China’s Livestream Industry: Market Growth, Regulation, Enabling Technology, and Business Strategies

We discuss how China’s livestream industry enables brands to connect with Chinese consumers in an engaging and interactive manner and relevant marketplace regulations. E-commerce giant Alibaba’s Taobao Live has top market share in this industry, followed by Douyin, Kuaishou, JD.com, and Baidu.

China’s livestream industry has witnessed exponential growth in recent years. This medium offers brands a unique opportunity to connect with Chinese consumers in an engaging and interactive manner.

In 2022, the total revenue of China’s e-commerce livestream sector is projected to reach RMB 1.2 trillion (US$180 billion) with total of 660 million viewers. This figure is expected to further grow to RMB 4.9 trillion (US$720 billion) in 2023, according to a 2021 iResearch report. This will account for 11.7 percent of total e-commerce sales in the country, injecting new impetus into the economy.

Livestream functions as a key means for brands to boost sales and for smaller operators, such as farmers, to have better access to consumers. It grew exponentially during the pandemic, which promoted people to shop online and gain interactive and immersive experiences amid lockdowns. Currently, the e-commerce giant Alibaba’s Taobao Live has taken the lion’s share of livestream, taking up 68.5 percent of consumers, followed by Douyin and Kuaishou. Other major Chinese internet players like JD.com and Baidu are also trying to grow their presence in the market.

In this article, we explore how livestream can generate profits and what are the effective ways to enter this massive market.

What is livestream and why is it popular?

The typical livestream session, enabled by mobile devices, features hosts promoting and selling goods while customers watch, chat with others, and shop, all at the same time. Livestream allows hosts to answer call-in questions from audiences in real time, which significantly enhances shopping experiences and attracts customers.

The entertaining and immersive shopping characteristics attract and maintain a strong viewer base. Online shoppers who grew tired of simply scrolling and clicking on a website can enjoy this interactive experience. Gradually, livestream has become part of Chinese people’s online shopping routine, especially among young audiences.

What’s more, livestream platforms often promote products directly provided by factories, greatly lowering the price. On top of that, with other time-limited discounts or coupons, the consumers can often find a great deal on selected products, raising the attractiveness of this experience.

Who are livestreamers?

Livestreamers are salespersons in the age of e-commerce. As of 2020, there were at least 1.23 million “professional” livestream hosts working in the industry, compared with fewer than 250,000 in 2019. Almost anyone that registers with the local industrial and commercial bureau can open an account to promote their products. This enables some small businesses, such as farmers in remote areas, to participate in a larger market.

Popular livestreamers, however, are backed by professional marketing teams and can earn millions in brand endorsements and sponsorships. Some are even endorsed by the government as innovators and job creators. Their status as retail rainmakers has given them immense power over sellers and buyers, influencing what products get featured and product pricing. Previous popular livestreamers Jiaqi Li and Viya were reported to facilitate millions of dollars’ worth of online purchases in one night.

Livestream hosts earn commissions on products they promote while a key revenue stream comes in the form of tips and virtual gifts from devoted fans, ranging from a US$0.15 virtual beer to a US$1,100 virtual spaceship.

What is sold on livestreams?

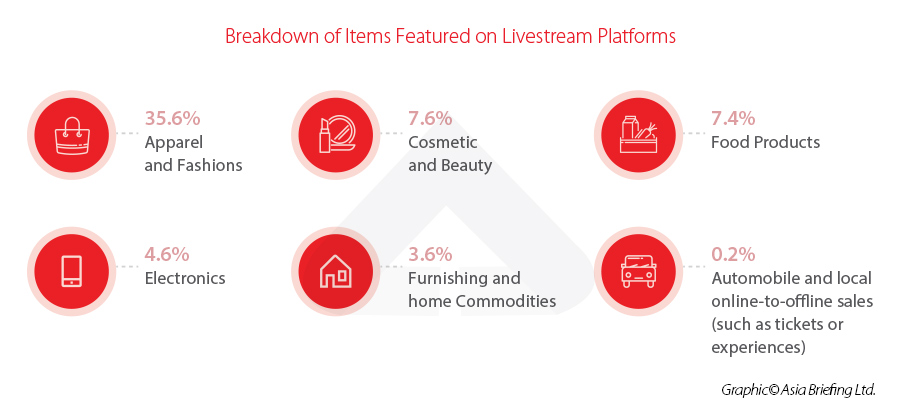

The most popular livestream product categories are led by women’s fashion, followed by cosmetics, food, electronics, and home goods. In terms of gross merchandise value, big-ticket items such as computers and large home appliances lead the pack. According to a McKinsey analysis, the breakdown of items featured on China’s livestream platforms are as below:

Nonetheless, the booming livestream e-commerce sector has become increasingly homogenous and crowded, yearning for novel products that can quickly stand out and attract customers’ attention.

In June 2022, Dong Yuhui, a former English teacher from education giant New Oriental, caught the public’s eye. With a content-driven approach that offers free English, history, and culture lessons, he distinguished himself from typical livestreams who simply promote products. Following the crackdown on the private tutoring sector (since 2021), the New Oriental has looked at using livestream platforms to diversify their business operations. Currently, Oriental Selection, its livestream arm, sells books and agricultural products. On its peak day, the company recorded daily revenue of RMB 69.85 million (US$ 10.29 million) with Dong’s debut in June 2022.

To attract consumers, several livestream platforms have already planned a big foray into “content and knowledge-based” livestreams. New Oriental CEO Yu Minhong revealed plans in his live broadcast to open an e-commerce academy to train livestreamers for high-quality content. Before this, Luo Yonghao, founder of Smartisan, also founded an academy to nurture talent for the sector to generate more social value.

China’s regulations for livestreaming

In recent years, China has been pushing to further regulate the livestream industry. Several top livestream hosts stopped their streams due to inappropriate or illegal behavior. Among them, Viya was fined a record RMB 1.3 billion (US$210 million) for tax evasion and has since disappeared from public view. Li Jiaqi has also stopped broadcasting publicly after a controversial session selling a tank-shaped dessert.

Regulations increasingly began to hold livestreamers accountable for product quality control, proper reporting of sales numbers, and minors’ participation in livestreams. On June 22, 2022, the Code of Conduct for Online Streamers (the Code) was released to instruct livestreamers with 18 guidelines and 31 categories of prohibited content, which range from violence and self-harm to showing off wealth. The guidelines aim to change the sector known for its “low threshold, high income” reputation.

The Code emphasizes the importance of upholding correct political values and positive social values. It requires livestreamers in professional fields like law, medical, education, and finance to obtain relevant qualification and approval from streaming platforms. Under the Code, platforms bear the responsibility for recognizing rule-followers and punishing violators by putting them on a blacklist and issuing them with a permanent streaming ban. They also need to check for proper content and ensure no “tainted” streamers appear on their platforms.

Emerging business strategies in China’s livestream sector

Private domain livestream: After years of booming development, many companies have found it challenging to keep a large customer base by using the public-domain livestream (such as those made through Taobao and Douyin). How many viewers will place orders remains a key question. More and more firms are shifting to the private domain livestream to attract and maintain long-term customers. Here private domain refers to the practice where companies use their own livestreaming software, websites, or other accounts to target potential customers to accumulate flows through their customized platforms. Compared with the public version, it is easier to build brand loyalty and maximize real-time interactions with users on private domain livestreaming. This accurate targeting reduces enterprise marketing costs and improves operational efficiency.

Application of virtual technology: The integration of virtual technology is driving changes to the traditional livestreaming format. AI technology creates a multidimensional, interactive experience of viewing, hearing, and feeling, to achieve the conversion between the virtual world and the real world. Technologies including AR (augmented reality), XR (extended reality), and MR (mixed reality) can bring better user experience by making the virtual world more realistic. Nonetheless, requirements for VR technology hardware configuration remain high as of now, adding challenges to the companies operating in this arena.

Livestream service providers: As competition in the livestreaming industry intensifies, companies are exploring ways to transfer from being technology providers to service providers to stand out. In addition to providing a single livestreaming product, the ability to understand user needs, build a full-link livestream service capability, and provide differentiated operational services will be necessary for success. More specifically, the whole-chain service may include project planning and targeting, video production, digital learning and digital marketing, and offline solution consulting. This aims to integrate “product, technology, service” into a closed loop, providing a one-stop comprehensive livestream operation service for enterprise customers.

How can livestream benefit businesses?

Livestream e-commerce can be a viable business model for many. It increases a brand’s appeal and pulls in additional web traffic, which leads to more consumption. Companies can also gain higher conversion rates of 30 percent – around 10 times higher than through conventional e-commerce.

Livestreaming is a great place for content collaborations. Inviting partners – either celebrities or brands – sometimes from completely unrelated fields, may give the livestream a sense of freshness and surprise that can catch people’s attention and attract more customers.

The livestream industry can also revive offline merchant management, particularly the supply chain. Online sales depend on back-end resources integration. Excellent supply chain management is key to the successful operation of livestreaming by anticipating sales, ensuring smooth procurement, and providing timely shipments. Achieving new breakthroughs in the supply chain management ecosystem to support livestreaming industries will create new opportunities for businesses.

What are the main challenges?

While the opportunities are promising, problems, such as sales of counterfeit goods and false advertising, also pop up. Certain products, especially those procured directly from smaller producers, may pose quality issues as well. As the outcome of livestream e-commerce is the product itself, poor product quality has a fatal impact on the company or platform’s user loss. Ensuring the rights and interests of consumers is critical to success in the sector.

Meanwhile, livestreaming with its high profit potential attracts fierce competition. Hosts with strong commercial endorsements are more likely to thrive than those without such support. Nearly 60 percent of livestream hosts are forced to leave the industry after less than a year.

Key takeaway

Foreign investors who eye on China’s livestream shopping space must gauge both the encouraging and limiting elements of this industry. Following China’s lead, Western brands, retailers, and marketplaces are establishing their own live-commerce ventures and events to promote products. For example, Tommy Hilfiger recently extended its livestream program to Europe and North America following success in China, where one show reportedly attracted an audience of 14 million and sold 1,300 hoodies in two minutes. The potential for the livestreaming industry remains strong – especially as it facilitates traction in previously unreachable markets, fosters closer customer-brand relationships, and draws valuable insights directly from consumers.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article 10 Things Businesses Need to Know When Setting Up a Company in China and the UK: Episode 4

- Next Article Tax Liabilities for Equity Transfer in China: An Introduction