China to Further Extend the Additional VAT Deduction Policy for the Services Industry

China has decided to further extend the additional value-added tax (VAT) deduction policy for the production and life service sector in a bid to help service sector businesses survive the pandemic. No specific expiry date is provided. Previously, the policy of additional deduction of VAT in the production and life services industry had been extended by one year to December 31, 2022. Qualified enterprises can continue to enjoy a 10 percent or 15 percent additional deduction of creditable input VAT in the current period from the tax amount payable. This will reduce the financial burden on small businesses in the country and boost job creation.

On July 29, 2022, Premier Li Keqiang chaired an executive meeting of the State Council and decided to adopt a host of measures to further bolster demand, promote effective investment, and boost consumption. Among others, it reinstated that China will “fully extend the additional VAT deduction for services”. Analysts believe this is sign that the additional VAT deduction policy will be further extended.

Originally set to expire on December 21, 2021, the additional VAT deduction is a preferential tax policy provided to qualified production and life services under which their input VAT in the current period could be deducted from their VAT amount parable on a weighted basis.

Earlier this year, in March, China had extended this additional VAT deduction policy to December 31, 2022, according to an announcement released by the Ministry of Finance (MOF) and the State Taxation Administration (STA).

Now, with the statement released after July 29’s State Council executive meeting, it is very likely that enterprises engaging in production services and life services can continue to enjoy the 10 percent and 15 percent additional VAT deductions, respectively, beyond December 31, 2022.

WEBINAR – Digitalize Your Business in China: E-Business Licenses and E-Chops Explained

Tuesday, September 13, 2022 | 4 PM China / 3 PM Vietnam / 10 AM CET

In this webinar, Viktor Rojkov, Senior Associate of International Business Advisory, will discuss how businesses can move from a physical brick-and-mortar presence toward integrating digital solutions into their day-to-day business operations. He will also explain how China’s local policies and authorities are progressing with digitalization of the traditional systems to streamline the entry of new businesses into the market as well as help existing businesses operate smoothly and in compliance.

This webinar is FREE of charge.

What is the original additional VAT deduction policy?

In March 2019, the MOF, the STA, and the General Administration of Customs (GAC) jointly released an announcement, which provided that between April 1, 2019, to December 31, 2021, taxpayers in the postal, telecommunications, modern, and life services will be eligible for a 10 percent additional VAT deduction based on deductible input VAT in the current period.

In September 2019, the MOF and the STA further announced that from October 1, 2019, to December 31, 2021, the additional VAT deductions available for taxpayers in the life services industry shall be increased from 10 percent to 15 percent based on the current period of deductible input VAT.

Eligibility

To be eligible for these additional deductions, the taxpayer’s business must fall within the scope of the ‘postal services’, ‘telecommunication services’, ‘modern services’ and ‘life services’ industry and must meet a requisite percentage of sales activity.

1) Meeting the 50 percent sales requirement

As a general rule, the enterprise’s sales in the relevant services industry should account for more than 50 percent of the total sales.

For postal services, telecommunication services, and modern services, the sales for businesses established after April 1, 2019, will be calculated based on the first three months from the date of establishment.

For life services, the sales for businesses established after October 1, 2019, will be calculated based on the first three months from the date of establishment.

Once a taxpayer is determined to be eligible for the additional VAT Deduction policy, no adjustment will be made in the current year, and its eligibility in the following years should be determined based on its sales for the previous year.

The additional VAT deduction amount that a taxpayer is qualified to enjoy but has not yet done so is allowed to be deducted together at the period when it is determined to apply the additional VAT deduction policy.

2) Scope of business in the life services industry

The specific scope of the Four Services should be determined according to the Notes to the Sale of Services, Intangible Assets, and Immovable Properties (Cai Shui [2016] No. 36).

Accordingly, the services are defined to include the following:

- Postal services: Mail deliverance, postal remittance, confidential communication, stamp issuance, and newspaper distribution.

- Telecommunication services: Voice call services, SMS, MMS, or other services requiring transmission, receiving, or application of electronic data and information using fixed network resources.

- Modern services: Research and development, information technology services, cultural and creative services, certification and consulting services, business support services, and radio, film, and television services.

- Life services: Cultural and sports services, logistics and ancillary services, certification, consulting, and business support services, education and healthcare, travel and entertainment services, and other services considered to be within the life services industry.

3) Being VAT general taxpayers

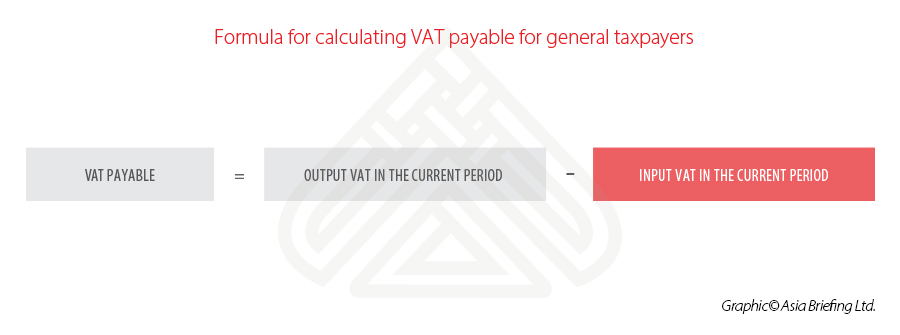

As only VAT general taxpayers can deduct input VAT from output VAT when calculating VAT payable, the underlying eligibility for enjoying the additional VAT deduction policy is that the enterprise must be registered as a VAT general taxpayer.

For newly established service businesses, they can apply the additional VAT deduction policy from the date when it is registered as a general taxpayer – if its sales of three months from the date of incorporation meets the eligibility criteria

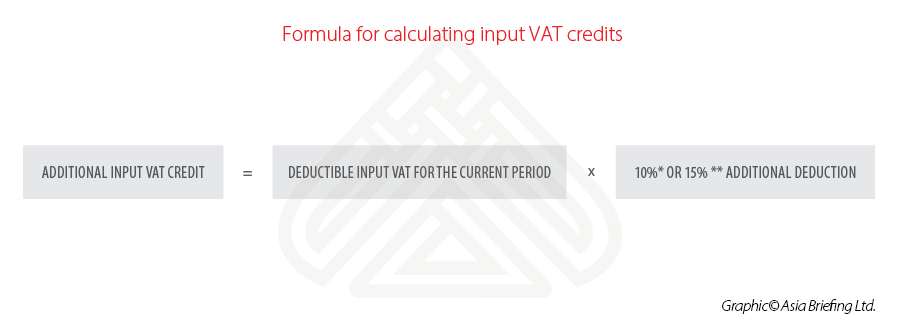

Calculating the additional VAT deductions

The new deductions will affect the input VAT credits calculated in the current period so:

The additional input VAT credit accrued for the current period is:

Note: Whether the 10 or 15 percent additional deduction applies, depends on the type of service the taxpayer is engaged in.

Taxpayers shall, after calculating the tax amount payable under the general taxation method according to existing provisions (hereinafter referred to as “pre-deduction tax amount payable”), make additional VAT deductions as follows:

- If the pre-deduction tax amount payable is zero, all the deductible additional deduction amount in the current period should be carried forward to the next period for deduction;

- If the pre-deduction tax amount payable is a positive number and higher than the deductible additional VAT deduction amount in the current period, then all the deductible additional VAT deduction amount for the current period should be deducted from the pre-deduction tax amount payable; or

- If the pre-deduction tax amount payable is a positive number and less than or equal to the deductible additional VAT deduction amount in the current period, then the deductible additional VAT deduction amount in the current period should be deducted from the tax amount payable, till the balance of the tax amount payable is zero, and the balance of the deductible additional VAT deduction amount in the current period may be carried forward to the next period for continuous deduction.

To be noted, the additional VAT deduction policy is not applicable to the export of goods and labor services or cross-border taxable activities carried out by a taxpayer.

Taxpayers are required to separately calculate changes in provision, deduction, decrease, and balance of the additional VAT deduction amount.

How to apply?

If taxpayers meet the eligibility of the Additional VAT Deduction policy, they can continue to submit the Declaration of the Application of the Additional Deduction Policy or the Declaration of the Application of the 15 Percent Additional Deduction Policy through the electronic tax bureau or go to the tax bureau in person.

Businesses are advised to seek local professional assistance to comply with the new norms and benefit from greater tax reductions.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article 10 Things Businesses Need to Know When Setting Up a Company in China and the UK: Episode 2

- Next Article Tourism in China: 2022 Trends and Investment Opportunities