Pudong New Area Issues Fresh Guidelines for Growth and Investment

The Pudong New Area in eastern Shanghai recently issued a new set of guidelines widely seen as a blueprint for the area’s future growth and development. They contain suggestions for new policy incentives to attract foreign investment and identify industries for reform and development. Key policy incentives focus on innovation in high-tech industries, while other proposed measures look to revamp industries, such as finance and healthcare.

On July 15, 2021, the Communist Party of China’s Central Committee and the State Council released a new set of guidelines for reforming and spurring growth in the Shanghai Pudong New Area (hereinafter referred to as ‘Pudong’). Labelled a “pioneer area for socialist modernization” in China, Pudong continues to be a key zone for piloting new policies and initiatives to drive consumption, economic growth, and technological development.

The guidelines propose several measures, including new policies and reforms for attracting foreign investment to the area, making this already investor-friendly zone even more attractive to foreign companies, traders, and investors.

It is important to note that the guidelines do not provide specific measures for implementation or criteria for eligibility; rather, they outline provisions for future policy roll-out in order to meet the area’s development goals.

In this article, we provide an overview of the proposed incentives and industries for development and discuss what opportunities may arise from the continued promotion of this area.

Pioneering the next phase of development

The Pudong New Area has been a point of pride for both Shanghai and the whole of China for the three-plus decades of its existence. The 1,210 sq km area situated on the east bank of the Huangpu River is home to 5.57 million permanent residents, and has long served as a testbed for reforms and innovative policies that have seen the area become one of the most highly developed and vibrant in China.

Today, Pudong is home to over 350 foreign headquarters, including giants like DuPont and GlaxoSmithKline, as well as the first Tesla Gigafactory outside the US, and the Shanghai Disney Resort.

The latest guidelines come as part of a new phase of the area’s development. In November 2020, in a speech at the 30th anniversary celebration of the designation of Pudong as a national development zone, President Xi Jinping called on the Party Central Committee to “give the Pudong New Area major new tasks for reform and opening up” and urged Pudong to “strive to pioneer the building of a modernized socialist country”.

In the months following, Pudong set the gears in motion to fulfil this request. Experts have speculated that this move is a reaction to slowdowns in economic growth and headwinds from the US-China trade war, tasking Pudong with the difficult duty of implementing successful measures to revitalize growth and consumption, particularly in key high-end and high-tech areas.

Proposed policy incentives for investment in key industries

Reduced corporate income tax for high-tech sectors

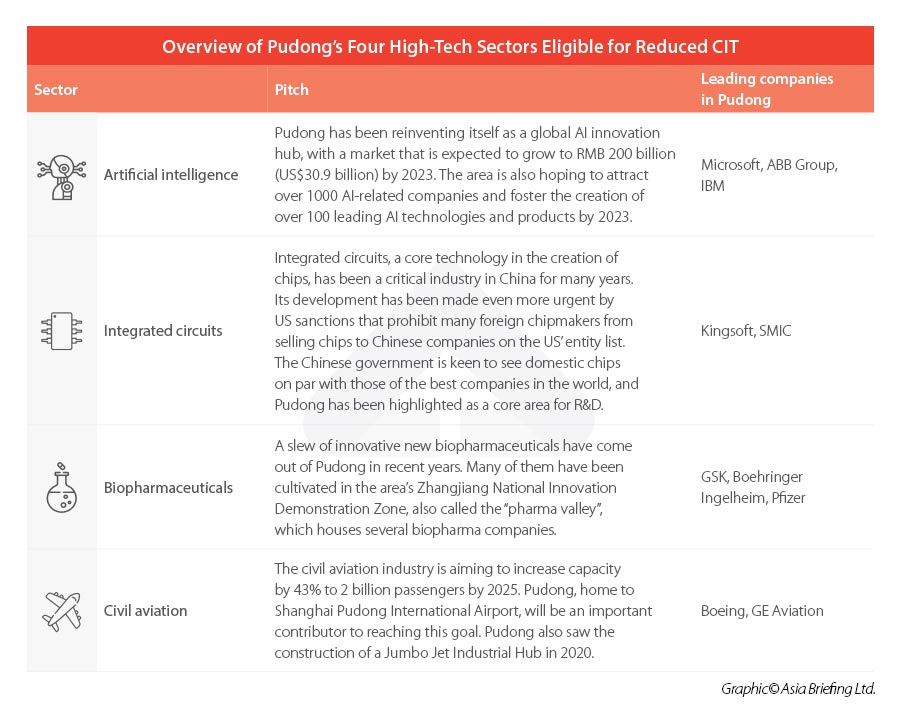

Pudong has become a core engine for sharpening China’s competitive edge in high-tech sectors, and Shanghai has singled out four key sectors for boosting innovation: artificial intelligence (AI), integrated circuits (IC), biopharmaceuticals, and civil aviation.

To this end, the guidelines propose an expansion of the 15 percent corporate income tax (CIT), down from the China-wide standard of 25 percent, for companies engaged in these four sectors in “specific areas” of Pudong. The reduced CIT would be in effect for five years from the date of the company’s registration in Pudong. The guidelines do not mention which areas of Pudong will enjoy the reduced CIT or specify exactly what criteria companies must meet to be eligible.

Investors who have followed policy developments in Pudong will know that this kind of incentive is not entirely new. China has long had a reduced 15 percent CIT for high-tech enterprises. However, this is a specific legal definition, which requires, among other things, for a company to have been established for at least three years, thereby excluding a large number of younger companies from enjoying the tax reduction.

To help stimulate development in the four key sectors (AI, IC, biopharmaceuticals, and civil aviation), in July 2020, the Shanghai Municipal Finance Bureau announced an expansion of the reduced 15 percent CIT in Pudong’s Lingang New Area (‘Lingang’) for companies engaged in these fields.

The new policy for Lingang waived the “high-tech enterprises” definition in favor of specific criteria for eligibility for companies engaged in these four key sectors, which include a detailed breakdown of eligible subfields, thereby expanding the scope of companies that could benefit from the reduced tax rate. The policy was implemented retroactively from January 1, 2020 and guaranteed the reduced 15 percent CIT for five years from the date of the company’s registration in the area.

The policy proposed in the new guidelines would expand this reduced CIT for companies engaged in these four sectors to other areas of Pudong and are likely to follow similar requirements to the existing tax policy in Lingang. However, it remains to be seen exactly which areas will benefit from the reduced CIT and whether the criteria for eligibility will differ.

In addition to the reduced CIT, the guidelines also outline areas for renewed development, specifically mentioning Zhangjiang Science City. A 79.9 sq km area, Zhangjiang Science City houses several industrial parks, many dedicated to high-end technology and medical industries. The guidelines urge for the development of R&D in the four core tech fields as well as other emerging industries, with proposals that include:

- Building new labs, engineering research centers, and clinical medical research centers.

- Promoting the establishment of a large-scale R&D and application platform for intelligent vehicles with open computing power.

Waived import-related taxes for medical R&D equipment

The Shanghai government is keen to bolster medical R&D in Pudong by implementing measures that make it easier for research institutes and laboratories to acquire the equipment they need.

To facilitate R&D in some of these key industries, the guidelines propose waiving import-related taxes (import value-added tax and import consumption tax, where applicable) for key laboratory consumables and equipment, as well as relaxing restrictions on certain research areas. The proposals include:

- Exploring the exemption of import-related taxes for drugs used for clinical research.

- Allowing qualified medical institutions to pilot self-developed in-vitro diagnostic reagents in accordance with relevant requirements.

- Exempting R&D institutes recognized by Pudong from paying import-related taxes on equipment for their own use.

Improving preferential policies for foreign talent

Another proposition for bolstering foreign investment in Pudong highlights measures to facilitate the employment of high-end global talent. The proposed measures include:

- Further studying the decentralization of assessment authorities for high-end talent engaged in investment work in Pudong.

- Loosening restrictions on the employment of foreign talent in professional fields and providing them with equal treatment to participate in market-oriented competitive industries.

- Establishing a certificate recognition system for international vocational qualifications.

- Assisting Pudong in the trial implementation of supporting policies for the entry and exit of foreign personnel during the China International Import Expo (CIIE).

Although no concrete policies have been issued yet, the guidelines suggest that Pudong may further relax restrictions on foreign talent, with a focus on highly skilled talent engaged in high-tech industries or areas where there are high-skilled labor shortages.

Potential new market opportunities

Opening up the financial system

The guidelines propose significant advances into the reforming of Pudong’s financial system, outlining landmark plans for opening up the market to foreign investors and traders.

One such proposal, which has gained a fair amount of attention, is the suggestion of creating an international financial asset trading platform in Pudong. This would allow foreign investors to use RMB to issue and trade shares on the Shanghai Stock Exchange Science and Technology Innovation Board (also known as the STAR Market) through the Qualified Foreign Institutional Investor (QFII) program.

Another landmark proposition is to research and explore the implementation of a pilot program for RMB foreign exchange futures trading under the China Foreign Exchange Trading System (CFETS). The guidelines also call for supporting Pudong to develop an offshore financial system for RMB transactions, cross-border trade settlement, and overseas financing services.

Under the guidelines, Pudong aims to improve the foreign debt management system and increase the number of foreign investors engaged in Shanghai’s bond market. The guidelines propose the implementation of pilot reforms that would simplify foreign debt registration in Pudong. They also propose accelerating the opening of the Chinese bond market, including the inter-bank and exchange bond markets, to further facilitate foreign investors’ participation in the Chinese bond market through the QFII program.

Taking steps to improving data market regulations

In tackling issues surrounding data regulation, brief mentions are made regarding the creation of a mechanism for data trading, including the creation of an “international data port” and a “data exchange”. The guidelines also call for the establishment of standardizing the definition of data ownership, data sharing, and data transactions, as well as data supervision and management.

Although more detailed guidelines are required before any concrete conclusions can be drawn from these proposals, this requirement potentially paves the way for a regulated data trading market and local data regulations, in line with ones we have seen in Shenzhen.

In intellectual property, the guidelines call for the creation of an IP protection system and stronger punitive measures for IP infringement. They also propose supporting universities and research institutes to establish specialized technology transfer institutions.

Boosting quality of life and revitalizing consumption

A significant portion of the guidelines is dedicated to exploring measures for improving the overall quality of life for residents in Pudong, while simultaneously boosting high-end consumption.

The guidelines stress the need to improve several key public services to achieve these goals, focusing on increasing the supply of:

- High-quality and internationalized education

- High-quality and internationalized healthcare

- Elderly care

- Cultural services

- Basic service facilities, such as parking lots with charging stations, public parks, and public activity spaces

The city is also keen to see Pudong become a driver in the consumption of high-quality goods and services, seeking to capitalize on Pudong’s position as a high-end manufacturing and shipping hub.

One idea proposed to promote this consumption upgrade is for Pudong to explore the possibility of relaxing restrictions on foreign investment in the telecom and healthcare service consumer markets, potentially opening the door for foreign investors to participate in the supply of these high-end services.

The guidelines also urge for an overall strengthening of medical infrastructure, calling for increasing investment in public emergency health facilities and strengthening systems and capacity for tackling emergency situations. This includes improving monitoring, warning, prevention, and control of epidemics, guaranteeing emergency supplies, improving capabilities to treat major diseases, and increasing scientific research on prevention, control, and treatment.

The guidelines also outline the need for building telemedicine and online diagnosis and treatment platforms, while promoting the sharing of medical resources, such as isolation wards.

Taking the lead in reform and opening up

The new guidelines can be seen as a continuation of Pudong’s legacy of pioneering reform and achieving breakneck growth through well-designed policy incentives.

The next phase of development, however, is likely to be a lot more difficult, as economic slowdowns and technological bottlenecks begin to take their toll. Pudong, despite its attractive investment landscape, does face fiercer competition today than it did 30 years ago, including from other cities in China.

The government is therefore likely to look to innovative new policies to spur growth and attract investment, trialing brand new reforms and opening new market areas that have previously been closed to foreign investors.

Pudong will continue to be an area to watch closely for new policy incentives and unrivaled opportunities for growth and innovation in China.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Launches Carbon Trading Market as Urgency to Cut Emissions Grows

- Next Article China Releases First Negative List for Cross-Border Services Trade in Hainan: See Translated Document