Why Shanghai FTZ’s New Offshore Trade Policies Are Attracting Foreign Businesses

On April 29, 2020, Volvo Construction Equipment (CE) signed a memorandum with the government of Pudong New District, Shanghai, which signaled the official movement of Volvo CE’s Asia headquarters from Singapore to Shanghai. This is believed to be a result of Shanghai Free Trade Zone’s (FTZ) endeavors to promote offshore trade businesses.

What is offshore trade?

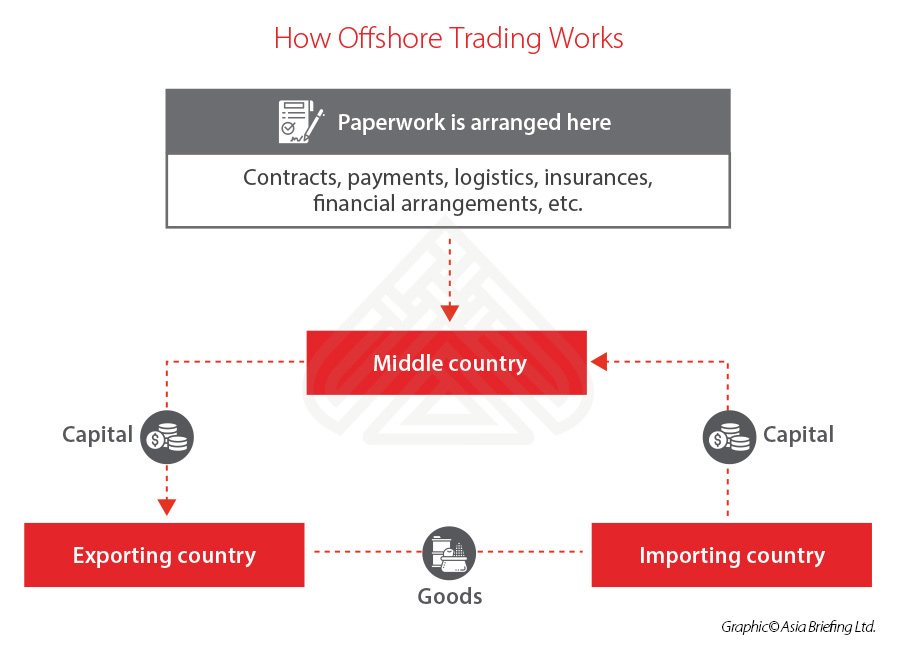

Offshore trade, or documentation processing trade, refers to a trade model in which the goods are transferred directly from the exporting country to the importing country without entering the border of the middle country where the contracts, payments, logistics, insurances, financial arrangements, as well as other trading documentations are processed in.

For example, in 2019, Volvo CE shipped two excavators to Nigeria directly from its manufacturing subsidiary in South Korea. In this transaction, the equipment did not enter China, but Volvo CE’s Shanghai subsidiary handled all the paperwork, including accepting the order and signing the contract, getting the deposit and the final payment, arranging the production and the later logistics, insuring the goods and settling the tax, etc.

Why did Shanghai lose out to competitors in the past?

In offshore trade, the subsidiary in the middle country actually plays the role of centralizing and allocating the resources of the supply chain, which in not only good for improving the host country’s role in global trade, but also implies greater tax benefits. Meanwhile, the huge capital turnover in offshore trade can nourish the financial sector and make it more prosperous.

Given this, offshore trade has always been welcomed by major free trade hubs, such as Hong Kong and Singapore. However, it was underdeveloped in Shanghai and other mainland cities, mostly due to the strict regulatory controls.

The customs and the foreign exchange authorities had long held on to the idea that it is hard to determine the authenticity of offshore trade, considering the exporting and importing parties are located outside of China, and the goods, capital, and trade documentation are all separate from each other under this trade model. As fabricated transactions can be very harmful to a country’s economic order and foreign exchange market – squeezing the capital from real economy, accelerating the imbalance of international payments, and encouraging unreasonable investments in foreign exchange – authorities in China tended to be very cautious and strict towards offshore trade transactions.

In fact, since 2012, China’s State Administration of Foreign Exchange (SAFE) has released several administrative documents to exert greater control to foreign exchange in offshore trade and combat fake transactions. In particular, in 2016, the SAFE issued the Notice on Further Facilitating Trade and Investment and Improving Authenticity Check (Huifa [2016] No.7), requiring the bank to review the contract, invoice, transportation documents, and the ownership license of the offshore transactions one by one. Enterprises who failed the reviews would not be able to receive money or make payments.

This strict scrutiny made it hard to do offshore trade business in China where payments and settlements were slow. In the past, many well-established companies engaged in offshore trade have had to shift to Singapore or Hong Kong.

What has Shanghai done to support and revitalize offshore trade?

The development of offshore trade is in line with Shanghai’s ambition to play a bigger role in global finance and become an international trade center.

After years of strict control, offshore trade was brought back into attention again when China planned to build Shanghai FTZ into a first-class free trade port.

In 2017, when the draft plan of Shanghai free trade port was released, offshore trade was listed as one of the top targets to promote.

On October 31, 2019, Shanghai FTZ announced seven preferential policies for offshore trade companies, at a conference about promoting the development of offshore trade business.

List of preferential policies at Shanghai FTZ

- Shanghai FTZ supports offshore trade companies so they can enjoy tax incentives. For example, offshore trade companies are encouraged to apply to be an advanced technology service enterprises (ATSE), which implies a lower corporate income tax rate of 15 percent, rather than the standard rate of 25 percent.

- Shanghai FTZ supports financial institutions to provide efficient foreign-related financial services for genuine offshore transactions.

- Shanghai FTZ supports offshore trade companies to apply for recognition as the regional headquarters of multinational companies by:

– Removing the restrictions on the paid-in registered capital of its parent company;

– Removing the restrictions on the number of authorized management agencies at its regional headquarters; and

– Encouraging centralized operation and management of cross-border funds. - Shanghai will provide more attractive policies for talents:

– For qualified senior managers and skilled workers in offshore trade companies, Shanghai FTZ will provide them with the necessary conveniences to settle down and stay in China, and through preferential policies – enable their children’s schooling, their medical care, and their application for apartments. - Shanghai FTZ will offer more financial support to offshore trade businesses:

– Shanghai FTZ will give rewards to qualified offshore trade companies, which apply for recognition of various headquarters and operation centers in Pudong New Area; and

– Further supportive policies will be studied for key offshore trade companies with outstanding strength in terms of economic contribution, investment intensity, and industry ranking. - Shanghai FTZ will explore various cross-border financial service models for offshore trade companies:

– Financial institutions are encouraged to provide efficient and convenient cross-border financial services for enterprises carrying out offshore trade businesses. - Shanghai FTZ will establish industrial service centers to provide policy consulting, corporate training, reports researching, project coordinating, financial law consulting, talents, and other services to offshore trade companies.

Application of these preferential policies

Some of the above policies have already been put into practice.

On April 13, 2020, the Shanghai Free Trade Zone Offshore Trade Service Center was officially launched in Waigaoqiao Bonded Area, Shanghai, which signified that the development of offshore trade has entered the fast track.

So far, 47 companies are reported to have enjoyed preferential foreign exchange policies in offshore trade businesses.

According to the official news, the next step is to put the financial support into place and reduce the tax burden on offshore trade businesses.

Going forward

In the current promotion of offshore trade in Shanghai FTZ, more and more companies engaging in offshore trade are expected to set up as a legal entity in the zone or move their regional headquarters here, like Volvo CE.

However, companies are still advised to get themselves familiar with China’s regulatory environment and pay close attention to the policy changes now and in the future. In this way, they can stay agile while avoiding compliance and financial risks. For further information or assistance in China, please email us at china@dezshira.com.

Explore Our Related China Business Insights

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s Greater Bay Area: Looking Beyond its Flagship Cities

- Next Article There is no “post-COVID-19” era in China. There is only the COVID-19 era to adapt to.