Audit and Tax Compliance in China: A Step-by-Step Guide for Foreign Companies

To achieve full compliance, foreign invested enterprises (FIEs) in China need to follow the specified audit and tax compliance procedures established by the government.

In this article, we provide a step-by-step guide to conducting annual audit in China, including: general requirements, materials to be prepared, notes on regional differences, and tips from experienced accountants and auditors.

Audit and tax compliance in China: JVs, WFOEs, and FICEs

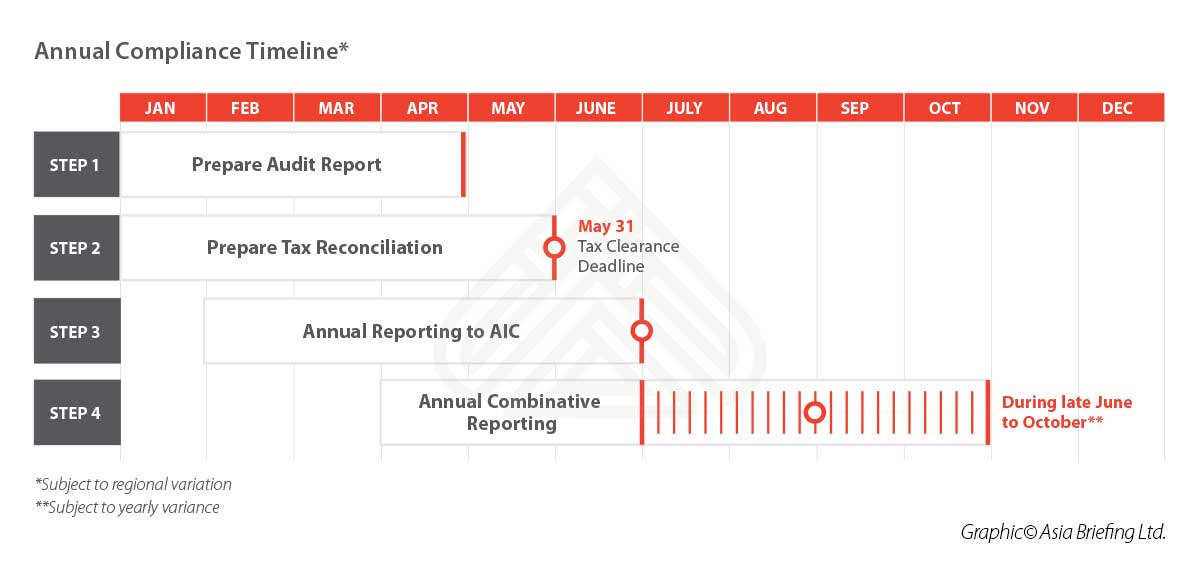

For wholly foreign owned enterprises (WFOEs), joint ventures (JVs), and foreign invested commercial enterprises (FICEs), achieving annual compliance can be a long and complicated process.

The work primarily involves producing an annual audit report, a corporate income tax (CIT) reconciliation report, and reporting to relevant government bureaus. These procedures are not only required by law but are also a good opportunity to conduct an internal financial health check.

The relevant procedures and key considerations vary slightly by region and entity type.

Companies should either contact a service provider or the local government to achieve full compliance.

Step 1 – Prepare an annual audit report

The annual audit report consists of a balance sheet, an income statement, and a cash flow statement.

To ensure that foreign-invested companies meet Chinese financial and accounting standards, the annual audit report must be conducted by external licensed accounting firms and signed by a Certified Public Accountant (CPA) registered in China for compliance purposes.

The requirements for the audit report vary by region.

For instance, in Shanghai, companies must include a taxable income adjustment sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing, or Shenzhen.

The audit procedure takes about two months, and the audit report should be completed before the end of April to meet the May 31 tax reconciliation deadline.

Step 2 – Prepare CIT reconciliation report (Annual tax returns)

In China, CIT is paid on a monthly or quarterly basis in accordance with the figures shown in the accounting books of the company – companies are required to file CIT returns within 15 days from the end of the month or quarter.

However, due to discrepancies between China’s accounting standards and tax laws, the actual CIT taxable income is usually different from the total profits shown in the accounting books.

As such, the State Administration of Taxation (SAT) requires companies to submit an Annual CIT Reconciliation Report within five months from the previous year’s year-end to determine if all tax liabilities have been met, and whether the company needs to pay supplementary tax or apply for a tax reimbursement.

Every year around March, depending on the location, the local tax bureau will issue annual guidance on CIT reconciliation.

Generally, the Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards.

FIEs that conduct frequent transactions with related parties should prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Moreover, FIEs in certain regions need to engage a Certified Tax Agent firm in China to prepare another separate CIT audit report. In Beijing, this requirement applies to firms that meet the following conditions:

- Yearly sales revenues exceed RMB 30 million (approx. US$4.35 million);

- Carrying over last year’s losses to deduct this year’s income; or,

- Yearly losses exceed RMB 100,000 (approx. US$14,500).

In Shanghai, the CIT audit report is needed when:

- Taxpayers who have made a loss (current year loss) of more than RMB 5 million (approx. US$0.73 million); or,

- Taxpayers who have offset losses carried forward from previous years.

The deadline for submitting the CIT Reconciliation Report to the tax bureau is May 31 every year, but the investigation of the tax compliance could last to the end of the year, and companies should be prepared to provide supporting documents upon demand from the tax bureau.

Step 3 – Annual reporting to AIC

According to the “Interim Regulations for the Publicity of Corporate Information”, each year from January 1 to June 30, all FIEs should submit an annual report for the previous fiscal year to the relevant Administration of Industry and Commerce (AIC).

This should be done through the corporate credit and information publicity system.

The annual report submitted should cover the following information:

- The mailing address, post code, telephone number, and email address of the enterprise;

- Information regarding the existence status of the enterprise;

- Information relating to any investment by the enterprise to establish companies or purchase equity rights;

- Information regarding the subscribed and paid in amount, time, and ways of contribution of the shareholders or promoters thereof, in the case that the enterprise is a limited liability company, or a company limited by shares;

- Equity change information of the equity transfer by the shareholders of a limited liability company;

- The name and URL of the website of the enterprise and of its online shops;

- Information of the number of business practitioners, total assets, total liabilities, warranties and guarantees provided for other entities, total owner’s equity, total revenue, income from the main business, gross profit, net profit, and total tax; and,

- Information regarding customs annual reporting of enterprises subject to the administration of the customs.

Step 4 – Annual combinative reporting to MOFCOM, MOF, SAT, AQSIQ, NBS, and SAFE

Besides the annual reporting to AIC, FIEs in China are required to conduct an annual combinative reporting to Ministry of Commerce (MOFCOM), Ministry of Finance (MOF), SAT, State Administration of Foreign Exchange (SAFE), and National Bureau of Statistics (NBS).

Under this system, all information can be submitted online through the annual combinative reporting system.

Unlike the previous annual inspection system, annual reporting compels relevant government bureaus to take on the role of supervisors, rather than judges.

They no longer have the right to disapprove reports that are submitted, even if they think the reports are unqualified – they can only suggest that the FIEs make modifications.

Accordingly, relevant government bureaus no longer affix any seals on a report.

In 2018, the previous foreign exchange reconciliation was further combined into the annual combinative reporting system. FIEs no longer have to conduct a separate foreign exchange reconciliation registration.

As an alternative, enterprises can submit foreign exchange relevant information together with other information through the annual combinative reporting system.

With this new rule implemented, the annual compliance requirements for FIEs have become much more manageable.

The deadline for this combinative report is subject to yearly variance. In 2017, the deadline was delayed to July 15. And in 2018, the reporting period was from April 1 to June 30.

Annual Custom Reporting Combined with Annual Reporting to AIC

From 2018, enterprises subject to customs administration are no longer required to submit the annual customs report through separate customs platforms.

Rather, they can submit the relevant customs information through the corporate credit and information publicity system during annual reporting to the AIC.

Enterprises subject to customs administration refer to enterprises that are registered with the customs, which include declaration enterprises, processing enterprises, and enterprises enjoying tax reduction for importing machines.

As the first year of reform, in 2018, enterprises subject to customs administration could fill in the relevant customs information from May 31 to August 31. The reporting time period is the same as that for other enterprises, or January 1 to June 30.

Annual Foreign Exchange Reconciliation Combined into Annual Combinative Reporting

All foreign exchange transactions in and out of China are strictly controlled by SAFE, the bureau under the central bank of China (the People’s Bank of China).

Previously, according to the “Notice on Further Simplifying and Improving the Foreign Exchange Management Policies for Direct Investment” (Hui Fa [2015] No.13), effective since June 1, 2015, relevant market players were required to make an “Existing Right Registration” before September 30 each year.

To cut red tape, starting from the year 2018, FIEs are no longer required to conduct separate annual foreign exchange reconciliation.

As an alternative, they can submit foreign exchange relevant information through the annual combinative reporting system (http://www.lhnj. gov.cn/). In 2018, the deadline was June 30.

Failure to comply with registration requirements results in the foreign exchange bureaus taking control over the parties in the capital account information system.

Further, banks will not carry out foreign exchange business under the capital account for offending companies.

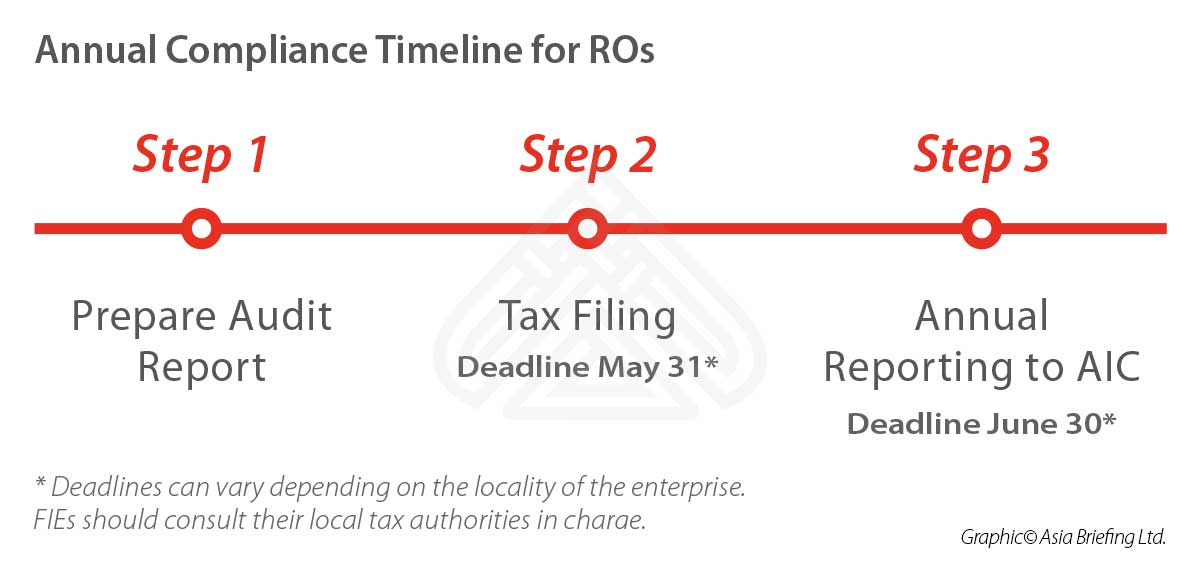

Audit and tax compliance for ROs

For ROs, annual compliance procedures are simpler. While ROs are exempt from annual combinative reporting, they still need to prepare annual audit report, a tax reconciliation report, and then report to AIC.

Step 1 – Prepare annual audit report

Similar to the annual audit for JVs, WFOEs, and FICEs, the annual audit report for Ros should also be prepared by external licensed accounting firms and signed by a CPA registered in China. When doing the annual audit works, auditors should pay special attention to the following factors.

- Bank statements, cash, staff, and IIT – The balance on the bank book should be the same as that stated in the bank statement. If not, a bank reconciliation should be prepared to verify the differences. The balance on the account should be the same as the cash contained in the cash box. The auditors will perform a cash count during their field work. Employment of staff has to be registered in accordance with the relevant regulations (local employees registered with FESCO and valid work permits for expatriate staff), and IIT correctly assessed and filed.

- Expenses report – Expenses include rent, transportation, telephone, salary, office purchases, entertainment, audit fees, utilities, and FESCO fees, regardless of whether these are paid from the RO or directly from its head office. Any expenses belonging to the fiscal year should be properly accrued with contracts or agreements as support. The total salary of the chief representative, whether paid offshore or locally, must be included in the expenses. If employees are involved in overseas social security plans, these payments have to be included in the expenses report.

- Taxable income – According to relevant laws and regulations, ROs of foreign enterprises in mainland China must pay CIT on their deemed taxable income, as well as value-added tax (VAT) and consumption tax (CT) when it is applicable. The CIT liability will be assessed by the deemed profit method, cost-plus method, or actual revenue method. Among these three methods, the cost-plus method is the most commonly used, since the other two methods require ROs to submit numerous supporting documents.

Under the cost-plus method, the taxable income, that is, the deemed revenue, is calculated on the basis of the expenses:

Deemed Revenue = RO’s Expenses / (1 – Deemed Profit Rate*)

*The deemed profit rate is decided by the tax bureau and shall be no less than 15 percent.

Step 2 – Annual tax filing

The responsibility for tax filing in China is with the taxpayer. The tax bureau does not send out tax returns; the taxpayer has to collect and file tax forms according to relevant regulations.

The tax authority additionally requires that accounting records and ledgers be set up and kept properly and that details of the accounting system be filed.

The annual tax reconciliation is finished through the online filing wholly.

ROs usually will need to submit the Annual Taxation Consolidation Report to the tax bureau by the end of May each year, but regional variations may exist.

If the audited taxes due are found to be different from the taxes paid by the RO, the RO shall discuss the variation with the tax bureau.

For foreign companies that suspect this might occur, it is wise to hold preemptive discussions with tax advisors prior to audit submission.

Step 3 – Annual reporting to AIC

ROs are required to submit an annual report between March 1 and June 30 every year providing information on the legal status and standing information of the foreign enterprise, ongoing business activities of the RO, and an audit report.

The registration authorities will issue an RMB 10,000 (US$1,493) to RMB 30,000 (US$4,480) penalty if the RO fails to provide these reports on time, and an RMB 20,000 (US$2,987) to RMB 200,000 (US$29,868) penalty if the report includes false information.

Fraud may also lead to license revocation.

During the annual reporting process, the following documents should be provided in paper or online:

- Annual report (the template will be distributed by AIC around March);

- Business registration certificate;

- Audit report; and,

- Proof of information on the legal status and standing of the headquarters overseas.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article Repatriación de beneficios desde China: compliance para pagos al extranjero

- Next Article China’s City-Tier Classification: How Does it Work?