China’s Auditing, Accounting, and Tax Services Industry

China’s auditing, accounting, and tax services industry caters to a thriving market fueled by the country’s rapid economic growth and increasing demand for professional services. In this article, we explore the opportunities and challenges that foreign firms have in this space.

The auditing, accounting, and tax services industry in China has undergone significant transformation in the last decade, driven by the country’s rapid economic growth and the increasing demand for professional services.

This article provides insights into the opportunities and challenges facing foreign firms seeking to operate in this dynamic and rapidly growing market.

China’s auditing, accounting, and tax services industry

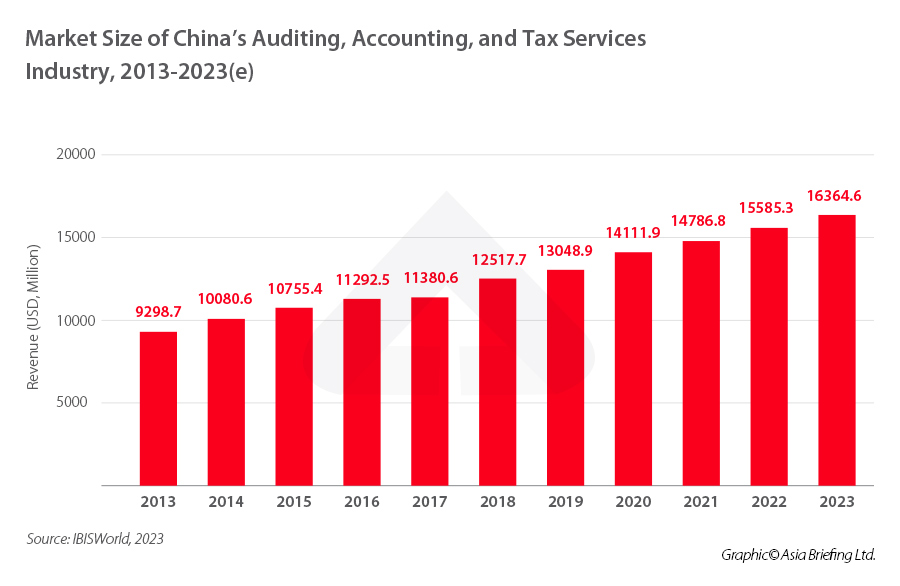

China’s auditing, accounting, and tax services industry reached a revenue of RMB 113.8 billion (US$16.4 billion) in 2020. The number of firms operating in this sector rose from 107,764 in 2015 to 136,200 in 2019, representing a growth rate (CAGR) of 26.3 percent.

In 2022, the industry was expected to reach US$15.6 billion, with a projected CAGR of 6.5 percent between 2017 and 2022.

Market share and players

The auditing and accounting industry in China is highly competitive, with several domestic and international firms vying for market share. The ‘Big Four’ international accounting firms – Deloitte, PwC, EY, and KPMG – have a significant presence in the Chinese market, but they face strong competition from domestic firms, such as Ruihua Certified Public Accountants and ShineWing Certified Public Accountants.

According to a 2020 report by the China National Institute of Standardization, the market share of the Big Four firms in China’s auditing industry was around 24 percent, with domestic firms accounting for the remaining 76 percent.

Foreign players

The industry is dominated by the Big Four: these firms have a significant market share as they are often preferred by multinational companies and larger Chinese firms for their global reach, industry expertise, and reputation. In addition to audit and assurance services, these firms also offer a range of consulting services, such as risk management, transaction advisory, and digital transformation.

In addition to the Big Four, there are a number of other foreign accounting firms operating in China, including Grant Thornton, BDO International, and Crowe Global. These firms have a smaller market share but still, play a significant role in the industry.

Foreign accounting firms in China face several challenges, including regulatory restrictions on their operations and competition from domestic firms. In recent years, the Chinese government has implemented measures to strengthen the regulatory environment for auditing and accounting services, which may lead to increased scrutiny of both domestic accounting firms and foreign firms operating in China. Despite these challenges, foreign accounting firms are likely to continue to play a significant role in China’s auditing, accounting, and tax industry, particularly in serving multinational clients and in providing expertise in specialized areas, such as cross-border transactions and financial reporting.

Domestic players

Domestic players in China’s auditing, accounting, and tax industry have grown significantly in recent years, and several large firms now compete with the Big Four international firms. ShineWing, for example, is a domestic accounting firm that has expanded rapidly in recent years, with over 8,000 employees across China and offices in more than 100 cities. The firm offers a range of services, including accounting and auditing, tax advisory, and consulting. In addition to its domestic operations, ShineWing has also established partnerships with accounting firms in other countries to offer cross-border services.

Another major domestic player in China’s auditing and accounting industry is Ruihua Certified Public Accountants. Founded in 1987, Ruihua has become one of China’s largest accounting firms, with over 15,000 employees and offices in more than 60 cities. The firm provides various services, including audit and assurance, tax advisory, and financial advisory services. In recent years, Ruihua has also expanded into consulting services, offering clients advice on issues such as corporate strategy, risk management, and digital transformation.

Asian accounting firms in China are also attractive to some clients because they better understand local business practices and scope of regulations. They are able to offer services at a lower cost than large international firms, and can assist with operations across multiple jurisdictions with similar ease. For example, service players like the pan-Asia Dezan Shira & Associates can provide customized solutions for accounting, management audit, and tax compliance and operations advisory throughout the enterprise’ business lifecycle. They have locally based teams that bring with them an expert understanding of the China market on one hand, and knowledge of the operations and business practices of multinational firms, on the other. Alongside being cost competitive, such firms are also familiar with the application of technology and software to streamline business processes and manage back-office functions.

Industry trends

There are several industry trends shaping the competitive landscape of the accounting, audit, and professional service sectors in China. These include the increasing demand for digital transformation services, the growth of sustainable investing, and the adoption of new technologies, such as blockchain and artificial intelligence (AI).

Increasing demand for digital transformation services

One major trend shaping the accounting, audit, and professional service sector in China is the increasing demand for digital transformation services. As companies move towards digitalization, there is a growing need for professional services that can help businesses adapt to this new landscape. This includes services, such as cloud computing, cybersecurity, and data analytics.

For example, PwC China has launched its “Digital Accelerator” program to help businesses implement digital transformation strategies and improve their operations through the use of technology.

Sustainable investing

Another trend that is shaping the industry in China is the growth of sustainable investing. As investors become more aware of the impact of their investments on the environment and society, there is a greater demand for professional services that can provide guidance on sustainable investing. This includes services such as ESG (Environmental, Social, and Governance) reporting, impact investing, and sustainability consulting.

For instance, Deloitte China has established a dedicated Sustainability Advisory team to help clients integrate sustainability considerations into their business strategies and operations.

Adoption of AI-powered technology

The adoption of new technologies, such as blockchain and AI, is also reshaping the accounting, audit, and professional service sectors in China. These technologies have the potential to transform the way businesses operate and interact with their customers, suppliers, and stakeholders.

For example, KPMG China has launched a blockchain-powered platform called “Digital Credit” that enables banks and other financial institutions to access credit information from multiple sources in a secure and efficient manner.

Regulatory environment

China’s regulatory environment for accounting, auditing, and professional services is complex and constantly evolving. The industry is overseen by a number of regulatory bodies, including the Ministry of Finance (MOF), the China Securities Regulatory Commission (CSRC), and the State Administration of Taxation (STA), among others. These bodies are responsible for setting standards, regulating activities, and enforcing compliance in the sector.

It has been challenging for foreign investors in this area to navigate the country’s regulatory environment, which can be subject to frequent changes. For example, in 2012, multiple ministries including the MOF jointly issued a new regulation that require Chinese-foreign cooperative accounting firms to transform and localize their operations. Under the regulation, after the five-year transitional period (around 2017), these foreign accounting firms need to have at least 80 percent locally licensed partners (i.e., those holding Chinese CPA certificates) in order to continue offering audit services to Chinese companies. This move was seen as a way to increase oversight and transparency in the industry, but it also posed challenges for foreign firms that had to reduce the ratio of overseas partners who do not have CPA qualifications in China from around 50 percent to below 20 percent.

Another issue facing foreign investors is the challenge of complying with local regulations and standards. China has its own set of accounting and auditing standards that differ from those used in other countries. Additionally, the country has a complex tax system that requires careful management and compliance. Foreign investors need to be prepared to invest in building local expertise and understanding local regulations and standards in order to succeed in the market.

Despite these challenges, the Chinese government has been taking steps to liberalize the sector and attract foreign investment. In April 2021, the CICPA issued the Development Plan of Accounting Sector in China (2021-2025) to encourage the development of the accounting and auditing industry, while also calling for further opening up of the market to foreign investment.

These latest developments signal a growing recognition of the importance of the industry to the country’s economy and a willingness to work with foreign investors here.

Other challenges and tips for foreign investors

One of the main challenges facing foreign investors in the tax, audit, and accounting services industry is the dominance of established firms. The Big Four already have an entrenched market share. This can make it difficult for newcomers to compete, particularly in areas where local expertise and connections are critical. However, there are still opportunities for foreign investors to carve out a niche in the market by specializing in specific areas or by providing differentiated services or SaaS-supported services.

Indeed, to succeed in China, foreign stakeholders need to be prepared to invest in building relationships and local expertise. This may involve hiring local staff with deep knowledge of China’s regulatory environment, as well as developing partnerships with local firms to gain access to key clients and markets.

Additionally, foreign businesses and investors must be sensitive to cultural differences and local business practices, which can vary significantly from their home countries.

To learn more about China’s auditing, accounting, and tax services sector, feel free to reach out at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article What to Expect from China’s 2023 Two Sessions and Government Work Report

- Next Article China Takes Steps to Empower Women: Latest Developments in Women’s Protection Law