How China Taxes International Sport Events and Foreign Athletes

By Ines Liu

More and more high-level sporting events are being held in China. This year, the NHL and the NBA held exhibition events in China, while the country’s own sporting events – such as the Shanghai Masters tennis tournament and the Formula 1 Chinese Grand Prix – are gaining more prestige internationally. Beijing will hold the Olympic Winter Games in 2022 after successfully hosting the Summer Games in 2008.

Besides these high-profile events, there are innumerable smaller ones being held across the country. These events, however, are subject to unique tax treatment in China. This article explores the tax requirements of foreign sporting events companies and the taxation of foreign athletes in China.

Taxation of foreign sporting event companies

Foreign sporting event companies entering into China, by law, require a partnership with a licensed Chinese event promotion company. As part of the relationship, the foreign sporting event company must authorize a licensed Chinese promoter to use its branded products and to dispatch personnel to manage and monitor the local events for a certain period.

Tax on brand authorization

An authorization allows Chinese promoters to host games in China in exchange for a fee. By definition, if the payment is made in relation to the use of intellectual property, such as patents, copyrights, trademarks, and proprietary technology, it would be regarded as a royalty.

When the Chinese promotion company remits the payment to the foreign sporting event company, the royalty received by the foreign sporting event company is subject to value-added tax (VAT) and its surcharge. Furthermore, the foreign sporting event company is also subject to a withholding tax on its China-sourced royalty incomes.

Tax on other management-related services

When a foreign sporting event company provides services to a Chinese promoter in China, as a general principle, when either the service recipient or the service provider is located within China, the foreign event company will bear the VAT. Thus, the foreign event company will be subject to VAT and its surcharges be subject to VAT and its surcharges, regardless of the physical location where services are actually rendered.

As a note, pursuant to China’s Double Tax Agreements (DTAs) with other countries, foreign sporting event companies should also manage to mitigate permanent establishment (PE) risk to avoid or reduce the risk of unexpected tax payments.

![]() RELATED: Why is China’s Tax System so Complex?

RELATED: Why is China’s Tax System so Complex?

Taxation of foreign athletes’ income

Here, we analyze how VAT, corporate income tax (CIT), and individual income tax (IIT) apply to three different categories of foreign athletes in China:

- Freelance foreign athletes

- Foreign athletes with agents

- Foreign athletes with club employment contracts

Endorsement income

VAT

Endorsement income is characterized as a “service income”. VAT does not apply if the income is not considered China-sourced income. Pursuant to China’s VAT regulations, the taxation scope is the sale of services in China, meaning that either the service provider or the service recipient is located in China. Therefore:

- No VAT will be due if the athlete is a foreign national

- VAT will be applicable if the athlete is a Chinese national

For freelance foreign athletes, if the endorsement fee is less than RMB 30,000 (US$4,540), the endorsement fee is exempt from any VAT payments.

CIT

Pursuant to China’s CIT regulations, for income derived from the provision of services, the source shall be determined according to the location of the services. Therefore, a portion of endorsement income may be deemed as China-sourced income for foreign athletes’ activities in China.

However, under most of China’s DTAs with other countries, the business profits of a company from a contracting state shall not be taxable in China unless it carries on its business through a PE situated in China. The provision of services will constitute a PE only if it lasts for more than 183 days or six months within any 12-month period.

For a service project that lasts for more than one year, the 183 days or six months will be calculated on a rolling basis. If the threshold is met within any 12-month period, all the services performed for the same or connected project shall be regarded as a PE.

IIT

If foreign athletes attend a sporting event, and they have resided in China for over 183 days, they are subject to individual income tax (“IIT”), since the income is derived from the activities carried out in China. This is the case regardless of whether the endorsement is from a Chinese company or an overseas one.

If foreign athletes stay in China for less than or equal to 183 days, and the endorsement fee comes from an overseas company, they may file for a treaty benefit at the relevant tax bureau for IIT exemption under the protection of a DTA. However, if a Chinese company pays the endorsement fee, IIT will be levied because there is no DTA involved.

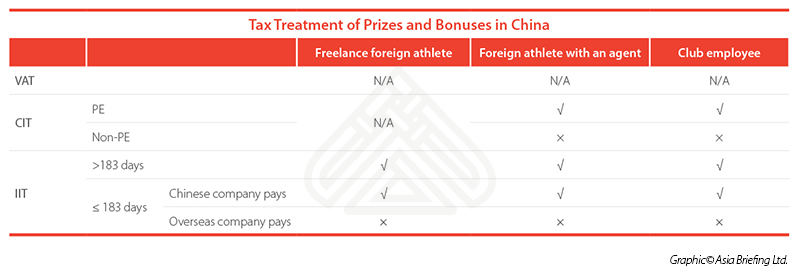

Tax treatment of prizes and bonuses

VAT

A prize or bonus won by an athlete is considered contingency income. Therefore, no VAT will be applied to such income.

CIT

Similar to the tax treatment of endorsement fees, pursuant to China’s CIT regulations, a portion of a prize, gift, or award may be deemed as China-sourced income for foreign athlete’s activities in China.

However, under most of China’s DTAs with other countries, no CIT burden will apply if a foreign athlete’s agent or club physically stays in China for less than 183 days or six months within any 12-month period.

IIT

For such contingency income, an IIT rate of 20 percent will also be levied, in accordance with relevant DTAs.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Optimizing your tax obligations

International sporting event companies and foreign athletes face unique tax issues in China. Sporting events in China are often held irregularly and only for short periods of times, and frequently take place in multiple locations. Further, the companies organizing such events and the athletes themselves often do not have significant experience in China.

Companies and athletes participating in China-based sporting events have several tax issues to consider to optimize their tax burdens. Strategically planning the location and timeframe of activities, as well as leveraging relevant DTAs, can reduce the total costs of a sporting event and ensure compliance in an unfamiliar environment.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

In this issue of China Briefing magazine, we provide foreign investors with best practices for implementing internal controls in China. We explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes.

- Previous Article A China-US Trade War: Good News for Asia

- Next Article Hong Kong Finalizes FTA with ASEAN, DTAA with India