Closing Your China Bank Accounts During Company Deregistration: New Instructions and Tips

The People’s Bank of China (PBoC) has circulated guidance pertinent to the closing of China bank accounts by a company during the deregistration process. We examine the new instructions and discuss best practices for foreign companies to avoid non-compliance, unnecessary delays, or getting blacklisted in the Chinese banking system.

Foreign investors may decide to close and deregister their business for multiple reasons. To legally close a business in China, investors need to go through a series of procedures to liquidate and deregister the company, which involves dealing with multiple government agencies, including the respective market regulatory bureaus, foreign exchange administrations, customs, tax departments, and banking authorities, etc. Among others, closing bank accounts is one of the last few steps that investors must cautiously deal with. If not properly managed, investors or overseas shareholders may suffer unnecessary loss and face potential compliance risks. In this article, we introduce some recent developments for closing bank accounts in China during the business deregistration process and share our on-the-ground experience in dealing with corresponding procedures.

What are the recent developments in China that impact bank account closure?

A company may have multiple bank accounts, such as the RMB basic account, the RMB general account(s), the foreign currency capital account, and the foreign currency settlement account, and so on.

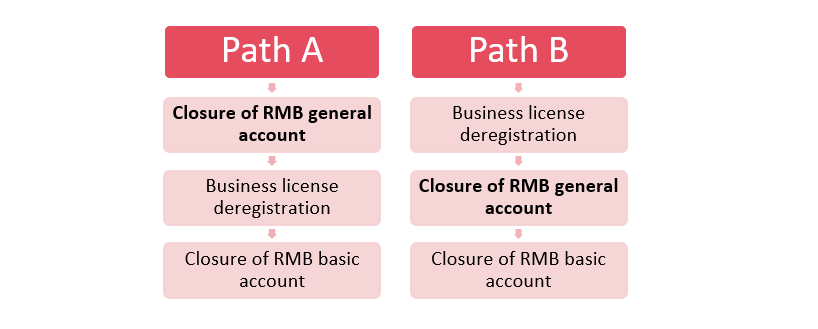

When finalizing the closure of bank accounts during company deregistration, the RMB basic account must always be the final account to be closed as it is the company’s primary account and is most closely monitored by the People’s Bank of China (PBOC). However, the closure of the RMB general account used to be more flexible in terms of timing and procedure. Previously, both the following two paths were manageable: If circumstances prevent the closure of the RMB general account, such as challenges in delivering the legal representative’s passport to the bank in China, an alternative approach for the company could involve prioritizing the deregistration of the business license first to save time. Subsequently, the bank typically consents to the closure of the RMB general bank account since the account holder (i.e., the deregistered company) no longer maintains its existence. Nonetheless, recent instances of company deregistration have revealed certain internal protocols, as opposed to openly available regulations, which the PBOC has circulated to local commercial banks:

If circumstances prevent the closure of the RMB general account, such as challenges in delivering the legal representative’s passport to the bank in China, an alternative approach for the company could involve prioritizing the deregistration of the business license first to save time. Subsequently, the bank typically consents to the closure of the RMB general bank account since the account holder (i.e., the deregistered company) no longer maintains its existence. Nonetheless, recent instances of company deregistration have revealed certain internal protocols, as opposed to openly available regulations, which the PBOC has circulated to local commercial banks: Tips on managing bank account closure in China during business deregistration

Given the circumstances outlined above, it is advisable for companies to meticulously verify the following details prior to initiating the deregistration process:

- Does the company maintain accounts with multiple banks?

- Are there any remaining balances within these bank accounts?

- Are there any instances of a frozen RMB general account, resulting in the inability to transfer its balance?

If the answers to the above questions are ‘Yes’, then companies are strongly advised to focus on the following key aspects:

- Addressing any anomalies tied to the abnormal bank accounts to reinstate transaction functionality before initiating the business license deregistration process.

- Ensuring that all banking transactions, encompassing not only the settlement of outstanding fees (such as rent, service charges, etc.) but also the receipt of payments, are satisfactorily completed before embarking on the business license deregistration.

- Confirming that the balances within all RMB general accounts have been fully transferred out prior to the business license deregistration.

If all these aspects have been properly managed, then in theory the RMB general accounts can be closed after deregistering the business license. However, to avoid any unnecessary risks, we still suggest companies ensure that all RMB general accounts have been properly closed before deregistering the business license.

Dezan Shira & Associates’ legal and finance professionals have rich on-the-ground experience in dealing with HR, tax, bank account, and other issues during the business closure process. To arrange a free consultation, please contact China@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article A Brief Guide to Hong Kong Company Audits

- Next Article China Annual (One-Off) Bonus: What is the Income Tax Policy Change?