Setting Up a Company in China

Choosing the right corporate structure for setting up a company in China is paramount and can mitigate unnecessary business constraints, costs, and official scrutiny. These challenges handicap growth following market entry and can undermine a company’s plans to expand.

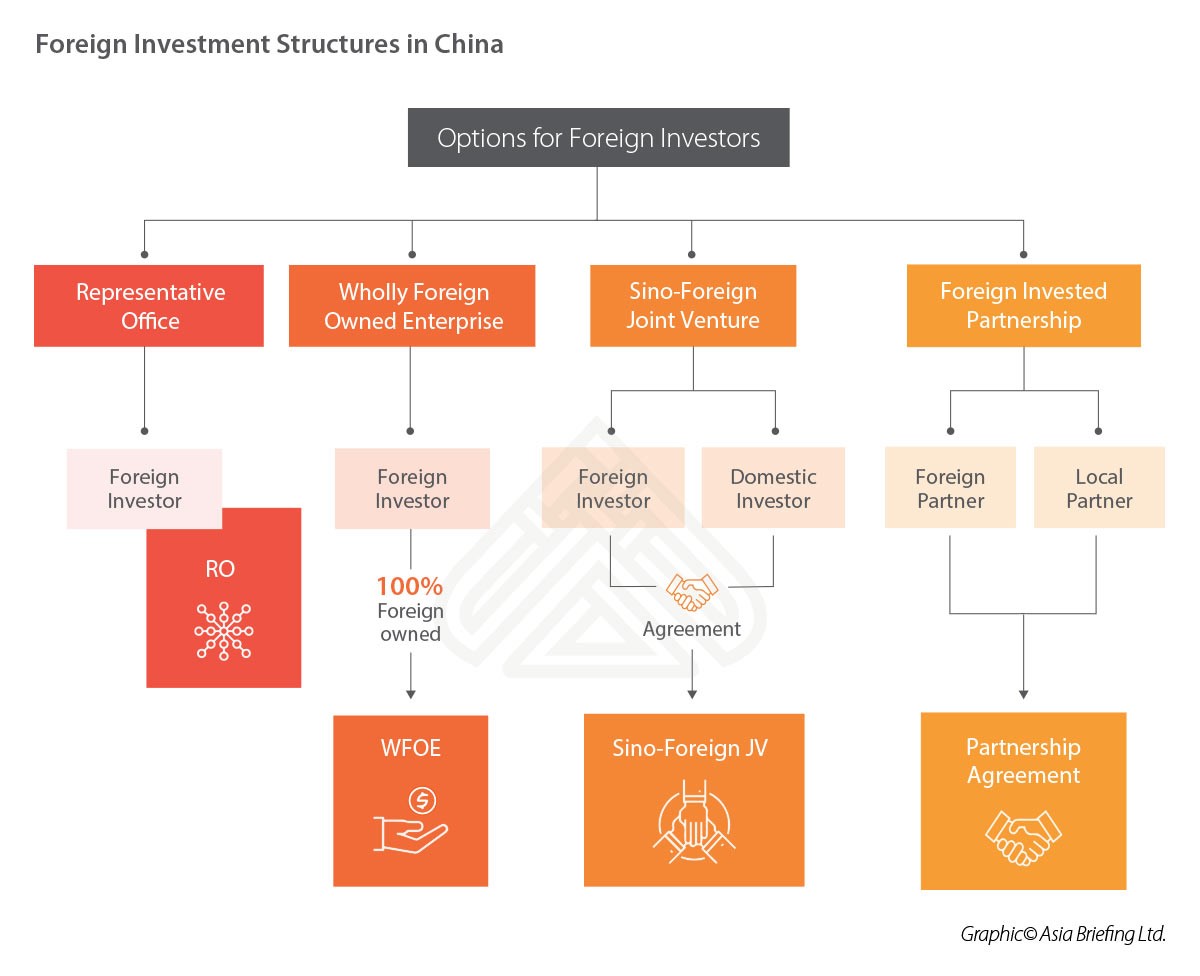

Investing in a market as complex and expansive as China comes with legal, regulatory, and cultural challenges. Many investors establish a local presence through a foreign invested enterprise (FIE), which helps limit the cost and increase the ease of doing business in China.

Investors need to be particularly careful in approaching how local authorities treat their industry, business objective, day-to-day operations, and the amount of domestic input they require. In addition, foreign investors should formulate how they would like to manage capital requirements, legal liability, tax, commercial and hiring capacity, and time needed to set up a company.

Establishing a business in China is not rocket science, but investors that want to save time and money should carefully consider the options and seek local expertise for best results.

Representative Office

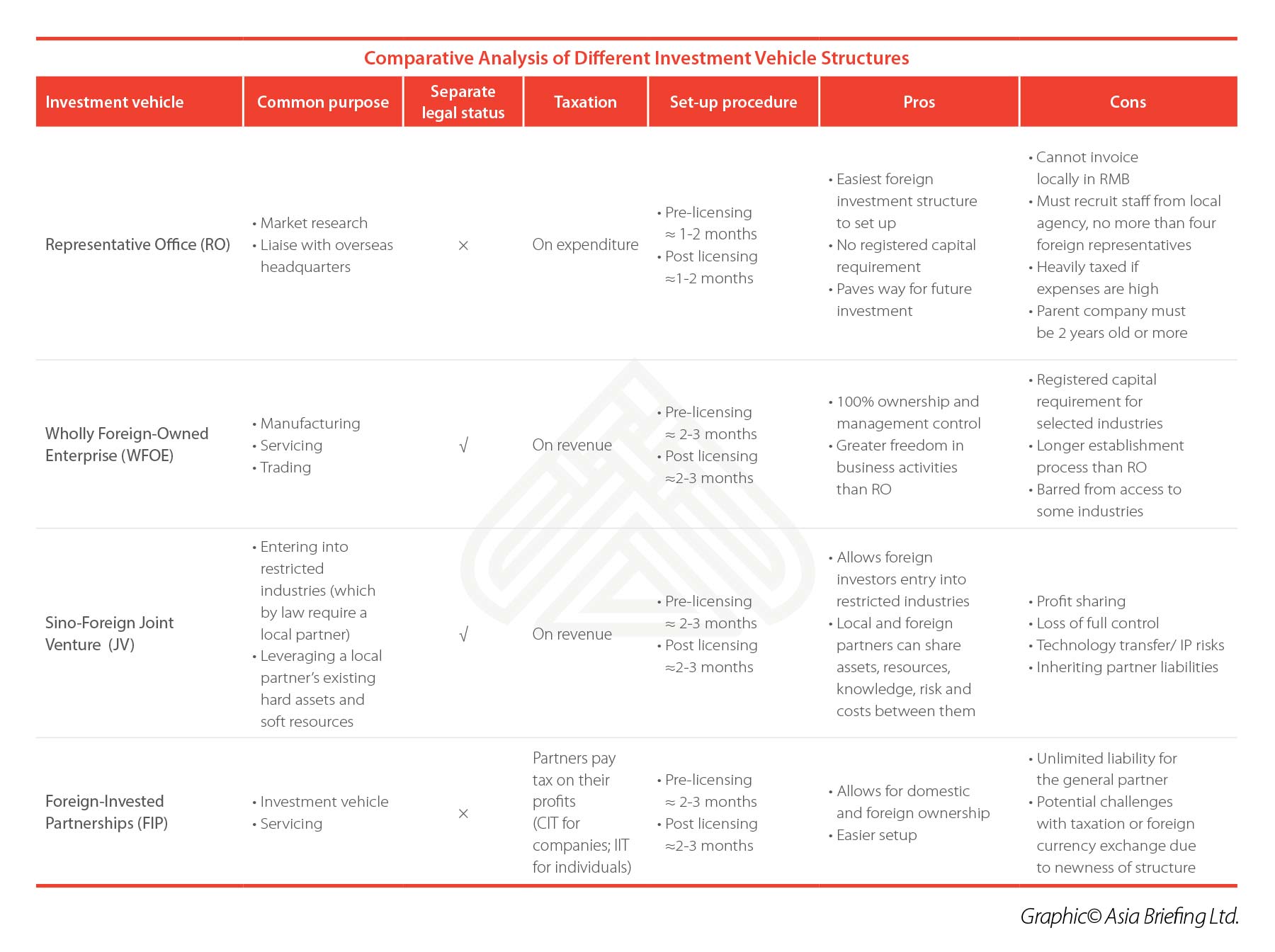

A Representative Office (RO) serves as an extension of a parent foreign enterprise. It does not form its own separate legal entity; the foreign parent enterprise assumes all legal liability and ownership of property acquired by the RO. When an RO breaches a contract, the foreign company is liable. Similarly, if the RO makes a purchase, the parent owns the purchase.

An RO is also limited in its commercial capacity. It cannot engage in profit-generating activities and can only hire local staff through a qualified labor dispatch agency.

Its main function is to facilitate the activities of a foreign company in China. Some foreign businesses use ROs to maintain quality control of products and services in China. However, local governments may not allow ROs to carry out such functions in some jurisdictions.

ROs are also an effective way to improve the efficiency of communication lines with Chinese partners or suppliers.

![]() RELATED: Pre-Investment Capital Planning for China’s Foreign Exchange Control

RELATED: Pre-Investment Capital Planning for China’s Foreign Exchange Control

Wholly Foreign Owned Enterprise

A Wholly Foreign Owned Enterprise (WFOE) is an enterprise owned by one or more foreign investors. It assumes its own separate legal personality status, which means it has rights and obligations under the law, such as the capacity to own property and the ability to enter into legally binding contracts.

Investors often set up WFOEs as a limited liability company, with the liability of each investor limited to the amount of capital contributed. In comparison to ROs, WFOEs provide greater freedom in business activities and offer foreign investors 100 percent ownership and management control.

Broadly speaking, there are three main categories of WFOE setups: service (or consulting) WFOE, trading WFOE, or manufacturing WFOE. While these WFOE setups share the same legal identity, they differ in terms of their setup procedures, costs, and range of commercial activities in which they can engage in.

Sino-Foreign Joint Venture

A Sino-Foreign Joint Venture (JV) is a commercial enterprise entered into by at least one foreign investor and one domestic Chinese party. A JV is not merely a merger of two companies: it forms a new legal entity (except in some rare cases discussed below). A JV may take many shapes and forms, and can be tailored to the specific needs of a business. However, there are two common types of joint venture: Equity Joint Venture (EJV) and Cooperative Joint Venture (CJV).

An EJV is a limited liability company where profits and losses are distributed between parties in proportion to their respective equity interest. Generally, a foreign investor in a JV should own at least 25 percent of total shares, while foreign investors should note that a Chinese individual cannot normally be a JV shareholder, except in some special circumstances.

A CJV is a JV structure that offers more flexibility for investors. It can operate as a limited liability company or as a non-legal entity. Further, unlike the EJV structure, profit, risk and control are not divided in proportion to their equity interests – they can be negotiated within the contract agreement.

Investors commonly opt for a JV in one of two situations. Foreign companies that want to invest in a restricted industry sector develop JVs with a Chinese partner to meet investment requirements. Otherwise, foreign companies form JVs when they want to make use of the sales channels and distribution networks of a Chinese partner.

Foreign Invested Partnership

A Foreign Invested Partnership (FIP) is an unlimited liability business entity that can be set up without any minimum capital. Similar to JVs, it consists of two or more investors coming together for commercial purposes.

The Partnership Enterprise Law regulates the set-up and operation of partnership arrangements. However, on terms relating to its operation, the law often awards discretion to the FIP and provides that where the partnership agreement specifies otherwise, the agreement will prevail. This provides partners to a partnership agreement a high level of autonomy on how they wish to operate.

FIPs are a less common structure for foreign investors, however, because investors need to assume more liability under this model.

Choosing the most appropriate investment structure

When choosing an appropriate investment structure, it is important to remember that—“strategy must lead structure.” This means that foreign investors entering a new market must first decide on their business strategy and then use this strategy to guide them to choose an appropriate investment vehicle that will allow them to carry out their desired commercial objectives.

To do this effectively, it is important to analyze the advantages and disadvantages of each foreign investment vehicle structure (for ease of comparison, see the table below).

![]() Corporate Establishment Services from Dezan Shira & Associates

Corporate Establishment Services from Dezan Shira & Associates

Generally, a WFOE structure may be the most appropriate investment vehicle if your business values autonomy and flexibility. Alternatively, an RO structure may suffice in cases where a company requires an expedient option that provides surface-level local support and oversight.

However, if your business operates within the restricted industry category or wishes to leverage a local partner’s existing hard assets or soft resources, the most appropriate structure may be a JV or an FIP.

Before executing a new business structure, it is important to consult a professional adviser on the latest laws and regulations surrounding entity set-ups and requirements, inquire about due diligence for would-be-partners and service providers, develop an exit strategy plan and obtain advice on any operational issues—including labor law and regional regulations.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Marriage Leave in China

- Next Article China’s FTA with the EAEU Will Improve Market Access, EU Transhipments