China-New Zealand FTA Upgrade: Reduced Costs and Compliance for NZ Exporters

The China-New Zealand FTA Upgrade modernizes the 2008 bilateral free trade treaty provisions, introduces new considerations like environmental safeguards, widens market access for services trade, removes more tariffs, and reduces compliances for New Zealand exporters.

On January 26, 2021, China and New Zealand signed an agreement to upgrade their existing free trade pact, securing a better deal for both countries through expanded market access, widened tariff-free schemes, and expedited processes for exporters.

The Protocol to Amend the New Zealand-China Free Trade Agreement was formalized on a video call by New Zealand Trade Minister Damien O’Connor and China’s Commerce Minister Wang Wentao, concluding three years of negotiations, which first started in 2016

The upgrade comes after more than a decade since the original FTA was signed in 2008 – which saw New Zealand become the first OECD (Organisation for Economic Co-operation and Development) country to conclude a trade treaty with China.

The revisions seek to modernize the FTA provisions to align with the latest trade policies and business practices in areas of e-commerce, government procurement, environment and trade, and competition. It also wipes away virtually all remaining tariffs and reduces compliance measures for exporters.

The Protocol will now undergo each country’s respective domestic ratification process before entering into force.

What is the size of China-New Zealand trade?

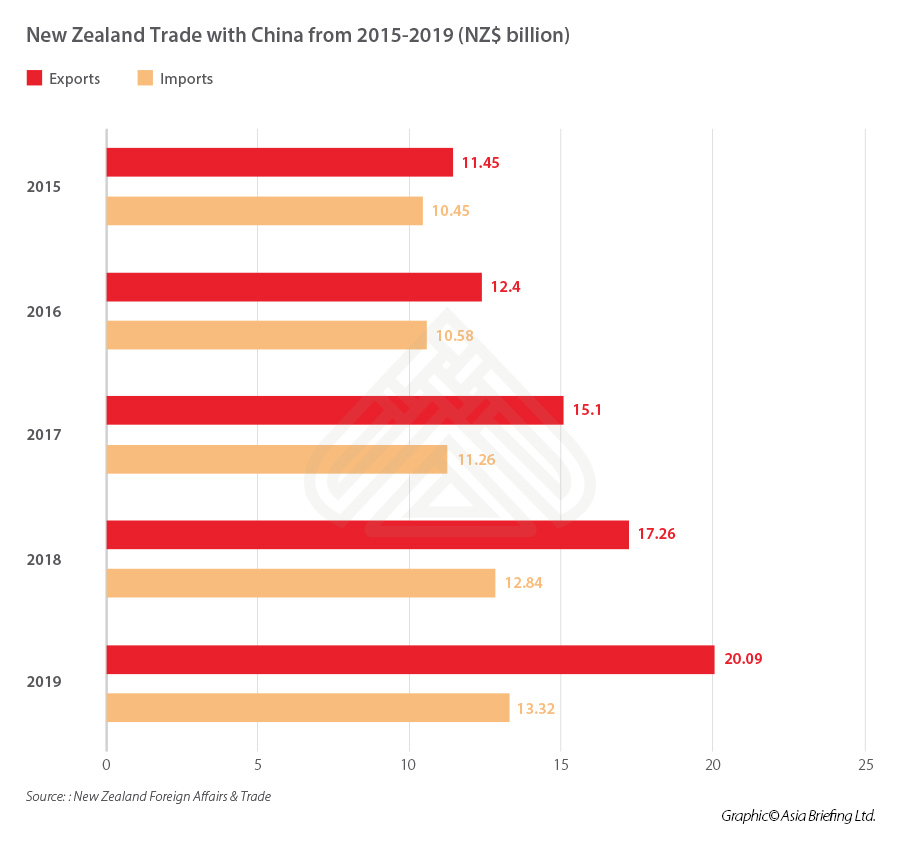

China and New Zealand’s two-way trade quadrupled from around NZ$8 billion (US$5.76 billion) in 2008 when the free trade agreement was first signed, to over NZ$32 billion (US$23 billion) in 2020 – making China New Zealand’s largest trading partner. At the end of 2019, China was New Zealand’s largest goods market, largest source of international students, second largest source of tourists, and a significant foreign investor.

New Zealand exports to China, of which fresh food products play a dominant role, totaled NZ$19.4 billion (US$13.96 billion), which include NZ$2.7 billion (US$1.94 billion) in services. Chinese exports to New Zealand are dominated by manufactured consumers goods, which amount to NZ$13 billion (US$9.36 billion) and NZ$700 million (US$504 million) in services.

The success of New Zealand dairy companies Fonterra and A2 are largely underpinned by exports to China. Fonterra, which is also the largest New Zealand source of Chinese investment, accounts for 36 percent of all dairy imports into China, and announced plans to expand its presence in the Chinese dairy market mid last year.

Details of the China-New Zealand FTA Upgrade

Widened tariff-free access for trade in goods

The Side Letter on Wood and Paper Products will act an official addendum to the treaty. When ratified, it will effectively implement a tariff elimination scheme phased over 10 years on an additional 12 lines of wood and paper products, amounting to NZ$36 million (US$26 million).

In effect, this will mean 99 percent of wood and paper products, amounting to NZ$3 billion (US$2.16 billion), will receive tariff-free treatment, now including the likes of toilet or facial tissue stocks, printing or writing paper, kraft paper, multi-ply paper, and self-adhesive paper and paperboards.

Wood and paper products are already New Zealand’s third biggest export commodity coming in at NZ$2.93 billion (US$2.11 billion) in 2019. These expanded tariff schemes will unlock even more opportunities for New Zealand exporters in this industry over the next decade.

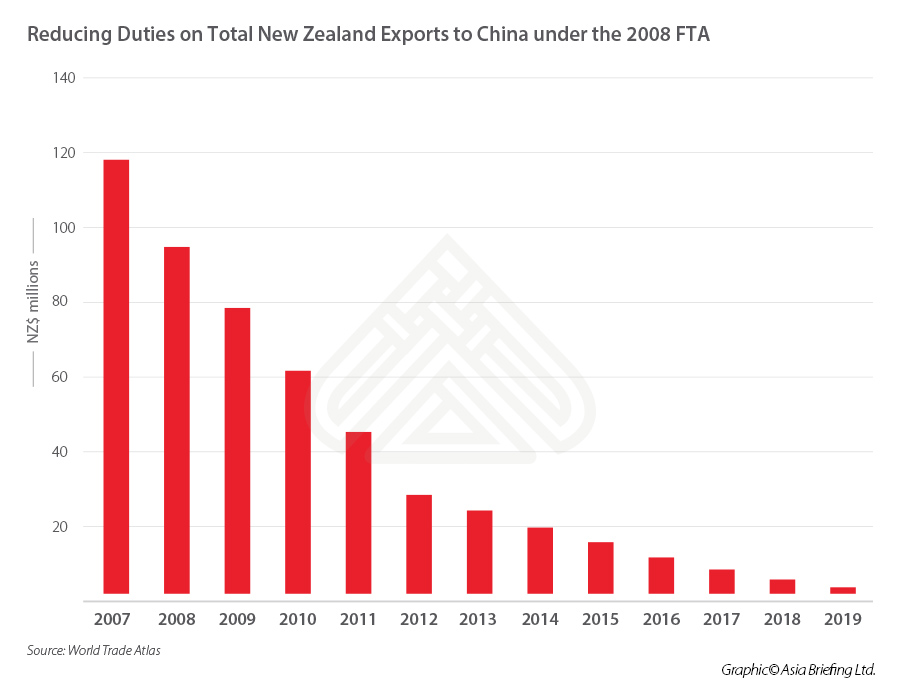

All other existing preferential tariffs schemes laid out in the 2008 FTZ will continue to take effect – in 2016, New Zealand had duty free access to over 97 percent of China’s tariff lines, and by 2024, New Zealand will see all its core dairy products (including milk powder) receive tariff-free access. Regarding Chinese products exported to New Zealand, from 2018 onwards, all products are eligible for tariff-free access.

Reducing technical barriers to trade

Several new measures were introduced to improve the rule of origin requirements, streamline customs procedures, broaden ruling provisions, unify labelling requirements, and other administrative formalities. Exporters within sectors, such as perishable goods, the forestry sector, and other primary sector industries, will benefit the most from the upgraded FTA.

Under the original FTA agreement, New Zealand goods exported to China require a Certificate of Origin to benefit from preferential tariffs. However, the certificate is not needed for New Zealand imports from China.

‘Approved exporters’ of goods to China will also be eligible to self-declare the origin of their goods for the purposes of claiming tariff preference under the FTA. This will be an additional option for exporters, alongside the option to obtain a certificate of origin, which will continue to exist.

In addition, New Zealand exporters will also no longer have to apply for additional certificates when their goods transit through another country on the way to China.

In terms of customs procedures, a six-hour clearance time will be available for ‘perishable goods’, such as seafood (including rock lobster and salmon). This will include the release of such goods outside normal business hours to ensure they are stored appropriately.

Finally, new transparency provisions will enhance access to information about customs laws and regulations, including the establishment of contact points at key ports in China, to provide timely information and address operational issues and concerns.

Expanded market access for services trade

Three groups of services sectors will benefit from new or enhanced market access commitments. The first batch, including environmental and audio-visual services, will benefit from brand new market access commitments. The second group of services sectors, including real estate, translation and interpretation, and education services, will see an expansion to market access commitments under the original FTA.

Finally, the last group of services sectors, including private education and architectural services, will now be covered by the “Most Favored Nation” commitment, which means that both New Zealand and China will benefit from the preferential treatment offered by the corresponding party to a third party trading partner, within these specific sectors.

New Zealand and China have also agreed to commence negotiation of a ‘negative list’ services framework within two years of entry into force of the upgraded FTA, which will provide scope for further services market access liberalization. This negative list format would provide exporters with a simple way to determine whether the FTA services chapter applies to their area of business in either market

Adjusted categories for movement of natural persons

The FTA upgrade will adjust the chapter on Movement of Natural Persons of the existing FTA, to reallocate the visa allocations for iconic Chinese occupations

Adjustment of the visa allocations to include:

- 100-200 more places for Chinese Tour Guides

- 150 to 300 more places to Mandarin Teaching Aides

- A corresponding decrease to other less utilized categories (Traditional Chinese Medicine Practitioners and Wushu Martial Art Coaches)

In addition, a new eligibility criterion will be introduced (different for each category) to make it easier for New Zealand businesses to employ suitably qualified staff through this visa category.

New framework for electronic commerce

Recognizing the rising prominence of digital trade, the protocol introduces a brand-new chapter on e-commerce to provide the necessary legal framework for this nascent but fast-growing industry.

Within this chapter, both countries committed to the adoption of electronic authentication and digital certificates to promote paperless trade and agreed to safeguard the personal information of e-commerce users through an appropriate legal framework.

Also within this chapter is an agreement to maintain the current practice of not imposing customs duties on electronic transmission, cooperation provisions to facilitate collaboration and dialogue on emerging issues, including initiatives to facilitate use of e-commerce by small and medium sized enterprises, and the development of cross-border e-commerce goods trade.

Screening of investments

There are no formal changes investment settings because of the upgrade negotiations.

However, in New Zealand, the screening levels for China have changed since the original FTA was signed as a result of the implementation of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The Investment side letter, therefore, confirms that Chinese government investments in New Zealand’s significant business assets are screened at NZ$100 million (US$72 million) and non-government investments in New Zealand significant business assets are screened at the NZ$200 million (US$144 million) threshold.

Similarly, within the Regional Comprehensive Economic Partnership, China has agreed to further expand its sectors, including aviation, education, finance, elderly care, and passenger transport.

China-New Zealand enters a new era of trade

New Zealand has had a long and positive trade history with China.

In 2004, it became the first developed country to commence FTA negotiations with China and in 2008, it was the first country to conclude FTA negotiations with China. In 2020, it became the first country to upgrade its existing FTA with China.

These firsts continue to propel the bilateral relationship forward.

The upgrades introduced by the new Protocol to Amend the New Zealand-China Free Trade Agreement will make exporting easier and cheaper by simplifying administrative requirements and establishing clear rules and contacts for businesses at the port.

The NZ-China FTA was initially projected to increase NZ exports to China by NZ$225 to $350 million (US$162-US$252 million) each year. However, this rapidly exceeded expectations, with exports increasing by NZ$1 billion (US$720 million) in the first year, and growth continuing.

New Zealand Trade Minister Damien O’Connor sums it up well: “What this does is modernize the free trade agreement that we signed in 2008, brings it up to date. It provides real opportunities for exporters. Ten years ago, some of the issues around trade were not as sophisticated, this agreement allows us to move forward, particularly in the area of services.”

Minster Wang Wentao also added: “The Upgrade Protocol is a specific action to practice multilateralism and build an open world economy, and an important measure to implement the FTA upgrading strategy.”

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Right to Privacy in China’s Civil Code and its Impact on HR Management

- Next Article Belt and Road Weekly Investor Intelligence, #16