The China-Iran 25-Year Cooperation Agreement: What is it and Should Investors be Encouraged?

We take a look back at the China-Iran 25-Year Cooperation Agreement, signed on March 27, 2021, and its implications for the status quo.

China and Iran signed a 25-year strategic cooperation agreement on March 27, 2021, addressing economic issues amid crippling US sanctions on Iran.

The deal was reached on the 50th anniversary of the establishment of diplomatic relations between China and Iran and hailed as a major step forward that will see China invest US$400-600 billion into the Iranian economy.

The deal was originally proposed in 2016, when the Islamic Republic of Iran and the People’s Republic of China issued a joint statement on comprehensive strategic cooperation between the two countries and agreed to sign a plan for comprehensive cooperation.

After rounds of consultations and negotiations, Iran’s Foreign Minister Mohammad Javad Zarif and the Chinese Foreign Minister Wang Yi signed the “Comprehensive Cooperation Agreement between the Islamic Republic of Iran and the People’s Republic of China” (the Agreement) on March 27, 2021.

What’s in the agreement?

The details of the deal remain murky, and is thought to involve the exchange of cheap Iranian oil in return for Chinese help in building telecommunications networks, hospitals, and underground railways etc. Meanwhile, China has been developing Gwadar port under the China-Pakistan Economic Corridor (CPEC) project, which is part of the Belt and Road Initiative (BRI).

Timeline

Major provisions

By far, the final details of the Agreement have yet to be officially announced. Some analysts believe this may be strategic and due to ongoing US sanctions on Iran. Besides, the Agreement is just a framework and has no binding authority. Thus, it does not need to be approved by respective component authorities.

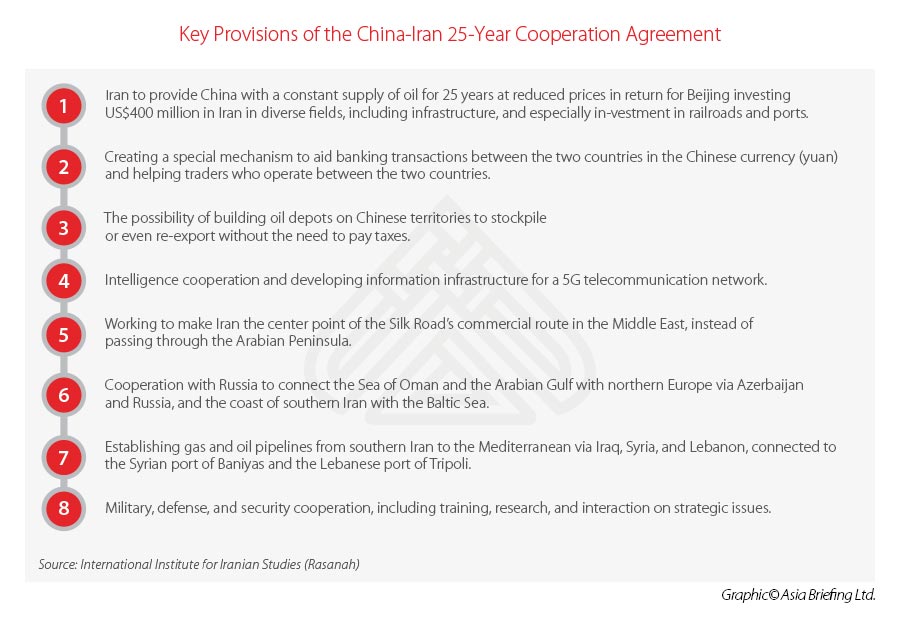

According to the apparently leaked 18-page draft containing provisions of the Agreement and media reports, there will be around 100 projects – aligned with President Xi Jinping’s ambitions to extend China’s economic and strategic influence across Eurasia through the BRI. The projects include major transport infrastructure like airports, high-speed railways, and subways.

Some of the most important provisions are mentioned below.

Clarification from the Chinese government

The leaked details are yet to be confirmed, and some have been denied outright by relevant government officials.

For example, the reported US$400 billion investment figure was not actually stipulated in any official announcement and the Chinese Foreign Ministry spokesperson Zhao Lijian refused to answer the question about the total amount, saying: “It neither includes any quantitative, specific contracts, and goals nor targets any third party, and will provide a general framework for China-Iran cooperation going forward.”

Businesses interested in investing in projects or trading in this region are suggested to keep a close eye on future developments, such as specific contracts awarded for keystone infrastructure projects, sector-wise participation of state-owned enterprises, and official and unofficial visits of key officials.

The big picture

The China-Iran agreement marks the first time Iran has reached such a deal with a major world power – the last one was a 10-year agreement with Russia, which was later extended to 20 years.

Prolonged US sanctions and COVID-19 has pushed the Iranian economy into dire straits. Despite being among the world’s largest oil producers and exporters, Iran saw its exports – its main source of income – plummet since 2018. The sanctions imposed by former US President Donald Trump threatened to cut off access to the international banking system for any country that did business with Iran.

Although the sanctions failed to achieve its stated goal of compelling Iran to agree to more restrictions on its nuclear program and to limit its influence in the Middle East region, they have suffocated the Iranian economy. In such a scenario, China has emerged as a reliable and irreplaceable trade partner for Iran. China has the technology and appetite for oil that Iran needs, suggesting a mutually beneficial relationship is possible. (In 2017, China replaced the US to become the world’s largest oil importer.)

Moreover, both China and Iran have an interest in expanding their technology and innovation footprint in emerging and underdeveloped markets, in turn exercising influence and building room for strategic cooperation. In January this year, Iran officially inaugurated the Iran House of Innovation and Technology (IHIT) in the Kenyan capital of Nairobi. As per reporting by the Tehran Times, the IHIT will serve as a “base for the creation of innovative ideas, the commercialization of these ideas, and the export of Iranian knowledge-based products and services to the East African market.” China has ample experience in spreading its tech and innovation expertise, and future collaboration between the two countries in third markets should not yet be written out.

How that takes shape, if it will at all, may be influenced by geopolitical considerations, such as the fate of the Joint Comprehensive Plan of Action (JCPOA) and potential roll-back of US sanctions on Iran.

Tensions with the US may foster a partnership of convenience

While much about China-Iran can take the form of conjecture, it is a known fact that Beijing has prioritized diversifying and strengthening its global supply chain presence as well as securing its access to key imports, such as oil and gas, amid growing tensions with the US.

In light of this, it is expected that the China-Iran deal could give China a stake in Iran’s oil industry, guaranteeing a market for its crude and refined products. In addition, Chinese investment in infrastructure projects would properly assimilate Iran into the Belt and Road Initiative as a transit point between Asia, Europe, and the Middle East.

However, these could trigger more punitive actions against Chinese companies by the US. In 2019, the US slapped sanctions on a Chinese state-owned oil company, Zhuhai Zhengrong, for importing Iranian crude in violation of US restrictions on Iran’s oil industry.

For years, China has been trying to buy Iranian oil in Chinese yuan, to circumvent potential restrictions associated with the US dollar payment system. In 2018, China launched yuan-denominated oil futures contracts in Shanghai, known as petroyuan, with the aim of internationalizing its currency and competing with US petrodollars.

The US campaign against the Chinese telecommunication giant Huawei includes a case against its chief financial officer, Meng Wanzhou, for seeking to disguise investments in Iran in order to evade American sanctions.

A lot of energy with little to pin down

Despite the implications discussed above, the Comprehensive Cooperation Agreement is merely a framework document with no fixed timetable or guarantees that the two countries will meet the goals set in the provisions. It is possible that the actual implementation of the deal will be less than expected. However, what it does is foster an environment of possibility – whenever interests align, and geopolitical factors allow.

According to Bill Figueroa, a researcher specializing in China-Iran relations, the specific area for cooperation in the Agreement are “all things that already exist” and are in line with China’s engagement with other countries in the region. Moreover, the complex geopolitics of the Middle East, the different opinions existing in Iran, and China’s cautious attitude towards geopolitical disputes, will likely hold back any radical benefits that could be unleashed by the Agreement.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Greater Bay Area – Executive Webinar Now Online

- Next Article China’s Circular Economy: Understanding the New Five Year Plan