China’s Healthcare Industry – Opportunities in Telemedicine and Digital Healthcare

China’s healthcare industry has been forced to do a hard reset in 2020. Just as the 2003 SARS epidemic caused China exposed the gaps in the country’s disease surveillance infrastructure, COVID-19 has exposed the cracks its delivery of healthcare services.

Now, as China is tasked with rebuilding and reorganizing its healthcare system, the government has started to signal its priorities for the next era of its healthcare transformation.

Battling the pandemic has caused China to rethink its priorities within the healthcare system – pushing critical health infrastructure, digital services, and public health promotion much higher on the list than if the infectious outbreak had not occurred.

In this three-part series we will take a look at the changes that are taking place in the healthcare industry in China in the following key health sectors:

- Telemedicine and digital healthcare

- Medical devices

- Pharmaceutical industry

In part one of the series, we provide an overview of China’s healthcare industry before diving into the growth and investment opportunities in the country’s emerging telemedicine and digital healthcare industry as well as the regulations facilitating their rise.

China’s healthcare industry (2010-2020)

China healthcare industry is currently ranked the second largest in the world behind the US.

The market has grown at a consistently rapid rate in the past five years, and in 2019, the market reached RMB 7.82 trillion (US$1.1 trillion), an increase of 10 percent when compared to that from the previous year.

In 2019, the market reached RMB 7.82 trillion (US$1.1 trillion), an increase of 10 percent when compared to that from the previous year. The market has grown at a consistently rapid rate in the past five years, having increased by more than a third of its size, growing at an average 11 percent year-on-year.

Despite this, the market remains relatively undeveloped, with China’s health expenditure – including pharmaceuticals, medical devices, distribution, hospital, pharmacies and insurance – accounting for only 6.57 percent of the total GDP in 2018, while the US reached 17.8 percent in the same year.

Given that many countries will see their GDP contract in 2020 due to COVID-19, this will impact the government’s total expenditure – of which a set sum is allocated to healthcare expenditure.

However, analysts estimate that China’s GDP will grow somewhere between 2.0 to 2.5 percent in 2020, with healthcare spending projected to rise too, albeit at slower rates than in 2019.

Thus, the market presents considerable opportunities for growth, particularly as the Chinese government has more recently laid out multiple initiatives to support long-term growth and innovation in healthcare delivery, it is likely that healthcare will feature even more heavily in the 14th Five Year Plan (covering 2021-25) than it did in the 13th Five Year Plan.

In terms of foreign investment, the healthcare industry has been steadily opening up to foreign participation – both in terms of removal of items in the National Negative List, and the addition of items on the National Encouraged List. In 2019, “new raw material for the production of vaccines” and “medical institutions” were newly added on the 2019 National Encouraged List, which means that they are now encouraged investment sector by the central government, unlocking opportunities for foreign investors to access preferential policies and tax rates.

In addition, healthcare remains a positive area of for foreign investment with two new sectors added to the 2019 National Encouraged List just last year. New raw material for the production of vaccines as well as medical institutions are now an encouraged investment sector by the central government, unlocking opportunities for foreign investors to access preferential policies and tax rates.

However, foreign investment in medical institutions is still limited to a joint venture structure and cooperation with a Chinese company, unless a special approval has been granted. An exemption exists for Hong Kong entities and eligible Hong Kong Service Suppliers, who are eligible to set up medical institutions in the form of a wholly-owned entity if the requisite conditions under the Mainland and Hong Kong Closer Economic Partnership Arrangement CEPA) are met.

Telemedicine and digital patient management

Prior to the outbreak, most Chinese consumers typically visited physical medical institutions for their healthcare needs. Though digital adoption was a much talked about concept, the actual digital penetration rate was relatively low.

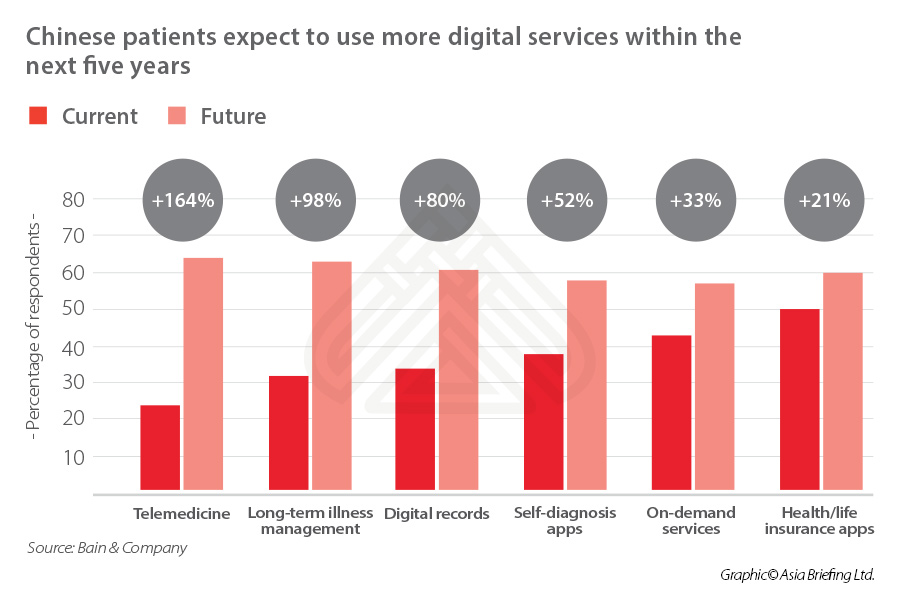

According to the survey completed by Bain & Company, in 2019, only 24 percent of Chinese respondents had used telemedicine, which is the use of technology to provide remote clinical services.

However, as an inevitable consequence of COVID-19, there has been a rapid acceleration of the wide-spread adoption of digital technology in both the delivery of healthcare services (remote patient monitoring, online booking, and telemedicine) and the digitally assisted delivery in healthcare services (artificial intelligence, machine learning for diagnostics and treatment, augmented reality or AR surgeon training, robotic and AI assistance).

In fact, during the COVID-19 outbreak, the country’s National Health Commission (NHC) promoted the use of internet-based medical services to minimize population movements and reduce the risk of infection. This led to the exponential increase in the user base and engagement of China’s online medical platforms.

For example, Ping An Good Doctor – China’s largest healthcare platform – experienced a 900 percent surge in new users, and 800 percent surge in online consultations during the period of December 2019 to January 2020.

Though the need for remote healthcare delivery was clear during the epidemic, there are fundamental reasons why this model is here to stay.

The pandemic both exacerbated and shone light on the pervasive bottleneck within China’s healthcare provider system, which consistently obstructed easy access to quality healthcare services.

China has a tiered healthcare system in which smaller community health centers (CHCs) and Class I institutions provide first-contact care, and larger Class II and III institutions provide specialist referral services.

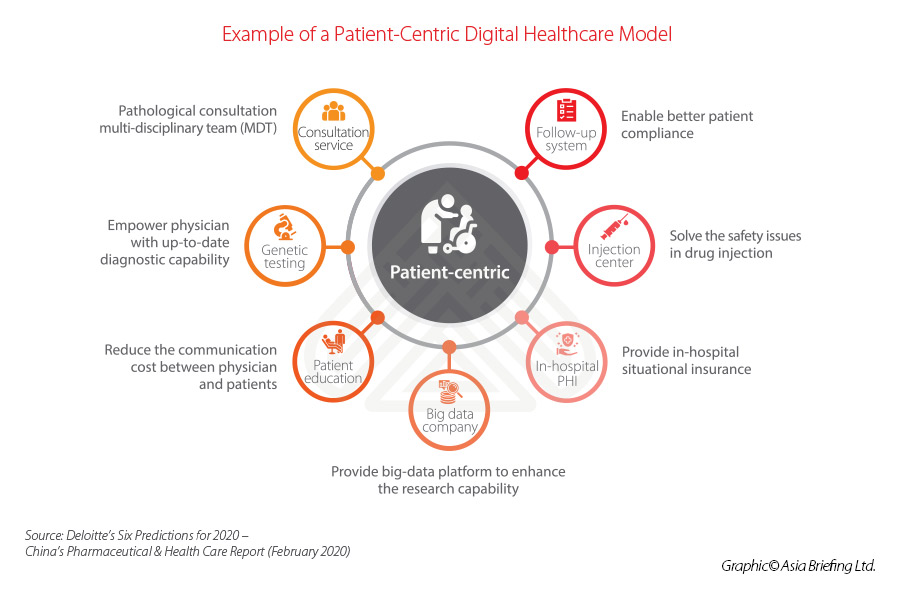

However, in practice, the provision of healthcare is extremely unbalanced with more than 2,300 top tier public hospitals running at capacity while the remaining low-tier hospitals, community health centers, and clinics struggle to attract patients. In response, online healthcare platforms are expected to continue to grow against the backdrop of a congested and unbalanced healthcare provider system to create a more patient-centric engagement model, as seen below.

New regulatory developments

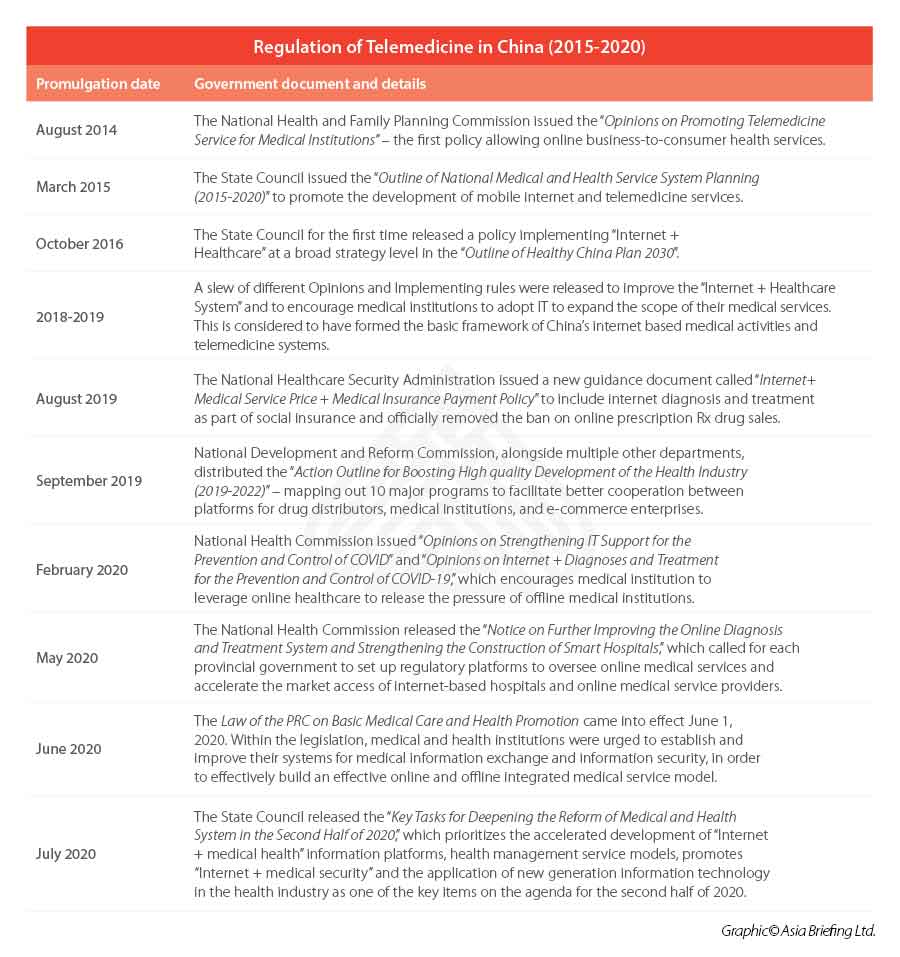

Though telemedicine is not a new concept in China, it has only recently started to adopt a more cohesive and regulated approach to this sub sector – most crucially supporting the digitalization of both the infrastructure and the administrative (licenses and insurance) landscape.

In 2019, the National Healthcare Security Administration (NHSA) launched the electronic medical insurance system – regulating the prices and insurance policies to allow for internet-based medical services to be covered by the country’s medical insurance system. Starting from August 2019, patients able to access to diagnosis and prescription services from hospitals via WeChat and Alipay without bringing any medical insurance identity cards, thus promoting the widespread adoption of telemedicine.

Also, notably, in May 2020, the NHC encouraged provincial governments to establish their own online regulatory platforms to oversee and regulate individual online medical providers and to accelerate the market access of internet-based hospitals. This was backed up by a notice which will take effect August 2020, officially introducing the use of electronic licenses and certificates for medical institutions, nurses, and doctors.

Collectively, these reforms have allowed medical institutions to more readily adopt telemedicine services. However, currently the legal framework only accounts for physical medical institutions in mainland China, and no legal framework exists for internet-based cross-border medical activities provided by foreign medical institutions from overseas to Chinese domestic patients.

Below we highlight some of the new regulations released by the central government to allow telemedicine to grow to scale, adding new opportunities for existing and new healthcare market players.

China’s digital healthcare outlook

Prior to the COVID-19 outbreak, China’s digital healthcare market was already posited to reach RMB 23.5 billion (US$3.29 billion) by 2020. However, the outbreak has caused a massive acceleration in the use of telehealth services – prompting healthcare providers, patients, and insurers to adopt telehealth tools much more readily than before.

One of the major tipping points to facilitate the rise of digital healthcare is the shift in consumer attitudes towards online platforms.

According to a survey conducted by Bain & Company, Chinese patients are much more open and indeed expectant of higher uses of digital health services within the next five years.

While this applies to telemedicine, which recorded an exponential growth of more than 164 percent, there is also now a higher acceptance of digitalization of healthcare services across the board including: online long-term illness management, digital records, on-demand services, and health/life insurance apps.

The collection of health data in a centralized and organized manner, made possible by a more coordinated regulatory approach, is also making it easier for more businesses to adopt to a digital delivery across a whole range of healthcare services.

As such, new opportunities exist particularly for digital companies that wish to solidify their position in the Chinese market. Equally, medical technology (MedTech) companies and software as a service (SaaS) businesses, are well-positioned to partner with offline healthcare providers to transition into more innovative business-to-consumer (B2C) healthcare delivery models to provide a more holistic and comprehensive care.

Digitized health services are still at a relatively early stage of development but represent one of the largest potential areas of growth in the healthcare sector. With the coming adoption of 5G and the Internet of Things (IoT), support for digitized healthcare and telemedicine will continue to be a point of emphasis for government planners in the coming years.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s Business Reforms are Yielding Success: World Bank Report

- Next Article China’s Incentives for Integrated Circuit, Software Enterprises