China’s New VAT Fapiao Requirements to Affect Taxpayers, Service Providers

By Jake Liddle

China’s State Administration of Taxation (SAT) has released new requirements for collecting VAT fapiao, which are special tax invoices.

The policy, which will come into effect on July 1, 2017, will change the type of information taxpayers need to provide when obtaining a general VAT fapiao. It also specifies measures fapiao issuers (service providers) need to take to be compliant.

Both taxpayers and vendors should study the new general fapiao rules to understand how it affects business as usual:

- Service providers need to sync their internal systems with the SAT’s VAT control system to ensure that there are no errors made when issuing fapiao after July 1.

- Taxpayers need to review the new rules to understand how their employers and service providers will treat fapiao; the new rules increase accountability for taxpayers.

- Employers should task their human resources and finance teams to inform employees about the reform and develop new standard operating procedures for the reimbursement of business expenses.

![]() RELATED: Evaluating China’s VAT Reform

RELATED: Evaluating China’s VAT Reform

The fapiao reform

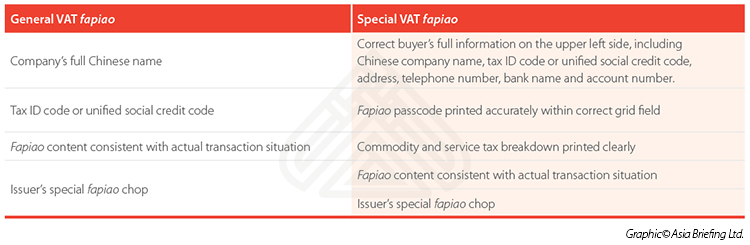

Under the current system, taxpayers are only required to supply their company’s full listed name in Chinese in order for suppliers to issue a valid fapiao.

When the new law comes into effect on July 1, the following items are required when requesting fapiao:

Fapiao issued without the above information will not be seen as a valid tax payment receipt. This means that it cannot be used as a means to deduct from corporate income tax (CIT), or VAT (in cases where taxpayers are engaging in labor dispatch, HR outsourcing, or tourism services, where the taxpayer chooses to pay VAT on the difference between revenue and expense fees).

Fapiao issuers will be required to link their service systems with the SAT’s VAT control system, meaning that all fapiao issued will only be valid if the data is coherent in both systems. Issuers with discrepancies will need make due amendments to their service systems.

The nature of the fapiao

The law introduces more stringent rules relating to ‘nature of expenditure’ specified on fapiao: it stipulates that fapiao issuers are now required to specify the actual purpose of expenditure, and not to accord with that requested by customers.

Service providers will now need to specify the purpose of the product when issuing VAT fapiao, rather than asking the customer for thier input on the nature of the fapiao. Taxpayers, in turn, will need ensure that they match the specific purpose of the VAT fapiao for the expense that they would like to claim. As an example, taxpayers will need to use fapiao issued for accomodation to claim accomodation expense, rather than using fapiao issued for food expenses for accomodation expense.

This new measure is ultimately designed to put an end to some grey practices: it will become more difficult for taxpayers to request issuers to falsely write on fapiao issued for other purposes.

![]() RELATED: Audit and Financial Services from Dezan Shira & Associates

RELATED: Audit and Financial Services from Dezan Shira & Associates

Validity of new and old fapiao

Taxpayers will need to retain both the special VAT fapiao deductible and invoice copies, which are issued together, for validity. Authorities will not treat any special fapiao as valid if it has not verified and filed in a VAT return within 360 days of its issuance. This applies to fapiao issued after July 1.

For fapiao issued before July 1, it will be non-deductible if it is not verified within 180 days upon issuance. In either case, taxpayers must submit their fapiao to the internal finance department at least 30 days ahead of the expiration date to reclaim an expense.

Increased transparency for VAT collection

The new law makes for more transparent VAT collection, and forms part of China’s broader effort to reform its taxation system.

After the successful implementation of the 2016 VAT reform , issuance of special fapiao was standardized. However, that of general fapiao was not so uniform: in some cases, fapiao issuers would only require the full company name to issue a fapiao, while others would insist on varying amounts of the required information.

This change in requirements ultimately means more effort will be required by taxpayers and service providers. For individual taxpayers, checking the consistency of fapiao contents after issuance can ensure smooth reimbursement of business costs.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Le Système de Facturation ‘Fapiao’ en Chine Expliqué

- Next Article Empleados extranjeros en China y el impuesto sobre la renta