China’s Coffee Market: Production, Consumption, and Investor Prospects

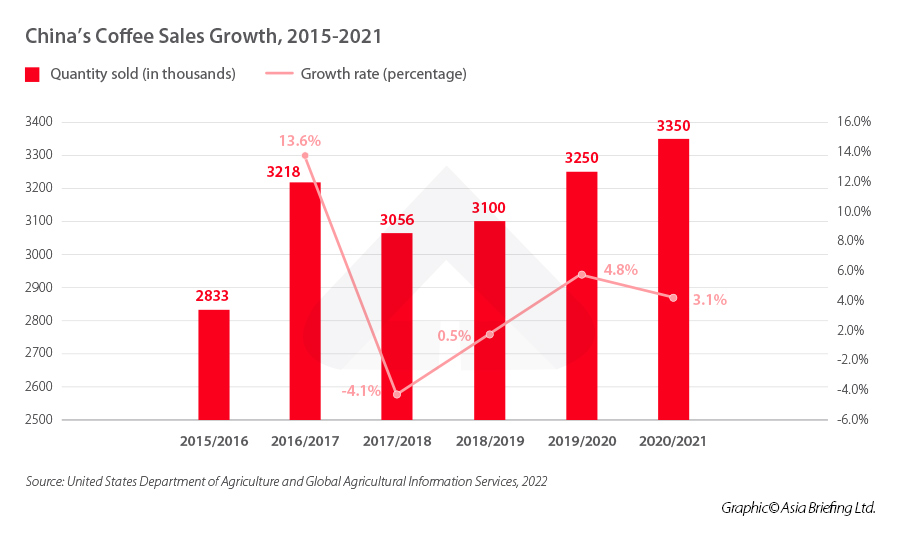

Although China is not the biggest coffee market worldwide, the demand for coffee products and year-on-year sales continue to increase.

Coffee reportedly made its initial appearance in China when a French missionary planted coffee beans throughout Yunnan Province in the 1890s. The drink would go largely unnoticed for the following hundred years. However, as with many things in China, over the past 20 years, the market has undergone a rapid change. In 2021, China’s coffee market grew by 31 percent over the previous year and is projected to increase at a compound annual growth rate (CAGR) of 9.63 percent between 2022 and 2025.

As the country is quickly turning into one of the fastest-growing coffee markets worldwide, we explore the industry development, key trends, and opportunities.

China’s coffee market overview

As the population of Chinese coffee consumers continues to grow, in 2022, the coffee segment will generate US$15.34 billion in revenue. The average volume of coffee consumed per person will reach 0.07kg in 2022.

The market was among the least affected by the COVID-19 pandemic – cities like Chengdu saw an average of one new coffee shop open each day in 2020. As a result, the number of coffee shops continues to increase nationwide, especially in first- and second-tier cities. Additionally, because of the epidemic prevention and control measures during 2020-2022, more Chinese customers are drinking coffee at home, which has led to an even bigger increase in instant coffee sales.

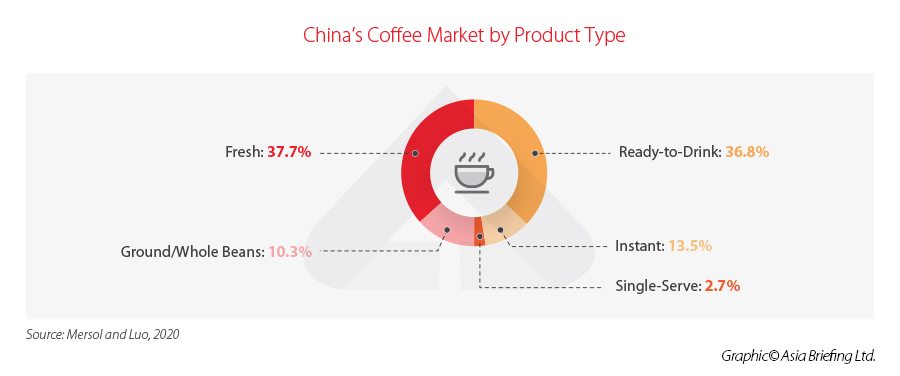

Like other countries, China’s coffee market can be divided based on the product category and distribution channel.

Fresh coffee, single-serve, ground or whole beans coffee, ready-to-drink (RTD), and instant coffee are some of the several product categories that make up the Chinese coffee market.

The products are distributed through on-trade and off-trade channels. These include supermarkets, convenience stores, specialty shops, and online retail stores.

A survey jointly issued by e-commerce major Alibaba Group Holding and takeout platform Ele.me, revealed that the number of people in China purchasing coffee online increased by 1.5 times since 2019.

Chinese customers favor consuming coffee in a portable, easy-to-drink style while on the go. Nearly all coffee consumed in China – until Starbucks entered the Chinese market in 1999 – was of the instant or ready-to-drink (RTD) type. As of the end of 2021, fresh coffee comes in second place (36.7 percent) among the preferred types of coffee products on the market, despite the continued Chinese preference for RTD coffee (36.8 percent).

Government policies stimulating the growth of China’s coffee market

The Chinese government has rolled out a series of initiatives to promote China’s coffee market.

Nationwide, coffee cultivation and coffee beverage R&D and production are encouraged sectors for foreign investment, according to the Catalogue of Encouraged Industries for Foreign Investment, the latest of which was released in October 2022.

Local governments are also encouraging the development of the coffee industry. One notable example is the I-coffee Exposition in Haikou (Hainan province), funded by the Chinese government in an effort to advance both domestic and international coffee commerce and Chinese coffee culture. The production, trade, and consumption of coffee are the main topics of the Exposition.

Looking at the production side, in August 2022, several departments from Yunnan’s local government issued Measures for Promoting the Improvement of the Rate of Fine Coffee Products and the Rate of Deep Processing (Measures). The goal is to increase the production rate of high-quality beans in the region by 30 percent and the rate of intensive and deep processing of coffee by 80 percent – within the next two years – as part of efforts to transform Yunnan into an important area for high-quality global coffee production. The Measures include:

- Delineating suitable areas for coffee plantations;

- Introducing new high-quality coffee varieties;

- Upgrading coffee planting criteria according to area suitability;

- Improving “green” approaches to coffee cultivation; and

- Devolving financing and subsidies for coffee plantations.

Coffee consumption in China

In terms of consumption, compared to more developed markets in Europe and the US, the Chinese coffee market is still in its infancy – which means there is a lot of space for expansion. While the international growth rate of coffee consumption is two percent, coffee consumption rates in China are growing 30 percent each year.

Consumption patterns

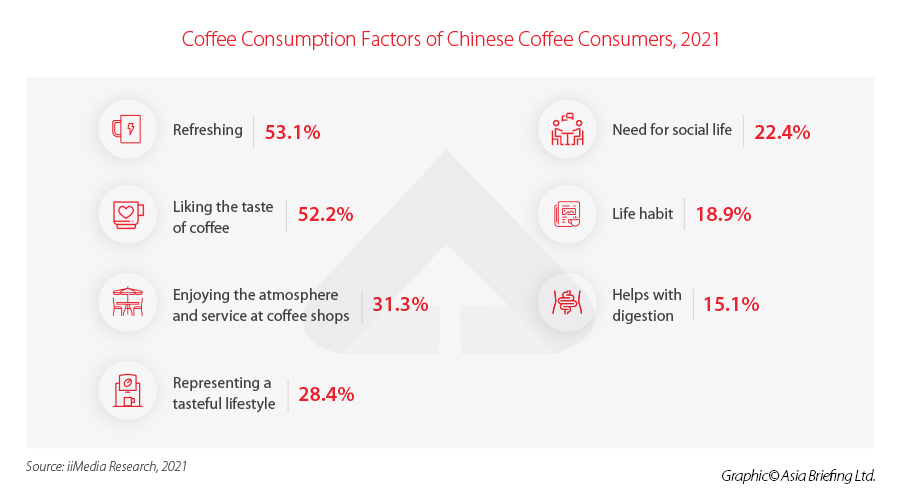

Below are the main reasons why Chinese consumers drink coffee:

- Need for refreshing with a cup of coffee (53.1 percent);

- Liking the taste of coffee (53.2 percent); and

- Enjoying the atmosphere and service of coffee shops (31.3 percent).

Data shows that the single consumption range of Chinese consumers in coffee shops is concentrated at RMB10-40 (US$1.43-5.72), and the single consumption price range of bottled coffee consumers is concentrated at RMB 4-15 (US$0.75-2.15). Recent data shows that coffee consumers are pursuing the quality of the product while the single consumption price falls in the middle price range, indicating that customers prefer to buy cost-effective coffee products.

Chinese coffee consumer profile

China stands out among major economies because it lacks a vibrant local coffee culture. Even in Japan, a country long recognized for its tea culture, drinking coffee is widespread, especially in major cities. Nevertheless, coffee habits have picked up quickly, especially among younger consumers.

Much like how each successive generation in China differs significantly from the previous, so do their coffee consumption and preference.

Coffee is typically seen as a novelty and distinct from the traditional Chinese lifestyle by older users (60+ years old). They generally do not go looking for it themselves; however, they could enjoy it with family or give it as a present.

In major cities, middle-aged consumers (40–59) have embraced coffee as a social experience rather than a product. This group also perceives coffee as a commodity, a need for doing business, and a status symbol. In the latter case, buying coffee regularly—especially from well-known brands like Starbucks—is a sign of having achieved financial success because it is costlier compared to local alternatives and reflects above-average earning capacity.

In varying degrees, millennial and Gen Z customers (people under 40) are considered “native” coffee drinkers. Their upbringing coincided with the entry of the most famous coffee companies into China, whose influence has become widespread over the past 20 years. Many in this category of Chinese consumers share similar characteristics with coffee drinkers in mature coffee markets.

Key players in China’s coffee market

The Chinese coffee market is fiercely competitive, with both domestic and foreign businesses emerging as top players. The market concentration is relatively low, and significant new brands have popped up in the past decade. Still, some brands are substantially more successful than others in their respective categories – instant or ready-to-drink coffee, freshly grounded coffee, and specialty coffee. Top players (both foreign and Chinese) in these categories are summarized in the table below:

| Top Players in China’s Coffee Market | |||

| Product category | Market share | Brand name | Distribution channel |

| Instant coffee | 75% | Nestlé (50%)

Maxwell (30%) |

Supermarkets, convenience stores, e-commerce |

| Ready-to-drink coffee (RTD) | 10% | Nestlé (70%)

Yaha (10%) |

Supermarkets, convenience stores, vending machines |

| Fresh ground coffee | 15% | Starbucks (50%)

Shangdao Coffee (16%) Mc Cafe (12%) |

Independent coffee shops |

| Specialty coffee | Greybox, Seesaw, etc. | Independent coffee shops | |

| Source: Gafei.com | |||

Foreign players

Market leaders in the freshly brewed coffee space enjoy widespread brand recognition among millennial customers. Starbucks Coffee Company, Nestle SA, and Luigi Lavazza SPA are three major industry leaders – all of them foreign brands.

In 1999, Starbucks entered the Chinese market, opening its first location in Beijing’s China World Trade Center. More than 20 years later, Starbucks dominates the Chinese coffee industry with 80 percent of the market share. In December 2019, the company had over 4,000 locations spread across 200 cities; its goal is to reach 6,000 by the end of 2022. The reason behind the American company’s enormous success lies in a combination of a premium experience, adapting menu offerings to local taste, and an exclusive social environment. These elements captured the attention of younger consumers and the newly emerging Chinese middle class, who wanted to pursue a contemporary lifestyle combined with upscale surroundings.

In 2019, Starbucks and Nestlé announced a new premium coffee experience for Chinese consumers with the introduction of two new business solutions on their online platforms – packaged coffee and single-serve capsule systems. Their alliance saw the roll-out of 21 new products, including whole bean roast and ground packaged coffees, as well as the first line of Starbucks coffee capsules. The two companies formally joined forces in 2018 under the Global Coffee Alliance.

Italian coffee is well-known across the world, and China is no exception. Lavazza is among the top three players in the market, and in April 2020, the Italian coffee manufacturer launched a joint venture with Yum China. After launching its first flagship store outside of Italy in Shanghai, Lavazza has swiftly gained popularity with Chinese customers thanks to its excellent Italian coffee, cutting-edge cuisine, and the appeal of the Italian cultural ambiance. By focusing on the growing Chinese market for coffee, Lavazza sped up the launch of new stores and has opened over 20 locations across the country as of 2022.

Chinese players

In recent years, the term “Chinese style” has grown to encompass a wide range of items, beyond simply those with traditional Chinese cultural components, and is associated with many aspects of contemporary Chinese lifestyle – including coffee habits.

Chinese coffee firms have a sizable market in their backyard. However, they face stiff competition from international players. Comparatively speaking, domestic brands are rapidly growing having improved their product quality and marketing strategies. Still, as of 2022, their market concentration is relatively low, with many emerging brands and a few top competitors. The two largest brands in quick coffee pick-up and delivery are Luckin Coffee and Coffee Box. In terms of market positioning, Pacific Coffee is a sit-down café similar to Starbucks. Specialty, high-end coffee is the main focus of Fisheye Cafe and Greybox Coffee. Newly established and successful cases include Manner and Seesaw coffee.

Luckin Coffee, a technology-driven coffee company, first entered the China coffee industry in 2018 and quickly rose to prominence. By the end of March 2019, it operated more than 2,300 outlets in 13 cities. Its utilization of a centralized technological system to gauge consumer demand and boost productivity helps it remain competitive.

Coffee Box was first developed in 2014 as a coffee delivery software for international companies like Starbucks and Costa Coffee. The business launched its own brand, Coffee Box, in 2016, drawing on insights from the information it acquired on consumer preferences and demographics. In order to provide coffee deliveries to consumers, Coffee Box establishes small coffee shops, or “stations,” with only two baristas and a number of delivery workers in a single shop. The majority of its orders come from well-known social media sites like WeChat or meal delivery applications like Meituan.

Pacific Coffee, the renowned brand for retail coffee shops, opened its first location in Hong Kong in 1992. Before selling an 80 percent ownership to the state-owned China Resources Enterprise, it developed into a well-known brand in Hong Kong. In 2011, it formally entered the mainland Chinese market. Since then, the company has also expanded to other countries, including Singapore and Malaysia, with the ambitious objective of building 1,000 locations on the mainland.

In 2015, Manner Coffee was a solitary roadside stand with queues that extended onto a busy Shanghai Street. In an interview for a coffee blog, the company’s creator, Han Yulong, a former veterinarian, and coffee aficionado, stated, “We didn’t suddenly become ‘hot’ as everyone believes.” In order to stand apart, Manner focused on a younger audience. It rose to fame for its smooth flat whites, stylish interior decor, and pricing that were 30 percent to 40 percent less than those of Western franchises. Additionally, environmentally friendly, customers could get coffee for just RMB 10 (US$1.50) if they provided their own cups. Following a US$12 million investment from Today Capital, Manner started its national expansion in 2019. It opened new locations in Suzhou, Beijing, Chengdu, Xiamen, and Shenzhen, to name a few, becoming one of China’s most recognizable brands.

Another local brand that grew its success in recent years is Seesaw Coffee. After its debut in 2012, today the business identifies itself as the biggest consumer of specialty-grade coffees originating in Yunnan province. The Chinese specialty coffee roaster and retailer just recently received an RMB 100 million (about US$15.4 million) investment from boutique tea chain HeyTea and its shareholders, which will allow the brand to expand even further.

Other emerging brands

As a result of China’s coffee market expansion, several new players have emerged.

In 2019, Saturnbird Coffee won first place in sales of the “double eleven” and “double twelve” in the Tmall coffee categories. Founded in 2015, Saturnbird Coffee takes its name from creator Wu Jun’s notion of a “coffee lifestyle” that includes three meals per day plus a half-meal of spiritual food. The brand’s “super-instant little can of coffee” revives the flavor of freshly ground coffee. It emphasizes its 3-second dissolution in ice, hot water, and milk. The online channel performance of Saturnbird Coffee was outstanding, and in 2019, the brand debuted its first offline location in the city of Changsha, its home base, and then started to open elsewhere. So far, it has collaborated with the Swedish oat plant protein company OATLY, and the Korean coffee brand FRITZ COFFEE, among others.

Another good brand that has been growing at an impressive speed is Yongpu Coffee, founded in 2014 by Hou Yongpu. Its signature item is cold-extracted coffee liquor, which debuted in 2018. Since its establishment, the company has collaborated with over 300 brands of coffee products, including Netease Cloud Music, First Financial Commercial Data Center, Interface News, TYAKASHA, Wanda, Shanghai Translation Publishing House, and New Weekly. Thanks to this collaborative strategy, Yongpu has been able to establish a solid name for itself in the Chinese market and created an independent fanbase.

China’s coffee supply chain

Confronted with growing demand and a change in people’s habits, coffee has become increasingly popular in China’s beverage market, and the country has been importing coffee beans from a variety of places, mostly Southeast Asia. China’s coffee imports increased 144 percent in 2021 to US$1.12 billion, with Malaysia, Vietnam, Japan, Guatemala, and Colombia being the top five suppliers, accounting for 57 percent of total Chinese coffee imports.

| Chinese Coffee Import Suppliers (in million US$) | ||||

| Country | 2018 | 2019 | 2020 | 2021 |

| Malaysia | 130 | 156 | 180 | 188 |

| Vietnam | 174 | 122 | 138 | 167 |

| Japan | 17 | 30 | 68 | 106 |

| Guatemala | 24 | 17 | 33 | 99 |

| Colombia | 37 | 34 | 44 | 87 |

| Brazil | 30 | 36 | 40 | 83 |

| Ethiopia | 21 | 28 | 31 | 81 |

| Italy | 36 | 42 | 49 | 49 |

| Switzerland | 14 | 19 | 33 | 33 |

| Indonesia | 27 | 26 | 29 | 30 |

| Australia | 3 | 0.97 | 2 | 16 |

| Source: GACC, 2022 | ||||

Meanwhile, China has also become an exporter of coffee. In June of the coffee harvest year 2021/22, China produced almost two million 60-kilogram bags of coffee, up from 1.8 million from the previous year.

Until a couple of decades ago, most Chinese-produced coffees were considered of poorer quality and more affordable, and it was exported globally mostly through Starbucks and Nestlé. Since then, smaller Chinese coffee farms have enhanced the quality of their products, and have started to become more sustainable. Although tea may be the first beverage that comes to mind when you think of China, the Pu’er area of Yunnan province has quietly earned a reputation for producing some of the greatest coffee in the whole of Asia. Since the 1990s, major companies like Nestlé have utilized Yunnan coffee.

Currently, China’s southwest province of Yunnan produces over 100,000 tons of coffee annually, accounting for 95 percent of all the locally-produced coffee consumed in the mainland – the remaining 5 percent of which comes from the Hainan and Fujian provinces.

The majority of Yunnanese coffee is exported to Germany and Japan. A few years ago, however, Starbucks began selling coffee beverages made with Yunnanese coffee beans in its Chinese stores. Steadily, Yunnan coffee is becoming known in the specialty coffee sector, because of its distinctive flavor and the region’s cautious efforts to expand production.

The demand for coffee in second and third-tier cities is the cause behind the expansion in domestic coffee consumption, bringing China’s coffee imports to 4 million 60-kilogram bags of soluble coffee between 2021 and 2022. The total amount of coffee (roasted, green, and soluble coffee) products imported into China between 2020 and 2021 was over 3.8 million 60-Kg bags, a nearly 30 percent increase over the previous year.

Main retail channels

Buying an experience: the high attractiveness of coffee shops

As of 2020, China counted over 108,000 retail coffee shops, with first- and second-tier cities housing 75 percent of them. With about 75 million customers reached in March 2021, the Chinese brand Luckin Coffee overtook Starbucks as the leading coffee retailer in the country. Rewards and promotional activities used in Luckin’s strategy were crucial in raising consumer awareness around coffee culture. Moreover, with the success of brands such as Family Mart Coffee, 7/11 Coffee, Convenience Bee Coffee, and KFC Coffee (K-Coffee), purchasing coffee from local convenience stores has become a new habit.

According to industry sources, coffee retail will increase by 5 percent over the next few years, reaching more than 120,000 stores by 2023. Notably, over 95 percent of such coffee shops are located in major cities.

With one of the highest densities of coffee shops (nearly 8,000) in China, Shanghai earned the nickname “Coffee City” in 2021, and is now considered one of the coffee capitals of the world. Foreign companies now make up nearly 65 percent of the city’s retail coffee outlets, including Hokkaido Letao Café, Japan’s Arabica, Canada’s Tim Hortons, and Italy’s Illy brands. In March 2022, Nestlé opened its first retail location for Blue Bottle Coffee in Shanghai.

Online retailing: the rise of mini-programs

China’s growing coffee culture undoubtedly drew many investors who staked their money on cafes and coffee chains, but the country also saw a boom in online coffee sales. A total of 312 million EUR (US$310 million) worth of coffee-based items were purchased in 2019 by over 18 billion people on the Alibaba-run Taobao and Tmall e-commerce platforms, representing an 18 percent increase over the prior year.

This is not surprising, since the incredible success of online retailing in China, where the impressively large base of smartphone users is parallel to the expansion of mobile applications (apps), including those for shopping. Moreover, the vast majority of online consumers are composed of a population aged between 26 and 30 (25.3 percent), and 31 and 40 (33.3 percent). Given that, by 2020, 49 percent of Chinese coffee consumers were between the ages of 26 and 35, this may help to explain why many coffee firms have made significant investments in their social media and internet platform presence. It is the case, for example, of the Chinese domestic brand Luckin Coffee, which debuted on the market in 2017 by offering coffee cups for sale and cup recycling on its online platform.

As of September 2020, daily service mini-programs – built-in systems which allow users to access several services without having to leave the main app – offered on the Chinese social media app WeChat accounted for around 733 million monthly active users in China, reflecting an annual growth rate of 36.5 percent. Consequently, several coffee brands have also developed their own mini-program on the platform. In fact, WeChat mini-programs can really function as mini-commerce since they combine social media and e-commerce platforms to provide shoppers with an alternative to traditional marketplaces and e-commerce. Social commerce is a trend that is quickly gaining traction in China and mostly draws the attention of young people who are eager to engage in more engaging buying experiences.

Other evolving trends in China’s coffee market

Increasing consumption of instant coffee

Due to its ease, the instant coffee category enjoys a substantial share of the Chinese coffee market. Additionally, middle-class consumers’ adoption of foreign cultural norms, changing lifestyles, and growing family expenses have contributed to the country’s expanding demand for instant coffee.

Manufacturers of instant coffee have introduced a number of flavored products in response to consumers’ growing preference for coffee over other beverages in an effort to reach a wider market. For the past few years, China’s online retailing has primarily served as a minor distribution channel for instant coffee.

Industry innovation and market digitalization

In the current digital era, the growth of businesses is increasingly dependent on technology. A major development trend in the Chinese coffee industry is to further enhance the core competitiveness of coffee brands and expand market share based on digital operations. Through digital transformation, coffee companies have acquired more advanced digital operation capabilities, thereby improving management and execution efficiency.

To deal with a highly competitive landscape, active businesses are introducing innovation in packaging and product offerings to meet the rising demand for coffee among customers to maintain their positions in the market. For online marketing and branding of their products to draw in more customers, major businesses are now concentrating on social media platforms and online distribution methods. Due to a sharp increase in coffee consumption, both international and domestic producers are investing in enlarging their facilities throughout China.

Sustainability and the rise of conscious consumption

Coffee consumption in China has been rising consistently and will undoubtedly continue to do so. Conscious consumption means buying and consuming only coffee that has been responsibly obtained from producers who have treated the environment with respect and paid their workers a fair salary. This can be considered another emerging trend in China’s coffee market. Some ethically-sourced coffee brands on the rise include Hani Coffee, Torch Coffee, Manlao River Coffee, Arabica Roaster, and Gorilla Coffee.

Initiatives to make the coffee market more sustainable can be seen in Yunnan province, which had more than 4,600 hectares of organic coffee fields with more shade trees to increase soil quality and water retention in 2020, and where farms are improving the use of organic fertilizer and bio-pesticides.

Outlook: Opportunities for foreign players in key segments

Although Chinese consumers prefer to drink coffee in social settings or on the go, home brewing is becoming more popular as coffee culture spreads. Generational differences in coffee use are evident, particularly in terms of where it is drunk, why, and how central a part of one’s lifestyle it is. When it comes to establishing China’s coffee culture and general consumption patterns, millennials and Gen Z are in the driver’s seat.

In general, although fiercely competitive, the rapidly expanding coffee shop business in China creates a wealth of options as living standards rise, the adventurous younger generations seek out new experiences, and partnerships between digital behemoths and coffee chains intensify.

Some of the key segments and trends to look at include:

- Gen-Z consumers and younger generations as the drivers of coffee consumption, especially in larger cities;

- Social settings and experience value;

- Ready-to-drink products are a big favorite;

- Coffee shops continue to flourish, especially with the post-pandemic opening up;

- Online retailing is indispensable for brand awareness and rapid growth; and

- Imports of coffee beans continue to grow.

All in all, as China’s coffee market continues to expand outside of large cities, companies have the potential for long-term growth in the country.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Building China’s Social Credit System – New Draft Law Outlines Legal Framework

- Next Article An Introduction to Doing Business in China 2023 – New Publication from Dezan Shira & Associates