Q&A: Investing in China’s Elderly Care Industry

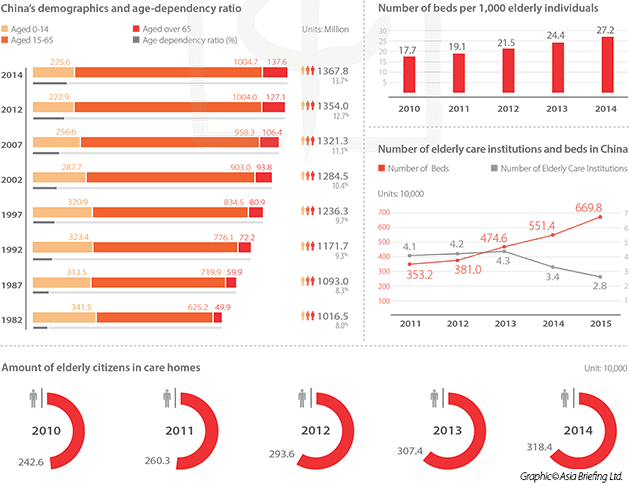

In the coming years, China’s health care sector will be one of the largest business sectors of the Chinese economy. Within health care, the elderly care industry is turning out to be one of the most dynamic areas of investment. As the number of senior citizens in China is expected to grow from current 220 million to 400 million by 2050, China’s domestic institution will be largely unable to cater to the increasing demand for elderly services. This combined with a developing incentive framework in place, opportunities for foreign investment in elderly care abound.

In this article, we aim to answer some of the most commonly asked questions regarding investing in China’s growing elder care industry.

Q: Why is the elderly care services industry a very attractive investment for foreign investors?

A: The demand for elderly care services has surged in recent years. As a result, we are now faced with the issue that, because of lack of experience, expertise and infrastructure the supply of elder care services in China has not been able to keep up with the demand. Consequently, it can be seen that the elderly care services industry is a very lucrative sector for foreign investors who hold the necessary skills.

Q: What will be some of the obstacles when entering the Chinese elderly care market?

A: Cultural outlooks, unclear policies and regulations, and high operating costs are significant barriers to investors’ success. The filial piety of Confucianism which results in a stigma against sending the elderly to a nursing home and the priority of education for the younger generation, still act as cultural barriers in the market. Also, low respect for nursing professionals as well as a lack of professional training institutions pose challenges for investors who try to penetrate the market. In addition, despite the government incentives available, lack of consistency between the legislative agencies and administrative agencies might make it more difficult for investors to qualify for the incentives.

![]() RELATED: Find more Q&As on Dezan Shira’s Knowledge Sharing Platform

RELATED: Find more Q&As on Dezan Shira’s Knowledge Sharing Platform

Q: What are the supportive policies applied to foreign investors who try to enter the elderly care services industry?

A: For-profits elderly care institutions are entitled to a range of different incentives while non-profit establishments are eligible for greater tax support. Some of the preferential policies include value added tax exemption, administrative fees reduction and favorable utility prices.

Q: What are the steps required to open a for-profit elderly care institution for foreign investors in China?

A: There are roughly four steps involved: obtaining foreign investment approval from the provincial level commerce department, registering with the relevant industry & commerce authority, applying for an elderly care institution establishment permit from the Ministry of Civil Affairs, and complying with additional procedures if necessary.

As with most emerging industries in China, investing in the country’s elderly care services doesn’t come without challenges. Unique cultural considerations, an immature labor pool, and an unclear standard for FDI create a near perfect storm of risks that can easily cripple a foreign business before it gets off the ground. Conducting a thorough due diligence is unquestionably essential prior to market entry.

For additional information on investing in China’s elderly care industry, see more questions and answers on Dezan Shira & Associates’ Knowledge Sharing platform or read the May 2016 issue of China Briefing magazine – China Investment Roadmap: the Elderly Care Industry.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

China Investment Roadmap: the Elderly Care Industry

China Investment Roadmap: the Elderly Care Industry

In this issue of China Briefing magazine, we present a roadmap for investing in China’s elder care industry. We provide the latest market research, detail the procedures and benefits for foreign direct investment, and examine the main barriers and risks that foreign companies are likely to encounter when entering the market.

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, explores the establishment procedures and related considerations of the Representative Office (RO), and two types of Limited Liability Companies: the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV). The guide also includes issues specific to Hong Kong and Singapore holding companies, and details how foreign investors can close a foreign-invested enterprise smoothly in China.

An Introduction to Doing Business in China 2016

An Introduction to Doing Business in China 2016

Doing Business in China 2016 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates in June 2016, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies who already have a presence here and want to keep up-to-date with the most recent and relevant policy changes

- Previous Article The Complexity of Transfer Pricing for Intercompany Services

- Next Article The Practicalities of Buying Real Estate in China