Commercial Investments in the Beijing Olympic Winter Games: A Look at the Sponsors, Private Sector Participation

An introduction to the 2022 Beijing Winter Olympics from the commercial perspective. Beijing has worked hard to ensure that hosting the Winter Olympics Games do not become a drain on public resources by actively raising private sector funding and offering tax breaks and other preferential policies.

Beijing will host the 2022 Olympic and Paralympic Winter Games next year, starting on February 4 and running until February 20. This will be the first time for the city to host both Olympics, following the 2008 Summer Olympics events.

Although there has been diplomatic noise from various quarters, including the United States, United Kingdom, and Australia, among others, about not sending diplomats or officials, the political ‘boycott’ of the Beijing events is a fairly cheap shot as most of them would not have attended anyway due to the continuing coronavirus pandemic. COVID will continue to be high risk for travelling during the timeframe the Winter Games are being held, while China has strict entry regulations at this time.

Consequently, rather than duplicate what has already been said about this, in this article, we will concentrate on the commercial sponsorship angle, which has not been covered in any great detail.

Events venue infrastructure: Legacy venues reduce costs

A total of 109 events in seven winter sports will be held in three competition zones – Beijing, Yanqing, and Zhangjiakou, in north China.

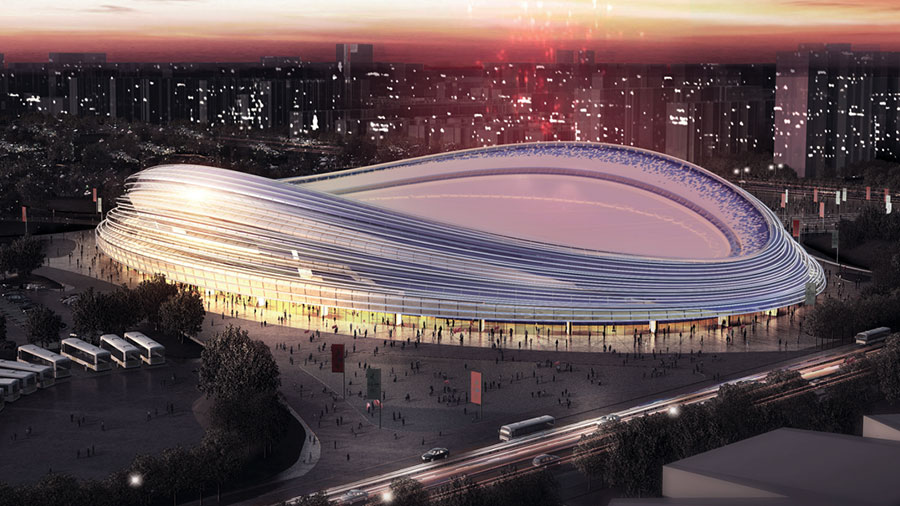

Beijing is going to reuse some 2008 Summer Olympics legacy venues – including the National Stadium (also known as the “Bird’s Nest”) and the National Aquatics Center (aka the “Ice Cube”, or “Water Cube”) – to save on infrastructure construction costs. The only new venue built on Beijing’s Olympic Park is the National Speed Skating Oval, which bears the nickname the “Ice Ribbon”.

| Beijing Olympic and Paralympic Winter Games Venues | |||

| Zone | Venue | Events/competitions | Beijing 2008 legacy venue |

| Beijing Zone | The National Stadium | Opening and Closing Ceremonies | Yes |

| National Aquatics Centre | Curling / Wheelchair Curling (Paralympic Winter Games) | Yes | |

| National Indoor Stadium | Ice Hockey / Para Ice Hockey (Paralympic Winter Games) | Yes | |

| Wukesong Sports Centre | Ice Hockey | Yes | |

| National Speed Skating Oval | Speed Skating | No | |

| Capital Indoor Stadium | Short Track Speed Skating, Figure Skating | Yes | |

| Big Air Shougang | Freestyle Skiing Big Air, Snowboard Big Air | No | |

| Beijing Olympic Village | – | – | |

| Yanqing Zone | National Sliding Centre | Bobsleigh, Skeleton, Luge | No |

| National Alpine Ski Centre | Alpine Skiing / Para Alpine Skiing (Paralympic Winter Games) | No | |

| Yanqing Olympic Village | – | – | |

| Zhangjiakou Zone | National Biathlon Centre | Biathlon / Para Biathlon & Para Cross-Country Skiing (Paralympic Winter Games) | No |

| National Ski Jumping Centre | Ski Jumping, Nordic Combined (Ski Jumping) | No | |

| National Cross-Country Centre | Cross-Country, Nordic Combined (Cross-Country) | No | |

| Genting Snow Park | Freestyle Skiing, Snowboarding / Para snowboarding (Paralympic Winter Games) | No | |

| Zhangjiakou Olympic Village | – | – | |

Private sector participation

All three Olympic villages are invested by capital from the private sector, according to Zhou Xing, vice minister of finance and market development department of Beijing 2022 Olympic Winter Games Bid Committee. After the Games, the houses in the Olympic Villages in Beijing and Zhangjiakou will be sold as commercial housing, while those in the Yanqing Olympic Village will be used as resort hotels and provide returns on the original investment.

Beijing has announced an estimated budget of US$3.9 billion for the games, less than one-tenth of the whopping US$43 billion spent on the 2008 Summer Olympics, and also less than the US$14 billion that was spent by South Korea for the 2018 Pyeongchang Winter Games.

Tax incentives for the private sector

To incentivize winter sports businesses to invest in the event, China has introduced various measures ahead of hosting the 2022 Winter Olympics. For example, in terms of the tax incentives, according to the Announcement about Preferential Tax Policies for 2022 Beijing Olympic and Paralympic Winter Games (MOF SAT GAC [2019] No.92):

- Revenue stemming from the Beijing Olympic Winter Games obtained by non-resident enterprises associated with the International Olympic Committee (IOC) will be exempt from corporate income tax (CIT).

- Sponsors, suppliers, franchised operators, and their subcontractors will not have to pay value-added tax and consumption tax on goods and services provided to the Beijing Organizing Committee (BOC) for the 2022 Olympic and Paralympic Winter Games under the international sponsorship plan, global supply plan and global franchising plan.

Who are the sponsors at the 2022 Beijing Winter Olympic Games?

Currently, the International Olympic Committee (IOC) collaborates with 13 major corporate sponsors – Airbnb, Alibaba Group, Allianz, ATOS, BRIDGESTONE, Coca Cola, Intel, OMEGA, Panasonic, P&G, SAMSUNG, TOYOTA, and VISA. These main sponsors support the staging of the Olympic games as well as the operations within the Olympic movement, including funding, technical services, and products.

| The Olympic Partner Program | |

| Sponsor | Exclusive Product or Service Category |

| Airbnb | Accommodation products and Olympian experiences services |

| Alibaba Group | Cloud infrastructure, Cloud services, Ticketing and e-commerce platform services |

| Allianz | Insurance |

| Atos | Information technology |

| Bridgestone | Tires, certain tires and automotive vehicle services, self-propelled bicycles, seismic isolation bearings and a variety of diversified products |

| Coca Cola | Non-alcoholic beverages |

| Intel | 5G technology platforms, VR, 3D and 360 content development platforms, artificial intelligence platforms, sports performance platforms, drones and processors |

| Omega | – |

| Panasonic | Audio/TV/Video Equipment |

| P&G | Personal care and household products |

| Samsung | Wireless communications equipment and computing equipment |

| Toyota | Vehicles, mobility support robots, and mobility services |

| Visa | Payment services, transaction security, pre-paid cards |

Source: The official website of the Beijing Organizing Committee for the 2022 Olympic and Paralympic Winter Games

The Beijing Organizing Committee (BOC) for the 2022 Olympic and Paralympic Winter Games has signed agreements with 45 sponsors, including 11 official partners (level 1), 11 official sponsors (level 2), 10 official exclusive suppliers (level 3), and 13 official suppliers (level 4), according to its official website.

Most of the sponsors are Chinese companies, except EF Education (a language education institution), SNICKERS (an American chocolate bar), and PwC (one of the Big Four accounting firms).

| Partners, Sponsors, and Suppliers of Beijing Olympic and Paralympic Winter Games | |||

| Category | Name | Foreign brands | Chinese brands |

| Worldwide Olympic partners | Airbnb, Alibaba Group, Allianz, ATOS, BRIDGESTONE, Coca Cola, Intel, OMEGA, Panasonic, P&G, SAMSUNG, TOYOTA, and VISA. | 12 | 1 |

| Official partners of Beijing 2022 (Level 1) | Bank of China, Air China, VILI, ANTA, China Unicon, Shougang Group, CNPC, Sinopec, SGCC, PICC, CTG | 0 | 11 |

| Official sponsors of Beijing 2022 (Level 2) | TSINGTAO BEER, VANJING BEER, Jinlongyu, SHUNXIN, CIH, BEIAO, Hengyuanxiang, Qi An Xin, Yuanfudao, Yum China, PANPAN FOODS | 0 | 11 |

| Official exclusive suppliers of Beijing 2022 (Level 3) | EF Education First, iFLYTEK, CHINA POST, HYLINK, SINCKERS, HONGYUAN GROUP, 3trees, Dongdao, LANDSKY, BOSS Zhipin | 2 | 8 |

| Official suppliers of Beijing 2022 (Level 4) | PwC, Suirui Group, Kingsoff Office, 1Rock, BGCTV, HBTN, BBCA, KEESON, TINTAN, SJZBP, SHUA, NABEL, DONGPENG | 1 | 12 |

Source: The official website of the Beijing Organizing Committee for the 2022 Olympic and Paralympic Winter Games

What are the rights enjoyed by sponsors at the 2022 Beijing Winter Olympic Games?

According to public reports, the Beijing Organizing Committee will grant different rights to sponsors at different levels, such as marketing rights and exclusive rights to provide products and services. For example, the level 3 official exclusive suppliers will be able to enjoy preferential tax incentives, exclusive special treatment, specific rights (such as the right to use the sponsorship logo, advertising opportunities, and market development support), etc.

In addition to the preferential tax policies, enterprises might be most interested in the exclusive sponsorship rights – namely, in a certain time and geographical scope, the enterprises can enjoy exclusive monopoly rights agreed on products or services. Other competitors in the same industry are forbidden to provide such products or services in the same period or area. The specific scope of the exclusive interest will need to negotiate with the BOI.

Sponsoring sporting events can be of huge commercial value to enterprises; in addition to increasing sales, sponsorships promote the brand to a wide audience across the world and could significantly enhance the brand/product market share due to positive association with the Games, among other factors. By sponsoring the official Games events, enterprises can also establish good relations with the government, tap into preferential tax policies, and improve the loyalty of their dealers and agents.

Beijing has worked hard to ensure the 2022 Winter Olympics do not become a drain on public resources and has been active in both raising private sector funding and illustrating that returns on investment can be made from building what really amounts to a gigantic infrastructure project.

What China has learned from its own experiences, such as in developing infrastructure projects along the Belt & Road Initiative and hosting the Summer 2008 and upcoming 2022 Winter Olympic Games, could serve as a financial investment blueprint for countries staging such events – including figuring out how to return dividends on investments by participating stakeholders.

The Games may attract political criticism for unrelated non-sporting matters from certain countries, but from a financial modeling perspective they should be looked at as a primary case study for holding and gaining longer-term benefits from global events. Among the unfortunate political noise, that achievement – the level of G2B cooperation (Olympics-only tax incentives, for example) and what it means for future Olympics, World Cup football, and global event planners – should not be so easily dismissed.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China 2021 Recap: Overview of a Pivotal Year

- Next Article China’s Golden Tax System Phase IV: An Explainer