Income Tax Subsidies for Overseas Talents in China’s Greater Bay Area: Application Process and Deadlines

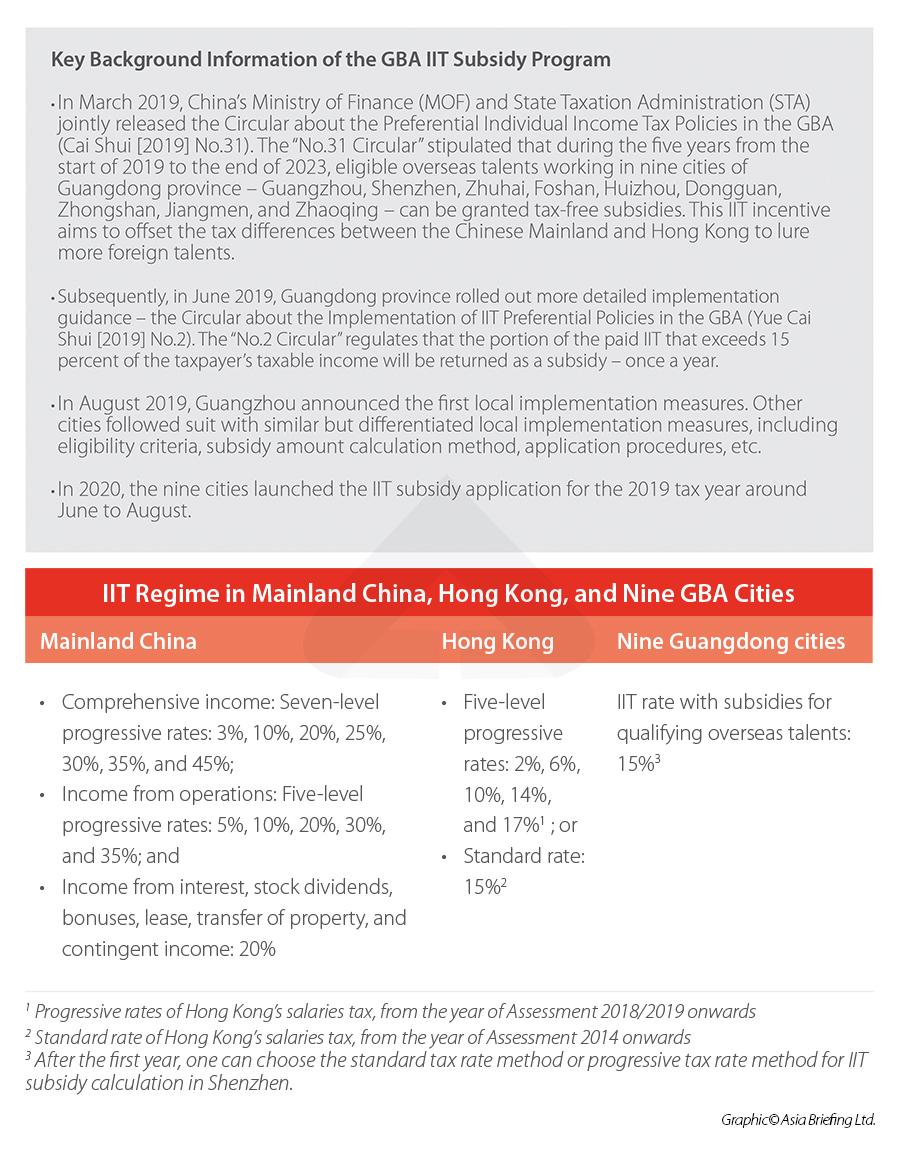

IIT subsidies are available to expatriates in China’s Greater Bay Area. From the start of 2019 to the end of 2023, eligible foreign talents working in nine cities in Guangdong province can enjoy a financial subsidy, which could lower the effective individual income tax (IIT) rate to 15 percent. So far, all nine cities have kicked off the new round of application in 2021.

All nine cities in Guangdong province in the Greater Bay Area (GBA), including the belated Shenzhen, have opened application channels for foreign talents to apply for the individual income tax (IIT) subsidies (see the application timetable below).  The application deadline in most cities is August 31, 2021. Shenzhen will be open for applications from August 16, 2021 to September 30, 2021. Notably, the cities of Dongguan, Zhuhai, and Jiangmen will soon close their application channels on August 15, 2021.

The application deadline in most cities is August 31, 2021. Shenzhen will be open for applications from August 16, 2021 to September 30, 2021. Notably, the cities of Dongguan, Zhuhai, and Jiangmen will soon close their application channels on August 15, 2021.

Foreign talents and their employers can apply for the subsidy for the 2020 tax year before the deadline. Most cities, including Shenzhen and Guangdong, also allow talents to reapply for the subsidy for the 2019 tax year.

Besides, based on last year’s implementation, this year, the nine municipal governments have all refined their IIT subsidy policy implementation rules, which will be applied to the tax years from 2020 to 2023. All cities, except for Zhaoqing, have updated their catalogues of ‘high-end’ talents and ‘shortly needed’ talents.

China Briefing explains the latest changes in the implementation measures and talent catalogues of Shenzhen and Guangzhou (please refer to the article Guangzhou’s Next Round of GBA IIT Subsidy Applications: July 1 to August 31, 2021 and GBA IIT Subsidy in Shenzhen: Updated Application Rules and Dealine).

China Briefing’s parent company Dezan Shira & Associates has assisted many foreigners and their employers in obtaining their IIT subsidies in the period between June and August 2020. Our GBA-based professionals have received various questions regarding the subsidy application and provided answers to the commonly asked queries in this article – IIT Subsidy Application in the Greater Bay Area: FAQs. You are welcome to check it out and find the answer you might need.

China Briefing’s parent company Dezan Shira & Associates has assisted many foreigners and their employers in obtaining their IIT subsidies in the period between June and August 2020. Our GBA-based professionals have received various questions regarding the subsidy application and provided answers to the commonly asked queries in this article – IIT Subsidy Application in the Greater Bay Area: FAQs. You are welcome to check it out and find the answer you might need.

Calculation method of the subsidy amount

Generally, to calculate the amount of subsidy, the formula is: The subsidy amount = the amount of IIT paid in the GBA city – taxable income × 15%. Specifically, under the IIT subsidy policy, the taxable income includes the following sub-items:

- Comprehensive income, including:

- Income from wages and salaries;

- Income from labor compensation;

- Remuneration income; and

- Income from royalties.

- Operating income

- Subsidized income from selected talent programs or talent projects

The subsidies will be calculated based on the above taxable individual income sub-items separately and will then be distributed on a lump-sum basis next year. Thus, the calculation formula of subsidy amount can be extended as:

The subsidy amount = ∑ (annual IIT difference by item × ratio of taxes paid by item)

The ratio of taxes paid by item = annual IIT paid by item in the GBA city÷ annual IIT paid by item in China

To better understand how much income savings can be achieved under the IIT subsidy scheme, you can read our article IIT Subsidies in the Greater Bay Area: How Much Can be Saved. In that article, we provided expert analysis by a tax professional, discussing four scenarios and calculating how much income tax a talent can save under each scenario.

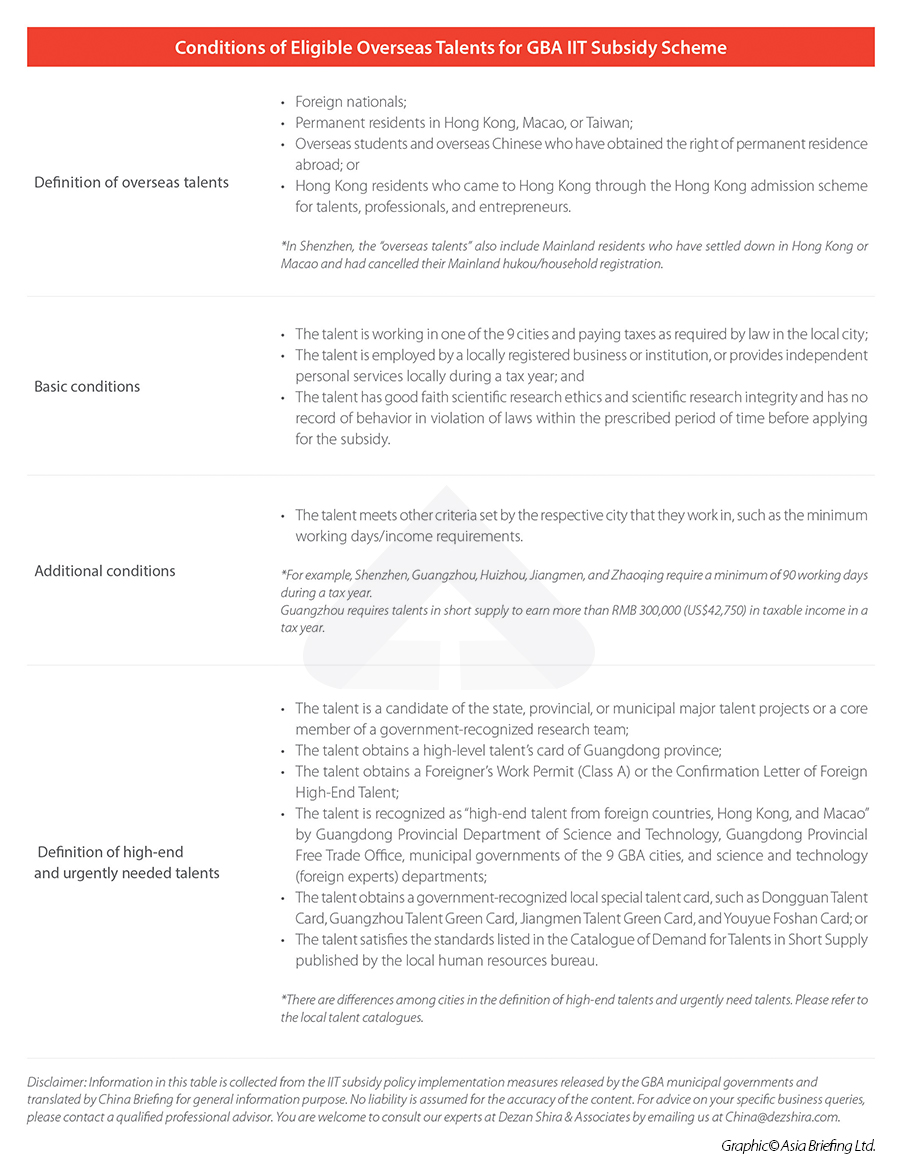

Scope of eligible overseas talents

As each city formulates the implementation rules based on the local conditions – the rules may vary slightly from city to city in the aspect of the identification and conditions of foreign ‘high-end’ talents and ‘shortly needed’ talents, the application procedures, etc. Here, we summarized some key information for general information purposes. To apply for the subsidies, eligible talents generally must fall under the following scope:

File your 2021 application now

Some cities have clearly clarified rules for retroactive application – for example, Guangzhou stated that retroactive application is acceptable during the application period for the following year, but if it is overdue again, the application will not be accepted any longer and the subsidy will not be granted. And retroactive application does not apply to the subsidy for the 2023 tax year (the last tax year).

However, some other cities might not have such clear rules on retroactive applications. For example, Jiangmen did not provide any provisions on retroactive application.

To ensure timely access to the subsidies and avoid subsidy loss, it is recommended that enterprises and eligible individuals make appropriate preparations and file applications as soon as possible according to the implementation measures and actual conditions issued by their cities. Employers can also help their foreign employees to evaluate the feasibility of applying for the subsidy.

You are welcome to contact our GBA-based professionals for assistance in foreigners’ IIT calculation, subsidy application, and derive practical solutions on human resource arrangement in GBA. Please email us at China@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Shanghai Scraps ‘Levying Upon Assessment’ for Corporate Income Tax

- Next Article What is BEPS 2.0? OECD’s Two-Pillar Plan and Possible Impact on Multinational Enterprises