’ strategy, which aims to narrow the economic gap between the less developed west and affluent east coast, kicked off at the beginning of the millennium. Ever since, local governments have initiated financial support, tax breaks, and other incentives to lure investment.

Entering its third decade, the ‘Go West’ campaign was reported having mixed results. The economy of the western region improves, but still lags far behind the eastern provinces. Foreign investment didn’t flood into the vast western China as Beijing wished.

Over the last two decades, the contribution to gross domestic product (GDP) from China’s 12 western provinces increased four percent to slightly above 20 percent. To compare, the east coast’s contribution remains well above 50 percent, according to government data.

Foreign direct investment (FDI) inflow to the western regions accounts for no more than seven percent of the total FDI inflow in China, while the FDI inflow of the eastern areas contribute nearly 85 percent.

Disadvantages in geographic connectivity and resource limits have a role in undermining the western region’s scope of development and scale of growth over the decades. Although local governments attempted to improve the situation, irrational industrial arrangement, investment promotion not linked to capacity, and homogeneity competitions between the western provinces left local governments burdened with debt, low efficient use of industrial land, and pollution problems.

Yet, the Go West plan is far from being snubbed by Beijing.

The strategic importance of China’s western provinces has increased after the One Belt and One Road Initiative (alternately, Belt and Road Initiative) was launched. Moreover, after the US-China trade war and geopolitical tensions followed by the COVID-19 pandemic, China has looked more seriously at connecting its western provinces with the Belt and Road Initiative (BRI) countries for cementing its position in global supply chains.

In May 2020, the State Council published the Guiding Opinions on Promoting the Development of the West in the New Era to Form a New Pattern, saying the development of the country’s western regions aligns with China’s goals on building up the BRI, tackling income disparities, forming a modernized industrial system, and protecting the nation’s ecosystem.

Beijing’s policy blueprint hopes to fit western regions into the BRI big picture – for example, Xinjiang should form a traffic hub for China to connect BRI countries in the west; Inner Mongolia should be involved in the construction of Mongolia-Russia Economic Corridor; Yunnan should have more cooperation with the Lancang-Mekong region.

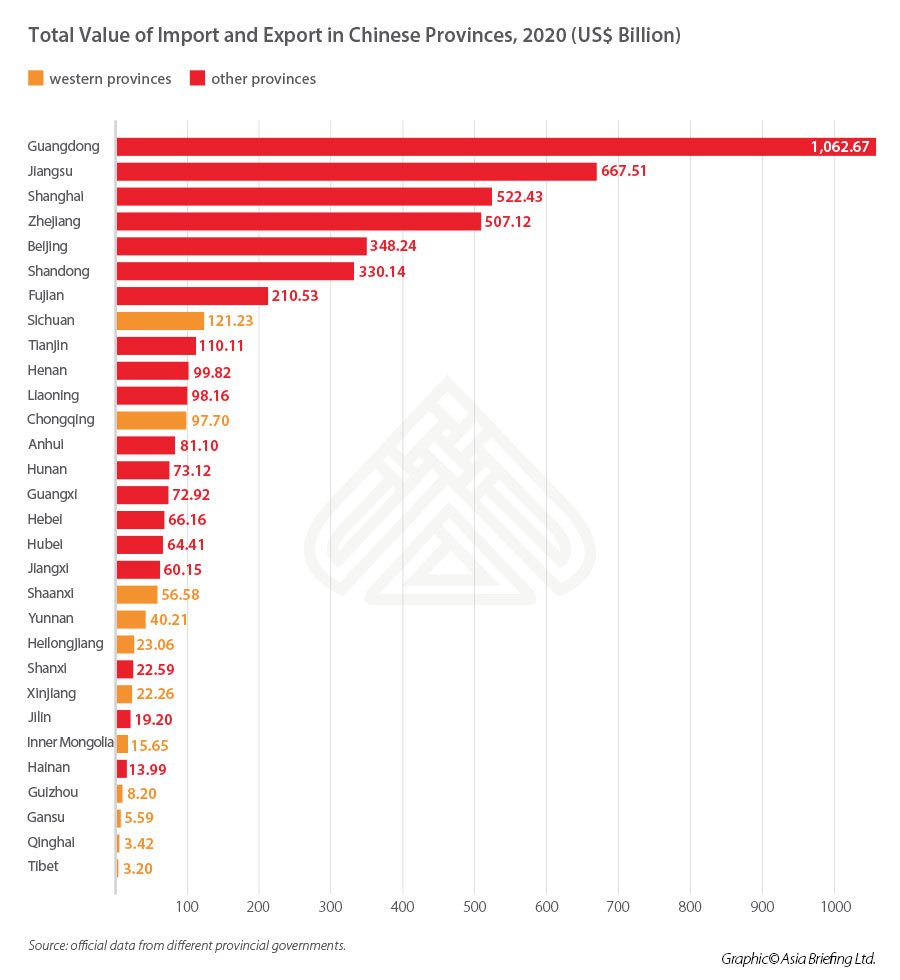

Some western regions are marked rise in foreign trade. According to official data, in 2020, coastal provinces Guangdong, Jiangsu, Shanghai, and Zhejiang remained the strongest in foreign trade, accounting for around sixty percent of the country’s total import and export. But the central and western regions of China also fared well, with import and export growing 11 percent, accounting for 17.5 percent of the country’s total – a 1.4 percentage points increase.

Some western provinces like Sichuan and Chongqing saw stable growth in exports – by more than 10 percent. Guizhou and Yunnan’s exports even jumped by 30 percent in 2020 as ASEAN replaced the US as China’s largest trading partner.

With the ongoing BRI development and the signing of the Regional Comprehensive Economic Partnership (RCEP) Agreement between China, ASEAN, Japan, South Korea, Australia, and New Zealand – China’s western regions aim to become more competitive with Vietnam and other Southeast Asian countries and be an alternative investment destination for foreign investors. So far, the region is improving its infrastructure, has lower labor costs, and is connected to China’s supply chain networks.

Dezan Shira & Associates has handled multiple foreign investments into western China over the years. We have offices in China, Vietnam, Singapore, and elsewhere in ASEAN and can therefore assist at both ends of the manufacturing supply chain. Please email us at china@dezshira.com for inquiries on how to proceed with market intelligence and obtaining qualification approval for obtaining CIT reductions related to investments in China’s Western Regions.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Enforces Antitrust Guidelines on its Online Economy

- Next Article Investing in China’s Greater Bay Area – New Issue of China Briefing Magazine