China Trade Data: H1 2021 Shows Stronger Than Expected Results

We look at China’s trade data for H1 2021, trade performance with prominent partners, and ask if the trade surge will be sustainable through to the end of 2021.

China’s latest trade data brought the first half of the year to a close with stronger than expected results, as the country’s economic performance continued to outpace projections.

In June, China’s exports increased by 32.2 percent year-on-year, up from 27.9 percent in May. Imports, meanwhile, grew by 36.7 percent, down from 51.1 percent the month before.

This trade performance contributed to China’s 7.9 percent GDP growth in the second quarter and 12.7 percent overall growth through the first half of 2021.

The high growth numbers reflect the previous year’s unprecedented trade disruptions caused by the COVID-19 pandemic, as the world economy came to a standstill amid international border closures and lockdown measures. Because of the previous year’s low base, this year’s trade numbers are particularly eye popping on the surface.

Even factoring in this caveat, however, China’s trade through the first half of 2021 has still been more robust than most economists expected.

What is behind China’s first half trade surge, and is it sustainable through to the end of the year?

China’s trade surge: A look at the data from H1 2021

China’s exports grew by 32.2 percent in June and imports by 36.7 percent, far outpacing economists’ forecasts. A Bloomberg survey of economists projected 23 percent growth for exports and 29.5 percent for imports, while a Caixin survey projected 22 percent for exports and 24 percent for imports.

In US dollar terms, exports were worth US$281.4 billion, while imports were worth US$229.9 billion. Put together, June’s trade surplus was US$51.5 billion, the highest figure since January.

For the first half of 2021, China’s foreign trade volume was worth US$2.8 trillion, a 27.1 percent increase from a year ago, including 28.1 percent export growth and 25.9 percent import growth.

That translates to US$1.52 trillion in exports and US$1.27 trillion in imports, for a trade surplus of US$251.5 billion, up from US$164.3 billion during the same period in 2020.

Compared to 2019 levels, before the pandemic, total trade rose by 22.8 percent, with 23.8 percent growth in exports and 21.7 percent in imports.

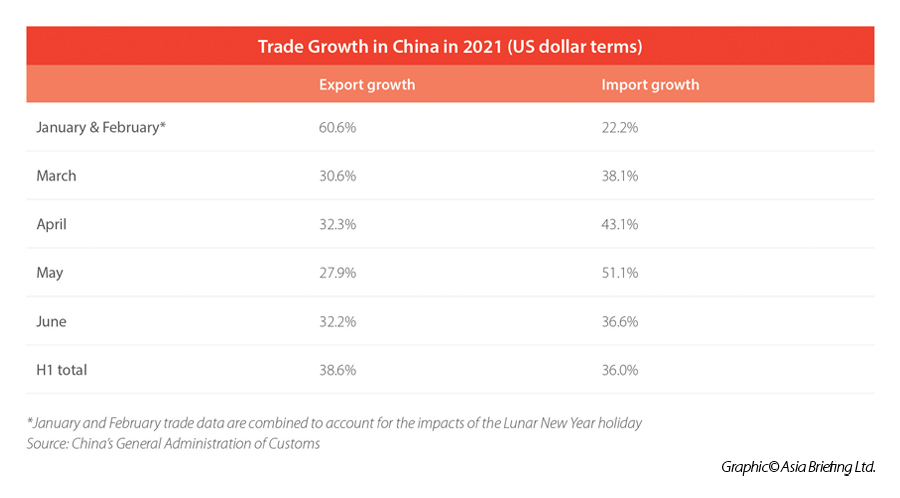

Trade Growth in China in 2021 (US$ terms)

*January and February trade data are combined to account for the impacts of the Lunar New Year holiday

Source: China’s General Administration of Customs

Trade with foreign partners

In line with China’s strong overall trade figures, trade with major trading partners gained momentum in the first half of the year.

In June, China’s exports to the US grew by 17.8 percent to US$46.9 billion, while imports increased by 37.6 percent to US$14.3 billion. Accordingly, China had a trade surplus with the US worth US$32.6 billion, up from US$31.8 billion in May.

Through the first half of the year, China’s exports to the US increased by 31.7 percent, while imports grew by 43.9 percent. Overall, trade grew by 34.6 percent percent to reach a total of US$340.8 billion.

According to Chinese customs, exports to the US were driven by demand for products such as laptops, smartphones, home appliances, and clothes. China’s trade surplus with the US increased slightly from US$31.78 billion in May to US$32.6 billion in June.

The ASEAN bloc, however, remains China’s largest trade partner. Through the first half of the year, exports and imports both rose by 27.8 percent, leading to an identical 27.8 percent total trade increase.

Exports to the EU, China’s second largest trading partner, increased by 25.5 percent in the first half of 2021, and imports by 28.5 percent, as trade rose by 26.7 percent.

Australia, another major trading partner, saw trade increase by 24.8 percent. This includes 20.2 percent growth in exports, and 26.7 percent growth in imports.

Trade with Belt and Road Initiative countries increased by 27.5 percent, and trade with RCEP members increased by 22.7 percent.

Of China’s major trading partners, trade with Singapore suffered the most. Exports to Singapore decreased by 9.3 percent in the first half of 2021, while imports increased by 20 percent. Overall, trade grew by just 1.2 percent.

Conversely, trade with India grew at a rapid pace over the first six months of the year. Exports increased by 48.5 percent, and imports by 56.8 percent, for total growth of 50.5 percent.

What to expect in the second half

China’s customs spokesperson, Li Kuiwen, touted the country’s trade performance, but cautioned that it may slow in the second half of 2021.

In a press briefing, Li said, “Due to a higher base one year ago, the year-on-year growth rate of imports and exports in the second half of the year is likely to slow down, while the trade throughout the year is still expected to maintain a rapid growth.”

Besides last year’s low base, high trade growth can be ascribed in part to a surge in global demand. The reopening of major world economies from pandemic restrictions, such as the US and Germany, led to a boom in external demand, both by consumers making individual purchases amid a return to normalcy and retailers restocking their inventory.

This could mean that the second half of the year will have a more moderate level of trade growth, as the initial buying boom wears off. As pent up demand from markets emerging from lockdown restrictions dissipates, consumption in these markets will normalize and soften from their initial high levels.

High commodity and shipping prices are also likely to damper trade growth in the second half of the year. Despite coming from a lower than usual base, China’s crude oil imports fell by 3 percent in the first half of the year, while imports of iron ore grew by just 2.6 percent over the same period.

Further, shortages of in-demand products like semiconductors could also impact trade. China imported over 310 billion semiconductor devices from January to June, a 29 percent increase from the previous year. But, a global shortage in semiconductors means manufacturers are facing procurement barriers, leading to delays and higher production costs.

The ongoing pandemic may also continue to destabilize global trade, as another wave of COVID-19 in the fall and winter could devastate countries with low vaccination rates. Li noted, “The coronavirus is still spreading at multiple places around the world and the pandemic situation remains complex.”

Although China has for the most part kept the virus under control, recent outbreaks in South China led to closures of major ports that will result in months-long shipping delays. Outside China, the virus continues to rage in major economies like India and Brazil, and the development of new variants could affect economies worldwide.

Domestic demand may be unable to bridge the gap created by moderating foreign consumption, as boosting that area continues to be a challenge for Chinese policymakers. Given the country’s Dual Circulation policy, finding ways to boost domestic demand will continue to be a priority for Chinese economic planners in the latter half of the year.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Circular Economy: Understanding the New Five Year Plan

- Next Article Belt and Road Weekly Investor Intelligence, #38