China Releases 2020 Negative List for Market Access

- Foreign investors should consult both the 2020 MA Negatives List and the 2020 FI Negative List before investing in a chosen sector.

- For guidance on how to use these lists to inform your market entry investment strategy, you are welcome to contact us at china@dezshira.com.

On December 16, the National Development and Reform Commission and the Ministry of Commerce unveiled the Market Access Negative List (2020) (“The 2020 MA Negative List”), with immediate effect.

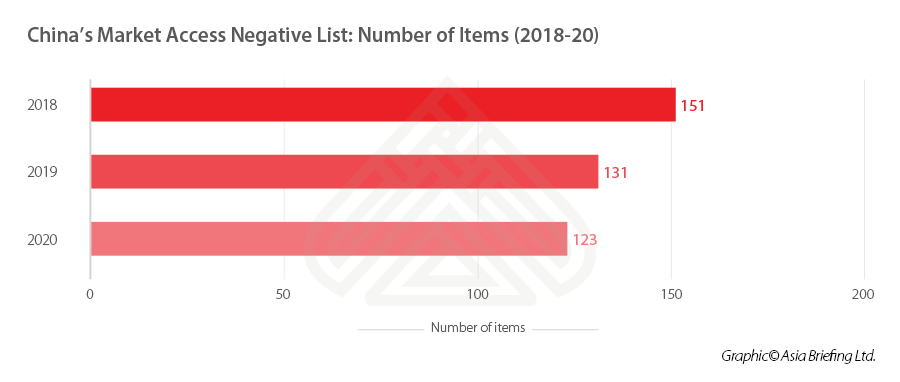

Compared with the 2019 MA Negative List, the new list has been shortened to 123 items from 131 last year – relaxing requirements in sectors, such as oil and gas, resource management, and trading and financial services.

Since the first MA Negative List was released in December 2018, the list has been revised on an annual basis, with the items gradually decreasing from year to year. According to NDRC spokesperson Meng Wei, in 2020, the list decreased by 18 percent from 151 at its inception in 2018. This is also less than half of the 328 items that were included in the “Draft Market Access Negative List (Pilot Version)” that was released in 2016.

Distinct from the FI Negative List, the MA Negative List standardizes market entry rules for all players (domestic or foreign), including state-owned firms, private companies, joint-ownership firms, and foreign firms.

The 2020 MA Negative List and 2020 Negative List for Foreign Investment (or FTZ equivalent) therefore work in tandem to inform foreign investors as to which sectors can be accessed and how to do so.

How does the MA Negative List work?

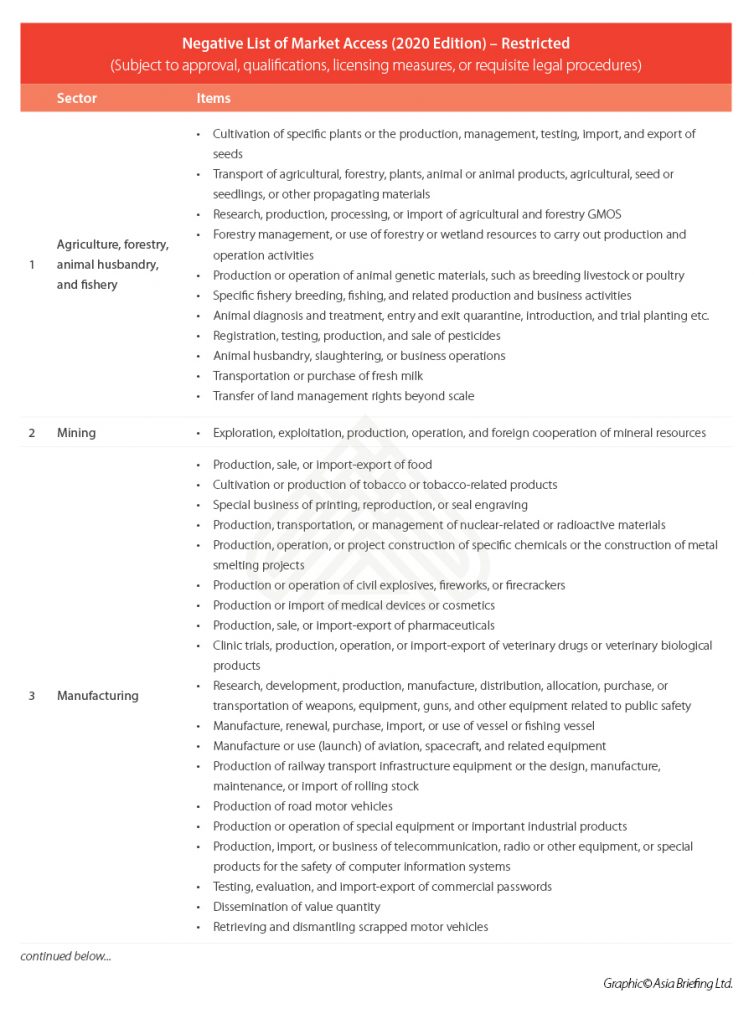

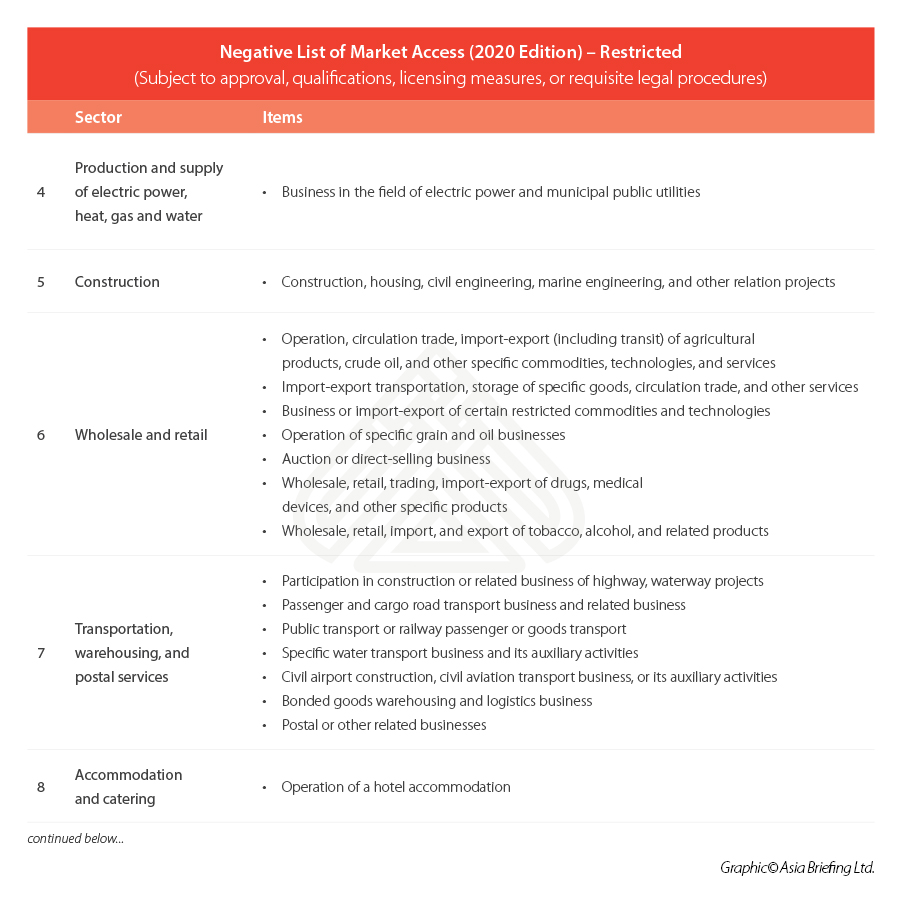

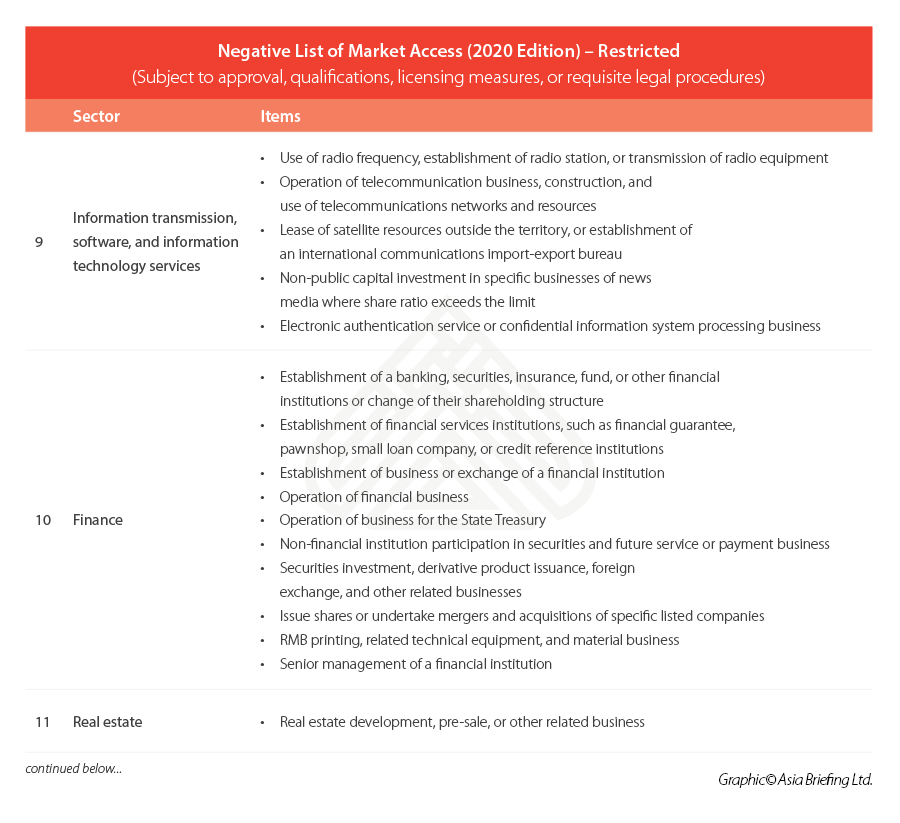

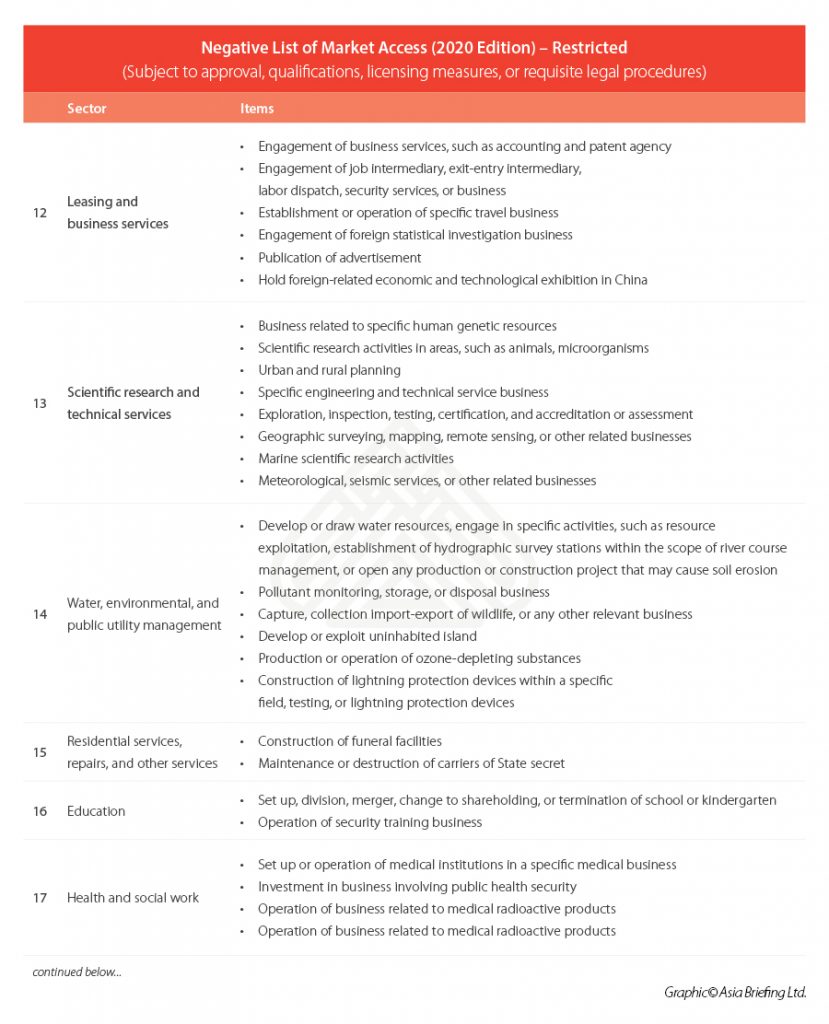

Similar to previous years, the MA Negative List continues to include two categories: prohibited and restricted markets.

For the prohibited list, market players are forbidden from engaging in these industries, fields, and businesses in any way – whether it be in the form of investments, partnerships, or takeovers.

Market players wishing to enter “restricted” categories must do so by filing an application for access to the relevant administrative organs as per the laws and regulations.

Finally, for sectors outside of the list, market players can access them on an equal footing in accordance with the law.

The 2020 MA Negative List

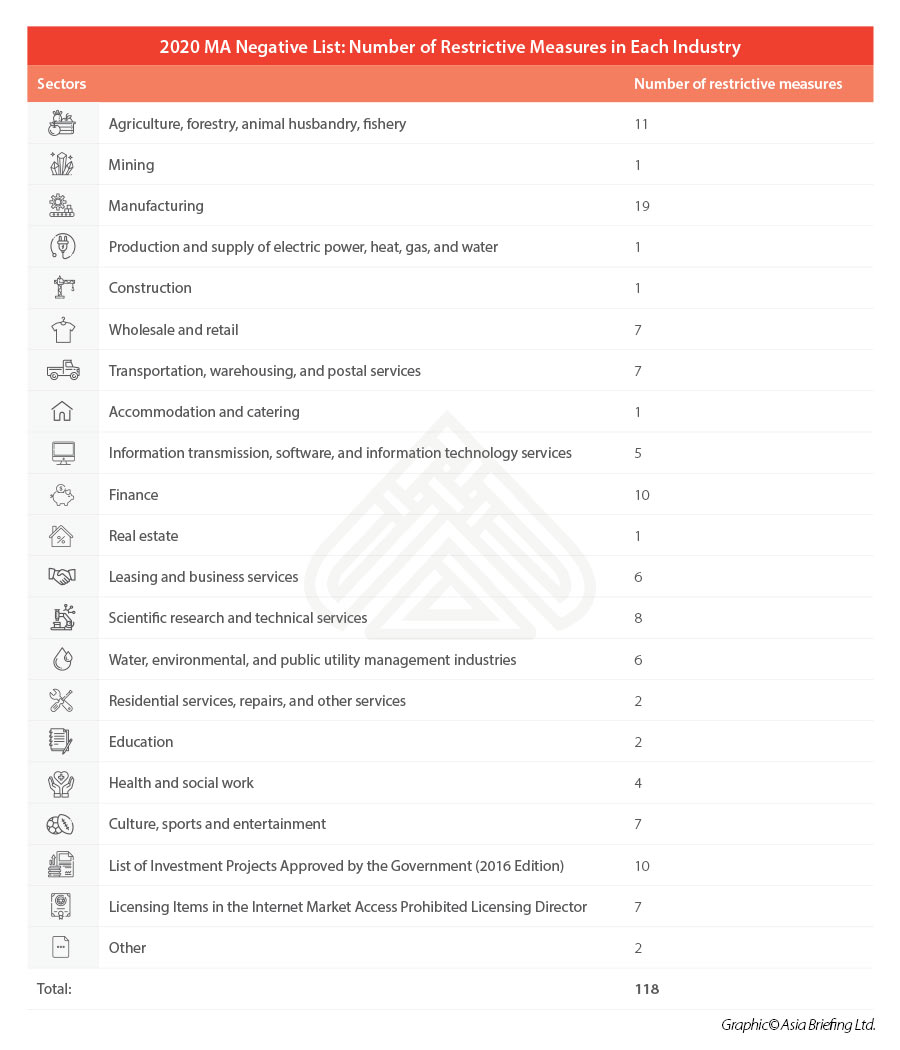

Compared with the 2019 MA Negative List, the new list has been shortened to 123 items – with five prohibited items and 118 restricted items.

Fourteen management measures were deleted from the latest list, including oil and gas exploration and production, providing inspection services for exported and imported goods, services assessing forest and mineral resources and carbon emissions, and appointing new executives in securities companies.

While items added to the list concerned restrictions on the establishment of financial holding companies and the large-scale transfers of land management rights, among others.

Negative List of Market Access (2020 Edition) – Prohibited

Negative List of Market Access (2020 Edition) – Restricted: Sector-wise items

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Common Errors in Accounting, Tax, Forex Management of FIEs in China

- Next Article A New China for 2021: Foreign Investor Friendly Access, Overseas Direct Investment in Hi-Tech Projects and M&A, and More Belt & Road Initiative Opportunities