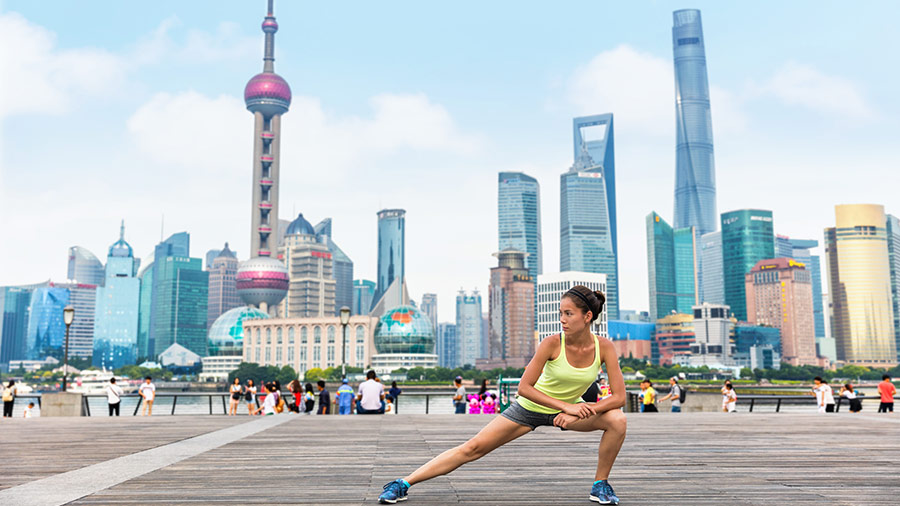

China’s Fitness Industry: New Lifestyle Trends Boost Investment Prospects

Chinese urbanites are trading in their designer handbags for gym bags and their stilettos for sneakers. And, with growing numbers of Chinese consumers embracing a more active and healthy lifestyle, their spending habits are moving beyond consumer products.

Today, the country’s gym and fitness sectors make for a US$6 billion industry. Parallel to this growth is China’s rapidly expanding sportswear market, which is projected to hit RMB 280.8 billion (US$43.10 billion) by 2020, according to Euromonitor.

This contrasts with spending in China’s once booming luxury goods market, which has relatively slowed down. The segment is expected to post only single digit growth in the coming years, to reach about RMB 192.4 billion (US$28.17 billion) by 2020.

Given China’s growing affluent consumer base and a push from the government to be a more active nation, there are no signs that the country’s fitness industry will slow down anytime soon.

Fitness clubs, multipurpose gyms: China joins the workout lifestyle trend

In 2001, the Chinese gym-goer was limited to roughly 500 options for training facilities across the nation. Today that number has grown massively, to over 37,000 gyms.

According to a report from the China Business Research Academy, gym memberships in China reached 6.6 million in 2016 – double the amount of memberships from 2008. In Tier 1 and Tier 2 cities, around five percent of the population is actively working out in gyms.

Many foreign franchise giants already have plans to enter the market or expand existing operations. For example, in June 2017, the US-based Anytime Fitness announced plans to establish 500 new gyms in China over the next several years.

Multipurpose or boutique style gyms are also popping up more frequently, breaking the mold of the classic large, franchised gym. The Chinese consumer is shifting towards a gym where they can specialize in a certain exercise, like yoga, CrossFit, or Pilates.

With these smaller, specialized gyms comes a heftier price tag. In Shanghai, one spinning center with a club-style atmosphere – flashing lights and loud music – charges an annual membership fee that costs RMB 22,000 (US$3,221). Another boutique studio offers a monthly pass for unlimited classes that rings up at just under RMB 2,000 (US$293).

These premium boutique fitness centers are doing well, as indicated by their plans to expand into more Chinese cities. The willingness of the Chinese consumer to pay these prices can be linked with the millennial desire to show off to their peers on social media – fitness memberships are viewed as being luxurious and a status symbol.

Outside of the gym, running has taken off, with the number of marathons growing from just 22 in 2011 to over 400 in 2017. In 2016, 2.8 million runners attended a marathon in China, nearly doubling from the 1.5 million runners in 2015.

Market for fitness apps, wearable devices

In August 2017, China’s top fitness app, Keep, reported that it had reached 100 million users in China, compared to 23 million in the US and 20 million in Europe. The app allows users to create custom workout programs so you can work out anytime, anywhere – all while connecting with your friends to share and comment on their workouts and progress. Keep reported that over 23 percent of its users live in Beijing, Shanghai, Shenzhen, Guangzhou, or Chengdu – five of China’s largest cities – and that 77 percent of users are under the age of 35.

An app of this type falls under the broad umbrella of the internet sports industry, which also includes sectors such as sports live streaming, e-sports events, and sporting goods e-commerce.

In August 2017, a study revealed that the internet sports industry in China, while still in its early stages, had reached over 350 million users. Consequently, it has seen a huge surge in venture capital interest, with investments growing 164 times to reach RMB 65.5 billion (US$9.83 billion) between 2013 and 2015.

Projections for 2018 show that the fitness app and wearable device industry could generate over US$6.5 billion in revenue in China, far surpassing the US – the next largest market – by over a billion US dollars. Revenue growth in the industry is expected to grow by three percent per year, resulting in a volume of US$4.1 billion by 2022, according to Statista.

In 2017, Xiaomi’s fitness tracker had 17 percent of the industry’s global market share, overtaking Apple and Fitbit. This despite the fact that 95 percent of its sales were from China.

Lifestyle preferences boost fitness apparel industry

With so much more time being spent at the gym, it is only natural that the activewear industry in China is reaping the benefits as well.

Chinese consumers are embracing changing trends and want the latest sportswear outfits to go with their new fitness regimes. In fact, activewear is outperforming the broader apparel industry in China – in 2016, sales of activewear grew 11 percent, while apparel overall rose by just five percent.

International giants, such as Nike and Adidas, share the lead for the brand share of China’s sportswear market, and both reported double digit sales growth in China last year.

These brands are seen as fashion items as much as fitness items, though, so the door is still open for more purely functional fitness brands to enter more niche markets.

Investing in China’s expanding health and wellness market

China has the right combination of factors – 415 million millennials, a growing middle class that is willing to spend money on fitness and health related products, and government investment in sports – for fitness centers, fitness accessories, and activewear brands to grow for years to come.

Foreign investors have room to carve out different niche areas, such as catering to novelty-craving urbanites by focusing on specialized, tailored gyms or making and retailing activewear lines that allow the wearer to express their personality.

Fitness centers can benefit from allowing their gym-goers to seamlessly share their workouts on their social media accounts – satisfying the Chinese consumers’ need to share – while also growing the brand awareness of the gym.

Fitness apps should gear towards making exercise fun, goal-oriented, and should be able to be linked to the user’s wearable fitness tracking device.

Companies making devices and apps that keep records on their users on their fitness journey – from their weekly workouts completed to their daily number of steps taken – hold a treasure trove of data that can be mined for its consumer market research. Such real-time feedback data could propel their growth and innovation as gadget makers.

Investors can thus bank on the fitness craze to accelerate in China as its young and affluent populations continue to seek healthier and self-fulfilling lives – mirroring global trends today.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Hong Kong High-Speed Rail Connecting with Mainland China Opens September 23

- Next Article Export Tax Rebates in China Increase for 397 Products