Investing in China’s Healthcare Industry

By Roy K. McCall

China is the third largest healthcare market in the world and this is growing by double-digits. Yet the country’s spending on healthcare per capita is only about 5 percent of its GDP—versus around 10 percent in Japan and Europe, and 18 percent in the U.S. Despite this, the Chinese government is expanding its healthcare budget and has said it welcomes foreign investment and aims to double the share of private hospital beds from 9 percent currently to 20 percent by 2015. Healthcare investment opportunity in China appears to be sizzling—but is it really?

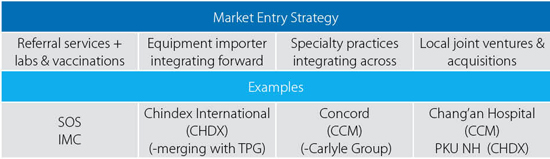

Healthcare foreign investors in China have followed a “begin or buy” approach, employing either greenfield/organic growth or M&As to achieve their investment targets.

Referral services such as International SOS and International Medical Center (IMC) represent early out-patient entrants into the Chinese healthcare market established to service expatriates in China. They have integrated forward into laboratory work and vaccinations. As private entities they do not publish financial results but appear to be well staffed, equipped and visited. In complex cases they utilize ambulances to take patients to premier urban hospitals such as Beijing’s premier-ranked Xiehe (Peking Union) in Wangfujing.

Equipment importers – who have integrated forward from outpatient clinics into OBGYN, inpatient surgery and most recently oncology (chemo and radiology) – include Chindex International’s United Family Hospital, which is publicly listed as CHDX. In addition, CHDX has attempted to grow new brands such as New Hope Oncology, which in May 2014 was rebranded Peking University New Hope Oncology (PKU NH). The CHDX parent group has swung from free-cash flow positive in 2012 to negative in 2013, and continued this trend in the last two quarters ending in March 2014. After continued borrowing to fund growing capital expenditures, on April 21 2014 CHDX agreed to a US$461 million privatization offer from a group led by TPG (Texas Pacific Group) at a generous 30+ percent premium (US$24) to the public trading price at the time (around US$19.50).

Specialty practices such as Concord Medical radiology centers (traded publicly as CCM, with Carlyle Group as its top shareholder) have attempted to integrate into general hospitals such as Chang’an Hospital in Xi’an. Contrary to CHDX, Concord swung from cash flow negative in 2012 to positive in 2013, but achieved this by reducing its pace of capital investment by one-half. Their operations cash flow improved little and they have remained liquid through borrowing—but their capital needs will continue to grow. After receiving government approval, CCM integrated into full cancer treatment with the establishment of the 400-bed Shanghai Concord Cancer Hospital at the Shanghai New Hongqiao International Medical Center. Construction is scheduled to start in the first half of 2015 and will continue for three years.

The last area, joint ventures and outright acquisitions, represents the largest potential opportunity and the greatest challenge. CHDX took the route of co-ventures and joint branding. While it currently operates in Beijing, Shanghai, Tianjin and Guangzhou, with a future facility under construction in Qingdao, CHDX joint-ventured with a TCM hospital in Guangzhou to provide combined western and traditional Chinese medical treatment.

It has been difficult for healthcare firms without an operating base in China to successfully buy into joint ventures and acquisitions. Fifteen years ago, an OTC traded firm of the now defunct SNLY based in California and led by a Chinese MD attempted to take control of multiple hospitals in China. It introduced a member-based discount system using TCM and western medicine, emphasizing immune system maintenance with nutraceuticals. Initially, the project was bolstered by strong tail winds of goodwill from the Health Ministry, but in the end could not raise the needed capital and bring its ambitions to fruition from an offshore base.

Another challenge for offshore investors will be to identify acquisition-worthy consolidators in healthcare. For example, both Europe and North America have extensive and efficient dialysis centers for treating diabetes that boomed in the 1990s and redirected treatment away from the congested hospital environment. China has the world’s largest CKD (Chronic Kidney Disease) population at around 200 million, and also one of the most underserved with a <10 percent treatment rate—due to lack of education and service provider networks. While CHDX and CCM are currently focusing on expanding into oncology, the future may be wide open for poorly addressed opportunities such as in kidney disease and diabetes treatment.

Roy McCall (HBS MBA 1984) is a CPA (1989), and CFA (2001). He was invited by China’s Ministry of Education to teach MBA classes at Nankai University and in 1998 became the first instructor to place a proprietary text on-line for students at Peking University. He has advised on healthcare investments in China dating back fifteen years and has also written cases on healthcare in China. His grandparents came to China in 1917, where his mother was born & raised. Roy has lived in Asia for three decades.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Industry Specific Licenses and Certifications in China

In this issue of China Briefing, we provide an overview of the licensing schemes for industrial products; food production, distribution and catering services; and advertising. We also introduce two important types of certification in China: the CCC and the China Energy Label (CEL). This issue will provide you with an understanding of the requirements for selling your products or services in China.

- Previous Article China’s Tech Industry Booms as Alibaba Files for Initial Public Offering

- Next Article China’s 2014 State Policy on Rural Development and the Agriculture Industry: Investment Implications