The Practicalities of Buying Real Estate in China

By Daniel Schaefer

In an effort to encourage foreign investment in its real estate sector – particularly in second tier cities – China released an adjustment lifting the limit on the amount of properties a foreign entity can own in August last year. Since implementation, there has been a marked increase in foreign entities buying properties in the country, but there are still a number of unique regulations and local house quota restrictions in place that can hinder attempts to enter the market.

Ownership of real estate and land

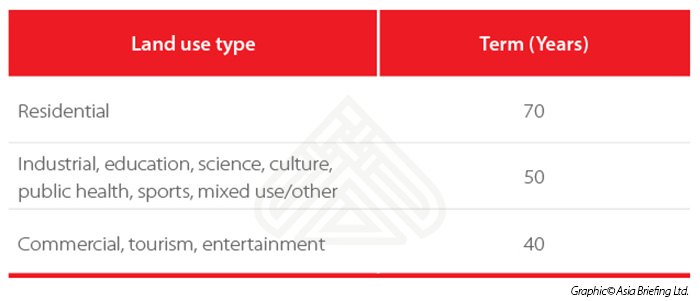

In China, the ownership of real estate and land usage rights are two separate things. While the land usage term is limited, as stipulated in relevant laws, the ownership of real estate is not limited. China practices ‘socialist public’ ownership of all land, meaning that it is technically impossible for any one person/organization to own land. When one purchases real estate in China, they are actually leasing land usage rights that will eventually expire in a fixed amount of years. Land right terms depend on the manner in which the land will be used, as follows:

Obtaining land usage rights allows the owner to manage the land however they choose (build houses and buildings, exchange land, inherit, pledge, put up as collateral, etc.), though true ownership belongs to the state, which maintains the right to withdraw the land leasing rights mid-term. In this case, a tenant will be compensated accordingly. If the land usage rights is transferred to a new owner, it does not reset the terms of the original lease, meaning that the original land usage contract expiration date still applies. When the land usage term expires, the real estate owner may be required to pay the land usage price again, according to the market price of land at that time. However, it is also possible that the land usage term could be renewed automatically.

RELATED: Market Entry Advisory Services from Dezan Shira & Associates

RELATED: Market Entry Advisory Services from Dezan Shira & Associates

Mortgages

Though paying for real estate upfront is generally the easier option for foreign individuals, it is possible to get a mortgage in China. Before applying for a mortgage, a foreign national must have been employed on a work visa in the city where one seeks to purchase property for at least one year, and have a Chinese sponsor (generally an employer) who is able to guarantee that the applicant’s income is sufficient to repay the loan.

Once the requirements have been met, the application for the mortgage can begin. To be approved for a mortgage, the applicant must submit several pieces of documentation, including passport, residence permit, certification of marital status, proof of employment, proof of tax payment, labor contract, and company business license. Upon approval, applicants may take out the loan at the same interest rates as Chinese citizens. However, the duration of the mortgage loan cannot be longer than the validity of the applicant’s passport, thus it is usually advised to renew one’s passport before applying for a mortgage.

Purchasing real estate

When the appropriate funds have been gathered and a property has been chosen, then the application process can be started. It is recommended to go through an agent as they can help sort through any possible problems that may arise. It’s also important to conduct due diligence in the region where property is being purchased, as policies and regulations vary from region to region. The application process includes:

- Submit an offer letter, which will include price, payment schedule, and all other details. Once the offer is accepted, a deposit of one percent of the purchase price is required.

- The legal representatives carry out checks on the property and owner. Once complete, the applicant must receive the approval from the government and Public Security Bureau to proceed.

- The buyer and seller draft an “Official Sales Contract” which the buyer must notarize. After the contract has been notarized, the buyer pays the seller 30 percent of the purchase price.

- An application is given to transfer the deed from the owner to the buyer. The owner must first pay off any expenses that are on the property such as loans and taxes before proceeding to transfer the deed. After the deed has successfully been transferred, the buyer pays the remaining 70 percent, and the purchase is then complete.

Takeaways

Purchasing real estate in China can be a complex procedure. Eligibility requirements for both acquiring a mortgage and buying real estate are numerous, making it important for investors to be aware of the practicalities of doing so and, particularly, the differences between owning real estate and land ownership rights in China.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

China Investment Roadmap: the Commercial Real Estate Sector

China Investment Roadmap: the Commercial Real Estate Sector

In this issue of China Briefing, we explore the latest trends in commercial real estate in China, and discuss how foreign companies can benefit from China’s massive construction boom. We provide a guide to how firms can sell construction materials in China, and finally detail how foreign architects can most effectively enter and take advantage of China’s rapid urbanization.

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Human Resources and Payroll in China 2016-2017

Human Resources and Payroll in China 2016-2017

A firm understanding of China’s laws and regulations related to human resources and payroll management is absolutely necessary for foreign businesses in China. This edition of HR and Payroll, updated for 2016/17, navigates China’s laws and regulations related to HR and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China.

- Previous Article China Regulatory Brief: Adjusted Maternity Leave in Guangdong and Cancelled Consumer Tax for Cosmetic Products

- Next Article Better Together: Assessing the Potential of Crowdfunding in China