Why it is Essential for Technology to Power Your Company’s Accounting

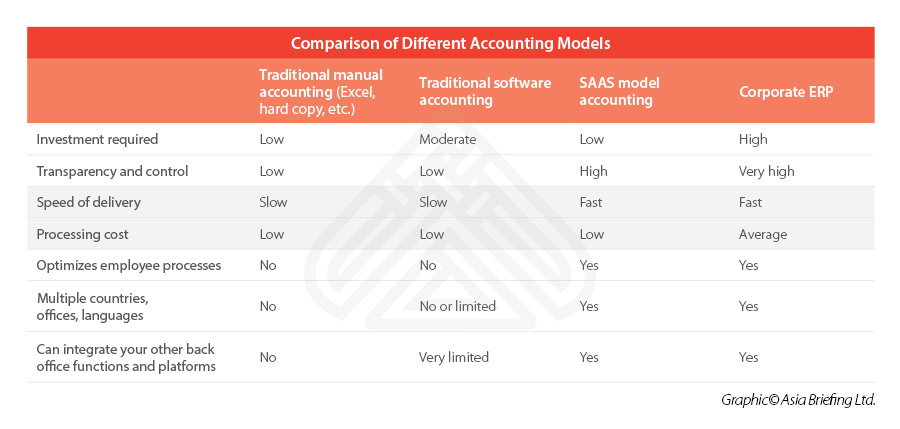

A tech-powered accounting solution means the use of information technology to optimize the basic business processes. It can be achieved through integrated software solutions which could be set up by the company itself, via the software as a service (SaaS) approach, or other cloud-based approach.

Without the use of accounting technology in your China operations today, your organization will remain reliant on the in-house accounting team or service vendor to maintain its tax compliance. This may be an inefficiency that your organization can no longer afford to sustain operationally or financially, depending on the nature of your local business.

When using traditional methods, data in accounting documents can be of some use to management when making key decisions. However, if such documents are produced manually, their content will inevitably be limited in terms of detail, delayed in terms of delivery, and likely ‘siloed’ in a manner that prevents any systematic repurposing of the information. In this sense, the work performed is less useful, and the documents mostly represent a duplication of work – work that can be done more effectively and without much human intervention.

Importantly, finance and accounting technology is no longer a costly investment. Flexible platforms exist, which are often provided for free by accounting providers to smaller firms, or with only minimal upfront setup fees. It is widely recognized that in smaller service-oriented Asian jurisdictions like Hong Kong and Singapore, technology is widely leveraged by accounting professionals to automate various aspects of the work. What is less known, is the extent of a similar development in China, and how small and medium-sized companies can leverage technology to optimize their operations more easily than ever.

This is important in China, because more compliance work is necessary to maintain the accounts of a company today than ever, which would otherwise mean more manual administrative work, draining time and resources. Fortunately, technology solutions have rapidly made manual administrative tasks increasingly redundant.

For instance, the increased adoption of e-fapiaos (e-invoices) is eliminating a lot of the workload relating to the issuance and receipt of paper documents. In the coming years, we can expect more businesses to be able to work in a ‘paperless’ accounting environment.

As this transformation continues, companies that have not started to adopt technology in their accounting processes will find themselves at a severe disadvantage in two key respects. Both relate directly to speed:

• Speed in work processing. Your clients, and even your employees, will have higher expectations in terms of the efficiency with which administrative tasks can be processed.

• Speed in reporting to management, and depth of detail available.

Speed in work processing

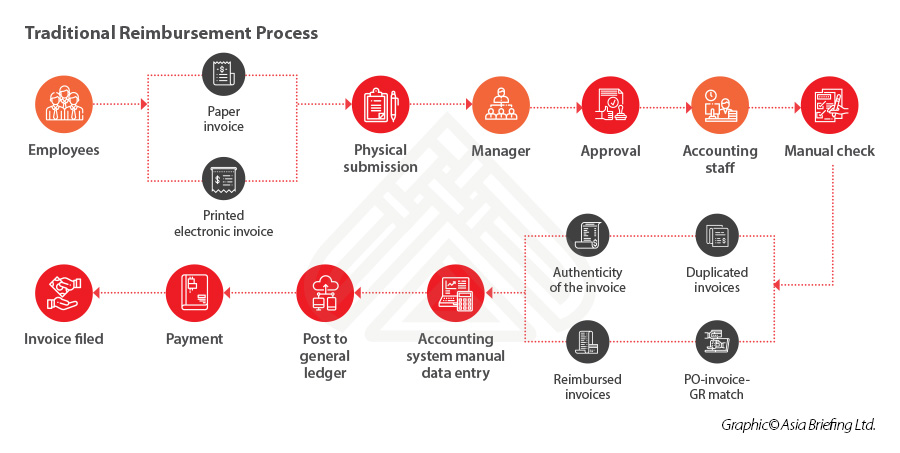

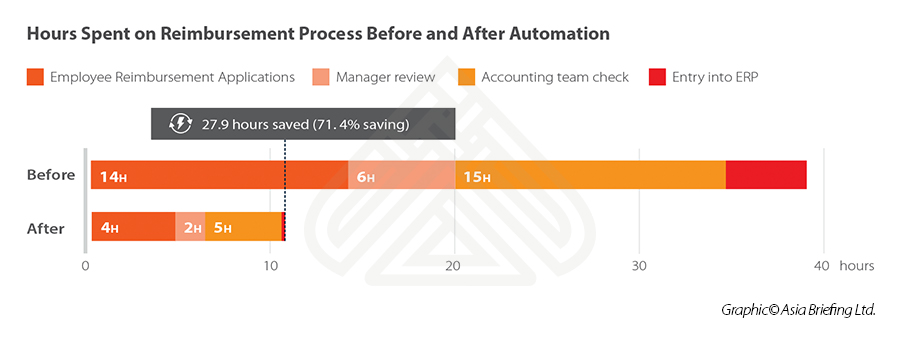

To illustrate the first point, let’s consider the time spent by your employees organizing documentation to make their monthly reimbursement claims. For many employees, especially those who travel a lot, the monthly process can take a couple of hours. This includes organizing all the relevant documentation and printing it all out. Manually entering figures line-by-line on an Excel sheet. Allocating the correct project to each cost. Finally, checking everything and then physically submitting the completed document, or more likely scanning the document and sending by email to the supervisor. It’s a tedious process, and some employees know that their supervisor is unlikely to go through a similar tedious process to check every expense, and thus, tend to save time by omitting significant information on the expense claims.

From the perspective of the supervisor as well as other important stakeholders that are interested in this information, such as internal accountants and auditors, wading through these paper documents is also a time-consuming challenge. Identifying potential problems is unnecessarily difficult because they are buried in a sea of unstructured data. While such a methodology can legitimately be called an internal control process, it is so cumbersome to implement that it probably can’t be very effective.

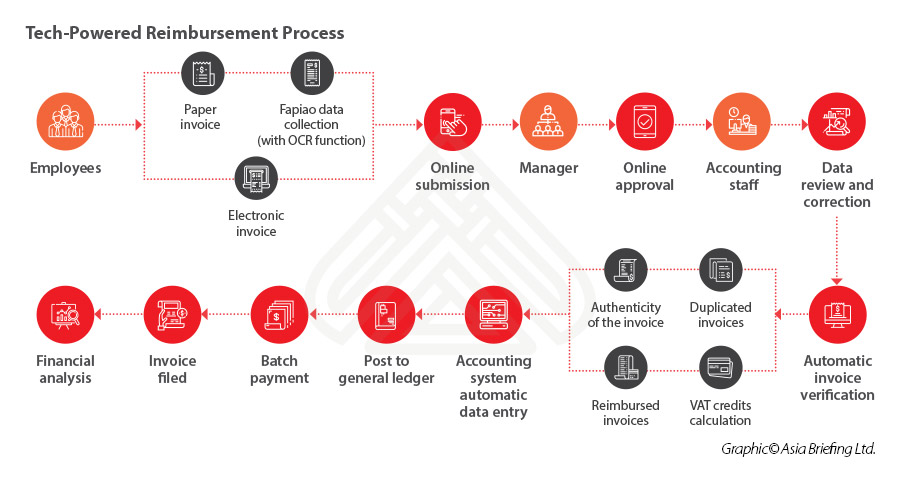

Contrast this with a methodology in which relevant documents and the key information on them are captured automatically by employees via their mobile phones. That information is directly and automatically transferred into a line on an expense report in digital form, in a format that allows the employee to easily supplement with an explanation relating to the expense. Project allocation for each expense can be easily achieved by a pull-down menu inside the app. No manual calculations are required, so no calculations need to be checked by the supervisor or the accountant. Submission can be made by one click within the app.

The supervisor can review immediately and approve (or more importantly) reject immediately. Other stakeholders, such as auditors, also have full access to the information, which allows them to do their jobs more effectively.

Speed of reporting to management

In terms of speed of reporting to management, under a traditional accounting model, an acceptable timeframe has typically been to provide historical monthly revenue figures a few days into the following month, with the standard set of accounting reports for consolidation provided around a week later.

That handful of days that pass before the provision of the relevant reports in the correct format may not seem like a long time, but each day represents a limitation for your company. During that period, there is a limitation in terms of the amount of information that has been manually captured. Another limitation exists in terms of the accuracy of the information recorded due to the inevitable occasional human error. Then, as a natural consequence of these two limitations, the ultimate limitation manifests itself in terms of inferior reporting capability to the management because of inferior volume and quality of data gathered by this traditional methodology. Finally, the inferior quantity and quality of reports provided to management limit their ability to make agile and accurate business decisions.

Below we look at how such data reporting and reconciliation of accounts may be possible with minimal human intervention while maintaining accuracy and efficiency, which will highlight the difference between traditional methods of accounting and the use of tech-powered software.

Bank account reconciliations

For companies with large volumes of transactions in China, it may be important for information displayed in these reports to be up to date. To achieve that, simple integration is required between the bank and the company’s accounting system, which is then integrated with the reporting function. In mainland China, this is not as straightforward as is the case in Hong Kong or Singapore. This is because banks in China make it difficult to pull data from their systems. This, however, is changing. Dezan Shira’s team has been involved in designing such bank integration solutions for clients as long ago as 2014.

Companies with lower volumes of transactions may prefer to skip an integrated system but set up an automated monthly reconciliation process. Bank statements downloaded in Excel form can be automatically imported into the accounting system. Based on a pre-determined logic in the accounting system, 90 percent of the reconciliation work can be processed immediately. A small amount of manual work might be necessary to recategorize a particular receipt/payment, or to supplement some information on a new vendor/client. Once uploaded and processed, the accounting software will deliver the account balance information to the necessary report automatically.

Accounts payable list

Useful information, such as how much money is owed to each vendor and what is the aging schedule/accounts receivable aging for each outstanding transaction, can be displayed on a searchable accounts payable list. This information itself is delivered from a specific module of the tech-powered accounting software, which in turn gets populated automatically from the expense management app (on which more will be explained in the next article). As mentioned above, while using such software, the reconciliation of payments will occur automatically from the bank statements that are uploaded. Therefore, the information on the accounts payable list is continually and automatically reflected in the new AP records captured from software tools, such as expense management apps. This means that reconciled payments are automatically dropped off the list.

Fixed assets list

Besides accounting concerns, management also needs to track the fixed assets that the company possesses. Important questions during audits include: What information does the company have about its fixed assets? How far have they depreciated? What is the nature of these assets? All this information can be pulled directly from the fixed assets module of the tech-powered accounting software and displayed on a fixed assets list.

Is it affordable?

Reading this article, I imagine that many people will be thinking that indeed a tech-enabled solution would be wonderful, but it also sounds like it would be prohibitively expensive and difficult to implement, especially in China. Actually, that is not the case.

Naturally, if your company would like to implement its own tech-powered accounting software with the fundamental IT infrastructure built from scratch, it is possible. However, such a major undertaking is time-consuming and may take many months to complete.

However, it is becoming much easier to enjoy the benefits of tech-powered accounting without going through such difficult processes. For companies that use an accounting service provider and don’t have highly complex requirements in terms of processing or reporting, out-of-the-box solutions exist. For instance, Dezan Shira & Associates offers the model described in this article to its clients as a value-added part of its standard accounting service in China. All the benefits of tech-driven accounting are already there, at no additional cost. Most clients are not even required to buy licenses for the tech-powered accounting solution that we are using, because the information on the reports that we provide to them in real-time via SharePoint Online is already adequate for their purposes. New clients can be onboarded within a matter of hours as it’s effectively a SaaS solution.

Case study 1

A European trading company (Company A) set up operations in China. Each month it was processing several hundred transactions, mostly relating to sales, to its clients. Company A expected to scale up further in the future. The company HQ was utilizing its own global ERP and wanted its China employees to produce purchase orders and sales orders from this centralized system.

Challenge

The company realized that configuring the HQ software in China to meet China’s special accounting and tax requirements would be an expensive and complex project. At the same time, the company realized that not finding any solution would limit the ability of the Chinese entity to grow in size and would also lead to problems with tax compliance.

Solution

Information entered by Company A in the supply chain module of its global system was exported by their IT team automatically each month and delivered to Dezan Shira.

Dezan Shira configured a supply chain module for Company A within its tech-powered accounting software. This module was specifically designed to integrate with the client’s HQ system directly via import. Each month, the imported data in the supply chain module is processed according to China’s accounting and tax rules and therefore reflected accurately in the finance modules of the tech-powered accounting software. Cost of goods sold (COGS) calculations is of particular importance, as is VAT treatment.

All the reports for China’s statutory reporting purposes are generated from Dezan Shira’s tech-powered accounting software and subsequently submitted to the relevant authorities. The reports for HQ are also generated from Dezan Shira’s tech-powered accounting software for subsequent upload/consolidation into Company A’s system. Some of these reports, as required, are generated according to the International Financial Reporting Standards (IFRS).

A localized expense management app does the heavy-lifting work to capture all the necessary information and manage Company A’s internal control process for daily expenses and approvals in China. In a similar way to the supply chain module data, the relevant information is uploaded automatically from the expense management app into the tech-powered accounting software’s account payable and general ledger modules.

To give Company A’s financial controller more flexibility to see all the accounting information within Dezan Shira’s system, Company A leased one license that enabled the financial controller to access all details relevant to Company A captured by the accounting software, which can be used by them to create customized reports using a powerful management reporting tool. The license fee is charged monthly, eliminating any high upfront cost.

In this way, Company A achieved all its objectives at an upfront cost of only several thousand US dollars. That represents a small fraction of what would have been necessary to completely configure its own software to function as effectively in China. Leveraging a pre-existing SaaS solution and making minor configuration changes as necessary is not only less risky and far cheaper, the timeframe for implementation is also considerably shorter. The above-mentioned solution was put in place within three weeks of the decision to implement being made.

Case study 2

An Indian company (Company B) selling access to its app via business to business (B2B) to clients in China wanted a way to effectively manage its expenses, issue official invoices (fapiaos) to its local clients, complete its statutory accounting work, and be able to see clear dashboards and metrics of all important indicators relevant to the company’s performance.

Challenge

Company B was effectively a start-up app developer, it did not possess a comprehensive tech-powered accounting system in place at HQ, nor did it have the time or the resources to develop such a system for its China entity. Company B was looking for an effective SaaS solution that could be put in place within one month, because it already had significant business activity in China and was expecting more in the near future.

Solution

Company B leveraged Dezan Shira’s tech-powered accounting software to be the central focus for all the information that needed to be processed both for statutory and management reporting purposes.

A localized expense management app was selected to efficiently capture all expense information and allow managers at HQ in India the necessary control to pre-approve payments based on information provided through the app. Relevant information stored in the app was uploaded into Dezan Shira’s tech-powered accounting software and became the source data to automatically produce the monthly expense transactions.

On the sales side, issuance of fapiaos was achieved by storing the required client information inside the AR module of Dezan Shira’s tech-powered accounting software and linking it with China’s Golden Tax System (GTS). As necessary, data relating to sales was sent to the GTS system in the format required, and then within the GTS platform itself, one simple instruction was made to recognize the VAT on the sale. Once completed, fapiaos could be printed out using the designated fapiao printer (Company B is not yet using e-fapiao methodology). After the allocation of fapiao number by the GTS system, the tech-powered accounting software writes that number back into the AR module automatically.

All the statutory accounting and reporting work was handled within the tech-powered accounting software, with 80 percent of the workload automated. Key data inside the tech-powered accounting software was captured in close-to-real time, and reflected in a section of Dezan Shira’s Sharepoint Online site that was dedicated to Company B. Company B’s designated employees could come onto this site to see up-to-date graphics and metrics relating to the China entity, and interact with our team in that space, instead of relying on monthly reports and email interactions.

Company B was also booking transactions manually within its management accounting software in India. Dezan Shira worked with Company B to complete a Chart of Accounts mapping, and subsequently produced a report that could be used directly to upload into the Indian software.

In this way, the company was not only able to meet its immediate objectives within a very short period of time and without any investment, it was also confident that a future scale-up in its operations could also be achieved without bumping up against speed limitations imposed by slow manual processing work.

Locating a qualified service provider

Service providers that are able to deliver these kinds of technology solutions should, of course, be tech-enabled themselves and have an internal team of specialists available to deploy solutions for clients at short notice. Ideally, they should have a strong track record of having already delivered a wide range of services to companies at a similar stage of development to your own. They should not only be able to provide a solution, but also to train your team on how to use it effectively. And critically, the service provider needs to demonstrate that the case manager for your account is able to work closely with your team and technology professionals on an ongoing basis so that improvements are continuous.

(This article was originally published in the magazine, Optimizing Your China Accounting and HR Processing with Cloud Technology, produced by Asia Briefing.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Belt And Road Weekly Investor Intelligence, #18

- Next Article Preparing for Annual Tax Reconciliation in China in 2021: FAQs