Breakdown and Analysis of China’s Economic Data for January and February 2023

China’s statistics bureau has released economic data for January and February 2023, providing the first signs that the country’s industries and markets are beginning to recover after the lifting of COVID-19 restrictions. They also unveil persistent long-term challenges to China’s economic development. We break down the latest economic indicators and discuss what they mean for China’s economic recovery in 2023.

China’s National Bureau of Statistics (NBS) has released economic data for the period from January to February 2023. The generally positive figures indicate that the economy has begun to recover since the lifting of zero-COVID restrictions in late 2022, but also show that there is still a significant amount of work ahead for the country to return to pre-pandemic growth levels.

The latest data follows a string of other economic indicators that have been released since the beginning of the year, including the positive activity indices that have buoyed optimism in markets and data on consumption and inflation and come in the wake of an uptick in consumption, travel, and production seen over the 2023 Chinese New Year period.

Below we discuss the economic figures and analyze what they mean for China’s recovery.

Modest recovery of production and consumption with strong activity indices

January and February 2023 saw a modest recovery of the key production and consumption indicators.

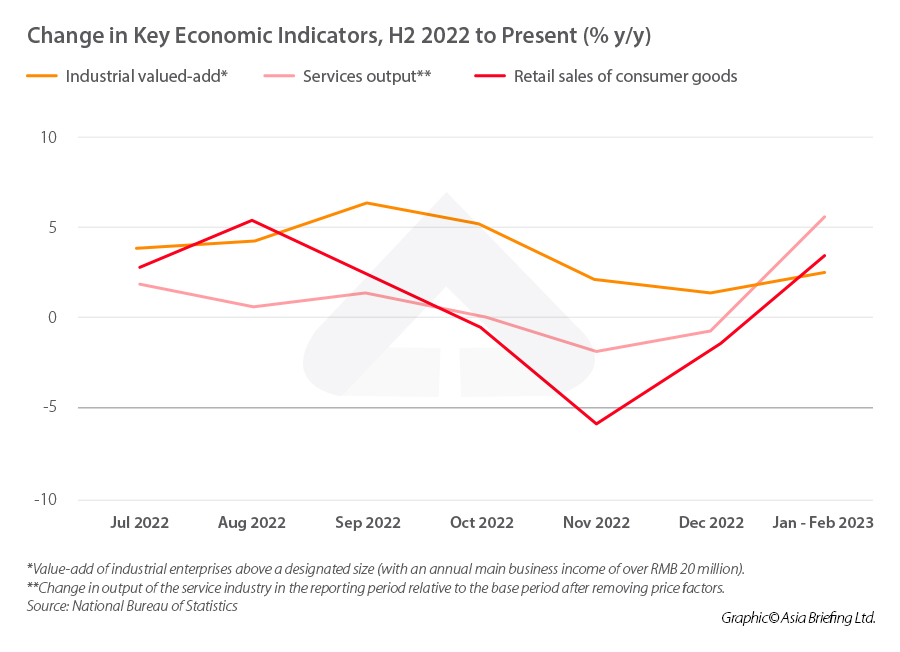

The industrial output of companies above a designated size (those with a main business income of over RMB 20 million (approx. US$2.9 million) grew 2.4 percent year-on-year in January and February, an acceleration of 1.1 percentage points from December. Although this is a decent recovery from the end of last year, it is much slower than the 7.5 percent year-on-year growth recorded in January to February 2022.

Looking at specific industries in the first two months of 2023, the value-add of the mining industry grew 4.7 percent, manufacturing grew 2.1 percent, and electricity, heating, gas, and water utilities grew 2.4 percent year-on-year.

This uptick in industrial indicators may be the beginning of a longer-term recovery, but it is too early to tell whether this trajectory will continue. The growth of industry value-add decelerated significantly over the course of H2 2022, slowing from a high of 6.3 percent year-on-year growth in September to just 1.3 percent in December. The September figure was itself a recovery from the sharp slowdown experienced as a result of COVID-19 lockdowns in the first half of the year. However, as the main hindrance to industrial output (COVID-19 restrictions) has been removed, it is likely that industry value-add will continue to recover over the next few months, barring any unexpected economic pressures.

At the beginning of March, the NBS also released the manufacturing purchasing manager’s index (PMI), an index compiled through monthly surveys of purchasing managers, reflecting a change in economic trends. In February 2023, the manufacturing PMI reached 52.6, up from 50.1 in January and 47 in December, marking the highest reading since April 2012 (a reading of below 50 indicates a contraction, and above 50 indicates expansion). Moreover, the production PMI reached 56.7, up 6.9 percentage points from January, while construction reached 60.2, up by 3.8 percentage points in January, indicating rapid expansion in these sectors.

Meanwhile, the service industry production index (which measures the change in the service industry output) grew by 5.5 percent in January and February 2023, a significant recovery from the 0.8 percent deceleration recorded in December 2022. This was also faster than the growth recorded in the same period the previous year when the service industry production index grew 4.2 percent year-on-year.

Among the service industry sectors:

- Software and IT services increased by 9.3 percent year-on-year;

- Financial industry production index grew 7.6 percent year-on-year;

- Catering and hospitality grew 11.6 percent year-on-year;

- Transportation, warehousing, and postal industry grew 4.2 percent year on year; and

- Wholesale and retail grew 3 percent year-on-year.

Similar to manufacturing and other industrial sectors, services took a significant hit from COVID-19 restrictions, but unlike industrial sectors, did not experience the same level of recovery in the latter half of 2022. However, indicators from the beginning of 2023 show that activity is picking up. The Caixin China General Services Business Activity Index (the “Caixin services PMI”) rose to 55 in February, up from 52.9 in January and the highest level it had been for seven months. As this index provides “an independent snapshot of operating conditions in services industries such as retail and travel”, this rise signals that hard-hit industries have begun to rebound.

Finally, consumption took a significant hit in 2022 and finding ways of boosting domestic demand has been an area of particular concern for policymakers.

In January and February 2023, retail sales of consumer goods reached RMB 7.7 trillion (approx. US$1.1 trillion), a year-on-year increase of 3.5 percent. This is up from a decrease of 1.8 percent year-on-year in December 2022. However, this growth rate is significantly slower than that recorded a year prior, when retail sales grew 6.7 percent year-on-year in the same period.

Breaking down the sales figures, we see that retail sales of goods accounted for 89 percent of total sales, reaching a total of RMB 6.8 trillion (approx. US$985.8 billion), a year-on-year increase of 2.9 percent. Catering services saw the highest growth rate of any sector, with revenue growing 9.2 percent year-on-year to reach RMB 842.9 billion (approx. US$122.2 billion). Online sales reached RMB 2 trillion (approx. US$290 billion), up 6.2 percent year-on-year. Of this, online sales of physical goods accounted for 85 percent (RMB 1.75 trillion, approx. US$253.7 billion) of all online sales and 22.7 percent of overall retail sales.

Low inflation despite rise in demand

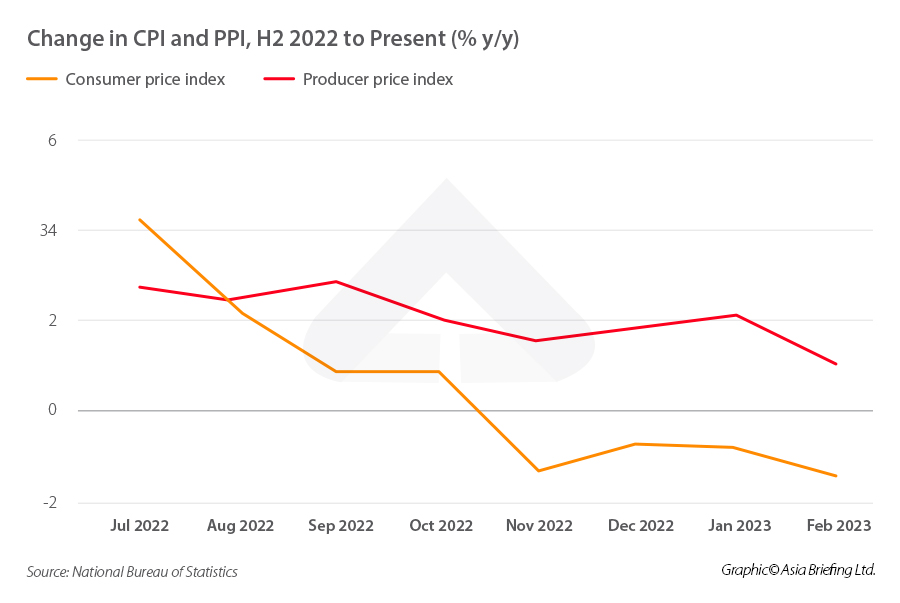

One of the major concerns raised about China’s reopening is that the surge in spending in the country would drive up inflation. The release of China’s main inflation indicators for the beginning of 2023 – the consumer price index (CPI) and producer price index (PPI) – should assuage these fears.

In February 2023, CPI grew at a rate of just 1 percent year-on-year, down from 2.1 percent in January. CPI remained below 3 percent year-on-year growth throughout the whole of 2022, reaching a high of 2.8 percent in September.

The deceleration in CPI was impacted by food and energy prices. In February, the price of food, tobacco, and alcohol rose by 2.1 percent year-on-year, down from 6.2 percent year-on-year growth in January. According to the NBS, the price of food, tobacco, and alcohol accounted for around a 0.59 percentage point rise in overall CPI. Other factors included the price of fresh fruit (up 8.5 percent year-on-year, accounting for 0.18 percentage points), pork (up 3.9 percent, accounting for 0.05 percentage points), and eggs (7.8 percent, about 0.06 percentage points).

Among non-food items, service prices rose by 0.6 percent year-on-year, a drop of 0.4 percentage points from January. Air tickets and travel prices rose by 19.9 percent and 3 percent year-on-year, respectively. Meanwhile, energy prices rose by 0.6 percent year-on-year, a drop of 2.4 percentage points from January. Of this, both petrol and diesel prices saw significant deceleration in price rises, with prices increasing just 0.4 percent and 0.3 percent year-on-year, respectively – a drop of 5.1 and 5.6 percentage points from January.

On a monthly basis, PPI fell 0.4 percent from January, which according to Dong Lijuan, chief statistician of the Urban Department of the NBS, was due to accelerated recovery of the production of industrial companies, which increased market demand.

Looking from an annual perspective, PPI in February fell by 1.4 percent year-on-year, a steeper drop than in January, when the PPI fell by 0.8 percent year-on-year. This drop was in part due to the high base effect of industries, such as petrol, in the same period in 2022.

Moreover, among the 40 industrial sectors surveyed, 17 experienced a drop in prices in February, two more than in January. Moreover, some industries saw a change from rising to falling prices from the last month, including the oil and natural gas exploration industry (from a 5.3 percent rise in January to a fall of 3 percent in February) and the manufacturing of computer communications and other electronic equipment (from a 4 percent rise to 0.5 percent drop).

High investment and low trade

Fixed asset investment reached RMB 5.4 trillion (approx. US$782.8 billion) in the January and February period this year, an increase of 5.5 percent from the same period in 2022 and 0.4 percentage points faster than the 2022 average. From a month-on-month perspective, fixed-asset investment in February increased by 0.72 percent compared to the previous month.

By sector, infrastructure and manufacturing investment saw relatively strong growth, growing 9 percent and 8.1 percent year-on-year, respectively. Investment in the secondary industries as a whole increased 10.1 percent year-on-year, reflecting the overall uptick in industrial activity.

Real estate development investment, however, decreased by 5.7 percent year-on-year, indicating continued stress in the housing market.

Investment in high-tech industries increased by 15.1 percent year-on-year, of which investment in high-tech manufacturing and high-tech services increased by 16.2 percent and 12.3 percent year-on-year, respectively.

Foreign investment inflows into China at the beginning of the year also appeared to be off to a good start. In January, the latest data available, actual use of foreign capital amounted to RMB 127.7 billion, a year-on-year increase of 14.5 percent (in dollar terms, the amount reached US$19.02 billion, up 10 percent year-on-year).

This is a marked acceleration from the 6.3 percent year-on-year growth in December and is especially strong given the relatively high rate of growth recorded in January 2022 of 11.6 percent year-on-year. (Due to the very high level of growth in FDI inflows recorded in February 2022 – 37.9 percent – expect to see a slower growth rate in February 2023.)

The industries with the high growth in the actual use of foreign capital included:

- Manufacturing (40 percent year-on-year);

- High-tech (62.8 percent year-on-year);

- High-tech manufacturing (74.5 percent year-on-year); and

- High-tech services (59.6 percent year-on-year).

In contrast to the strong investment numbers, foreign trade continued to record a decline in January and February compared to the previous year. According to the General Administration of Customs, the total value of imports and exports from January to February reached US$895.72 billion, a year-on-year decrease of 8.3 percent in dollar terms. Of this, exports were US$506.3 billion, down 6.8 percent year-on-year, while imports reached US$389.42 billion, down 10.2 percent year-on-year.

This is a continuation of the decrease in foreign trade value recorded at the end of 2022. In November and December 2022, overall trade in goods decreased by 9.7 percent and 8.9 percent year-on-year, respectively.

China’s foreign trade volume declined significantly in the latter half of 2022, due in part to lower demand for Chinese goods in overseas markets after the pandemic, and weak domestic demand due to continued COVID-19 restrictions. High inflation in target consumer markets, such as the EU and the US, has continued to impact on exports in 2023.

These factors putting pressure on China’s foreign trade will not be resolved overnight, and we may therefore continue to see weak trade figures in the months to come.

Youth unemployment remains high

The urban surveyed unemployment rate in February reached 5.6 percent, up 0.1 percentage point from January. This slight increase has been attributed to seasonal factors, as many people leave or switch jobs after the Chinese New Year holiday. Youth unemployment (among those aged 16 to 24) in February remained stubbornly high at 18.1 percent. This is an increase from December 2022, when the youth unemployment rate was at 16.7 percent.

Getting down the overall unemployment rate, and youth unemployment in particular has been high on the government’s priority list for some time. In the 2023 Government Work Report presented at the Two Sessions on March 5, the government committed to creating around 12 million new urban jobs and keeping the overall urban unemployment rate at 5.5 percent. The report also called for implementing an employment priority policy that would place higher importance on the employment of young people and college graduates.

The big picture

There is no question that China’s economy is on the path toward recovery following the lifting of COVID-19 restrictions. The main hindrance to China’s economic growth in 2022 was unquestionably the stringent COVID-19 restrictions, which led to overall GDP growth slowing to 3 percent. The removal of these restrictions, therefore, removes the single largest obstacle to growth, and industry and society alike will benefit in the coming year as a result.

China has set a GDP growth target of “around 5 percent” for 2023, a goal that has been deemed as being relatively modest and achievable. The IMF has projected China’s GDP to grow 5.2 percent in 2023.

Certain areas of the economy, such as manufacturing and industry, are already experiencing a strong rebound and will help to stimulate overall growth. Others, such as the service sector, are growing at a slower pace but nonetheless appear to be on the trajectory toward recovery from the data currently available. Strong investment figures, both domestic and foreign, indicate higher levels of confidence and optimism toward China’s markets.

Of course, there are also persistent challenges for China’s long-term recovery. One is foreign trade, which is expected to continue to drag on overall economic growth in the coming months. Improving employment rates, in particular among the youth, will also be important for boosting overall economic activity and domestic demand. China’s path to post-COVID recovery in 2023 will therefore be uneven, with some areas and sectors slower to rebound, but an overall improvement is nonetheless the most likely outcome.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Current Trends and Opportunities in Mongolia: Mining Sector and Vision 2050

- Next Article The Putin-Xi Moscow Summit: What Will Be Discussed