China Household Appliances Market: Consumption Trends, Policy Support, and Investment Opportunities

The State Council recently approved a series of measures to boost consumption in China’s household appliances market. As the policy move is intended to stimulate overall economic growth, by accelerating domestic demand and manufacturing activity, this article offers an overview for foreign investors keen to do business in this sector.

In a State Council executive meeting chaired by Premier Li Qian on June 29, 2023, a key agenda was the discussion and approval of measures aimed at promoting household consumption, particularly in the realm of household appliances. Following this, the State Council adopted the Measures on Promoting Household Appliances Consumption (关于促进家居消费的若干措施).

In this article, we discuss trends in China’s household appliances market and enabling policy initiatives.

This is important information for foreign investors seeking to enter the Chinese market or tap into specific segments based on customized tech-based innovation. Understanding consumption trends and aligning with the country’s growth goals will give investors and foreign companies an edge in the Chinese market.

Why does the China government want to promote the consumption of household appliances?

Household appliances constitute a vital component of consumer spending, playing a crucial role in improving living standards and enhancing convenience. These appliances span a wide range of categories, encompassing major appliances like air conditioners and refrigerators, as well as small appliances, such as kitchen gadgets and personal care devices. Their significance extends beyond individual households, as the growth and performance of the household appliances market have substantial implications for the broader economy.

As consumers upgrade their living conditions and seek greater convenience, the demand for household appliances increases. Purchasing appliances, such as air conditioners, refrigerators, washing machines, and kitchen gadgets, not only satisfies immediate needs but also encourages additional spending on related products and services. This surge in consumer spending generates positive ripple effects throughout the economy, stimulating production, employment, and business activities.

Additionally, this market is a key sector within China’s manufacturing industry. The production and sales of household appliances contribute to industrial output, supporting employment and income generation.

Lastly, with the rise of smart appliances, energy-efficient models, and customizable options, the industry is experiencing a transformation driven by technological progress. Manufacturers investing in research and development to create innovative, environmentally friendly, and user-friendly appliances not only cater to consumer demands but also enhance the competitiveness of Chinese enterprises in the global market.

Ever since China reopened its borders post-pandemic and refocused on economic growth, Chinese authorities have been emphasizing support for purchases of items like new energy vehicles (NEVs) and home renovations to spur consumption. While auto consumption, particularly NEVs, has seen improvements, consumption of household appliances has been comparatively sluggish.

This calls for special attention to be given to the home improvement sector, as Chinese policymakers hope that a rebound in household demand will stimulate growth across the entire supply chain, benefiting raw material firms, manufacturers, retail outlets, and downstream service providers.

What are the measures proposed to promote household appliances consumption?

A key focus is to create a favorable policy environment that supports the consumption of household appliances. The policies introduced in the State Council measures are supposedly designed to align with other initiatives, such as the renovation of old residential areas, the adaptation of housing for the elderly, the development of convenient living communities, and the improvement of waste material recycling networks.

The government believes that coordination among these policy initiatives will cumulatively promote consumption.

While not specifically detailed in the State Council meeting readout, the measures recognize the shift of consumer preferences in the household appliances sector towards quality, green, intelligent, and personalized products. As such, the government encourages companies to provide more personalized and customized household products, which will enhance Chinese consumers’ willingness to purchase and contribute to improving their quality of life.

Will the proposed measures lead to big rebound in the household appliances consumption?

The implementation of measures aimed at promoting household appliance consumption carries with it significant economic implications, but we must take a more balanced view.

It is crucial to note that the main driver of housing-related spending is new home sales. Without a sustained recovery in the China property market, the impact of new measures aimed at stimulating consumption in the household appliances sector will be limited. It’s yet to be seen whether China’s policymakers will consider the broader economic factors and address the potential barriers to consumer spending in the housing market.

China’s household appliances market at a glance

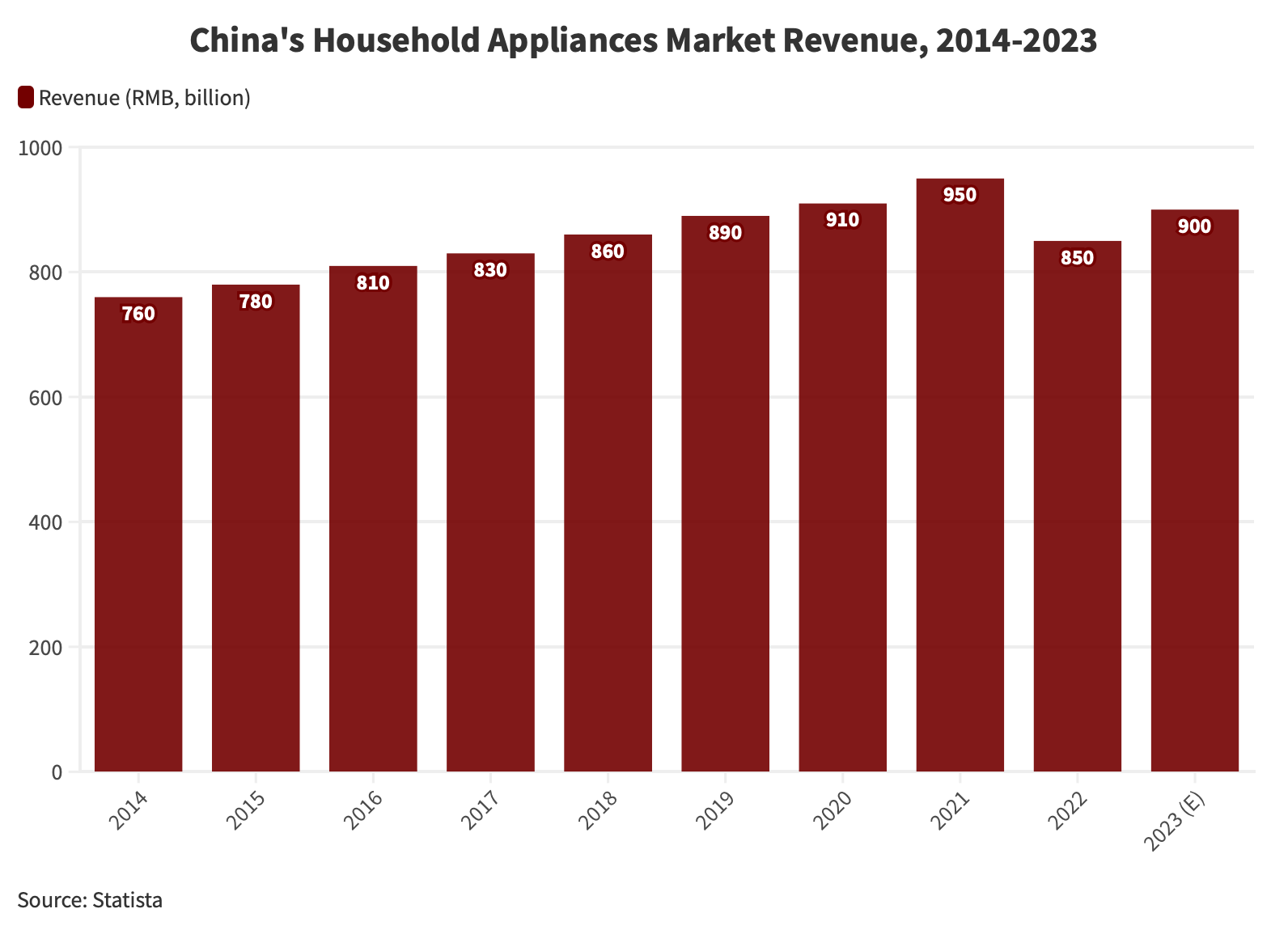

In 2022, the combined revenue generated by these sectors in China reached RMB 850 billion (US$177.70 billion), and it is projected to rise to RMB 900 billion (US$124.63) in 2023. China has consistently held the position of top revenue-generating country in the global household appliances market, and this trend is expected to continue.

Nevertheless, the country witnessed a decline of 10.2 percent in market revenue during 2021-2022. The downturn can be attributed to sluggish consumer spending power and instability in the real estate sector.

Moreover, when adjusted for inflation, China’s per capita consumption expenditure only experienced a modest increase of 1.5 percent between 2021 and 2022.

Trends and foreign investment opportunities in China’s household appliances market

Recent developments indicate a positive outlook for China’s household appliances market. The relaxation of Covid-related restrictions, coupled with the new measures and those previously introduced in 2022 by China’s Ministry of Commerce, are expected to stimulate market growth.

All in all, investors and businesses can take advantage of the following trends:

- Health focus and multifunctionality: Chinese consumers prioritize health and well-being, leading to increased interest in health-related appliances. The trend of living alone has also fueled demand for multifunctional appliances that optimize space and functionality.

- Rise of smart small appliances: Automation and AI technology advancements have propelled the growth of smart small appliances. Robotic vacuum cleaners, smart kitchen appliances, and personal care devices are gaining popularity among tech-savvy consumers.

- Online sales dominance: E-commerce channels have become the primary platform for household appliance sales in China. Businesses can leverage online platforms to expand their reach, strengthen their online presence, and target a wider customer base.

- Sustainability and energy efficiency: Consumer awareness of environmental issues and government initiatives have increased the demand for energy-efficient appliances. Investing in eco-friendly and energy-saving appliances aligns with consumer preferences and contributes to a greener future.

By embracing these trends and seizing the investment opportunities, foreign enterprises and investors can thrive in China’s dynamic household appliances market. With a focus on innovation, sustainability, and catering to evolving consumer demands, companies can position themselves for success in this rapidly evolving industry, which is presently supported by state policy initiatives.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Monthly Tax Brief: June 2023

- Next Article Liberando el potencial de la economía plateada en China