China’s Cosmetics and Personal Care Market: Key Trends and Business Outlook

China’s cosmetics and personal care market is on track to reach a remarkable US$78 billion by 2025. China is now the world’s second-largest market and leads regional growth in Asia. In this article, we delve into the key drivers building up China’s beauty and personal care sector and the business scope for foreign brands.

China’s cosmetics market is experiencing an unprecedented boom, positioning itself as a formidable global player. The country’s beauty and personal care sector is projected to reach a staggering US$78 billion in revenue by 2025.

These figures solidify China’s position as the second-largest beauty market in the world, trailing only the United States. Remarkably, within the Asia-Pacific region, China is poised to drive nearly 70 percent of the growth in the regional beauty and personal care market up until 2025.

We discuss the factors fueling the rapid expansion of China’s beauty market, examine key consumer trends, and provide valuable insights for businesses seeking growth in this area.

Market overview

The beauty and personal care industry caters to consumer goods for cosmetics and body care. These include cosmetics for the face, lips, skin care products, fragrances, and personal care products, such as hair care, deodorants and shaving products, and beauty tech.

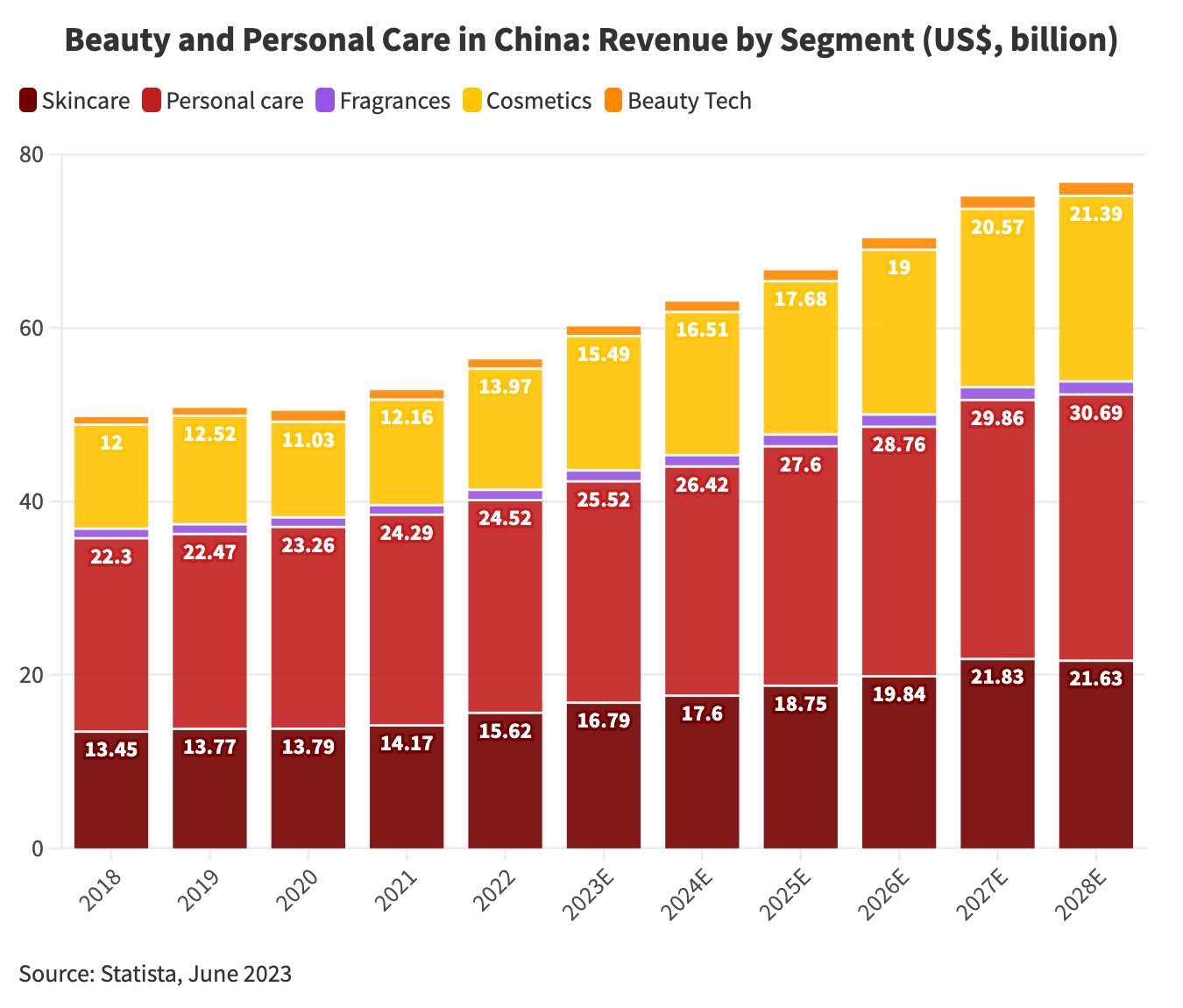

Based on Statista’s Market Insight, the beauty and personal care market in China is forecast to reach a substantial revenue of US$60.7 billion by 2023, with a projected compound annual growth rate (CAGR) of 5.03 percent between 2023 and 2028.

Specifically, the cosmetics segment is expected to play a significant role, with its revenue expected to exceed US$15 billion in 2023 and further increase to US$21.39 billion by 2028.

Indeed, China’s beauty and personal care market is experiencing a rapid recovery following a challenging period marked by economic uncertainties, policy changes related to the pandemic, and numerous lockdowns. Despite the decline in sales between 2020 and 2022, the interest in cosmetics and beauty products in China has maintained its momentum. A case in point is the online makeup tutorial sector, which garnered an average monthly view count of 100 billion last year.

Key players and major competitors

The Chinese beauty and personal care market is vast, yet highly competitive, with significant participation from both domestic and international players.

Domestic brands have emerged prominently in the Chinese market by focusing on local preferences and implementing competitive pricing strategies. Notable Chinese companies, such as Pechoin, Chando, and Herborist, have successfully gained market share by understanding and addressing the specific demands of Chinese consumers.

For instance, Pechoin, a popular domestic brand, accounted for a substantial 4.5 percent share of the market, with sales reaching RMB 110 billion (US$15.22 billion) in 2022, reflecting its strong foothold in the Chinese cosmetics industry. Pechoin’s rise to becoming a top player in China’s cosmetic market can be attributed in part to its effective use of traditional Chinese medicinal ingredients. By catering to local preferences, the brand has captured the attention of younger shoppers who value natural and herbal ingredients for their skincare regimen.

Pechoin recognized the growing interest among Chinese consumers, particularly younger ones, in incorporating traditional remedies into their beauty routines. They conducted extensive research to identify key medicinal ingredients known for their skincare benefits and then integrated them into their cosmetic formulations.

On the other hand, international cosmetics giants have also made significant investments in the Chinese market, adapting their products to meet the unique demands of their domestic consumers. Renowned brands like L’Oréal, Estée Lauder, Procter & Gamble, and Shiseido have all established a strong presence in China, leveraging their global reputation and expertise.

L’Oréal, for one, witnessed robust revenue growth in China, surpassing US$40.9 billion in 2022. The brand’s success in the Chinese beauty and personal care market can be attributed to several key strategies that have allowed the company to establish itself as a leader in the market. One of these strategies is the implementation of the “5-power model,” which encompasses powerful brands and products, superior innovation, new marketing techniques, expansion into retail channels, and a strong social media presence.

In particular, L’Oréal has embraced new marketing techniques to engage with Chinese consumers. They have leveraged digital platforms and social media channels to create immersive brand experiences and connect with their target audience. By understanding the importance of a strong social media presence in China’s digitally savvy market, L’Oréal has effectively utilized online platforms to build brand awareness, drive engagement, and foster a sense of community among consumers.

Regulatory environment and government policies

China’s beauty and personal care industry operates within a regulatory framework overseen by two key authorities: the State Administration for Market Regulation (SAMR) and the National Medical Products Administration (NMPA).

Within this industry, adherence to multiple laws and regulations is crucial. Among these, the most significant is the Regulations on Supervision and Administration of Cosmetics, of which the latest version was issued by the State Council in 2021 as an update to the previous 2015 draft. This set of updated regulations replaces the original 2007 Regulations on the Hygiene Supervision of Cosmetics, introducing improvements to facilitate market access for international cosmetics businesses.

Since 2021, China’s beauty and personal care industry has placed increased emphasis on quality control and safety supervision. It is imperative for companies operating within this domain to acquaint themselves with the updated regulatory provisions.

Despite the stricter quality control measures, the new regulations are a positive development for foreign businesses. They provide enhanced clarity and certainty in the Chinese market, offering a more favorable environment for international companies than ever before. In particular, the regulations introduce a simplified filing system to replace the previous cumbersome approval process for an increasing number of products.

More details are included in the table below.

Consumer behavior and preferences

Consumer behavior and preferences in the Chinese beauty and personal care market are continuously shaped by various factors, including changing demographics, rising disposable income, evolving consumer values, and the influence of technology.

Changing consumer demographics and rising disposable income

China’s population has witnessed significant demographic shifts in recent years, with a burgeoning middle class and rising disposable income. China’s median disposable income per capita reached RMB 31,370 (US$4,340) in 2022, an increase of 4.7 percent from the previous year. This figure has more than doubled from the RMB 15,632 (US$2,163) recorded in 2013.

Naturally, the rising disposable income has led to higher spending on personal care and beauty products.

The projected growth of the beauty and personal care market in China, reaching US$60.7 billion in revenue by 2023 according to Euromonitor, is closely tied to a significant shift towards premium and high-quality products. This transformation is precisely driven by China’s middle class, who not only have increased disposable income but also demonstrate a greater propensity to invest in personal grooming and self-care. As consumers seek elevated experiences and superior quality, the demand for premium beauty products continues to rise, fueling the overall growth of the industry.

One direct result of this shifting trend is the rise of premiumization. Higher-end brands are gaining significant traction as female consumers, in particular, prioritize self-investment and align beauty with the flourishing wellness and self-care lifestyle trends in the country. Recent data reveals that the premium beauty sector has the potential to capture 53 percent of the market share in China by 2025.

Several prominent players in the industry are already making substantial investments in their prestigious brands with the aim of enhancing such premium experiences. For instance, L’Oréal Paris organized an art exhibition at Tank Shanghai to elevate its brand presence. On the other hand, luxury brand Hermès has revealed plans to expand its beauty offerings by introducing a new line of eye makeup products, driven by strong demand in China reported in 2022.

These developments reflect the industry’s recognition of the Chinese market’s potential and the growing appetite for luxury beauty products among Chinese consumers with higher spending power.

Increasing demand for natural and organic cosmetics

Labels like “natural” and “organic” have emerged as new drivers of purchasing preferences in China’s cosmetic industry. Increasingly, consumers are opting for these products due to their perceived health benefits and environmental friendliness.

Tmall Global, one of China’s largest cross-border e-commerce platforms, witnessed a significant surge in sales of natural and organic cosmetic brands ever since the Double 11 Shopping Festival, with a record year-on-year increase of over 400 percent. Recognizing this trend, Tmall Global has decided to invest more in this category in 2020.

However, it is worth mentioning that, while the organic and natural cosmetics segment presents potential opportunities for foreign brands, China’s regulatory framework does not currently acknowledge this subcategory, and authorities maintain a cautious stance towards these emerging concepts. Therefore, it becomes imperative for companies, especially small and medium-sized enterprises (SMEs) venturing into this specific segment, to have a comprehensive understanding of the specific regulations governing organic and natural cosmetics in the country.

Influence of social media and e-commerce on consumer choices

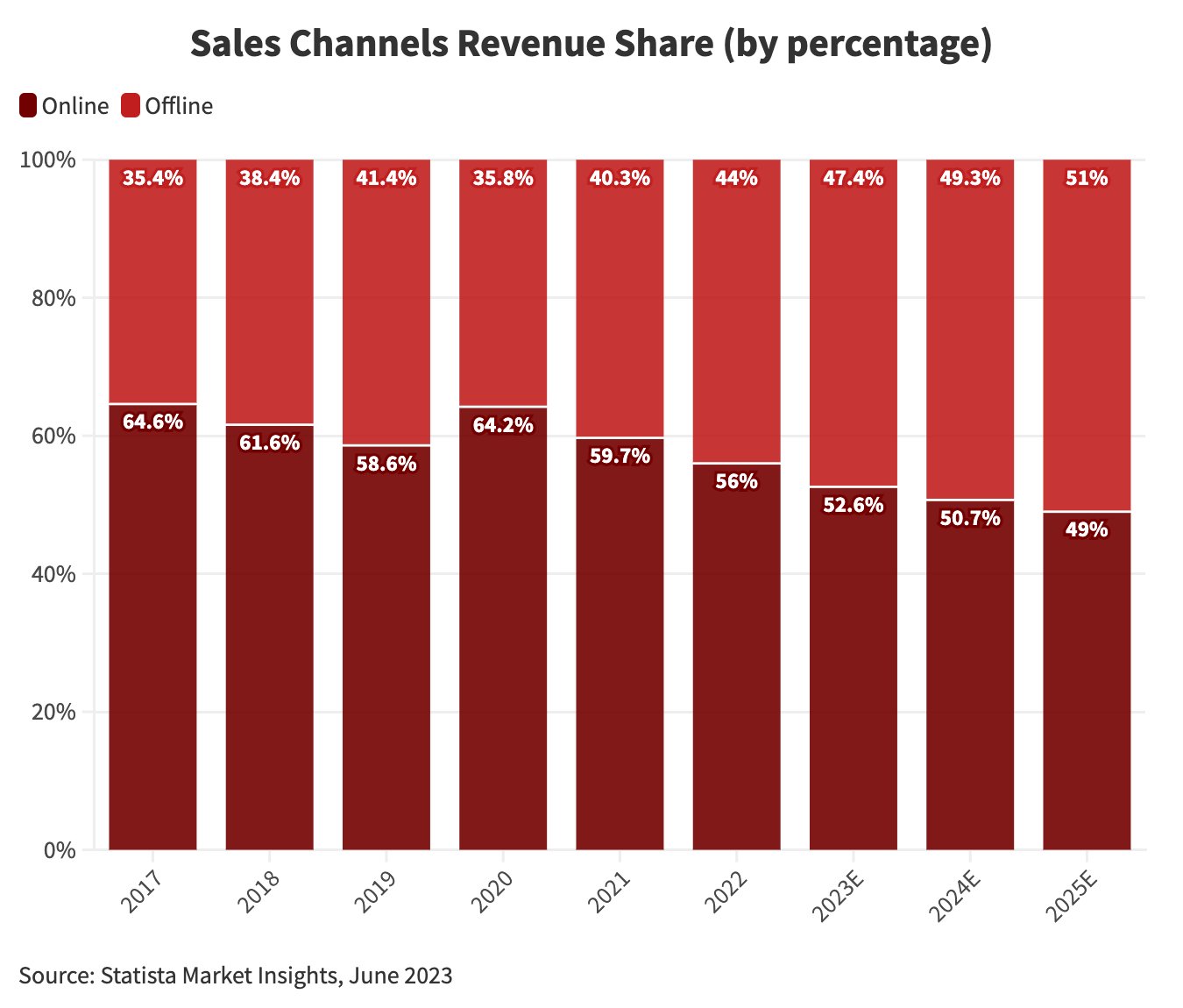

China’s cosmetic industry has been highly influenced by social media and e-commerce platforms in recent years. In the first quarter of 2022, despite the country’s zero-covid strategy, retail sales of beauty products experienced a 1.8 percent growth. Particularly impressive is the 8 percent increase in e-commerce beauty sales during the same period.

The impact of social media platforms on consumer behavior is also striking. Douyin, a popular platform, witnessed a remarkable 164 percent surge in beauty product sales, while XiaoHongShu (also known as ‘Little Red Book’) observed an annual growth of over 100 percent in influencer investments.

Notably, these platforms have become the new shopping arenas for Chinese consumers, as they seek beauty recommendations, trends, and purchasing opportunities.

Product trends: Focus on anti-aging and clinical brands

Beauty brands in China are intensifying their research and development (R&D) efforts in response to four key consumer demands: sun protection, whitening, skin rejuvenation, and anti-aging. Chinese consumers are increasingly scrutinizing ingredients and prioritizing efficacy, as highlighted in a 2022 white paper by Sephora and China Business News. According to the report, these consumers consider “sun protection and whitening,” “skin rejuvenation and anti-aging,” “moisturizing and soothing,” and “cleaning and oil control” as essential aspects of their skincare routines.

Beauty brands, especially domestic ones, have been quick to resonate with these emerging needs. For instance, Chinese cosmetic giant Florasis, known for its incorporation of traditional Chinese aesthetics and savvy social media marketing, has announced a RMB 1 billion (US$138.37 million) investment in product innovation and the establishment of five major R&D centers. Similarly, brands like PMPM and Proya have recruited chief scientific officers to enhance their product offerings.

Consumers in China are also increasingly drawn to clinical brands founded by doctors and chemists, driven by a desire for proven efficacy. Premium Chinese skincare brands hold an advantage as they cater to the specific skincare concerns faced by Chinese consumers. An example is the Chinese brand Winona, which focuses entirely on sensitive skin. This shift towards clinical and problem-solving brands reflects the evolving preferences and demands of Chinese consumers.

Distribution channels

Rise of e-commerce platforms and online sales

Chinese consumers allocate a significant amount of their online time to researching and evaluating beauty products, relying heavily on recommendations from friends and family when making purchasing decisions. The influence of China’s e-commerce platforms in shaping consumer behavior has grown exponentially, as they provide a platform for the beauty community to share shopping experiences and product recommendations. For instance, Xiaohongshu has amassed over 200 million predominantly female users under the age of 26. This demographic aligns closely with the target market for imported cosmetic products.

Livestreaming has emerged as a pivotal sales platform for cosmetics, catering to tech-savvy consumers who prefer shopping via their smartphones. It has rapidly gained market share, doubling its presence from 2019 to 2020, and as of 2022, contributed to approximately 10 percent of Chinese e-commerce. Including livestreaming as part of a comprehensive multi-channel sales strategy is crucial for success in the Chinese market.

Selling through online channels offers certain advantages as brands encounter fewer barriers compared to traditional brick-and-mortar stores, owing to differing regulations. This enables brands to tap into the vast potential of online channels and leverage the evolving purchasing behaviors of Chinese consumers.

Importance of physical stores and shopping malls

Despite the narrative surrounding the closure of physical stores, the significance of brick-and-mortar retail remains intact, particularly as China has now moved past the zero-COVID phase. Offline stores continue to hold a critical role in 2023, offering consumers the opportunity to fulfill their desire for professionalism, safety, prestige, comfort, and a sense of luxury. Sephora’s study emphasizes that offline experiences, such as beauty classes, casual makeup trials, ambient music, and visually appealing displays, cater to these desires.

Recent developments highlight the continued importance of physical retail. Chinese beauty giant Florasis opened its inaugural brick-and-mortar store, while Armani Beauty introduced a high-end global flagship store in China.

Industry experts believe that the years 2024-2025 will witness a significant wave of new growth as international brands capitalize on opportunities to enter the Chinese market. This indicates that offline stores will continue to play a crucial role in the beauty industry’s expansion and the integration of international brands in China.

Key lessons for foreign brands entering China’s cosmetics and personal care market

Entering the Chinese cosmetics and personal care market can be a rewarding endeavor for foreign brands, but it requires a keen understanding of local preferences. Here are three key lessons to consider when venturing into this competitive landscape:

- Competition and deep brand evaluation: Foreign brands should be prepared to face intense competition when entering the market and develop strategies to differentiate themselves. Chinese consumers are no longer solely focused on comparing prices; they want to understand brands on a deeper level and forge stronger connections. Foreign brands should invest in showcasing their brand values, sharing compelling brand stories, and highlighting their current initiatives. This can help establish an emotional connection with consumers and differentiate themselves in the market.

- Focused targeting: It is crucial for foreign brands to define their target audience beyond broad demographics like “Gen-Z.” There needs to be a clear understanding of who the target consumers are, their preferences, and their current mindset. This targeted approach enables brands to tailor their marketing strategies and product offerings to meet the specific needs and expectations of their intended audience.

- Diversified distribution channels: The evolving landscape of distribution channels in China offers several valuable opportunities, if properly harnessed. While Tmall and JD.com are well-established e-commerce platforms, emerging channels like Douyin and Xiaohongshu are gaining traction in the market. These new channels provide opportunities for brands to reach a wider audience and tap into the growing demand for cosmetic products.

- Leveraging KOLs and KOCs: Establishing strong partnerships with Chinese influencers – key opinion leaders (KOLs) and key opinion consumers (KOCs) – can greatly enhance brand visibility and credibility.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China H1 2023 Economic Roundup: GDP Grows 5.5% on Steady Path to Recovery

- Next Article China’s Tax Incentives to Support the Education Sector