China’s Beer Market: Outlook and Opportunities

China’s beer market accounts for 12 percent of global sales. Beer enthusiasts across the country are now starting to experiment with new trends such as premium and craft products, presenting excellent new opportunities for foreign investors interested in entering the market. We look at the characteristics, evolution, and future projections of China’s beer market.

China has been the world’s largest beer market since 2002. China’s beer industry is also the fastest growing in the world, with total revenue projected to reach US$131.5 billion by the end of 2023. However, the market is facing some challenges, such as the overcapacity of beer mass production and decreasing domestic beer consumption. That said, the value of beer sales in the country continues to grow thanks to rising demand for premium and flavored beers, which foreign brands dominate. In this article, we overview China’s beer market and explore the potential opportunities for foreign investors.

China’s beer market overview

The Chinese beer market has developed at an unprecedented pace, mainly due to large amounts of foreign investment and an increase in average consumer expenditure led by the government’s economic reform programs. Over the past two decades, China has become the largest beer market in the world, overtaking the United States.

By the end of 2023, it is estimated that the revenue in the beer segment will amount to US$131.5 billion, and the market is expected to continue growing at a compound annual growth rate (CAGR) of 5.98 percent between 2023 and 2025.

Beer production in China

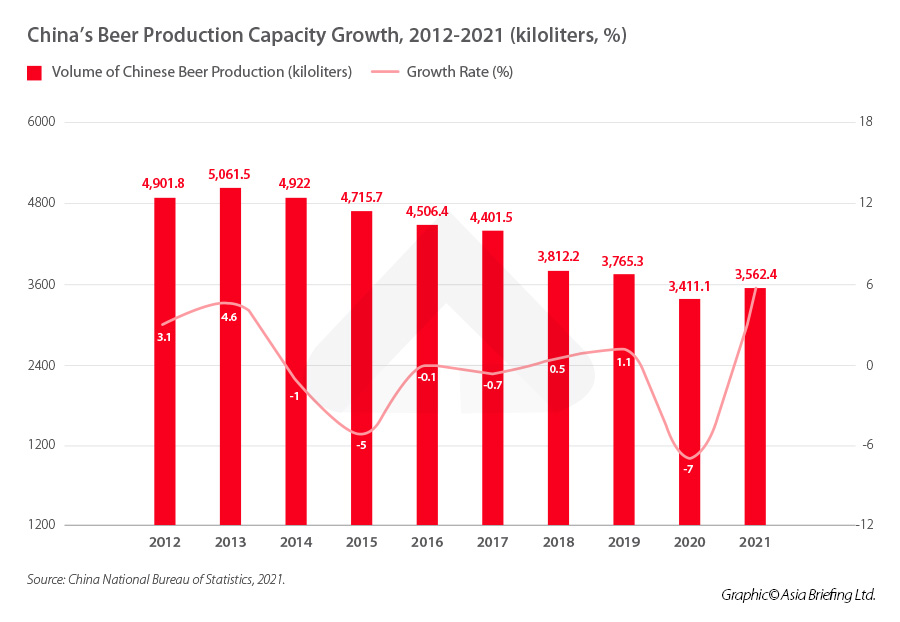

China’s beer industry has entered a new cycle characterized by more optimized product specialization and increased demand for medium and high-end products. After peaking in 2013, China’s beer production has been declining. However, in 2021, China’s beer production recorded 5.6 percent growth compared to the previous year, when the market was severely hit by the impact of the COVID-19 pandemic.

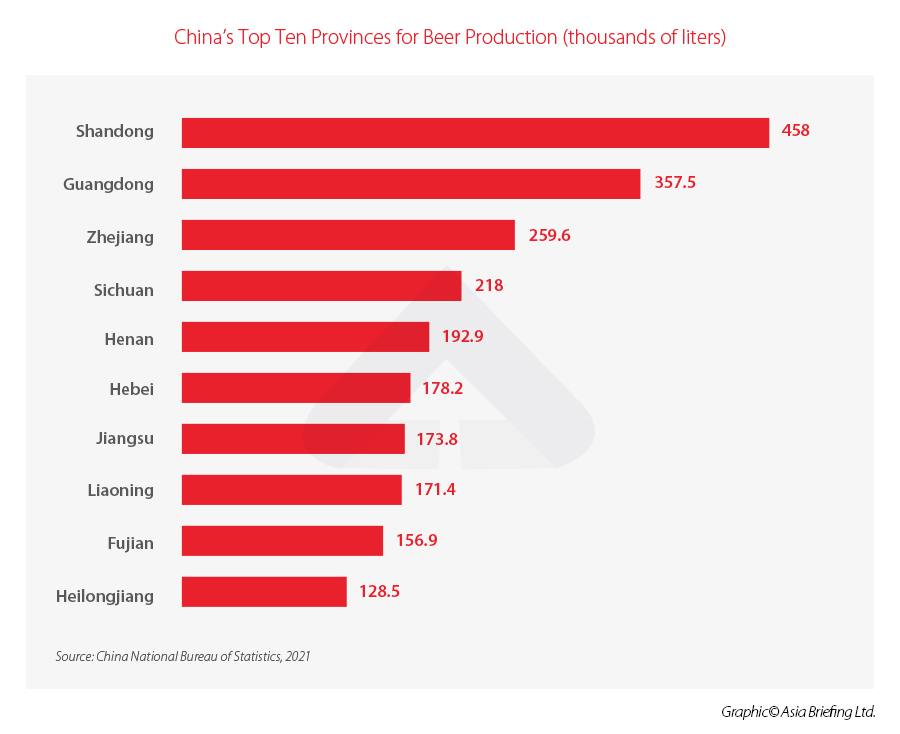

Except for Guangdong and Sichuan provinces, China’s beer production is currently mainly concentrated in the north and east, with less activity in the western regions. Thus, domestic beer production is highly influenced by regional characteristics, whereby the Bohai Economic Rim (BER), Yangtze River Delta (YRD), and Pearl River Delta Greater Bay Area (PRD) show relatively higher beer production.

Beer consumption in China

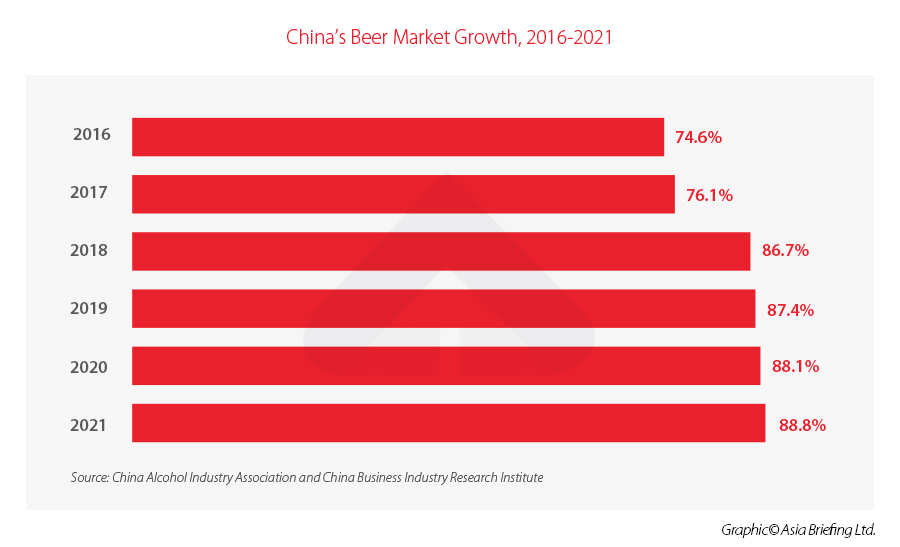

In 2021, China’s annual beer consumption (of both domestic and foreign brands) amounted to 45.7 billion liters. Meanwhile, imports have increased by volume and value by 11 percent and 13 percent year-on-year respectively. With more than 90 percent of the market made up of regional local beers, a notable segment for craft beers, premium brands, and foreign products has emerged. In terms of sales, foreign firms like Budweiser Asia Pacific and Carlsberg compete head-to-head with China’s largest breweries.

In China, people drink beer for various reasons. The most typical uses are solitary consumption, matching the drink with a meal or snack, and consuming in bars, restaurants, and at home. Even though most of these places had to close due to the COVID-19 outbreak, more beer was ordered online and consumed at home as a result of the widespread availability of alcohol on most e-commerce platforms.

China’s beer market consolidation and key players

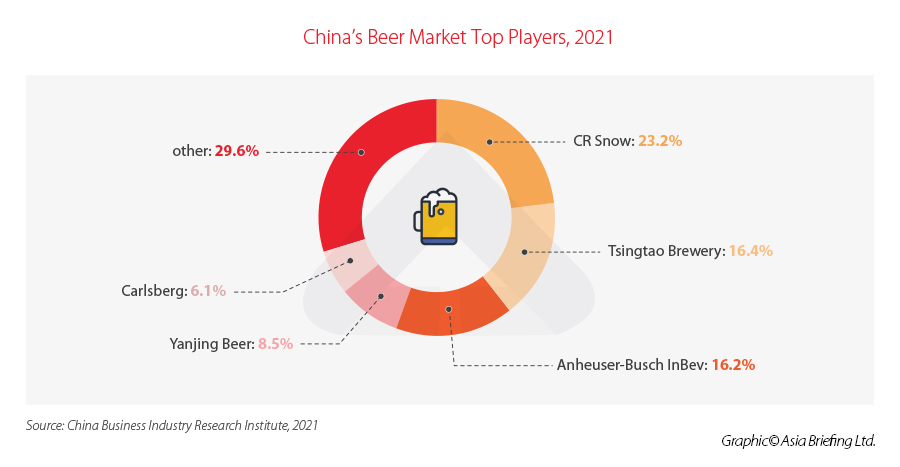

China’s beer market is highly consolidated. The five top businesses account for the bulk of sales volume and continue to hold a reasonably consistent share of the market. The Chinese beer industry is dominated by domestic companies (with a couple of exceptions for foreign brands who had an early entry in the market) making it challenging for international brands to join and take market share away from well-established competitors.

In 2021, CR Snow, Tsingtao Brewery, Anheuser-Busch InBev, Yanjing Beer, and Carlsberg were classified once again as the top players in China’s beer market. The combined market share of these five brands has reached more than 70 percent, with a relatively high industry concentration. Small and medium-sized brands carve up the remaining market share. Among the key players, CR Snow holds the largest market share (23.2 percent), followed by Tsingtao Brewery (16.4 percent), Budweiser Asia Pacific (16.2 percent), Yanjing Beer (8.5 percent), and Carlsberg (6.1 percent).

Domestic beer brands in China can benefit from superior base markets, geographically distinct branding, and better local consumer loyalty. For instance, CR Beer Snow clearly outsells its competition in Sichuan, the northeast, and eastern China, while Tsingtao Beer is the preferred choice in provinces such as Shandong and Shaanxi. Successful foreign brands have had to rely on international endorsements and effective marketing.

Budweiser and Carlsberg have both built a solid brand reputation and loyal consumer base by engaging in activities such as the promotion of important music festivals in China. In addition, these two brands gained an edge by entering the market between 2010 and 2012 – that is, significantly earlier than domestic companies that only started debuting a series of high-end beers in 2015. This is mainly because the Chinese beer industry has been progressively shifting towards a higher-end segmentation.

Major trends in China’s beer industry

A taste for craft beer

In recent years, the sales of high-end products have increased significantly. The implementation of this “high-end strategy” and improvement of product quality will likely become the new ground for competition between beer companies. Craft beer production, for instance, began in China in the late 2000s against a backdrop of increased competition and shifting customer tastes. As regional brewers experimented with crafting beer, microbreweries sprang up across the nation. Rapid urbanization also brought about a shift in lifestyle, particularly among the younger population, and made it possible for people to purchase specialty beers. By 2025, it is predicted that 50 percent of all beer drunk in China and 72 percent of all beer spending will occur outside the house, such as at bars and restaurants. Additionally, Chinese consumers have started to choose premium beer over mass-produced, less expensive options.

E-commerce as a key distribution channel

Between 2020 and 2022, businesses had to rely more on e-commerce for product distribution due to the unpredictability of lockdowns and social distancing measures implemented during the COVID-19 pandemic. On the Tmall platform, beer sales income and volume rose by 48.2 percent and 42.5 percent in 2020 respectively year-on-year, while the average online price of beer climbed by four percent over the same period.

Flourishing themed bars

Beer-themed taverns and bars have been flourishing. The total revenue of the domestic tavern industry rose at a CAGR of 8.7 percent between 2015 and 2019 and is expected to reach 18.8 percent by 2025. Although the number of bars continues to increase, the penetration rate and concentration are still low, indicating that the entry threshold of the industry is low, which will lead to fierce market competition. By creating a good atmosphere for consumers and providing high-quality and relatively affordable beers, taverns can further attract the interest of consumers and enhance the competitiveness of their own brands.

Sustainability and carbon neutrality

As new and cleaner technologies have continued to emerge and even subvert the entire industry in recent years, more and more consumer brands are joining forces to achieve carbon neutrality. By optimizing packaging and increasing the use of renewable energy in production, they convey the brand’s commitment to sustainable development to consumers. From the perspective of beer product packaging, for example, optimizing packaging is the first step to promoting recycling, which requires the active participation of production enterprises.

Future challenges and opportunities for foreign investors

By 2026, the China beer market is expected to reach US$151 billion, growing at a CAGR of 5.07 percent. The industry is likely to continue its growth as a result of factors like increasing barley imports, China’s cheap average retail price (ARP) for beer, rising beer consumption among millennials, and fast-paced urbanization. However, the long-term health concerns of excessive beer drinking, the damaging effects of beer manufacturing on the environment, and strict government controls are possible challenges that the market expansion may have to face during future expansion.

Nevertheless, some noteworthy positive trends will emerge, including growing consumer preferences for craft beers, a boom in online beer sales, a growing taste for premium beers, and an increase in the consumption of non-alcoholic beers. Moreover, the return to pre-pandemic travel and international exchange is likely to stimulate a growing appetite for imported goods, which has already emerged in a growing preference for imported beers in China.

Chinese customers are eager to treat themselves to pricier international beer brands over local ones, in their choice of quality over quantity. As such, premium beer consumption will continue to grow in popularity, contributing to the expansion of the beer industry. Precisely due to this increased propensity of young consumers toward premiumization, foreign brands are advised to focus more on the midmarket and premium segments.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article 5 Key Industries to Watch in China in 2023

- Next Article Key Considerations for Foreign Equity Investment in China