Camping and Outdoor Activity – Tapping into China’s Hottest New Travel Trend

In China, camping and outdoor activities are booming. The popularity of camping reflects a long-term rise in interest in outdoor sports and activities, as well as a trend toward short-haul and local travel driven by the pandemic. The budding industry presents a host of new opportunities in the outdoor activity industries. We discuss the trends and drivers behind the growing preference for camping in China and how investors can tap into the various related market segments.

Camping has become one of the hottest new trends in China’s travel industry. Domestic travel companies have reported a surge in searches for camping during recent holidays, and sales of camping equipment are growing at triple-digit rates. The trend reflects a new direction for the travel industry, as consumers move away from traditional tour groups and COVID-19 restrictions make short-haul nature breaks more attractive to city folks. It also signals an increasing interest in outdoor activities and sports, opening up a range of new possibilities for travel companies that specialize in outdoor tours.

The market is red-hot, but also has considerable room to grow. According to the US camping association Kampground, the participation rate of Americans in outdoor activity is over 50 percent. In China, it remains at under 10 percent. As living standards continue to rise and younger generations yearn for a return to nature, outdoor activities and sports are expected to continue on their upward trajectory, presenting an exciting new growth market for investors.

In this article, we look at the trends driving the camping frenzy and discuss the opportunities available for companies in the camping and outdoor activities space.

Key travel trends and drivers of the camping industry

Maturation of tourism in China

The rise of camping signals a longer-term maturation of the tourism industry. Organized tour groups that shuttle tourists between scenic spots are becoming increasingly passé, especially among younger consumers who prefer the flexibility and freedom offered by independent or customized travel.

Many experienced travelers who have already ticked major domestic cities and tourist destinations off their bucket lists are now looking for something different and more adventurous. Younger generations who grew up in wealthy families will also have experienced going on family holidays when they were young – something that was not accessible to many older generations – and therefore are more comfortable with newer forms of leisure and travel.

China has a wealth of natural scenery and a diverse range of environments, much of which has only recently begun to be explored (for the purpose of leisure) by intrepid travelers.

Camping in China, as in many other parts of the world, is closely associated with other outdoor pastimes, such as hiking and self-driving tours (called 自驾游 in Chinese). The camping trend therefore has the potential to pique interest in a wider range of outdoor activities, such as hiking, climbing, and fishing, as well as road trips and cycling tours.

COVID-19 driving increase in short-haul trips and staycations

The pandemic has played a significant role in driving the more recent surge in camping activity. With frequently changing and unpredictable local travel restrictions becoming the norm, many people opt to stay closer to home, as evidenced by the increase in popularity of city breaks, staycations, and short-haul trips.

According to data from Chinese travel platform Ctrip, more than 70 percent of bookings for scenic spots in the last year came from nearby areas, and more than 80 percent of bookings for products, such as hotels, tickets, and entertainment, were made one to two days prior to the trip. Short-haul trips also surged during the 2022 Dragonboat Festival in June and the Labor Day holiday at the start of May. According to Ctrip, over 50 percent of the bookings made in the run-up to the holiday were for destinations within the same province as where the user was located, while bookings for short-haul trips grew 20 percent in the run-up to the Dragonboat Festival holiday.

This phenomenon has also meant that travel is not limited to holiday periods and long weekends. Last-minute weekend city breaks are becoming increasingly popular, which is good news for travel companies seeking to capitalize on more consumption opportunities.

This short-haul trend is set to continue as China adopts a “normalized” approach to COVID-19 containment, which involves frequent COVID-19 testing, snap short-term lockdowns, and increased testing requirements for interprovincial travel.

Camping is well-suited to short-haul and weekend trips due to the vicinity of green spaces and camping grounds to most cities. Rural and suburban areas are accessible even from sprawling metropolises like Shanghai and the surrounding Yangtze River Delta (YRD) area, and many have large green spaces within the metropolitan areas as well.

Rural revitalization and promotion of outdoor activities

The central government is keen to encourage the development of outdoor activities as part of its “rural revitalization” strategy, as well as its policies on promoting better fitness and exercise. Rural revitalization is a policy that seeks to develop impoverished rural areas and balance the rural-urban economic divide. Developing rural tourism and activities is seen as one way in which to create more opportunities for rural populations that are otherwise limited in the scope of work available.

Government agencies have released several policy documents on developing outdoor activity. One such document is the 14th Five Year Plan for Sports Development (“14th FYP”), which seeks to promote sports and fitness activities by improving infrastructure, services, and awareness among the population. Although it doesn’t specifically mention camping, except with regard to establishing conferences for showcasing recreational vehicles (RVs), it does actively seek to develop several adjacent industries and expand China’s outdoor recreational economy. The 14th FYP dedicates a section to the development of outdoor activity, including winter sports, mountain sports, water sports, driving and motorcycling, air sports, cycling, marathons, and triathlons.

In March 2022, the National Rural Revitalization Administration (NRRA), a government agency under the Ministry of Agriculture and Rural Affairs (MARA), released a set of opinions on developing public fitness services. The opinions call for:

- Carrying out pilot projects for opening up natural resources to outdoor sports, and formulating a catalogue of outdoor sports activities that are allowed in available waters, airspace, forests, grasslands, and other natural areas.

- Encouraging outdoor sports equipment manufacturing companies to extend their development to the service industry.

- Building ice, snow, and mountain sports fields, mountain climbing and hiking trails, cycling trails, and other facilities.

- Improving outdoor sports infrastructure and service capabilities, such as parking, power and water supply, sanitation, communication, signage, and emergency rescue, as well as facilities such as showers, changing rooms, and storage.

In response to the policies, travel companies, such as Ctrip and Alibaba-owned Fliggy, have launched their own rural revitalization programs, often in collaboration with large hotel brands, which increase investment in rural tourism by assisting local businesses with online operations, training, and brand building.

Market overview: Where to invest?

“Glamping” and luxury nature breaks

“Glamping”, a portmanteau of “glamourous” and “camping” has become a hugely popular choice for weary office workers seeking a more up-market and comfortable nature break than that offered by bare-bones traditional camping. Many glamping campgrounds are situated in suburban green spaces and parks, making them ideal for a weekend getaway or short holiday. However, offerings for luxury rural retreats in more far-flung regions also exist for those seeking a longer stay.

Many glamping grounds and operators offer full packages, including luxury tents, meals, and entertainment, so that guests aren’t required to know how to set up a tent or light a barbeque in order to enjoy a camping experience.

Higher-end luxury tents, which focus on comfort and aesthetics and can cost between RMB 3,000 and 4,000 (US$444 to US$592) are becoming increasingly popular, as well as accompanying products, such as portable coffee machines, barbeques, lighting, foldable camping furniture, and so on. For foreign investors, the shifts in Chinese travel habits present a range of new sectors to tap into as consumers seek new outdoor adventures and customized experiences.

Glamping, and indeed ordinary camping, is also not confined to overnight stays. Setting up tents in local parks to enjoy a daytime picnic is a popular pastime during the warmer months, offering more opportunities for sellers of outdoor equipment, such as tents and picnic gear.

Outdoor sports equipment and supplies

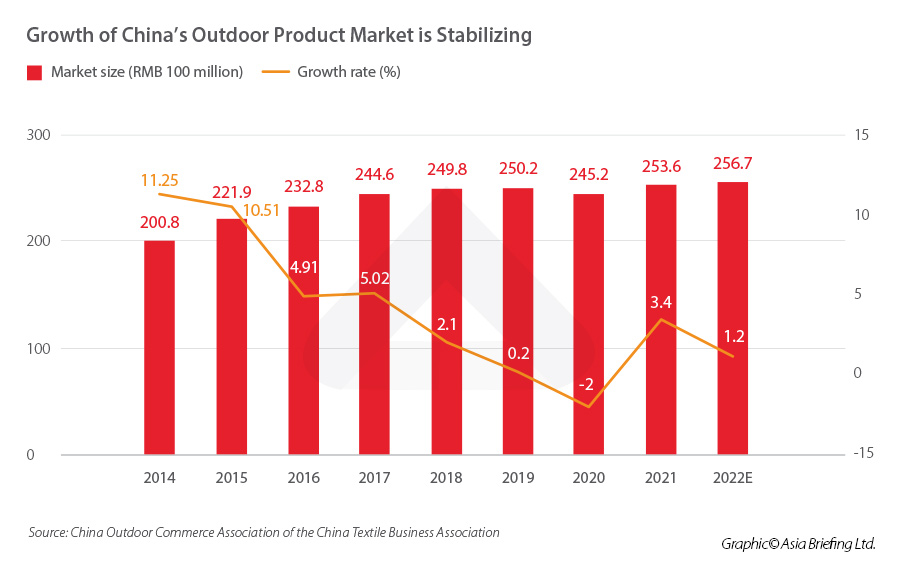

The outdoor sports and activity sector has been growing rapidly over the past decade as more people head to the great outdoors on their time off. Recent years have seen growth stabilize somewhat, perhaps due to the fact that many types of outdoor equipment are made to be durable and are used infrequently, translating to rarer repeat purchases.

However, the sector still has considerable potential for further growth as income and living standards continue to rise and more emphasis is placed on health and well-being. Compared to developed markets, China’s consumption of outdoor products remains relatively low, but with the current explosion in popularity of camping, we are likely to see a new cohort of consumers emerge.

In addition, research shows that consumers are willing to spend more money on camping equipment specifically. According to a survey by iiMedia Research, consumers had on average spent RMB 6,995 (US$1035) on camping equipment in the past. Among them, 26.5 percent had previously spent under RMB 3,000 (US$444) on camping equipment, whereas 25.9 percent spent between RMB 3,000 and RMB 5,000 (US$740) in the past year and 47.6 percent spent over RMB 5,000 in the past year.

According to e-commerce giant JD.com, searches for camping products surged 145 percent year-on-year between April and mid-May 2022, while the turnover for rescue equipment, tent mats, extreme outdoor activity supplies, and picnic supplies grew 256 percent, 229 percent, 165 percent, and 165 percent respectively.

Major companies operating in the outdoor sports equipment space include Nordisk, Snow Peak, and Kolon Sport in the high-end market and Decathlon, Mobi Garden, and Kailas in the mid-range market.

Recreational vehicles

The RV market in China remains relatively small compared to that in developed regions, such as the US and Europe, but nonetheless is a sector worthy of attention. According to data from market research firm Intelligence Research Group, the Chinese RV market grew from RMB 2.2 billion (US$325.9 million) in 2014 to RMB 20.8 billion (US$3.1 billion) in 2020, a compound annual growth rate of 45.48 percent. The number of RVs in ownership has also increased more than 10-fold during this period, reaching 218,204 vehicles in 2020.

There is also considerable growth potential for the sector. According to Intelligence Research Group, RV ownership per 1,000 people in the US and Europe stood at 30 and 15 vehicles, respectively, whereas in China it is only 0.2.

The areas with the highest sales of RVs were Jiangsu, Shandong, Zhejiang, Guangdong, and Beijing. The number of RVs approved for market by the Ministry of Industry and Information Technology (MIIT) has also continued to rise every year, with 428 new models applying for registration in 2020.

Major RV brands in China include SAIC Maxus, Yarte, and Geely.

Camping and outdoor fashion

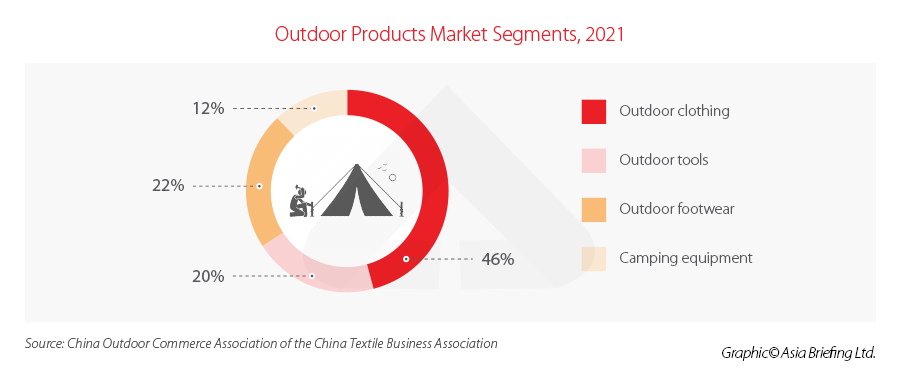

Although it may seem counterintuitive to camping and outdoor sports culture, there is a clear emphasis on looking good as well as feeling warm and comfortable among the new camping crowd. Outdoor clothing and footwear make up the largest segments of the outdoor products market, accounting for 46 percent and 22 percent of the market, respectively, in 2021.

In fact, the camping and outdoor sports frenzy have made outdoor fashion a trend even on urban streets. Major foreign brands that have found success in China include Patagonia, ARC’TERYX, The North Face, and Jack Wolfskin.

Outdoor sports and travel

Camping is, naturally, closely associated with other outdoor sports and activities, and its rise in popularity has happened in tandem with the spread of activities such as hiking, cycling, trail running, fishing, and climbing, as well as the so-called self-driving travel.

The rise in camping presents opportunities for travel companies to offer a range of activities in combination with camping, such as custom-made outdoor tours. Such tours are becoming increasingly popular for company outings and team-building trips, in addition to vacation plans among families and friend groups. These types of tours are particularly attractive to newer and more inexperienced travelers who are not yet as familiar with outdoor activity.

The car rental market has also seen significant growth over the past decade as the popularity of road trips has taken off. The car rental market reached a valuation of around RMB 100 billion (US$14.8 billion) in 2020 and is forecast to reach RMB 160 billion (US$23.7 billion) by 2025, according to Intelligence Research Group.

Investing in the future of China travel

The COVID-19 pandemic has had a devastating impact on the travel industry, and with strict quarantine requirements for inbound travelers to China, international travel for the vast majority of Chinese consumers has been out of the picture. However, China’s travel industry has been able to recover significantly due to the sheer size of the domestic consumer base, who have been keenly rediscovering the country and its natural scenery in the years since the pandemic broke out.

It is against this backdrop that the popularity of camping has risen. The camping trend also evidences the resilience and flexibility of China’s travel industry, as well as the types of new opportunities that can arise even under significant limitations. With its focus on short trips to nearby areas, camping is also shielded from a future in which international travel becomes possible again for Chinese travelers, as many camping trips are made on weekends and short holidays.

At the same time, the rise of camping over the past couple of years signals a longer-term shift in the way Chinese people like to travel – nature-focused, customized, and with an emphasis on lifestyle and well-being. Many consumers will have only recently had their first camping experience and will be eager to head to the outdoors again. For investors, this presents a range of new sectors to tap into that go beyond just camping, as consumers look to new outdoor adventures and experiences.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Tourism in China: 2022 Trends and Investment Opportunities

- Next Article Understanding China’s Digital Economy: Policies, Opportunities, and Challenges