Electrifying the Road Ahead: Unlocking China’s EV Charger Industry Potential

In the context of China’s position as the world’s largest electric vehicle (EV) market, the rapid expansion of the country’s electric vehicle charger industry holds immense potential for foreign direct investment (FDI).

This presents significant opportunities for foreign companies to actively engage in the development, manufacturing, and operation of charging equipment, while also contributing to the advancement of charging services and enhancing the overall user experience in China’s dynamic EV market.

This article aims to provide a comprehensive overview of China’s EV industry, highlighting the national and local policies that support the development of EV chargers. Additionally, it will outline the potential investment prospects available to foreign enterprises seeking to enter this thriving sector.

Current state of China’s EV charger industry

In recent years, the global new energy vehicle market has experienced significant growth, leading to an increased demand for charging infrastructure.

Within this segment, China has observed a rapid expansion in its EV charger sector, propelled by the widespread adoption of electric vehicles throughout the country.

This surge in demand for charging stations reflects the transition towards cleaner and more sustainable transportation solutions.

EV charging value chain and key players in China’s market

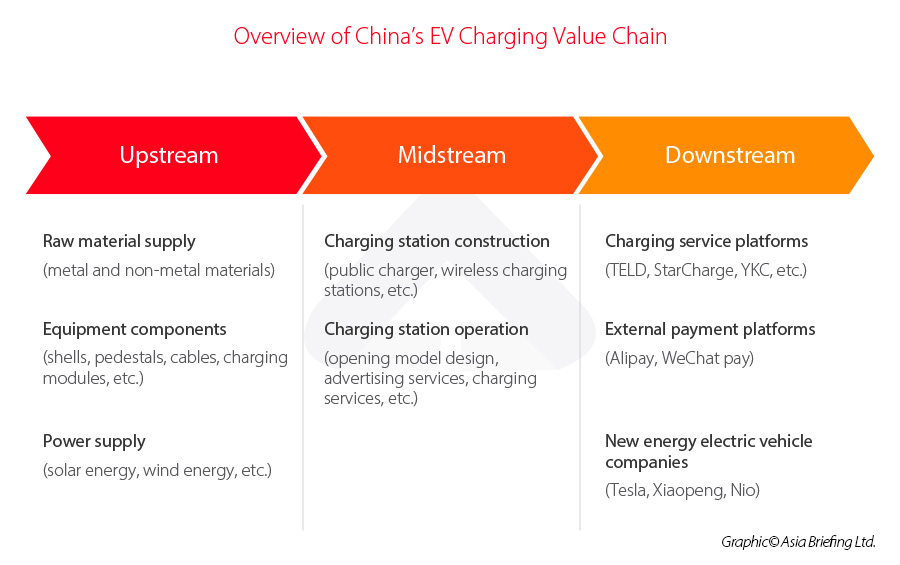

The electric vehicle charging station industry chain encompasses a diverse range of stakeholders.

At the upstream level, manufacturers specialize in producing essential equipment for charging station construction, including shells, pedestals, cables, and other critical components.

The midstream segment involves construction and operation companies responsible for building and managing the charging stations.

Lastly, the downstream sector comprises service providers offering location services, reservation and payment functionalities, operation management platforms, and comprehensive solutions. These service providers play a vital role in coordinating the needs of stakeholders across the chain, facilitating seamless integration and delivering comprehensive operational solutions.

It is worth noting that the public charging station operator landscape in China exhibits a notable level of concentration. According to the date from the China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA), as of December 2022, the top 15 charging operation companies in terms of the number of charging stations operated nationwide are as follows: TELD (特来电), StarCharge (星星充电), YKC (云快充), State Grid (国家电网), Xiaojuchongdian (小桔充电), Evking (蔚景云), ShenZhen Carenergy Net (深圳车电网), Southern Power Grid (南方电网), Wancheng Wanchong (万城万充), Hooenergy (汇充电), EV Power (依威能源), Eichong (万马爱充), SAIC Motor (上汽安悦), Potevio (中国普天), and Winlands (蔚蓝快充). These 15 operators account for 93.8 percent of the total number of charging stations, while the remaining operators make up the remaining 6.2 percent.

Supply side: Surging growth in China’s EV charging station construction scale

According to data released by the EVCIPA, the construction scale of EV charging stations in China has experienced substantial growth from 2018 to 2023. As of the end of 2022, the total number of charging infrastructure in China reached 5.21 million units, reflecting a significant year-on-year increase of nearly 100 percent. This includes approximately 650,000 units of public charging infrastructure, resulting in a cumulative total of 1.8 million units, as well as around 1.9 million units of private charging infrastructure, reaching a cumulative total of over 3.4 million units.

By 2023, the projected number of EV chargers is expected to reach 9.58 million units, representing an impressive growth rate of approximately 84 percent. This significant upward trend underscores the immense potential and opportunities within the EV charger industry.

Demand side: Escalating charger demand gap as new energy vehicles expand

The “Guidelines for the Development of Electric Vehicle Charging Infrastructure” issued in 2015 set forth ambitious targets for the construction of 4.8 million charging stations by 2020, effectively meeting the charging demands of 5 million new energy vehicles. This plan aimed to establish 500,000 public charging stations and 4.3 million private charging stations, ensuring a balanced vehicle-to-charger ratio of 1:1.

However, the progress in charging network construction has fallen short of the planned targets. As of the end of 2022, China had a total of 13.1 million new energy vehicles, while the number of charging stations stood at 5.21 million, resulting in a nationwide vehicle-to-charger ratio of 2.5:1. This highlights a considerable gap when compared to the targeted 1:1 ratio.

Clearly, it is evident that to achieve the national goals for new energy vehicles, the development of charging infrastructure will be a key focus in the future. The electric vehicle charging industry holds immense growth potential as the demand for charging stations continues to rise.

Government support and policy framework

With a strategic focus on building a comprehensive charging infrastructure, China has made significant investments and implemented supportive policies to foster the growth of its EV charger industry.

| Chinese Policies Targeting Charging Infrastructure for New Energy Vehicles | ||

| Issued date | Policy document | Key point |

| June 2023 | Guiding Opinions on Further Constructing a High-Quality Charging Infrastructure System | Goals by 2030 include establishing a comprehensive charging network that covers urban, highway, and rural areas, improving standardization, regulation, and market supervision systems, and achieving global leadership in charging technologies. |

| May 2023 | Accelerating the Development of Charging Infrastructure to Better Support the Deployment of New Energy Vehicles in Rural Areas and Rural Revitalization | Supporting local governments in developing county-level public charging network plans.

Prioritizing the installation of public charging facilities in commercial buildings, transportation hubs, and service areas along highways. |

| January 2023 | Guiding Opinions on Promoting the Development of Energy Electronics Industry | Enhancing the application level of energy electronic products in emerging facilities, such as 5G base stations and new energy vehicle charging stations. |

| December 2022 | Implementation Plan for Expanding Domestic Demand in the 14th Five-Year Plan | Strengthening the construction of supporting facilities such as parking lots, charging stations, battery swapping stations, and hydrogen refueling stations. |

| March 2022 | Plan for Modern Energy System in the 14th Five-Year Plan | Optimizing the layout of charging infrastructure and comprehensively promoting the coordinated development of vehicles and charging stations.

Conducting pilot demonstrations of innovative charging and battery swapping stations that integrate solar power generation, energy storage, and charging. |

| May 2021 | Implementation Plan for Enhancing the Service Capability of Charging Infrastructure | Coordinating the construction and retrofitting of charging stations in residential communities. |

| November 2020 | Development Plan for the New Energy Vehicle Industry (2021-2035) | Promoting the scientific layout and accelerated construction of charging stations and providing financial support for the construction of public charging stations. |

In the future, under the positive influence of the dual carbon goals, an increasing number of charging operators, load integrators, and other third-party market participants will engage in EV energy storage services to facilitate the transition to clean energy systems.

Presently, many provincial and municipal governments have set out specific development goals for EV charging stations to meet the growing demand for electric vehicle charging. They are overseeing the continuous improvement in the safety, intelligence, and connectivity technology levels of charging facilities. This effort aims to drive forward the development of the electric vehicle industry, promote consumer upgrades, and expand the upstream, midstream, and downstream industries in the charging industry value chain.

| China Regional EV Charger Development Goals | ||

| Province/city | Policy document | EV charger development goal |

| Beijing | Urban Management Development Plan for Beijing during the 14th Five-Year Plan Period | By 2025, the cumulative number of electric vehicle charger in the city will reach 700,000. |

| Shanghai | The 14th Five-Year Plan and Vision for 2035 for the Economic and Social Development of Shanghai | By 2025, the city will have 200,000 charging stations and 45 charging stations specifically for taxis. |

| Chongqing | Strategic Emerging Industries Development Plan (2021-2025) for Chongqing during the 14th Five-Year Plan Period | By 2025, the city will have 6,500 charging stations and 60,000 public chargers. |

| Liaoning | Digital Development Plan for Liaoning | By 2025, the city will have 12,000 chargers. |

| Shandong | Energy Development Plan for Shandong Province during the 14th Five-Year Plan Period | By 2025, the city will have 8,000 charging stations and 15,000 public chargers. |

| Jiangsu | Public Charging and Battery Swapping Facility Plan for Suzhou City during the 14th Five-Year Plan Period | By 2025, the cumulative number of electric vehicle charger in the city will reach 200,000. The vehicle-to-charger ratio will be 2:1. |

| Zhejiang | Energy Development Plan for Zhejiang Province during the 14th Five-Year Plan Period | By 2025, the cumulative number of energy service station in the city will reach 6,000. The vehicle-to-charger ratio will be below 3:1. |

| Guangdong | Energy Development Plan for Guangdong Province during the 14th Five-Year Plan Period | By 2025, the city will have 4,500 charging stations and 250,000 public chargers. |

Industry outlook and opportunities for FDI

The EVCIPA estimates that in 2023, China will add 3.4 million onboard chargers, bringing the total number of onboard chargers to 6.812 million. An onboard charger converts alternating current (AC) power from external sources, like residential outlets, into direct current (DC) power, which is then utilized to charge the battery pack of the vehicle.

Further, an impressive 975,000 public chargers are expected to be installed, resulting in a total of 2.772 million public chargers.

In 2023, China will install 60,000 new public charging stations, resulting in a total of 171,000 public charging stations established across the country.

According to the latest Catalogue of Encouraged Industries for Foreign Investment (2022 Version), foreign investors are encouraged to invest in multiple sectors related to EV chargers, such as:

- Development and manufacturing of onboard chargers with high power density, high conversion efficiency, and high adaptability, as well as wireless charging and mobile charging technologies.

- Manufacturing of charging stations and energy storage charging stations.

- Construction and operation of vehicle charging stations and battery swapping stations.

- Integrated solutions for solar power generation, energy storage, and charging, as well as the development, application, or production of new energy vehicle charging equipment technologies.

China’s EV charger sector offers promising opportunities for FDI in the following niche segments:

- Promoting charging network construction: Foreign enterprises can support the expansion of charging infrastructure, especially in underserved areas, by investing in the construction of new charging stations to meet the growing demand for EV charging.

- Strengthening operational capabilities: Foreign companies can enhance the operational capacity of charging stations by providing management expertise and advanced technologies, including station grading and assessment systems to ensure efficient and reliable charging services.

- Enriching the charging service ecosystem: FDI can contribute to the development of a diverse and user-friendly charging service ecosystem by investing in smart charging systems, mobile payment platforms, and value-added services to enhance the overall charging experience for EV users.

- Leveraging the synergy of the industry chain: Foreign companies can foster collaboration among different stakeholders by investing in multiple segments of the value chain, such as equipment manufacturing, software development, and service providers, to promote the high-quality development of the EV charging industry.

- Advancing the integration of renewable energy and charging: FDI can support the integration of solar power generation, energy storage systems, and charging infrastructure, including investments in solar-powered charging stations, virtual power plants, and initiatives aligned with carbon neutrality goals.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Hong Kong’s Visa Regime – Applying to Visit, Work, Study, and Invest in Hong Kong

- Next Article China Considers Extending its EV Subsidies to 2023 (updated)